When you get your federal tax refund, where does it go? You may be surprised to learn that most of your refund goes towards paying off past due taxes. The IRS holds onto a good chunk of your refund until your debt is paid off. However, there are some ways to get that money back sooner. One such way is by using Form TC 721A: the Taxpayer Advocate Service Direct Deposit Agreement form. This form allows you to request that the IRS send your refund directly to one or more financial institutions of your choice. By using Form TC 721A, you can speed up the process of getting your refund and put it towards other expenses. To learn more about this form and how to use it, keep reading.

| Question | Answer |

|---|---|

| Form Name | Form Tc 721A |

| Form Length | 1 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 15 sec |

| Other names | Purchaser, tc 721a utah, utah tc 721 fillable, 1950 |

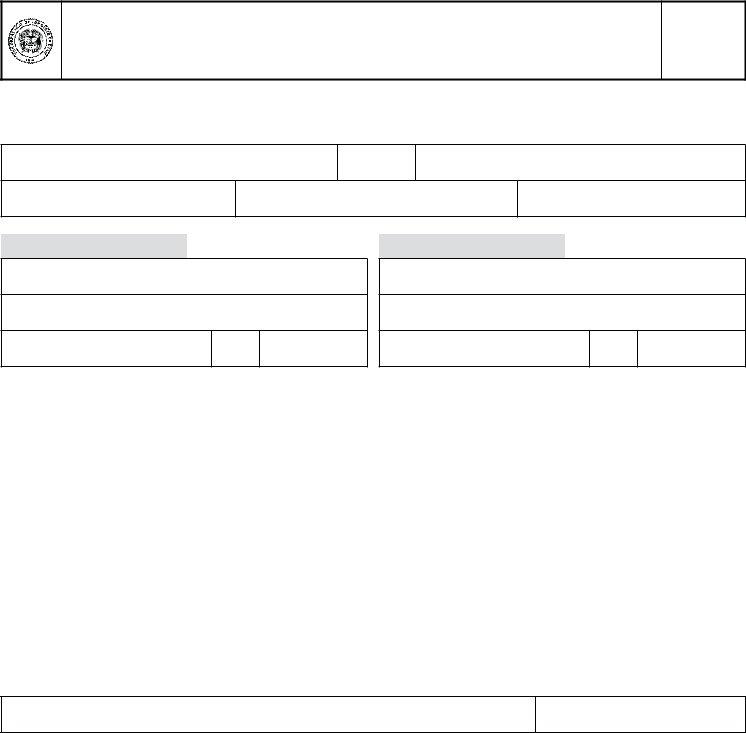

Utah State Tax Commission

210 N 1950 W • Salt Lake City, UT 84134 • www.tax.utah.gov

Sales and Use Tax Exemption Affidavit

for Exclusive Use Outside of Utah

Rev. 5/07

This sales tax exemption may be allowed only if all names and addresses are complete and this form is signed.

Type

Year

Make

Model

Style

Identification number

Purchaser

Name

Dealer

Name

Address

Address

City

State

ZIP Code

City

State

ZIP Code

USE THIS FORM to apply for an exemption of sales tax on a purchase of:

1.a vehicle required to be registered under the Motor Vehicle Act,

2.a boat required to be registered under the State Boating Act,

3.a boat trailer, or

4.an outboard motor.

This exemption is only valid if the vehicle, boat, boat trailer or outboard motor is not registered in Utah and is either:

1.not used in Utah, or

2.used in Utah, if the vehicle is used for

a.

b.business purposes, for the time period needed to transport it to the borders.

I have read and understand this affidavit and I certify I take sole responsibility in determining I am eligible for this claim of exemption. In addition, I certify the vehicle described on this affidavit will be taken out of Utah permanently and will not be used or registered in Utah. This affidavit is true and correct to the best of my knowledge.

X

Date signed

DEALERS: Keep this form for your records to verify the sales tax exemption. DO NOT send it to the Tax Commission.