Should you desire to fill out submits, you won't need to install any sort of software - just try our online tool. The editor is constantly improved by our team, acquiring powerful functions and becoming even more versatile. Starting is easy! All you need to do is stick to the following easy steps below:

Step 1: Firstly, open the editor by pressing the "Get Form Button" above on this site.

Step 2: With this handy PDF file editor, you could do more than simply fill out blanks. Edit away and make your forms look faultless with custom textual content added in, or modify the file's original content to excellence - all backed up by the capability to add any type of images and sign the PDF off.

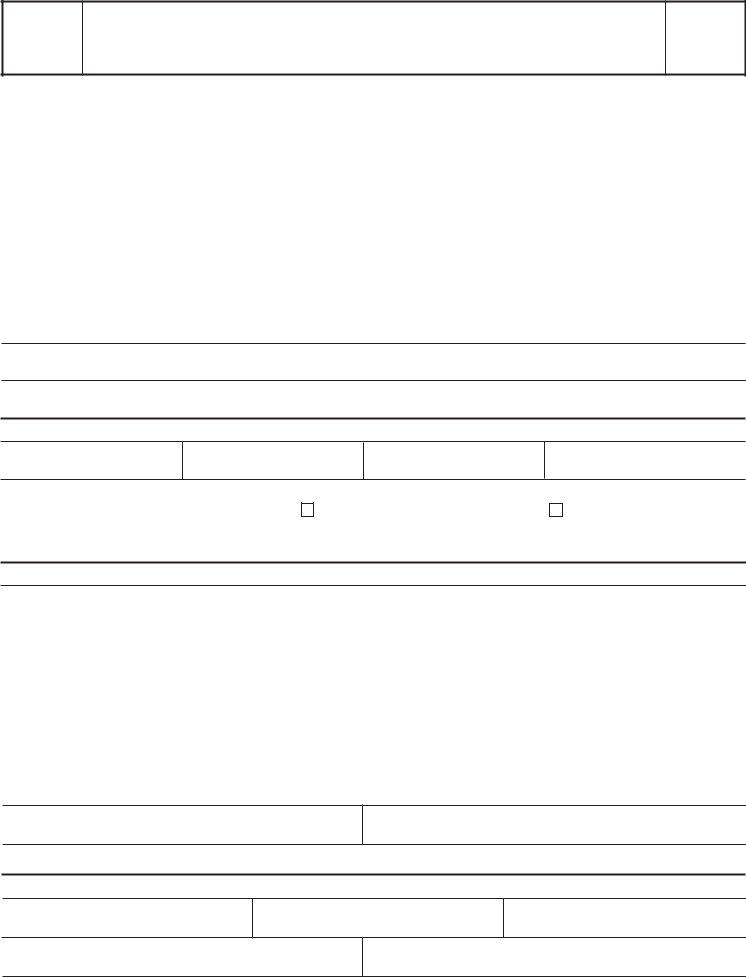

This document requires specific details to be entered, thus be certain to take your time to type in what's asked:

1. Fill out the submits with a selection of necessary blanks. Gather all the important information and ensure nothing is overlooked!

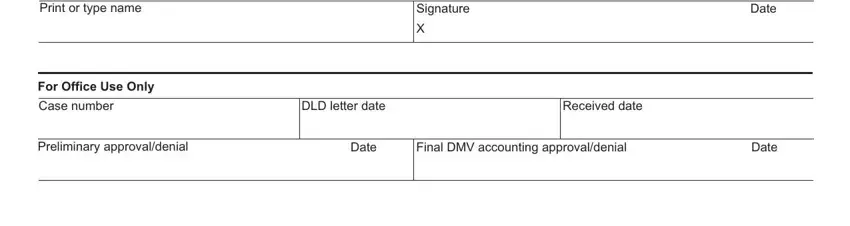

2. When this selection of blanks is done, proceed to enter the suitable details in all these: Print or type name, For Office Use Only, Case number, Signature, Date, DLD letter date, Received date, Preliminary approvaldenial, Date, Final DMV accounting approvaldenial, and Date.

Always be really attentive while filling out Date and Received date, as this is where a lot of people make a few mistakes.

Step 3: Prior to finalizing your document, make sure that form fields were filled in the proper way. Once you establish that it is fine, click on “Done." Join us today and instantly gain access to submits, ready for downloading. Every modification you make is conveniently saved , so that you can change the file later on if required. FormsPal is devoted to the privacy of all our users; we make certain that all personal information used in our editor is confidential.