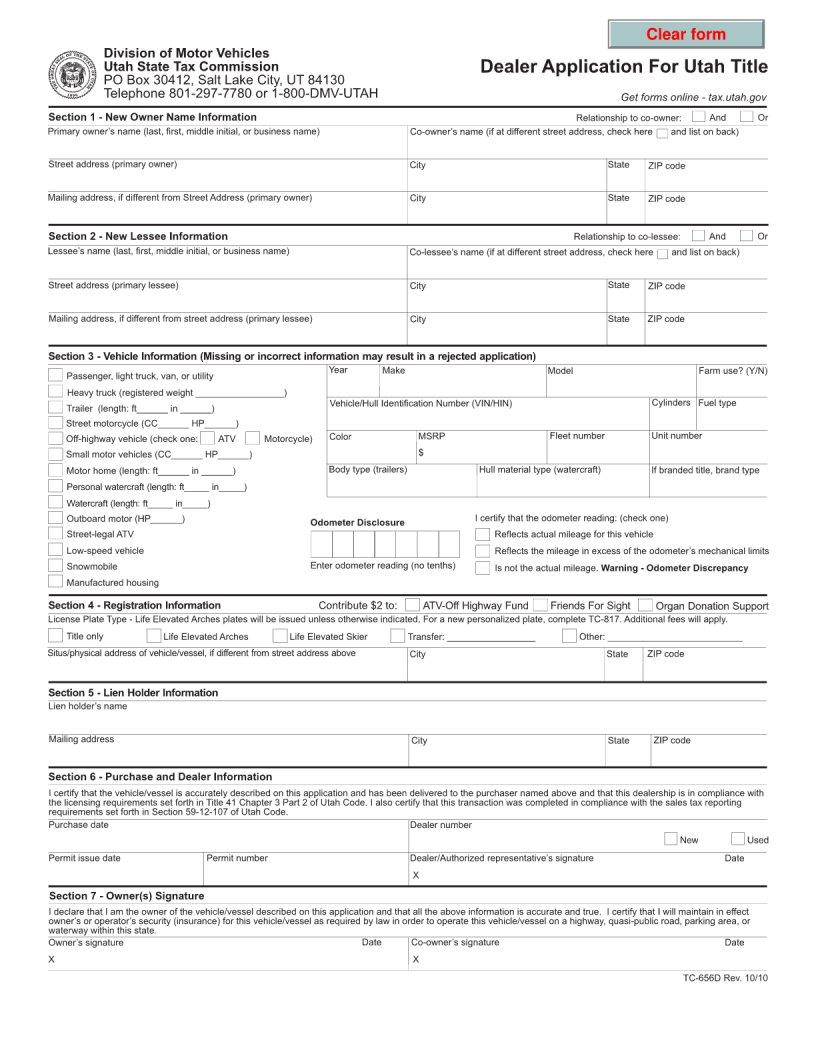

When navigating through the complexities of tax obligations, businesses and individuals often encounter the necessity of understanding various forms, one of which is the TC 656D form. This particular document serves a vital role in the process of addressing tax discrepancies, filing for adjustments, or amending previously submitted tax documents. Not only does it allow for the rectification of errors, but it also provides a structured pathway for taxpayers to communicate with tax authorities regarding any adjustments needed. The importance of accurately completing the TC 656D form cannot be overstated, as it directly impacts the timely and effective resolution of tax matters. Furthermore, by ensuring that all information is correctly presented, taxpayers can avoid potential penalties, additional audits, or prolonged processing times. It is designed to be comprehensive yet accessible, making it imperative for individuals and businesses to familiarize themselves with the form's requirements and how it fits into their broader tax compliance strategy.

| Question | Answer |

|---|---|

| Form Name | Form Tc 656D |

| Form Length | 1 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 15 sec |

| Other names | tc 656d tc 656d form |