If you need to fill out louisiana r 1029, it's not necessary to install any sort of programs - just give a try to our PDF editor. FormsPal team is dedicated to making sure you have the best possible experience with our tool by constantly presenting new functions and enhancements. With all of these improvements, using our tool gets easier than ever before! In case you are seeking to get going, here is what it will require:

Step 1: First of all, access the pdf editor by clicking the "Get Form Button" in the top section of this site.

Step 2: This tool will allow you to work with your PDF file in various ways. Change it by including your own text, correct what is originally in the PDF, and include a signature - all readily available!

It's an easy task to complete the form with this detailed tutorial! This is what you have to do:

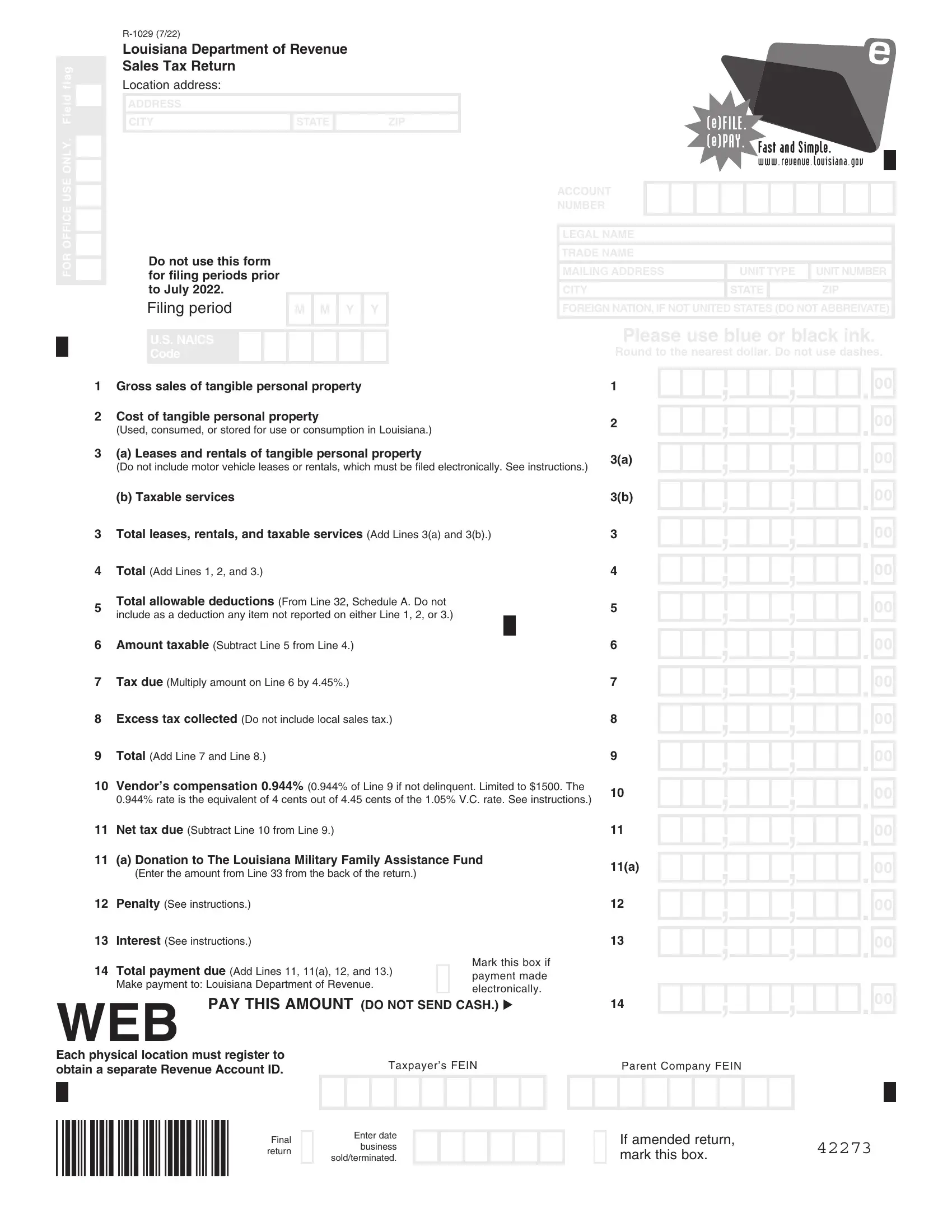

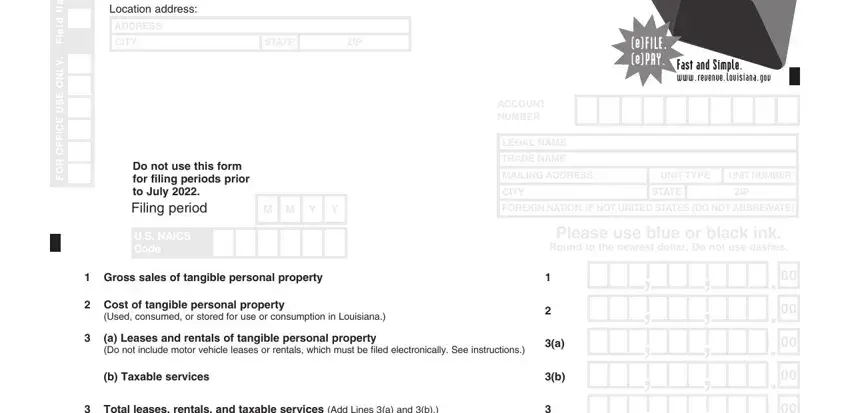

1. The louisiana r 1029 requires certain details to be typed in. Make certain the following blank fields are complete:

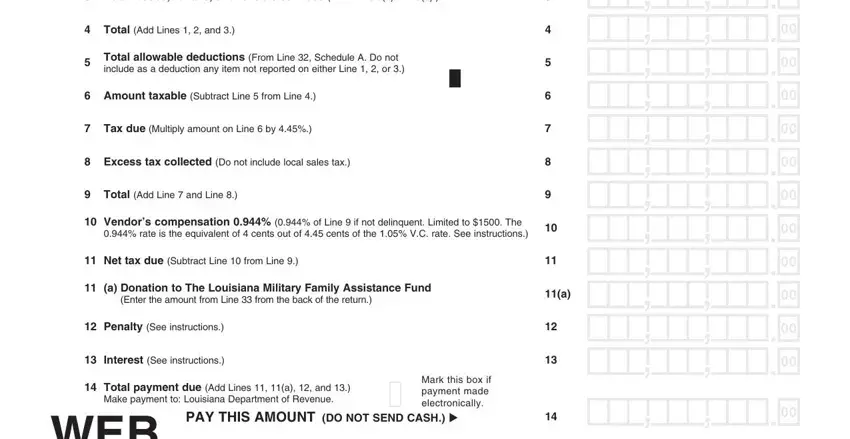

2. Soon after this array of blank fields is done, go on to enter the relevant information in these: Total leases rentals and taxable, Total Add Lines and, Total allowable deductions From, Amount taxable Subtract Line, Tax due Multiply amount on Line, Excess tax collected Do not, Total Add Line and Line, Vendors compensation of Line, Net tax due Subtract Line from, a Donation to The Louisiana, Enter the amount from Line from, Penalty See instructions, Interest See instructions, Total payment due Add Lines a, and Make payment to Louisiana.

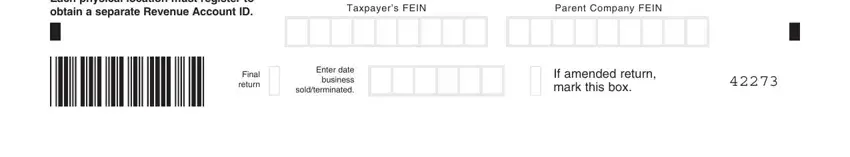

3. This next step is focused on Each physical location must, Taxpayers FEIN, Parent Company FEIN, Final return, Enter date business soldterminated, and If amended return mark this box - fill in each one of these blank fields.

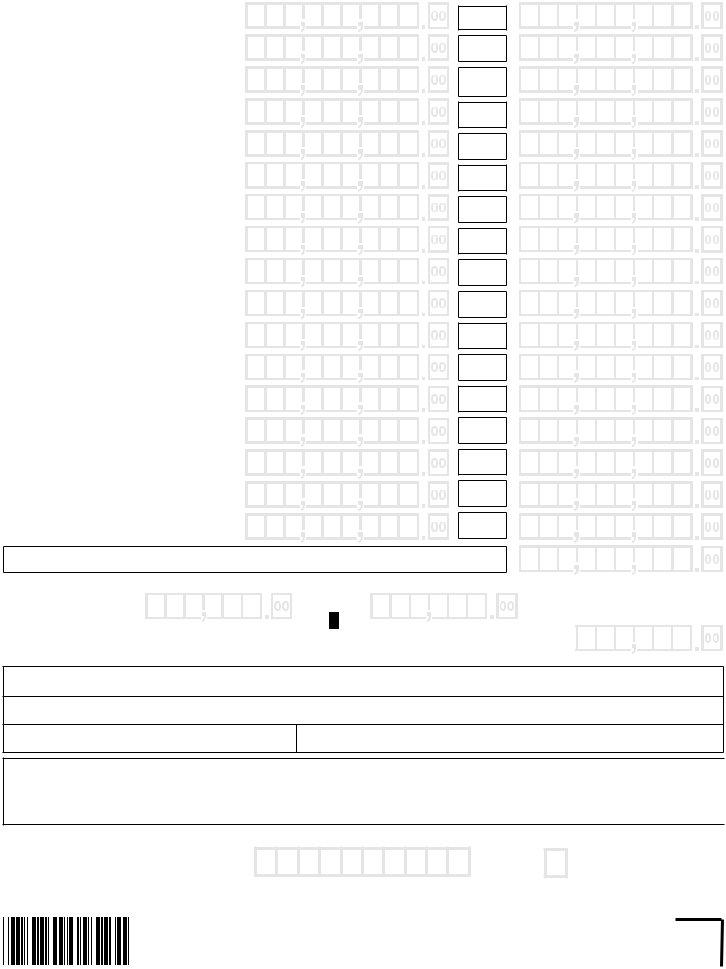

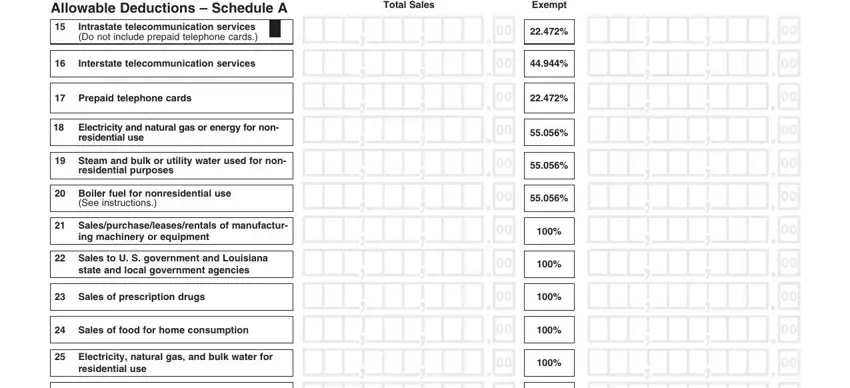

4. The next subsection requires your involvement in the following places: Total Sales, R Allowable Deductions Schedule A, Intrastate telecommunication, Interstate telecommunication, Prepaid telephone cards, Electricity and natural gas or, residential use, Steam and bulk or utility water, residential purposes, Boiler fuel for nonresidential use, See instructions, Salespurchaseleasesrentals of, ing machinery or equipment, Sales to U S government and, and state and local government agencies. Be sure to fill out all requested details to move further.

Be very mindful when filling out ing machinery or equipment and Boiler fuel for nonresidential use, because this is where a lot of people make mistakes.

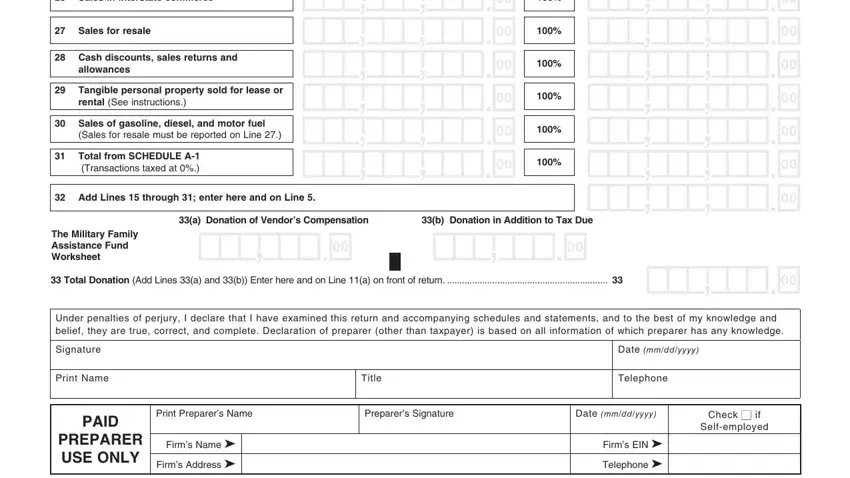

5. The form should be wrapped up by filling out this area. Here one can find a comprehensive list of form fields that must be filled in with correct details to allow your document usage to be faultless: Sales in interstate commerce, Sales for resale, Cash discounts sales returns and, allowances, Tangible personal property sold, rental See instructions, Sales of gasoline diesel and, Sales for resale must be reported, Total from SCHEDULE A, Add Lines through enter here, a Donation of Vendors Compensation, b Donation in Addition to Tax Due, The Military Family Assistance, Total Donation Add Lines a and b, and Under penalties of perjury I.

Step 3: Revise all the information you have entered into the form fields and then click the "Done" button. Acquire your louisiana r 1029 when you sign up for a free trial. Readily use the pdf file inside your FormsPal account, along with any edits and adjustments being automatically synced! FormsPal provides protected form completion with no personal data record-keeping or distributing. Rest assured that your details are in good hands with us!