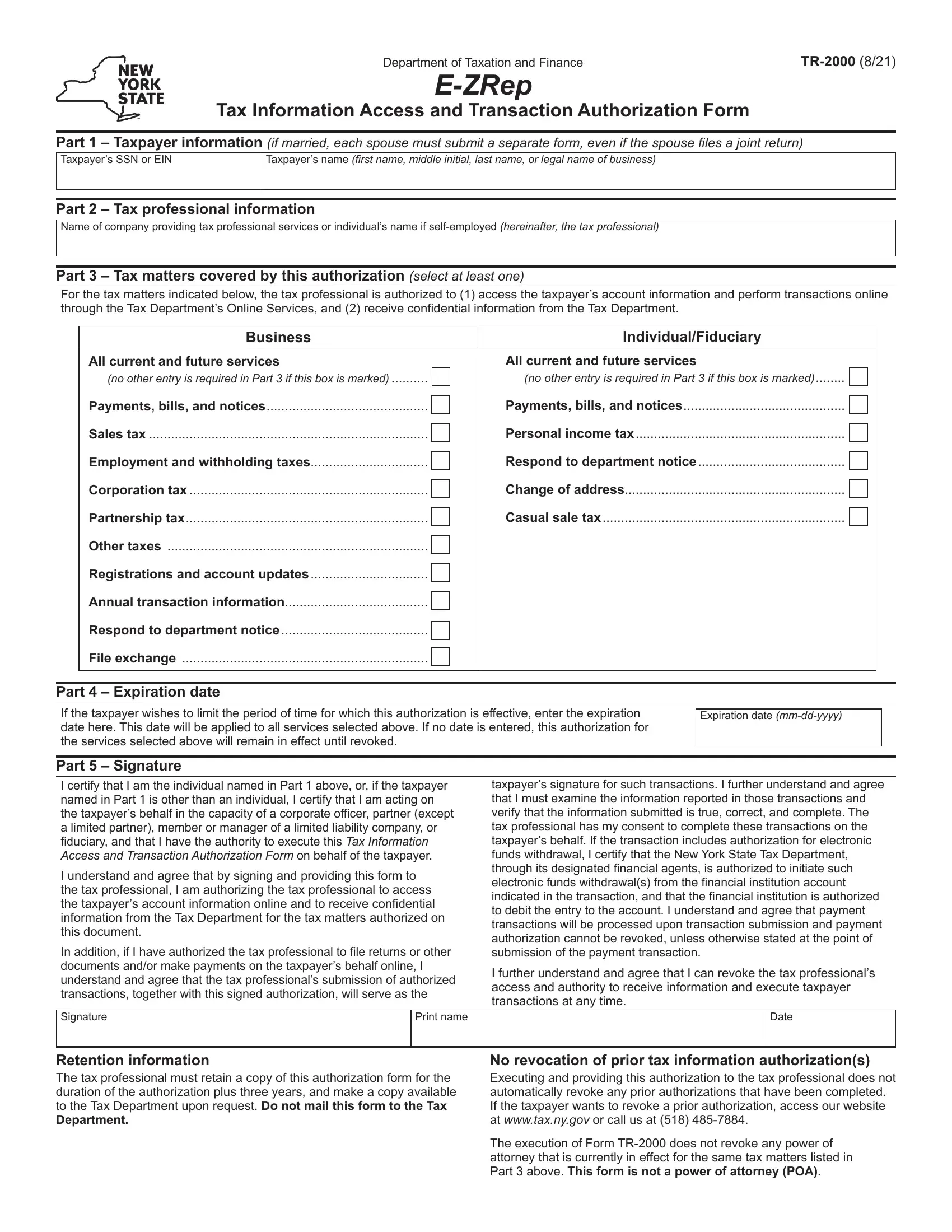

Should you would like to fill out ny tr tax, there's no need to download any kind of applications - simply try our online PDF editor. Our editor is continually developing to provide the very best user experience possible, and that's thanks to our resolve for continual development and listening closely to testimonials. Here is what you'll need to do to get going:

Step 1: Access the form inside our editor by hitting the "Get Form Button" above on this page.

Step 2: Once you access the online editor, you will find the form all set to be filled out. Other than filling out various fields, you may also do other actions with the Document, namely adding your own words, changing the initial text, adding graphics, putting your signature on the PDF, and a lot more.

This PDF requires particular info to be filled out, so be sure to take some time to enter what is required:

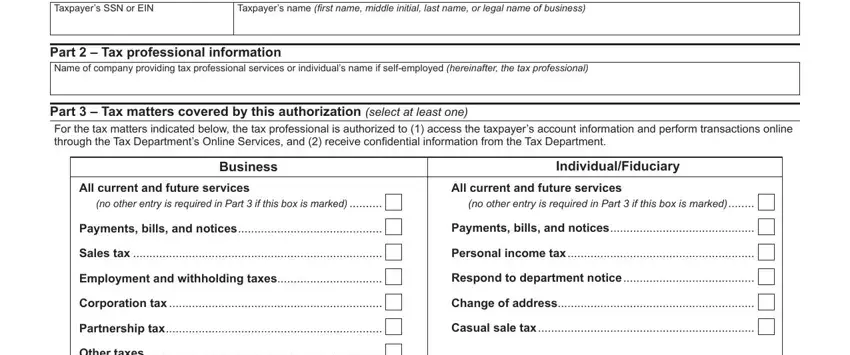

1. The ny tr tax necessitates specific details to be inserted. Be sure that the next blank fields are completed:

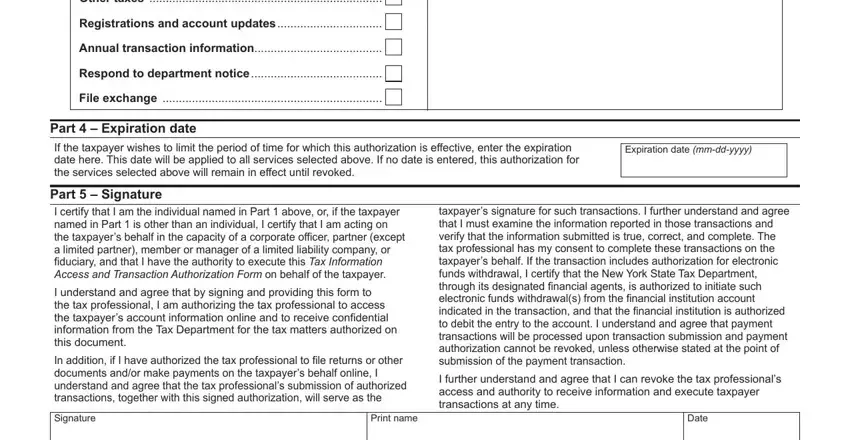

2. Soon after completing this section, go to the next stage and fill in the essential details in these fields - Other taxes, Registrations and account updates, Annual transaction information, Respond to department notice, File exchange, Part Expiration date If the, Expiration date mmddyyyy, Part Signature I certify that I, taxpayers signature for such, Signature, Print name, and Date.

Be very careful when filling in taxpayers signature for such and Part Expiration date If the, since this is the part in which many people make errors.

Step 3: Immediately after double-checking your filled in blanks, hit "Done" and you're good to go! Grab your ny tr tax when you register online for a 7-day free trial. Instantly view the document from your FormsPal account, along with any modifications and adjustments conveniently kept! FormsPal provides risk-free document completion with no personal information recording or distributing. Be assured that your information is secure with us!