The procedure of completing the fillable tc 40w is really simple. Our experts ensured our tool is not difficult to utilize and can help complete any form without delay. Check out a couple of steps you will have to take:

Step 1: The web page includes an orange button stating "Get Form Now". Click it.

Step 2: Once you have entered your fillable tc 40w edit page, you will notice all actions you can undertake regarding your template within the upper menu.

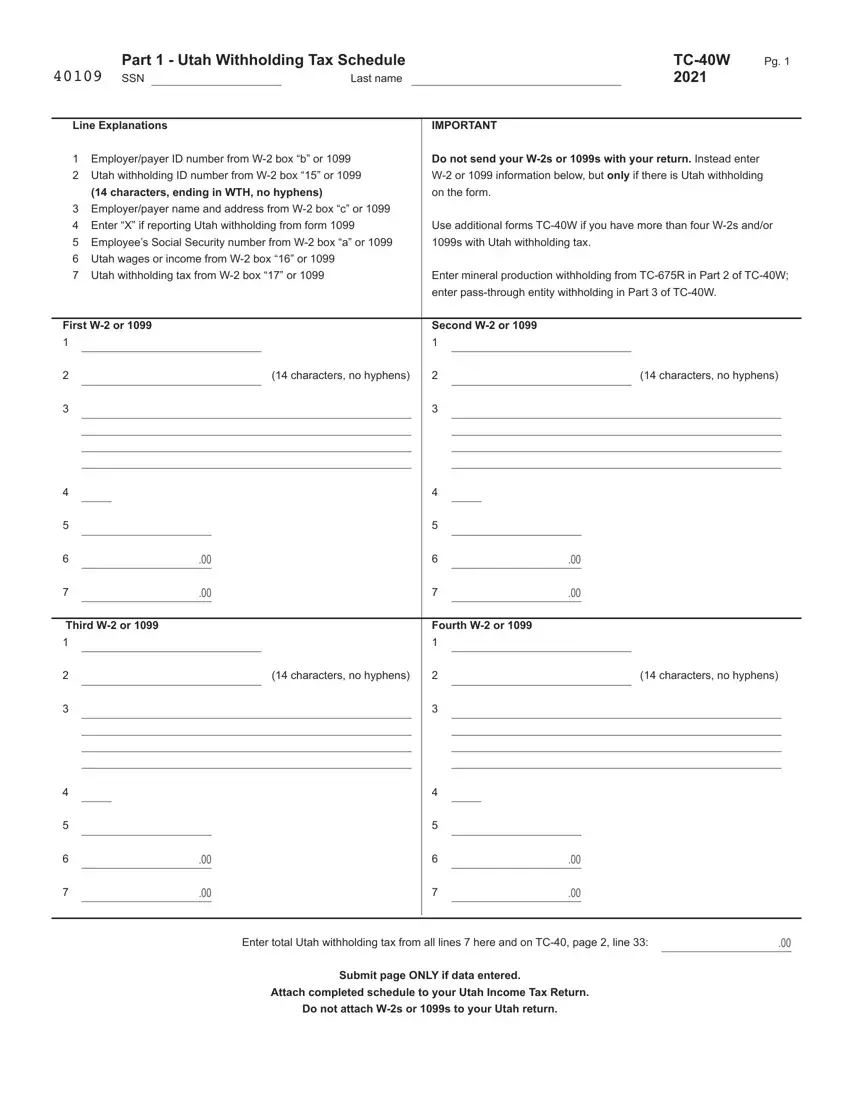

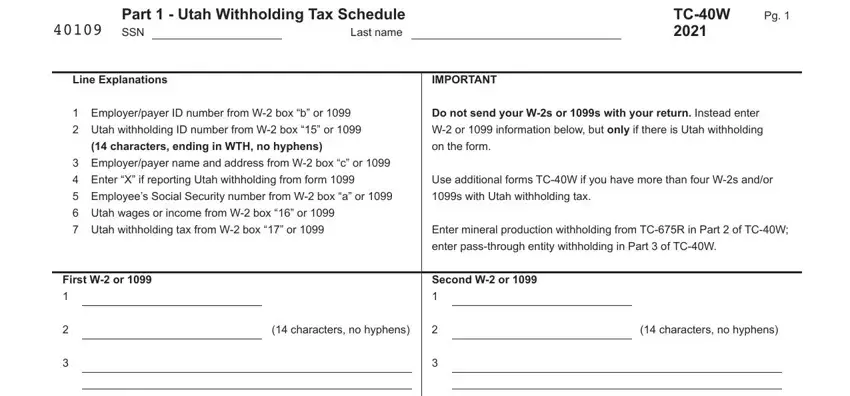

The PDF template you plan to prepare will cover the following parts:

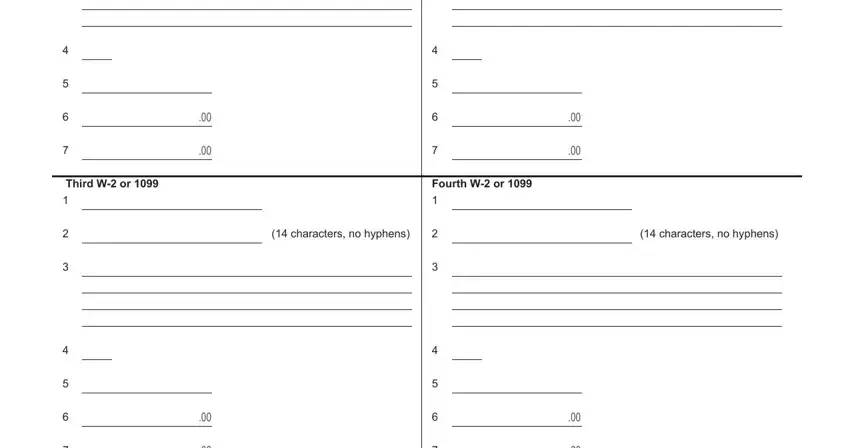

You should type in the demanded details in the Third W or, Fourth W or, characters no hyphens, and characters no hyphens area.

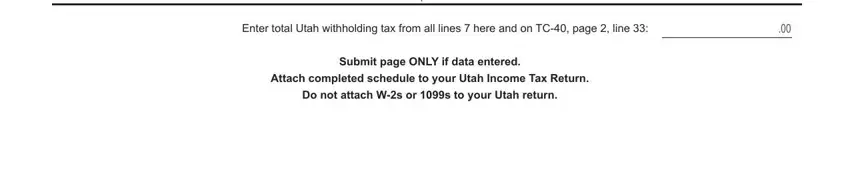

You can be instructed to enter the particulars to let the program fill out the part Enter total Utah withholding tax, Submit page ONLY if data entered, Attach completed schedule to your, and Do not attach Ws or s to your Utah.

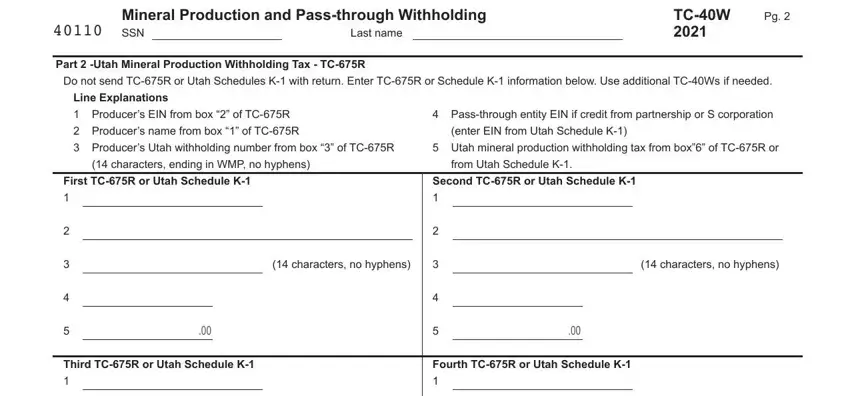

You have to describe the rights and responsibilities of the parties in the Mineral Production and Passthrough, Last name, Part Utah Mineral Production, TCW, Do not send TCR or Utah Schedules, Line Explanations, Producers EIN from box of TCR, Producers name from box of TCR, Passthrough entity EIN if credit, enter EIN from Utah Schedule K, Producers Utah withholding number, Utah mineral production, characters ending in WMP no, from Utah Schedule K, and First TCR or Utah Schedule K part.

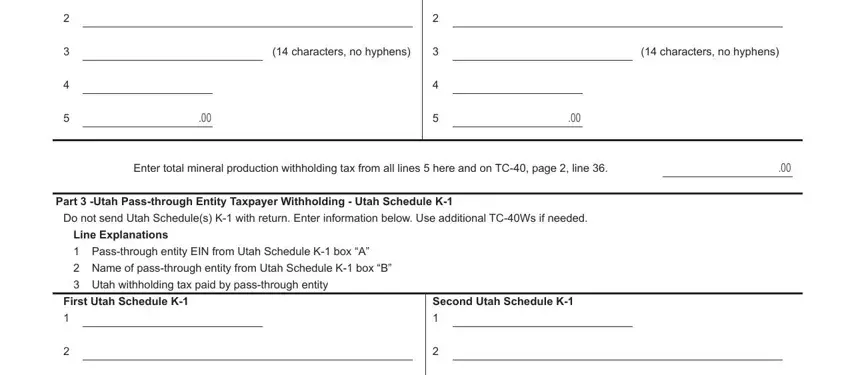

End by reading the following fields and completing them as needed: characters no hyphens, characters no hyphens, Enter total mineral production, Part Utah Passthrough Entity, Do not send Utah Schedules K with, Line Explanations, Passthrough entity EIN from Utah, Name of passthrough entity from, Utah withholding tax paid by, First Utah Schedule K, and Second Utah Schedule K.

Step 3: Press the Done button to save your document. So now it is obtainable for transfer to your electronic device.

Step 4: To prevent yourself from possible forthcoming issues, be sure you have minimally a couple of copies of each form.