By using the online tool for PDF editing by FormsPal, you'll be able to fill in or modify Form Tr 1040 here. To make our tool better and more convenient to utilize, we constantly work on new features, taking into account suggestions from our users. With some basic steps, you may start your PDF journey:

Step 1: First of all, open the editor by pressing the "Get Form Button" in the top section of this site.

Step 2: Once you open the file editor, there'll be the form ready to be filled in. Apart from filling out different fields, you may also do other actions with the Document, specifically adding your own text, editing the original textual content, adding images, signing the form, and a lot more.

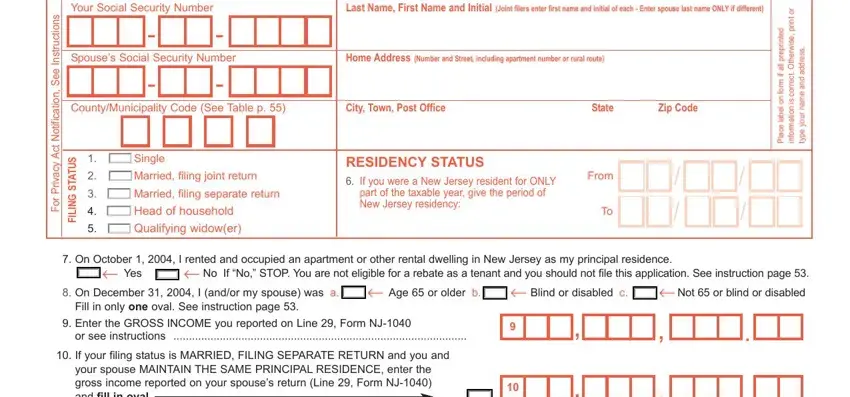

This form requires specific information; in order to guarantee accuracy and reliability, you need to take into account the guidelines hereunder:

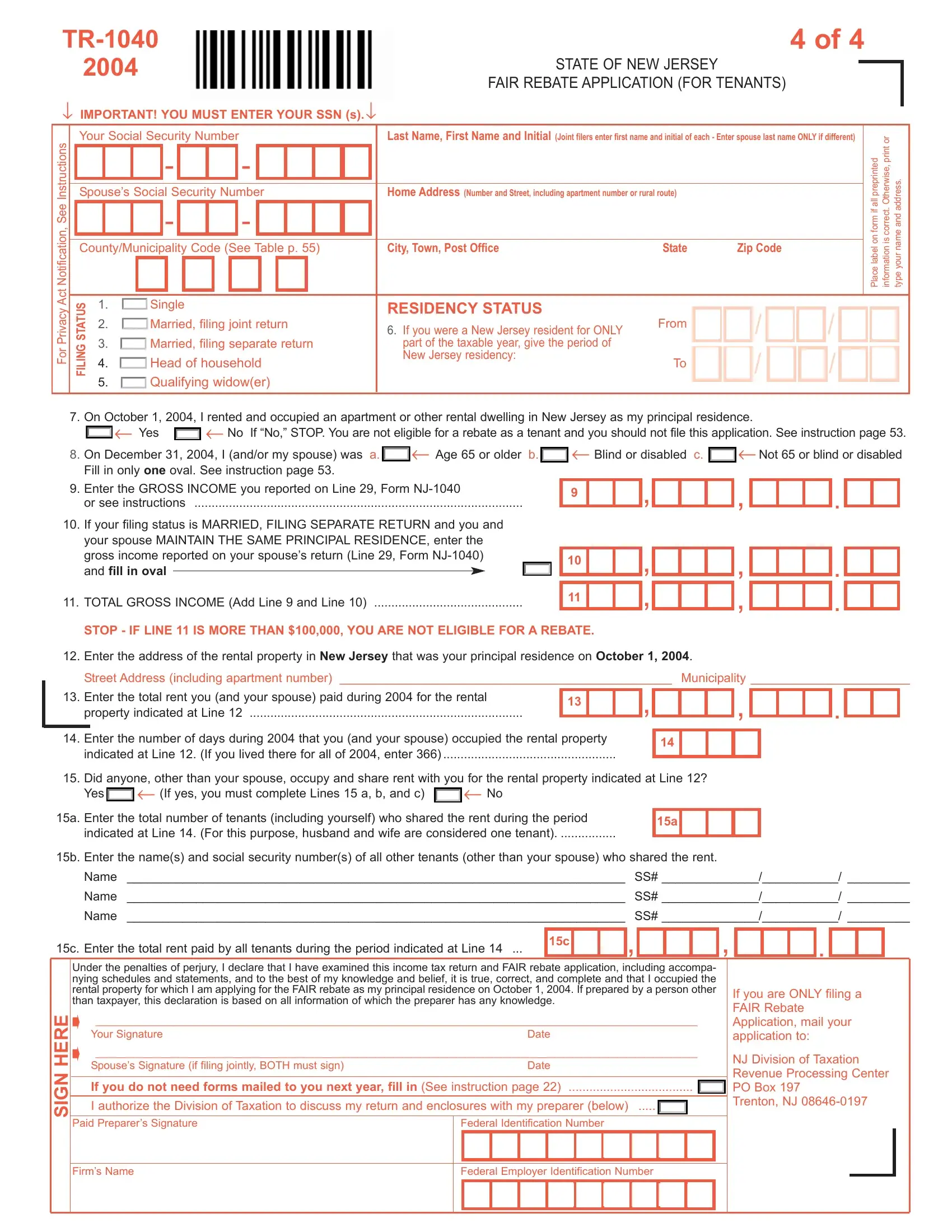

1. Firstly, when filling in the Form Tr 1040, start in the page that contains the subsequent blank fields:

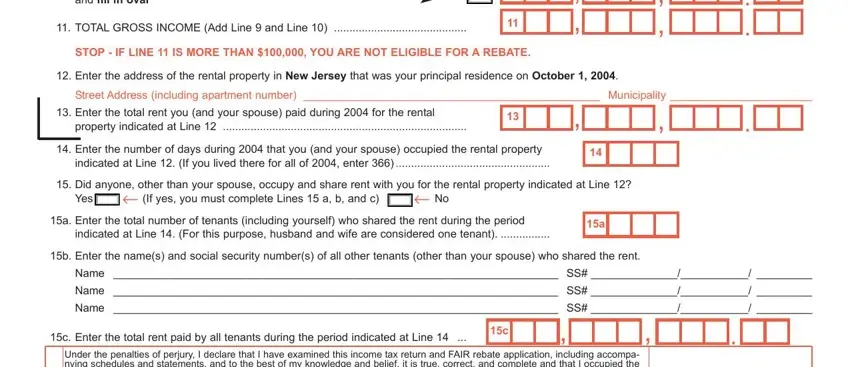

2. After filling in this part, go on to the subsequent part and enter the essential details in these blank fields - your spouse MAINTAIN THE SAME, TOTAL GROSS INCOME Add Line and, STOP IF LINE IS MORE THAN YOU, Enter the address of the rental, Street Address including apartment, Enter the total rent you and your, property indicated at Line, Enter the number of days during, indicated at Line If you lived, Did anyone other than your spouse, Yes, If yes you must complete Lines a, a Enter the total number of, indicated at Line For this, and b Enter the names and social.

Always be really mindful when filling in a Enter the total number of and Yes, since this is where most people make a few mistakes.

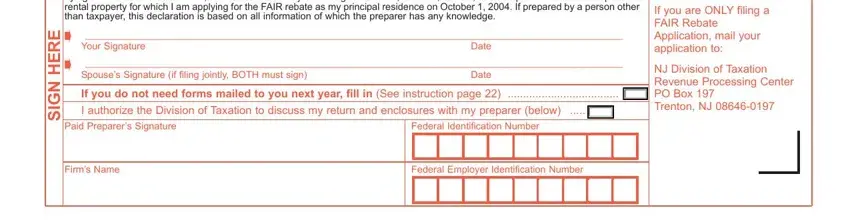

3. This next part is focused on E R E H N G S, Under the penalties of perjury I, cid cid, Your Signature, Date, Spouses Signature if filing, Date, If you do not need forms mailed to, I authorize the Division of, Paid Preparers Signature, Federal Identification Number, If you are ONLY filing a FAIR, NJ Division of Taxation Revenue, Firms Name, and Federal Employer Identification - type in every one of these empty form fields.

Step 3: Make sure your information is accurate and click "Done" to complete the process. Get hold of the Form Tr 1040 when you sign up at FormsPal for a 7-day free trial. Conveniently gain access to the form inside your FormsPal account, with any edits and adjustments being all synced! FormsPal is committed to the personal privacy of our users; we ensure that all personal information entered into our tool remains protected.