Taxpayers who are self-employed and have income from their business may be required to file Form T2042 E, Statement of Business Activities. This form is used to report the income and expenses from a specific business activity. The information on this form can be used to calculate the net income or loss from that activity. Taxpayers who file Form T2042 E may also be able to deduct certain expenses related to the activity. It is important for taxpayers who are self-employed to understand when they are required to file Form T2042 E, and what information needs to be included on the form. In this blog post, we will discuss what taxpayers need to know about filing Form T2042 E. We will also provide a few tips on how to complete the form accurately and efficiently. Finally, we will answer some frequently asked questions about Form T2042 E.

| Question | Answer |

|---|---|

| Form Name | Form T2042 E |

| Form Length | 5 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min 15 sec |

| Other names | GST, Vous, T4003, https form t2042 |

Statement of Farming Activities

Protected B when completed

For more information on how to complete this form, see Guide T4003, Farming Income.

Identification

Your name

Farm name

Your social insurance number

– |

|

|

|

|

– |

|

|

||||

|

|

|

|

|

|

Account number (15 characters)

Farm address

City

Province or territory

Postal code

Fiscal |

|

|

|

|

|

|

Year |

|

|

|

Month |

Day |

|

|

|

Year |

|

|

Month |

Day |

Was 2012 your last year of farming? |

Yes |

|

|

|

No |

|

|

|

|||||||||||||||||||||||

period |

From: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

To: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||

Main product or service |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Industry code |

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(see Chapter 2 of Guide T4003) |

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

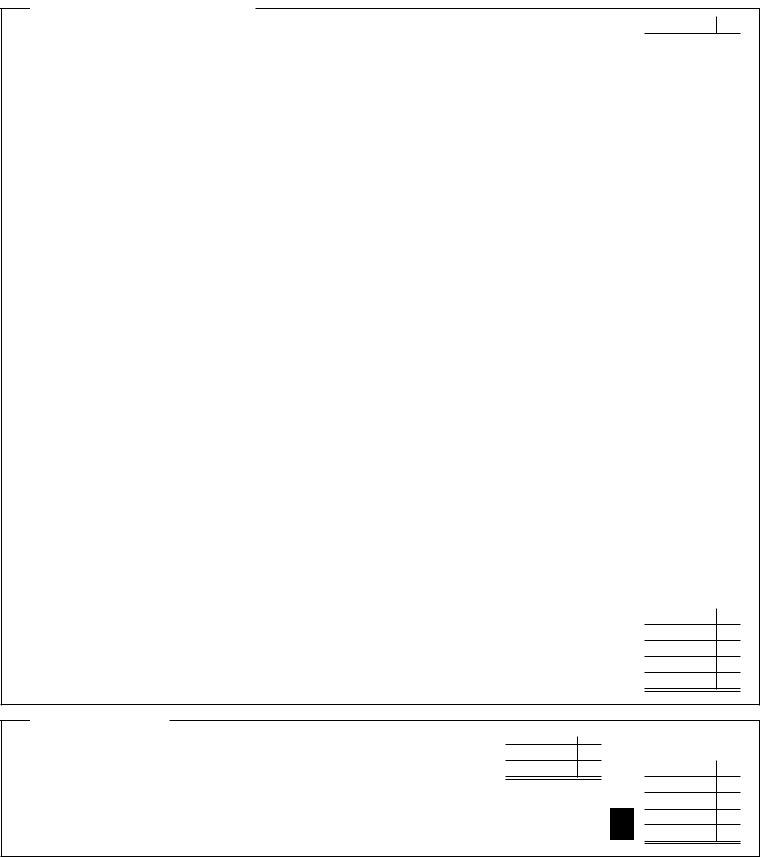

Accounting method |

|

|

|

|

|

|

|

|

|

|

|

Tax shelter identification number |

|

|

|

Partnership business number (9 digits) |

Your percentage |

|

|

|

|

|||||||||||||||||||||||||||||||

|

|

|

|

Cash |

|

|

|

|

|

|

Accrual |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

of the partnership |

% |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Name and address of person or firm preparing this form |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

Income

Wheat |

9371 |

|||

|

||||

Oats |

9372 |

|||

|

||||

9373 |

||||

Barley |

||||

|

||||

9374 |

||||

Mixed grains |

||||

|

||||

Corn |

9375 |

|||

|

||||

9376 |

||||

Canola |

||||

|

||||

9377 |

||||

Flaxseed |

||||

Soybeans |

9378 |

|||

|

||||

9370 |

||||

Other grains and oilseeds |

||||

|

||||

9421 |

||||

Fruit |

||||

|

||||

Potatoes |

9422 |

|||

|

||||

9423 |

||||

Vegetables (not including potatoes) |

||||

|

||||

9424 |

||||

Tobacco |

||||

|

||||

Other crops |

9420 |

|||

|

||||

9425 |

||||

Greenhouse and nursery products |

||||

|

||||

9426 |

||||

Forage crops or seeds |

||||

|

||||

Livestock sold |

|

|||

9471 |

||||

Cattle |

||||

|

||||

9472 |

||||

Swine |

||||

|

||||

Poultry |

9473 |

|||

|

||||

9474 |

||||

Sheep and lambs |

||||

|

||||

9470 |

||||

Other animal specialties |

||||

|

||||

Milk and cream (not including dairy subsidies) |

9476 |

|||

|

||||

9477 |

||||

Eggs |

||||

|

||||

9520 |

||||

Other commodities |

||||

|

||||

Program payments |

|

|||

9541 |

||||

Dairy subsidies . . |

||||

|

||||

9542 |

||||

Crop insurance . . |

||||

|

||||

Other payments . . |

9540 |

|||

|

||||

9570 |

||||

Rebates |

||||

|

||||

9601 |

||||

Custom or contract work, and machine rentals |

||||

|

||||

Insurance proceeds . . |

9604 |

|||

|

||||

9605 |

||||

Patronage dividends |

||||

|

||||

Other income (specify) |

|

|

|

|

|

|

|

9600 |

|

|

|

|

|

|

|

|

|

|

|

Gross income – Total of above lines (enter this amount on line 168 of your income tax and benefit return) |

9659 |

|||

|

||||

T2042 E (12) |

(Vous pouvez obtenir ce formulaire en français à www.arc.gc.ca ou au |

Page 1 of 5 |

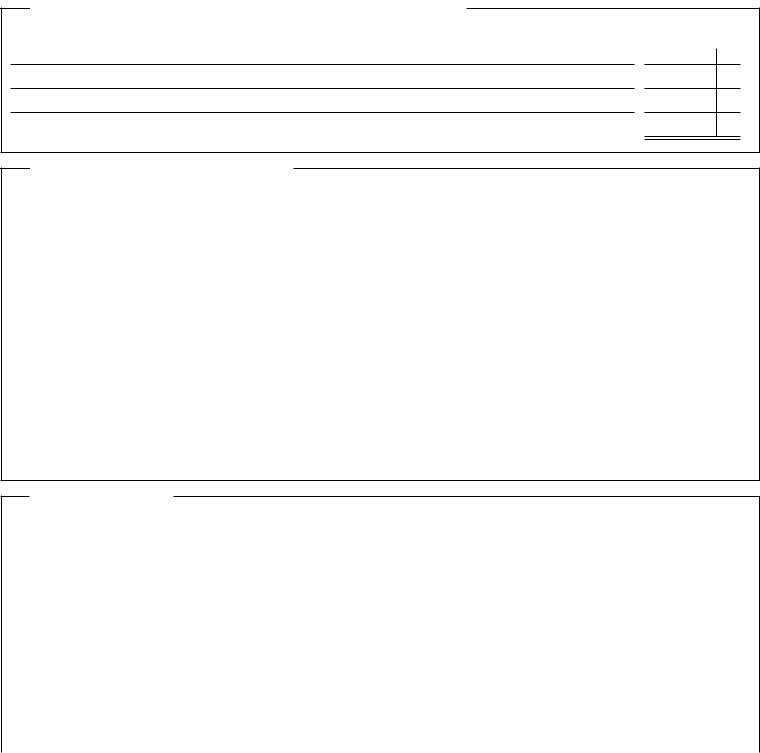

Protected B when completed

Net income (loss) before adjustments

Gross income (from line 9659 on page 1) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

|

Expenses (enter business part only) |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

Containers and twine |

|

|

|

|

|

|

9661 |

|

|

|

|

|

||

|

. . . . . . . . . . . . . . |

. . . . |

|

|

|

|

|

|

|||||||

|

Fertilizers and lime |

|

|

|

|

|

|

9662 |

|

|

|

|

|

||

|

. . . . . . . . . . . . . . |

. . . . |

9663 |

|

|

|

|

|

|||||||

|

Pesticides (herbicides, insecticides, fungicides) |

|

|

|

|

|

|

|

|

|

|

|

|||

|

. . . . . . . . . . . . . . |

. . . . |

|

|

|

|

|

|

|||||||

|

Seeds and plants |

|

|

|

|

|

|

9664 |

|

|

|

|

|

||

|

. . . . . . . . . . . . . . |

. . . . |

|

|

|

|

|

|

|||||||

|

Feed, supplements, straw, and bedding |

|

|

|

|

|

|

9711 |

|

|

|

|

|

||

|

. . . . . . . . . . . . . . |

. . . . |

9712 |

|

|

|

|

|

|||||||

|

Livestock bought |

|

|

|

|

|

|

|

|

|

|

|

|||

|

. . . . . . . . . . . . . . |

. . . . |

|

|

|

|

|

|

|||||||

|

Veterinary fees, medicine, and breeding fees |

|

|

|

|

|

|

9713 |

|

|

|

|

|

||

|

. . . . . . . . . . . . . . |

. . . . |

|

|

|

|

|

|

|||||||

|

Machinery expenses |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

9760 |

|

|

|

|

|

||||

|

Repairs, licences, and insurance |

|

|

|

|

|

|

|

|

|

|

|

|||

|

. . . . . . . . . . . . . . |

. . . . |

|

|

|

|

|

|

|

||||||

|

Gasoline, diesel fuel, and oil |

|

|

|

|

|

|

9764 |

|

|

|

|

|

||

|

. . . . . . . . . . . . . . |

. . . . |

|

|

|

|

|

|

|

||||||

|

Building and fence repairs |

|

|

|

|

|

|

9795 |

|

|

|

|

|

||

|

. . . . . . . . . . . . . . |

. . . . |

9796 |

|

|

|

|

|

|||||||

|

Clearing, levelling, and draining land |

|

|

|

|

|

|

|

|

|

|

|

|||

|

. . . . . . . . . . . . . . |

. . . . |

|

|

|

|

|

|

|||||||

|

Crop insurance |

|

|

|

|

|

|

9797 |

|

|

|

|

|

||

|

. . . . . . . . . . . . . . |

. . . . |

|

|

|

|

|

|

|||||||

|

Custom or contract work, and machinery rental |

|

|

|

|

|

|

9798 |

|

|

|

|

|

||

|

. . . . . . . . . . . . . . |

. . . . |

9799 |

|

|

|

|

|

|||||||

|

Electricity |

|

|

|

|

|

|

|

|

|

|

||||

|

. . . . . . . . . . . . . . |

. . . . |

|

|

|

|

|

|

|||||||

|

Heating fuel . . |

|

|

|

|

|

9802 |

|

|

|

|

|

|||

|

. . . . . . . . . . . . . . |

. . . . |

|

|

|

|

|

|

|||||||

|

Insurance program overpayment recapture |

|

|

|

|

|

|

9803 |

|

|

|

|

|

||

|

. . . . . . . . . . . . . . |

. . . . |

9804 |

|

|

|

|

|

|||||||

|

Insurance |

|

|

|

|

|

|

|

|

|

|

||||

|

. . . . . . . . . . . . . . |

. . . . |

|

|

|

|

|

|

|||||||

|

Interest |

|

|

|

|

|

9805 |

|

|

|

|

|

|||

|

. . . . . . . . . . . . . . |

. . . . |

|

|

|

|

|

|

|||||||

|

Office expenses |

|

|

|

|

|

|

9808 |

|

|

|

|

|

||

|

. . . . . . . . . . . . . . |

. . . . |

9809 |

|

|

|

|

|

|||||||

|

Legal and accounting fees |

|

|

|

|

|

|

|

|

|

|

|

|||

|

. . . . |

. . . . . . . . . . . . . . |

. . . . |

|

|

|

|

|

|

||||||

|

Property taxes . |

|

|

|

|

|

9810 |

|

|

|

|

|

|||

|

. . . . . . . . . . . . . . |

. . . . |

|

|

|

|

|

|

|||||||

|

Rent (land, buildings, and pasture) |

|

|

|

|

|

|

9811 |

|

|

|

|

|

||

|

. . . . . . . . . . . . . . |

. . . . |

9814 |

|

|

|

|

|

|||||||

|

Salaries, wages, and benefits (including employer's contributions) |

|

|

|

|

|

|

|

|

|

|

|

|||

|

. . . . |

. . . . . . . . . . . . . . |

. . . . |

|

|

|

|

|

|

||||||

|

Motor vehicle expenses (not including CCA) |

|

|

|

|

|

|

9819 |

|

|

|

|

|

||

|

. . . . . . . . . . . . . . |

. . . . |

|

|

|

|

|

|

|||||||

|

Small tools . . . . |

|

|

|

|

|

9820 |

|

|

|

|

|

|||

|

. . . . . . . . . . . . . . |

. . . . |

9937 |

|

|

|

|

|

|||||||

|

Mandatory inventory adjustment included in 2011 |

|

|

|

|

|

|

|

|

|

|

|

|||

|

. . . . . . . . . . . . . . |

. . . . |

|

|

|

|

|

|

|||||||

|

Optional inventory adjustment included in 2011 |

|

|

|

|

|

|

9938 |

|

|

|

|

|

||

|

. . . . . . . . . . . . . . |

. . . . |

|

|

|

|

|

|

|||||||

|

Other expenses |

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Total other expenses |

9790 |

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

Subtotal |

|

|

|

|

|

|

|

||

|

Allowance on eligible capital property |

|

|

|

|

|

|

9935 |

|

|

|

|

|

||

|

. . . . . . . . . . . . . . |

. . . . |

9936 |

|

|

|

|

|

|||||||

|

Capital cost allowance (from Area A on page 4) |

|

|

|

|

|

|

|

|

|

|

|

|||

|

. . . . . . . . . . . . . . |

. . . . |

|

|

|

|

|

||||||||

|

|

Total farm expenses (total of the above three lines) |

|

9898 |

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|||||||

Net income (loss) before adjustments (line a minus line b) |

|

|

|

|

|

|

|

|

|

|

|

9899 |

|||

|

|

|

|

|

|

|

|

|

|

|

|||||

. . . . . . . . . . . . |

. . . . . . |

. . . . |

. . . . . . . . . . . . . . |

. . . . |

|

||||||||||

Optional inventory adjustment included in 2012 |

|

|

|

|

|

|

|

|

|

|

|

9941 |

|||

. . . . . . . . . . . . |

. . . . . . |

. . . . |

. . . . . . . . . . . . . . |

. . . . |

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

9942 |

||||

Mandatory inventory adjustment included in 2012 |

|

|

|

|

|

|

|

|

|

|

|

||||

. . . . . . . . . . . . |

. |

. .Total. . of the above three lines |

|||||||||||||

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

||||||||

a

b

c

Your net income (loss)

Your share of the amount on line c |

|

|

9974 |

Plus: GST/HST rebate for partners received in the year |

|

Total (line d plus line 9974) |

|

Minus: Other amounts deductible from your share of net partnership income (loss) (from the chart on page 3) |

|

Net income (loss) after adjustments (line e minus line f) |

. . . . . . . . . . . . . . . . . . . . . . |

Minus: |

. . . . . . . . . . . . . . . . . . . . . . |

Your net income (loss) (line g minus line 9945) (enter this amount on line 141 of your income tax and benefit return) |

|

d

9943

9945

9946

e f g

Page 2 of 5

Protected B when completed

Other amounts deductible from your share of net partnership income (loss)

Claim expenses you incurred that were not included in the partnership statement of income and expenses, and for which the partnership did not reimburse you.

Total (enter this amount on line f on page 2)

Calculating

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Heat |

|

|

|

|

|

||

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Electricity |

|

|

|

|

|

||

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Insurance |

|

|

|

|

|

||

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Maintenance |

|

|

|

|

|

||

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Mortgage interest |

|

|

|

|

|

||

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Property taxes |

|

|

|

|

|

||

Other expenses (specify) |

|

|

|

|

|

|

|

|

Subtotal |

|

|

|

|

|

|

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Minus: |

|

|

|

|

|

||

|

Subtotal |

|

|

|

|

|

|

Plus: |

|

|

|

|

|||

Capital cost allowance (business part only) |

|

|

|

|

|

||

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Amount carried forward from previous year |

|

|

1 |

|

|

||

|

Subtotal |

|

|

|

|

||

. . . . . . . . . . .Minus: Net income (loss) after adjustments (from line g on page 2) (if negative, enter "0") |

|

|

2 |

|

|

||

|

|

|

|

||||

(line 1 minus line 2) (if negative, enter "0") |

|

|

|

|

|

||

|

|

|

|

|

|||

Allowable claim (the lesser of amount 1 and 2 above) (enter your share of this amount on line 9945 on page 2.) |

. . . . . . |

|

3 |

||||

|

|

|

|

|

|

|

|

Details of other partners

Name of partner

City |

Province or |

Postal code |

Share of net income or (loss) |

|

Percentage of partnership |

|||||||||||||||

|

|

|

territory |

|

|

|

|

|

|

|

|

$ |

|

|

% |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Name of partner |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

||||||||||||

City |

Province or |

Postal code |

Share of net income or (loss) |

|

Percentage of partnership |

|||||||||||||||

|

|

|

territory |

|

|

|

|

|

|

|

|

$ |

|

|

% |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Name of partner |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

||||||||||||

City |

Province or |

Postal code |

Share of net income or (loss) |

|

Percentage of partnership |

|||||||||||||||

|

|

|

territory |

|

|

|

|

|

|

|

|

$ |

|

|

% |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Name of partner |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

||||||||||||

City |

Province or |

Postal code |

Share of net income or (loss) |

|

Percentage of partnership |

|||||||||||||||

|

|

|

territory |

|

|

|

|

|

|

|

|

$ |

|

|

% |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Details of equity |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total business liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

9931 |

|

|

|

|

|||

. . . . . . . |

. . . |

. . . |

. . . . |

. . . |

. . . |

. . . |

. . . |

. . . . |

. . . . . . . . . . . . . . . . |

. . . . |

|

|

|

|

|

|

||||

Drawings in 2012 |

|

|

|

|

|

|

|

|

|

|

|

|

9932 |

|

|

|

|

|||

. . . . . . . |

. . . |

. . . |

. . . . |

. . . |

. . . |

. . . |

. . . |

. . . . |

. . . . . . . . . . . . . . . . |

. . . . |

9933 |

|

|

|

|

|||||

Capital contributions in 2012 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

. . . . . . . |

. . . |

. . . |

. . . . |

. . . |

. . . |

. . . |

. . . |

. . . . |

. . . . . . . . . . . . . . . . |

. . . . |

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Page 3 of 5

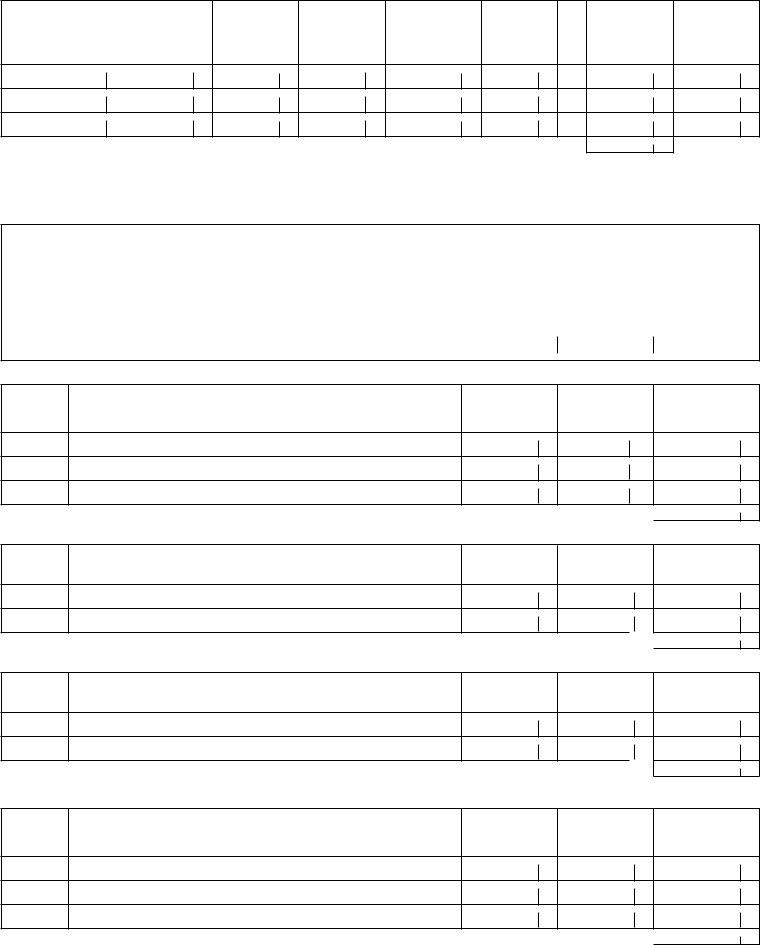

Area A – Calculating capital cost allowance (CCA)

Protected B when completed

1 |

2 |

3 |

Class |

Undepreciated |

Cost of additions |

number |

capital cost (UCC) |

in the year |

|

at the start of the year |

(see areas B and C |

|

|

below) |

|

|

|

4

Proceeds of dispositions

in the year (see

areas D and E below)

5*

UCC after additions

and dispositions (col. 2 plus col. 3 minus col. 4)

6

Adjustment for

1/2 x (col. 3 minus col. 4) If negative,

enter "0."

7

Base amount for CCA (col. 5 minus col. 6)

8

Rate

(%)

9

CCA for the year

(col. 7 x col. 8 or an

adjusted amount)

10

UCC at the end of the year

(col. 5 minus col. 9)

Total CCA on Part XI properties. Enter this amount, minus any CCA for |

|

|

i

*If you have a negative amount in this column, add it to income as a recapture on line 9600 "Other income" on page 1. If there is no property left in the class and there is a positive amount in the column, deduct the amount from income as a terminal loss on line 9790, "Total other expenses," on page 2. Recapture and terminal loss do not apply to a Class 10.1 property. For more information, read Chapter 3 of Guide T4003.

** For information on CCA for

Part XVII properties (acquired before 1972)

1 |

2 |

3 |

4 |

|

5 |

6 |

|

7 |

|

Year acquired |

Kind of property |

Month of disposition |

Cost |

Rate (%) |

CCA for this year |

Total CCA for this |

|||

|

|

|

(business part) |

|

|

|

and previous years |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Enter the total of lines i and ii on line 9936, on page 2. |

Total CCA on Part XVII properties |

|

|

ii |

|

|

|

|

Area B – Details of equipment additions in the year

1

Class number

2

Property description

3

Total cost

4

Personal part (if applicable)

5

Business part

(column 3 minus column 4)

Total equipment additions in the year 9925

Area C – Details of building additions in the year

1

Class number

2

Property description

3

Total cost

4

Personal part (if applicable)

5

Business part

(column 3 minus column 4)

Total building additions in the year 9927

Area D – Details of equipment dispositions in the year

1

Class number

2

Property description

3

Proceeds of disposition

(should not be more than the capital cost)

4

Personal part (if applicable)

5

Business part

(column 3 minus column 4)

Note: If you disposed of property from your farming business in the year, see Chapter 3 |

Total equipment dispositions in the year |

9926 |

|

of Guide T4003 for information about your proceeds of disposition. |

|||

|

|||

|

|

Area E – Details of building dispositions in the year

1

Class number

2

Property description

3

Proceeds of disposition

(should not be more than the capital cost)

4

Personal part (if applicable)

5

Business part

(column 3 minus column 4)

Note: If you disposed of property from your farming business in the year, see Chapter 3 |

9928 |

of Guide T4003 for information about your proceeds of disposition. |

Total building dispositions in the year |

|

Page 4 of 5

Area F – Details of land additions and dispositions in the year

Protected B when completed

Total cost of all land additions in the year |

9923 |

|

|

||

9924 |

||

Total proceeds from all land dispositions in the year |

||

|

||

|

|

|

Note: You cannot claim capital cost allowance on land. For more information, see Chapter 3 of Guide T4003. |

|

Area G – Details of quota additions and dispositions in the year

Total cost of all quota additions in the year |

9929 |

|

|

||

9930 |

||

Total proceeds from all quota dispositions in the year |

||

|

||

|

|

|

Note: All quotas are eligible capital property. For more information, see Chapter 4 of Guide T4003. |

|

Chart A – Motor vehicle expenses

Enter the kilometres you drove in the tax year to earn farming income |

|

1 |

||||||||||

Enter the total kilometres you drove in the tax year |

. . . . . . . . . . |

. . . . . . . |

. . . . . . . . . . . . . . . . . . . . . . . |

|

|

|

2 |

|||||

|

Fuel and oil |

|

|

|

|

|

|

|

|

3 |

||

|

. . . . . . . |

. . . . . . . . . . . . . . . . . . . . . . . |

|

|

|

|||||||

|

. . . . . . . . . . . . . . .Interest (see Chart B below) |

. . . . . . . . . . . |

. . . . . . . |

. . . . . . . . . . . . . . . . . . . . . . . |

|

|

|

4 |

||||

|

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Insurance |

. . . . . . . |

. . . . . . . . . . . . . . . . . . . . . . . |

|

|

|

5 |

|||||

|

. . . . . . . . . . . . . . . . . . . . . . . . . . . . .Licence and registration |

. . . . . . . |

. . . . . . . . . . . . . . . . . . . . . . . |

|

|

|

6 |

|||||

|

. . . . . . . . . . . . . . . . .Maintenance and repairs |

. . . . . . . . . . . |

. . . . . . . |

. . . . . . . . . . . . . . . . . . . . . . . |

|

|

|

7 |

||||

|

. . . . . . . . . . . . . .Leasing (see Chart C below) |

. . . . . . . . . . . |

. . . . . . . |

. . . . . . . . . . . . . . . . . . . . . . . |

|

|

|

8 |

||||

|

Other expenses (specify) |

|

|

|

|

|

|

|

|

|

9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

10 |

|

|

|

|

Total motor vehicle expenses (add lines 3 to 10) |

|

|

11 |

|||||

|

Business use part: ( |

line 1: |

|

) |

line 11: |

|

|

|

|

|

|

|

|

|

|

. . . . . . . |

. . . . . . . . . . . . |

. . . . . . . |

|||||||

line 2: |

|

|

|

|

|

|||||||

Business parking fees . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Supplementary business insurance . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Allowable motor vehicle expenses: (add lines 12 to 14)

Enter this amount on line 9819 on page 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Note: You can claim CCA on motor vehicles in Area A on page 4.

12

13

14

Chart B – Available interest expense for passenger vehicles

Total interest payable (accrual method) or paid (cash method) in the fiscal period |

. . . . . . . . . . . . . . . . . . . . . . |

|||

|

$10* |

the number of days in the fiscal period for which interest |

|

. . . . . . . . . . . . . . . . . |

|

|

was payable (accrual method) or paid (cash method) |

|

|

Available interest expense: (amount A or B, whichever is less) (enter this amount on line 4 of Chart A above) . . . . . . . . . . . . . . . .

*For passenger vehicles bought after 2000.

A

B

Chart C – Eligible leasing cost for passenger vehicles

Total lease charges incurred in your 2012 fiscal period for the vehicle |

. . . . . . . . . . . . . . . . |

. . . . . . . . . . |

. . . . . . |

. . . . . . . . . . . |

|

1 |

|||||

Total lease payments deducted before your 2012 fiscal period for the vehicle |

. . . . . . . . . . . . . . . . |

. . . . . . . . . . |

. . . . . . |

. . . . . . . . . . . |

2 |

||||||

. . . . . . . . . . . . . . .Total number of days the vehicle was leased in your 2012 fiscal period and previous fiscal periods |

. . . . . . . . . . . |

|

3 |

||||||||

. . . . . . . . . . . . . . . . . . . . .Manufacturer's list price |

. . . . |

. . . . . . . . . . . . . . . . . |

. . . . . . . . . . . . . . . . |

. . . . . . . . . . |

. . . . . . |

. . . . . . . . . . . |

|

4 |

|||

The amount on line 4 or ($35,294 GST and PST, or $35,294 + HST), whichever is more |

|

|

85% |

|

5 |

||||||

[($800 |

GST and PST, or $800 + HST) line 3] |

|

line 2: |

|

|

|

|

|

6 |

||

|

|

|

|

. . . . . . . . . . . . . |

|

||||||

|

30 |

|

|

|

|

|

|

|

|

|

|

[($30,000 |

GST and PST, or $30,000 + HST) line 1] |

|

|

|

|

|

|

7 |

|||

|

|

|

|

. . . . . . . . . . . . . . . . . . . . . . . . . . |

. . . . . . . . . . . . . . . . |

. . . . . . . . . . . . . . . |

|

||||

|

line 5 |

|

|

|

|

|

|

|

|

|

|

Eligible leasing cost: (line 6 or 7, whichever is less) (enter this amount on line 8 of Chart A above) . . . . . . . . . . . . . . . . . . . . . . . . .

* Use a GST rate of 5% or HST rate applicable to your province.

Privacy Act, Personal Information Bank number CRA PPU 005

Page 5 of 5