With the online PDF tool by FormsPal, you're able to fill in or edit Form Tr 692 right here. Our professional team is ceaselessly working to improve the tool and make it even easier for users with its extensive functions. Uncover an endlessly innovative experience today - explore and discover new possibilities along the way! This is what you would have to do to get going:

Step 1: Hit the "Get Form" button at the top of this webpage to open our PDF editor.

Step 2: With this online PDF editing tool, it is easy to accomplish more than merely fill in forms. Try all the functions and make your documents appear high-quality with customized textual content put in, or optimize the file's original input to excellence - all comes with an ability to add any kind of photos and sign it off.

Filling out this document needs thoroughness. Ensure that all mandatory blank fields are done accurately.

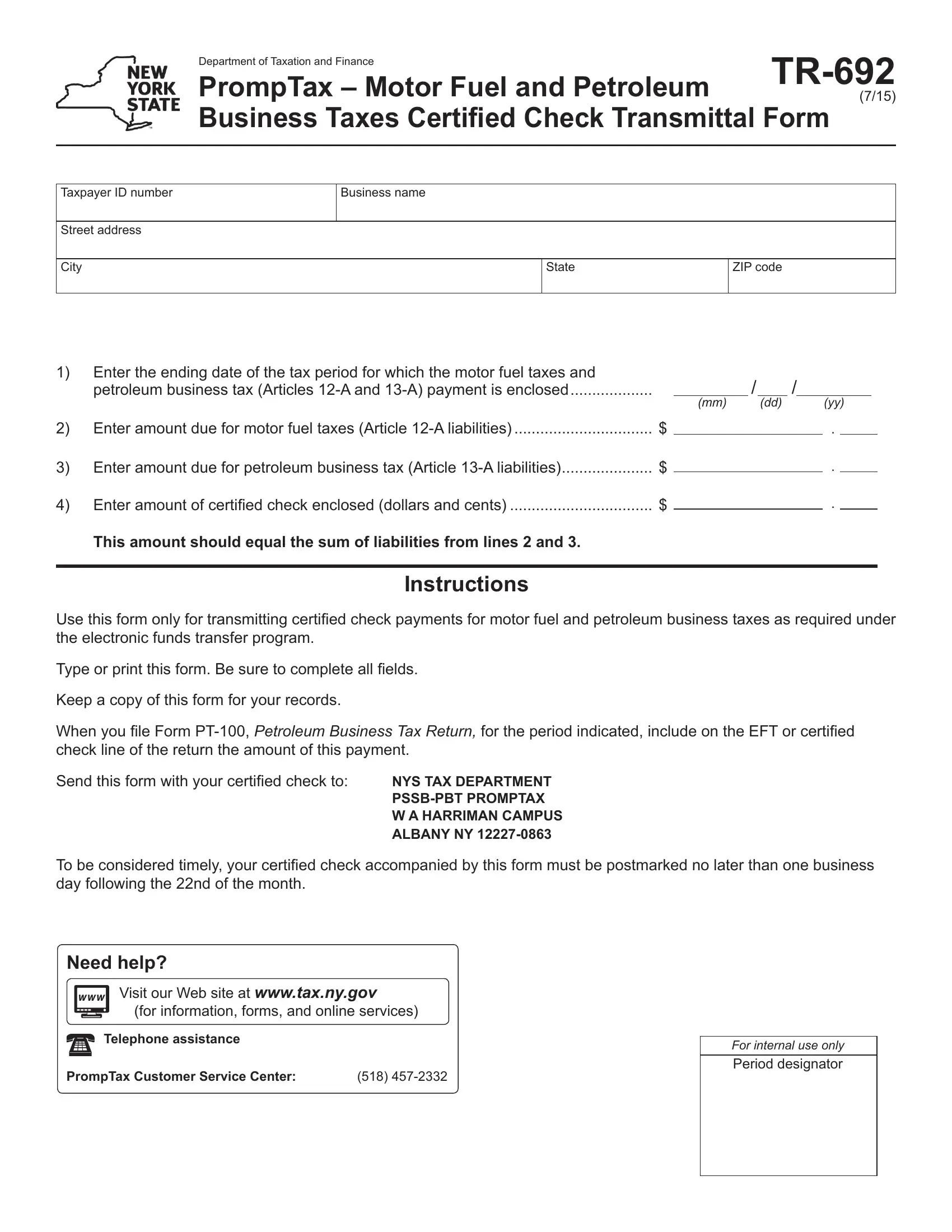

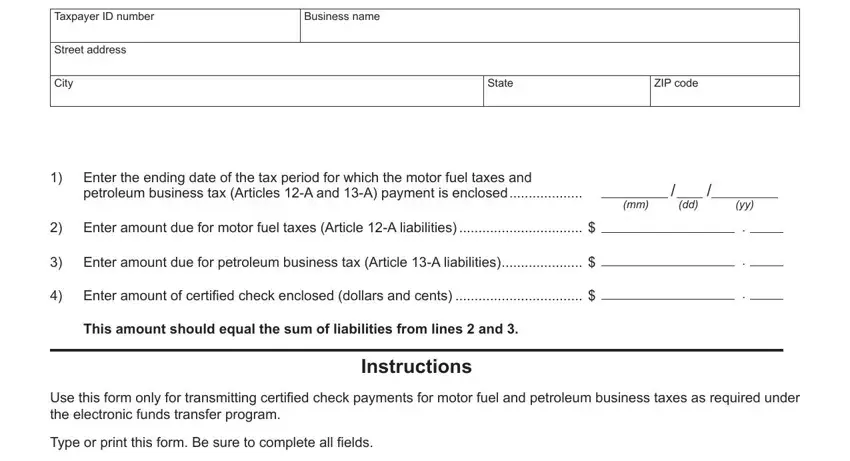

1. Fill out the Form Tr 692 with a selection of necessary fields. Consider all of the necessary information and make sure nothing is omitted!

Step 3: After you have looked once again at the information in the file's blanks, click "Done" to finalize your FormsPal process. Sign up with FormsPal right now and easily get Form Tr 692, ready for downloading. Every modification made is handily kept , helping you to modify the form further anytime. FormsPal guarantees protected document tools with no personal information recording or any type of sharing. Rest assured that your details are safe here!