2020 form m1 instructions can be filled out online effortlessly. Just use FormsPal PDF tool to perform the job quickly. We at FormsPal are dedicated to providing you with the ideal experience with our editor by continuously releasing new functions and enhancements. Our tool is now much more intuitive thanks to the newest updates! Now, editing PDF forms is simpler and faster than ever before. All it requires is a few basic steps:

Step 1: Hit the "Get Form" button in the top section of this webpage to access our PDF editor.

Step 2: With the help of this handy PDF file editor, you could do more than just fill in forms. Try all the functions and make your forms seem high-quality with custom textual content incorporated, or optimize the file's original input to perfection - all supported by the capability to incorporate stunning graphics and sign the PDF off.

It is straightforward to fill out the document with this helpful guide! Here's what you must do:

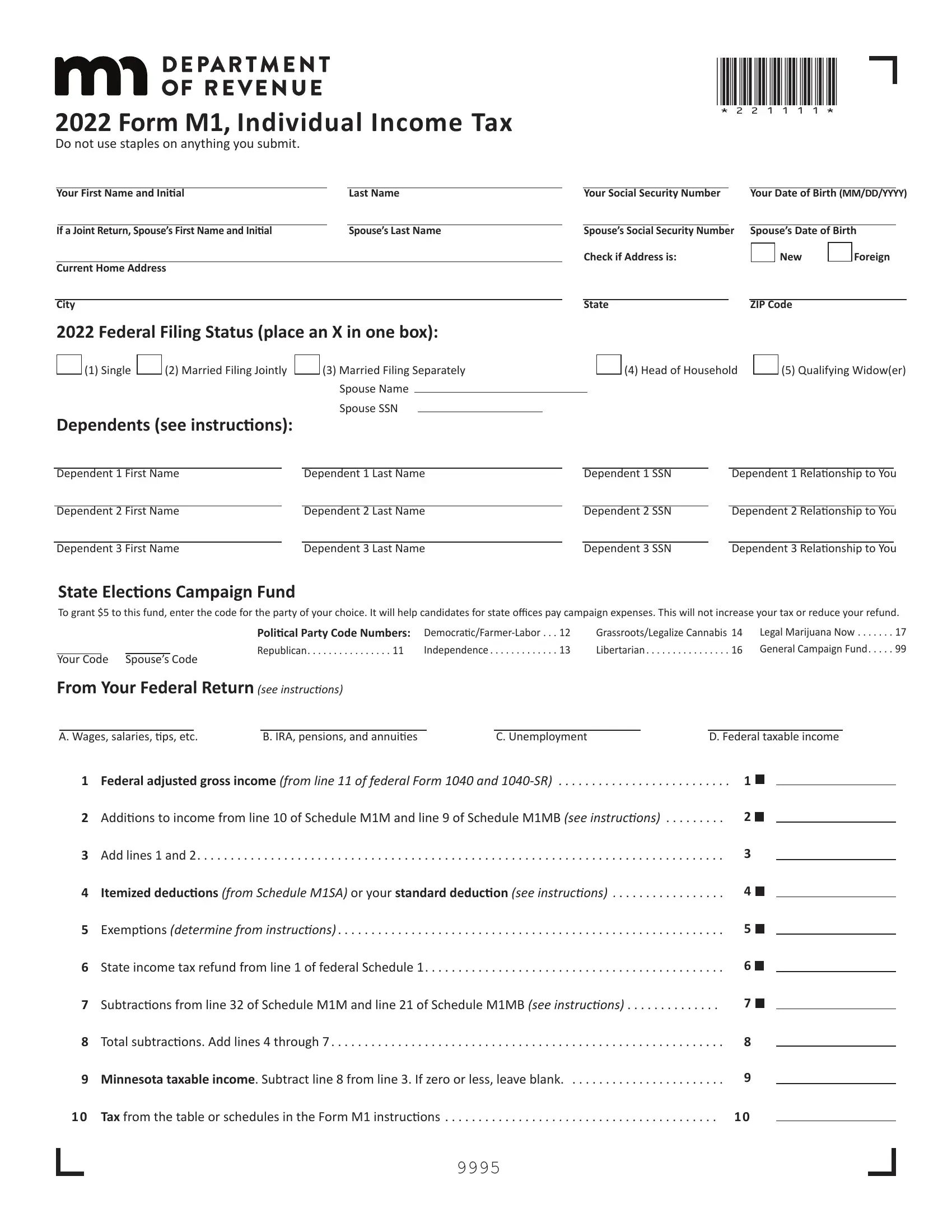

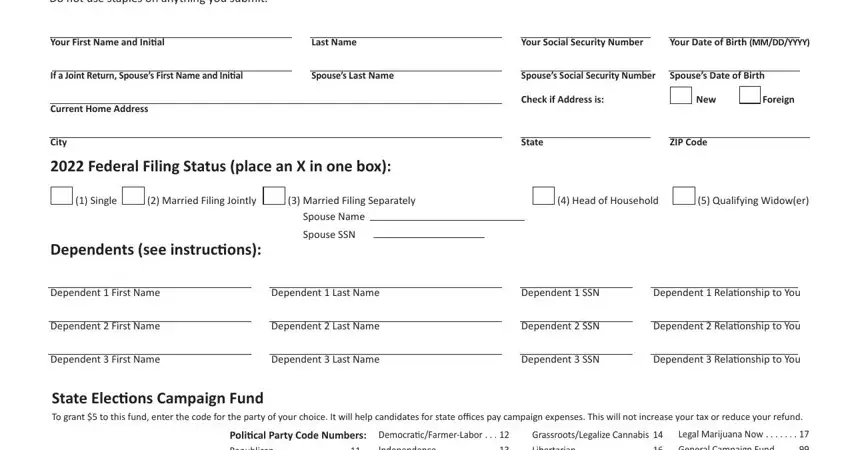

1. First, when filling out the 2020 form m1 instructions, begin with the section that contains the next blanks:

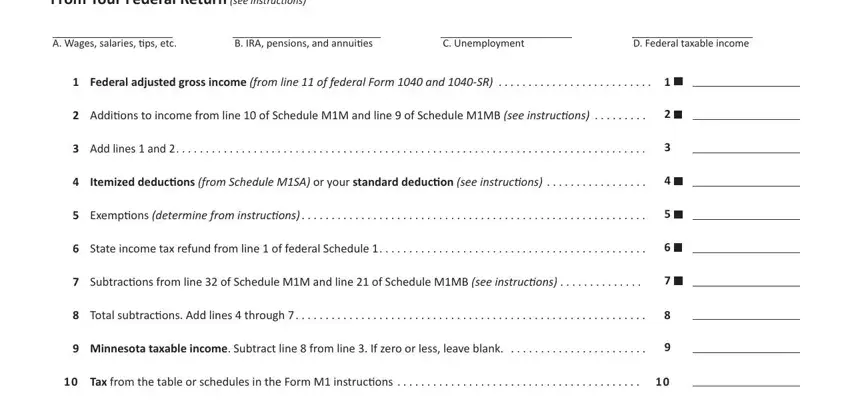

2. When the previous array of fields is finished, you're ready to add the required particulars in From Your Federal Return see, A Wages salaries tips etc, B IRA pensions and annuities, C Unemployment, D Federal taxable income, Federal adjusted gross income, Additions to income from line of, Add lines and, Itemized deductions from Schedule, Exemptions determine from, State income tax refund from line, Subtractions from line of, Total subtractions Add lines, Minnesota taxable income Subtract, and Tax from the table or schedules allowing you to move on to the next part.

Lots of people often make some mistakes when filling in Additions to income from line of in this part. You need to re-examine everything you type in right here.

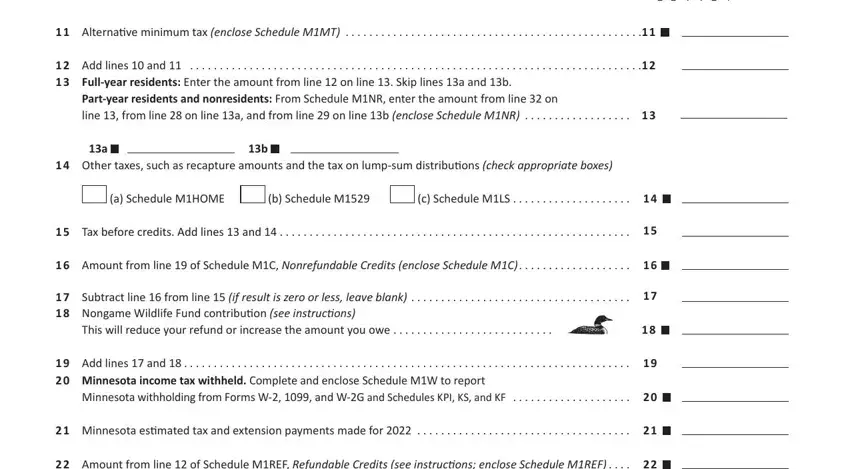

3. The third part is usually simple - complete all the fields in Alternative minimum tax enclose, Partyear residents and, line from line on line a and, Other taxes such as recapture, a Schedule MHOME, b Schedule M, c Schedule MLS, Tax before credits Add lines, Amount from line of Schedule MC, Subtract line from line if, This will reduce your refund or, Add lines and, Minnesota withholding from Forms W, Minnesota estimated tax and, and Amount from line of Schedule in order to finish this process.

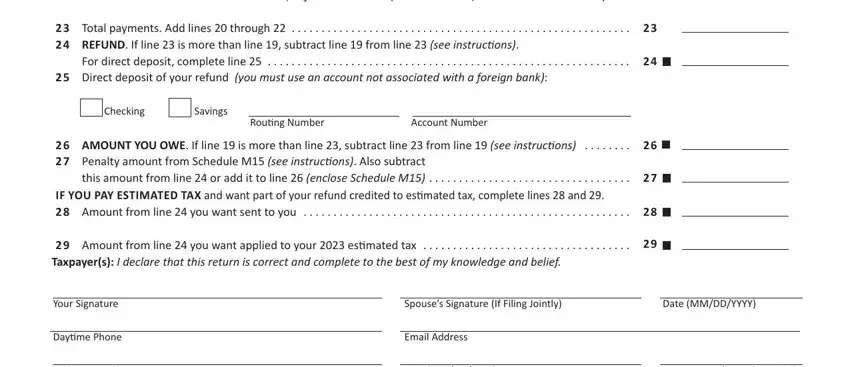

4. This next section requires some additional information. Ensure you complete all the necessary fields - Amount from line of Schedule, For direct deposit complete line, Account Number, Routing Number, Checking, Savings, this amount from line or add it, AMOUNT YOU OWE If line is more, Your Signature, Daytime Phone, Paid Preparers Signature, Spouses Signature If Filing Jointly, Date MMDDYYYY, Email Address, and Date MMDDYYYY - to proceed further in your process!

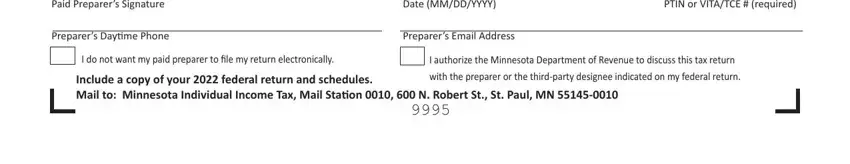

5. The very last notch to conclude this form is pivotal. Make certain to fill in the mandatory blank fields, for instance Paid Preparers Signature, Preparers Daytime Phone, Date MMDDYYYY, PTIN or VITATCE required, Preparers Email Address, I do not want my paid preparer to, and I authorize the Minnesota, prior to submitting. Neglecting to accomplish that might contribute to a flawed and possibly unacceptable form!

Step 3: Spell-check the information you've typed into the form fields and hit the "Done" button. Grab your 2020 form m1 instructions when you join for a 7-day free trial. Conveniently access the pdf document within your FormsPal account, along with any edits and changes all synced! We don't sell or share any details you provide whenever filling out forms at our website.