17419. Borrower’s Right to Cure Default. Whenever foreclosure is commenced for nonpayment of any sums due hereunder,

175the owners of the Property or parties liable hereon shall be entitled to cure said defaults by paying all delinquent principal and

176interest payments due as of the date of cure, costs, expenses, late charges, attorney’s fees and other fees all in the manner provided

177by law. Upon such payment, this Deed of Trust and the obligations secured hereby shall remain in full force and effect as though

178no Acceleration had occurred, and the foreclosure proceedings shall be discontinued.

17920. Assignment of Rents; Appointment of Receiver; Lender in Possession. As additional security hereunder, Borrower

180 hereby assigns to Lender the rents of the Property; however, Borrower shall, prior to Acceleration under § 18 (Acceleration;

181Foreclosure; Other Remedies) or abandonment of the Property, have the right to collect and retain such rents as they become due

182and payable.

183Lender or the holder of the Trustee’s certificate of purchase shall be entitled to a receiver for the Property after Acceleration

184 under § 18 (Acceleration; Foreclosure; Other Remedies), and shall also be so entitled during the time covered by foreclosure

185proceedings and the period of redemption, if any; and shall be entitled thereto as a matter of right without regard to the solvency or

186insolvency of Borrower or of the then owner of the Property, and without regard to the value thereof. Such receiver may be

187appointed by any Court of competent jurisdiction upon ex parte application and without notice; notice being hereby expressly waived.

188Upon Acceleration under § 18 (Acceleration; Foreclosure; Other Remedies) or abandonment of the Property, Lender, in

189person, by agent or by judicially-appointed receiver, shall be entitled to enter upon, take possession of and manage the Property

190and to collect the rents of the Property including those past due. All rents collected by Lender or the receiver shall be applied, first

191to payment of the costs of preservation and management of the Property, second to payments due upon prior liens, and then to the

192sums secured by this Deed of Trust. Lender and the receiver shall be liable to account only for those rents actually received.

19321. Release. Upon payment of all sums secured by this Deed of Trust, Lender shall cause Trustee to release this Deed of

194Trust and shall produce for Trustee the Note. Borrower shall pay all costs of recordation and shall pay the statutory Trustee’s fees.

195If Lender shall not produce the Note as aforesaid, then Lender, upon notice in accordance with § 16 (Notice) from Borrower to

196Lender, shall obtain, at Lender’s expense, and file any lost instrument bond required by Trustee or pay the cost thereof to effect the

197release of this Deed of Trust.

19822. Waiver of Exemptions. Borrower hereby waives all right of homestead and any other exemption in the Property under

199state or federal law presently existing or hereafter enacted.

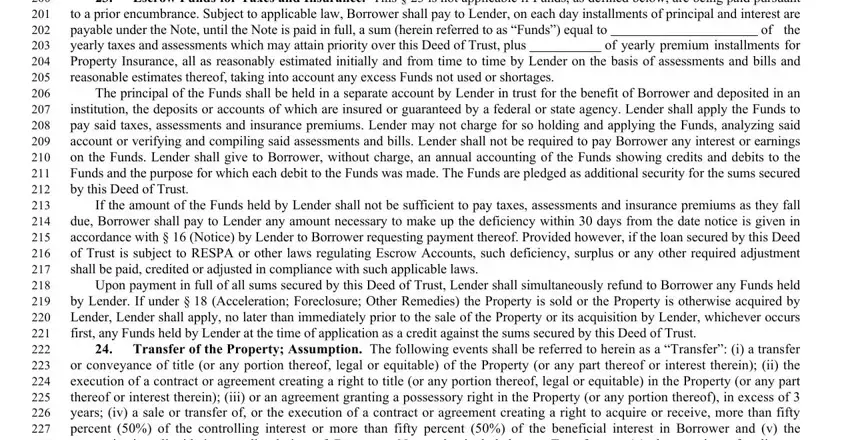

20023. Escrow Funds for Taxes and Insurance. This § 23 is not applicable if Funds, as defined below, are being paid pursuant

201to a prior encumbrance. Subject to applicable law, Borrower shall pay to Lender, on each day installments of principal and interest are

|

|

|

|

|

|

202 |

payable under the Note, until the Note is paid in full, a sum (herein referred to as “Funds”) equal to |

|

of the |

203 |

yearly taxes and assessments which may attain priority over this Deed of Trust, plus |

|

of yearly premium installments for |

204Property Insurance, all as reasonably estimated initially and from time to time by Lender on the basis of assessments and bills and

205reasonable estimates thereof, taking into account any excess Funds not used or shortages.

206The principal of the Funds shall be held in a separate account by Lender in trust for the benefit of Borrower and deposited in an

207institution, the deposits or accounts of which are insured or guaranteed by a federal or state agency. Lender shall apply the Funds to

208pay said taxes, assessments and insurance premiums. Lender may not charge for so holding and applying the Funds, analyzing said

209account or verifying and compiling said assessments and bills. Lender shall not be required to pay Borrower any interest or earnings

210on the Funds. Lender shall give to Borrower, without charge, an annual accounting of the Funds showing credits and debits to the

211Funds and the purpose for which each debit to the Funds was made. The Funds are pledged as additional security for the sums secured

212by this Deed of Trust.

213If the amount of the Funds held by Lender shall not be sufficient to pay taxes, assessments and insurance premiums as they fall

214due, Borrower shall pay to Lender any amount necessary to make up the deficiency within 30 days from the date notice is given in

215accordance with § 16 (Notice) by Lender to Borrower requesting payment thereof. Provided however, if the loan secured by this Deed

216of Trust is subject to RESPA or other laws regulating Escrow Accounts, such deficiency, surplus or any other required adjustment

217shall be paid, credited or adjusted in compliance with such applicable laws.

218Upon payment in full of all sums secured by this Deed of Trust, Lender shall simultaneously refund to Borrower any Funds held

219by Lender. If under § 18 (Acceleration; Foreclosure; Other Remedies) the Property is sold or the Property is otherwise acquired by

220Lender, Lender shall apply, no later than immediately prior to the sale of the Property or its acquisition by Lender, whichever occurs

221first, any Funds held by Lender at the time of application as a credit against the sums secured by this Deed of Trust.

22224. Transfer of the Property; Assumption. The following events shall be referred to herein as a “Transfer”: (i) a transfer

223or conveyance of title (or any portion thereof, legal or equitable) of the Property (or any part thereof or interest therein); (ii) the

224execution of a contract or agreement creating a right to title (or any portion thereof, legal or equitable) in the Property (or any part

225thereof or interest therein); (iii) or an agreement granting a possessory right in the Property (or any portion thereof), in excess of 3

226years; (iv) a sale or transfer of, or the execution of a contract or agreement creating a right to acquire or receive, more than fifty

227percent (50%) of the controlling interest or more than fifty percent (50%) of the beneficial interest in Borrower and (v) the

228reorganization, liquidation or dissolution of Borrower. Not to be included as a Transfer are (x) the creation of a lien or

229encumbrance subordinate to this Deed of Trust; (y) the creation of a purchase money security interest for household appliances; or

230(z) a transfer by devise, descent or by operation of the law upon the death of a joint tenant. At the election of Lender, in the event

231of each and every Transfer: