In the realm of navigating state tax regulations, understanding the nuances of forms like the TC-721A becomes crucial, especially for those engaging in transactions that might not be strictly local. The Utah State Tax Commission, located in Salt Lake City, introduces this specific affidavit to streamline the exemption process of sales tax for certain items identified under the form's criteria. Essentially, the TC-721A Sales and Use Tax Exemption Affidavit for Exclusive Use Outside of Utah serves as a gateway for purchasers to legally declare the exemption of sales tax on vehicles, boats, boat trailers, and outboard motors requiring registration under respective state acts. The affidavit underscores the importance of complete and accurate information alongside a signature to validate the claim. This exemption pivots on the condition that the items in question will not find their registration or extensive use within Utah borders, drawing a delineation based on the nature of use—whether for business or non-business purposes—and the longevity of such use within the state. The document outlines a clear expectation for accountability on the part of the purchaser while setting a responsibility framework for dealers regarding record-keeping and validation of the exemption. Through this affidavit, the Utah State Tax Commission tailors a process that balances regulatory compliance with facilitation of commerce, especially in scenarios where interstate transactions necessitate clarity and precision in tax exemption claims.

| Question | Answer |

|---|---|

| Form Name | Form Tc 721A |

| Form Length | 1 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 15 sec |

| Other names | Purchaser, tc 721a utah, utah tc 721 fillable, 1950 |

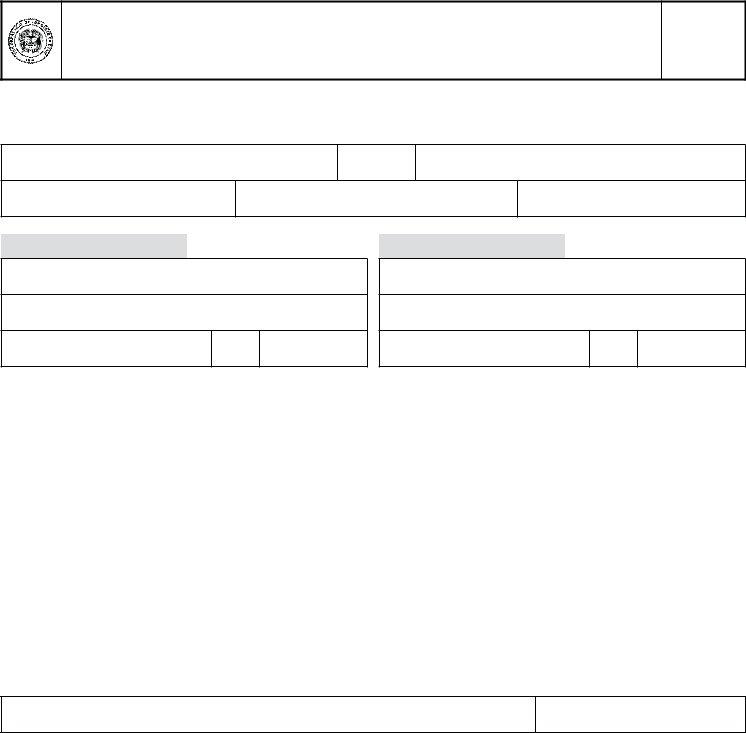

Utah State Tax Commission

210 N 1950 W • Salt Lake City, UT 84134 • www.tax.utah.gov

Sales and Use Tax Exemption Affidavit

for Exclusive Use Outside of Utah

Rev. 5/07

This sales tax exemption may be allowed only if all names and addresses are complete and this form is signed.

Type

Year

Make

Model

Style

Identification number

Purchaser

Name

Dealer

Name

Address

Address

City

State

ZIP Code

City

State

ZIP Code

USE THIS FORM to apply for an exemption of sales tax on a purchase of:

1.a vehicle required to be registered under the Motor Vehicle Act,

2.a boat required to be registered under the State Boating Act,

3.a boat trailer, or

4.an outboard motor.

This exemption is only valid if the vehicle, boat, boat trailer or outboard motor is not registered in Utah and is either:

1.not used in Utah, or

2.used in Utah, if the vehicle is used for

a.

b.business purposes, for the time period needed to transport it to the borders.

I have read and understand this affidavit and I certify I take sole responsibility in determining I am eligible for this claim of exemption. In addition, I certify the vehicle described on this affidavit will be taken out of Utah permanently and will not be used or registered in Utah. This affidavit is true and correct to the best of my knowledge.

X

Date signed

DEALERS: Keep this form for your records to verify the sales tax exemption. DO NOT send it to the Tax Commission.