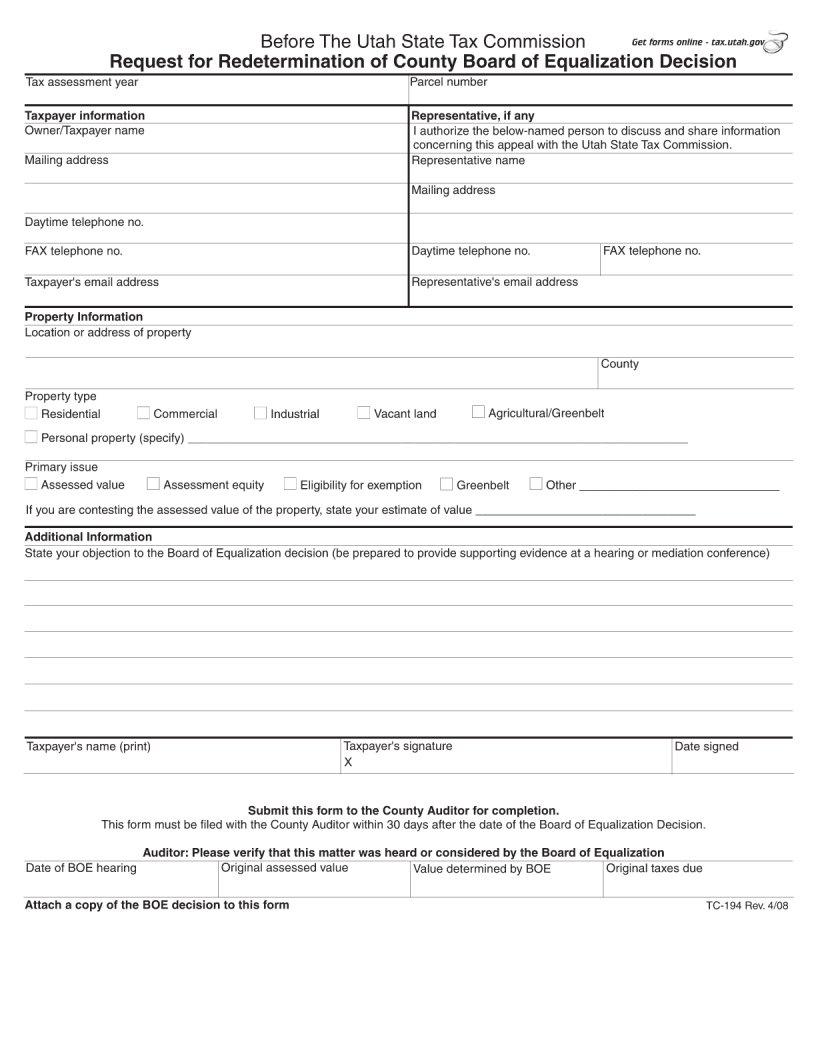

In the intricate network of legal paperwork that facilitates the operational aspects of real estate within the United States, the Tc 194 Utah form represents a critical component for those dealing within the state of Utah. This document primarily serves as an application for property tax abatement, relief, or deferral, offering a means for property owners to manage financial burdens associated with property taxes under certain conditions. Its significance lies in its ability to provide financial reprieve to qualifying residents, who may be facing hardship or meet specific criteria set forth by Utah law. By meticulously outlining eligibility requirements, the form guides applicants through the process of requesting tax adjustments, thereby ensuring that the local tax system accommodates variations in taxpayers' circumstances. Moreover, the intricacies of the form reflect the broader principles of equity and fairness that underpin the state’s approach to property taxation, ensuring that aid is accessible to those in genuine need. Understanding the Tc 194 Utah form, therefore, is not just about grasping its immediate practical applications but also about appreciating its role within the larger context of property tax administration and its contribution to a more adaptable and responsive fiscal environment.

| Question | Answer |

|---|---|

| Form Name | Form Tc 194 Utah |

| Form Length | 1 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 15 sec |

| Other names | tc 194 tc 194 utah form |