Navigating the intricacies of acquiring a grain dealer license in Wisconsin is facilitated by the completion and submission of the TR-GR-11 form, a comprehensive document designed to streamline the application process for the fiscal year ending August 31. This form, overseen by the Wisconsin Department of Agriculture, Trade and Consumer Protection's Division of Trade and Consumer Protection Producer Security Section - Grain, synthesizes vital information pertaining to the applicant's legal and trade names, the nature of the entity (spanning individual proprietorships to cooperatives), and detailed contact information. Moreover, it delves into the operational aspects of grain dealing, encompassing the fiscal metrics of the previous year, such as total amount paid for producer grain, use of deferred payments, and the volume of grain procured, thereby offering a snapshot of the applicant's financial interactions within the domain. It further probes into logistical elements like the number of trucks utilized for grain hauling, underscoring the form's role in ensuring compliance with state guidelines set forth in Chapter 126, Subchapter III of the Wis. Stats. The form's layout anticipates various scenarios, from grain used exclusively for the applicant's livestock feed or crop seeding to considerations for licenses when payments to producers deviate from immediate cash transactions, reflecting a nuanced understanding of the grain trade's dynamics. The inclusion of sections for detailed fee calculation, from a base license fee to surcharges for unlicensed operations, ensures that applicants can accurately gauge their financial commitment to securing licensure. Additionally, the application incorporates a declaration to indemnify the Wisconsin Agricultural Producer Security Fund against defaults, thereby safeguarding the fund's integrity. Completeness and authentication through a Notary Public are emphasized to underscore the seriousness and legality of the application process, culminating in a procedural pathway designed to ensure both regulatory compliance and the operational efficacy of grain dealers within the state.

| Question | Answer |

|---|---|

| Form Name | Form Tr Gr 11 |

| Form Length | 5 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min 15 sec |

| Other names | GrainDealerAppl wisconsin grain dealers license form |

GRAIN DEALER LICENSE APPLICATION

For the Year Ending August 31,

Mail check and application to:

Wisconsin Dept. of Agriculture, Trade and Consumer Protection Division of Trade and Consumer Protection

Producer Security Section - Grain PO Box 8911

Madison, WI

For Office Use Only

License No.

Date Issued:

Ch. 126, Subchapter III, Wis. Stats.

Personal information you provide may be used for purposes other than that for which it was originally collected. [s. 15.04(1)(m), Wis Stats]

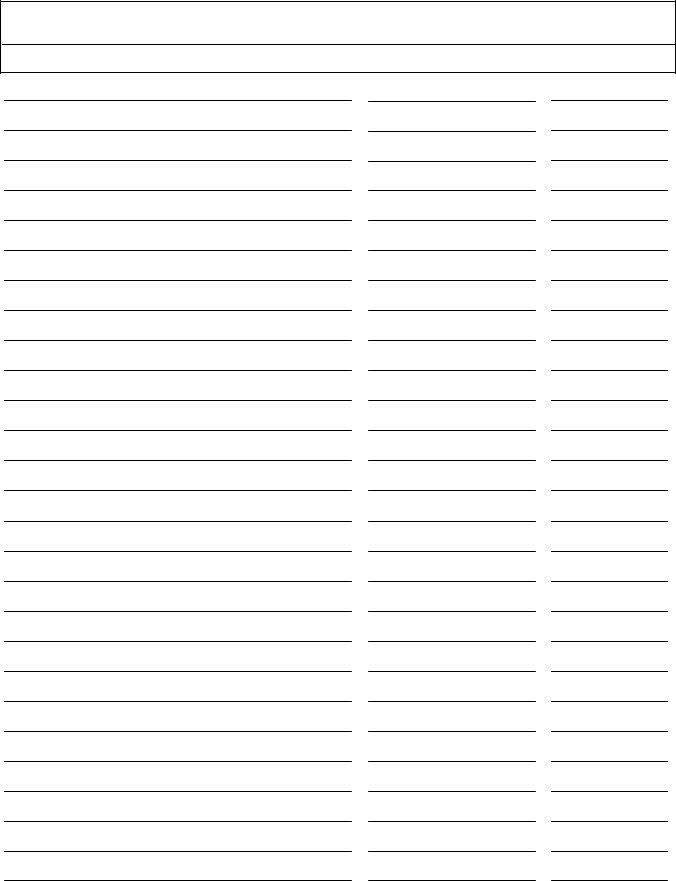

Legal Name:

Trade Name:

Type of Entity

Check One:

MAILING LOCATION:

Contact Person:

Address:

Primary Phone:

Email:

Individual |

|

Corporation |

|

LLP |

|

LLC |

|

Partnership |

|

Cooperative |

|||

Other |

|

|

|

|

|

|

|

|

|

State of Formation: |

|

||

|

|

|

|

|

|

|

|

|

|||||

Fax:

LIST ALL Corporation or Cooperative Officers, Partners, Trustees, or Managers/Members (Include titles).

TITLE |

|

NAME |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Attach additional lists if necessary.

Page 1

GRAIN DEALER LOCATION INFORMATION

PRIMARY LOCATION:

Address, Street, City, State and Zip Code |

Contact Person |

T |

elephone Number |

0)

Attach additional lists if necessary.

Page 2

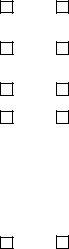

Section A Answer all questions

1. Fiscal year end date. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

2. |

Enter total amount you paid during your last completed fiscal year for producer grain procured in this state. |

|

$ |

|

|

|

|||||

|

Amount should include payments that qualify for exclusion under Section B regarding Default Claim Waiver. |

|

|

|

|

|

|||||

|

If zero, please estimate the amount of producer grain that will be procured during a full fiscal year. |

|

|

$ |

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

3. |

How much of line 2 above was paid for using deferred payment ? |

(Please enter zero if question does not |

|

|

|

|

|

||||

|

apply.) Deferred payment occurs when buyer takes title of producer grain and does not make full payment within 7 |

|

$ |

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|||

4. Enter total amount of bushels you paid for during your last completed fiscal year for producer grain procured in this state. |

|

|

|

|

BU |

||||||

|

Amount should include bushels that qualify for exclusion under Section B regarding Default Claim Waiver. |

|

|

|

|

|

|||||

|

If zero, please estimate the amount of bushels that will be procured from producers in this state during a full fiscal year. |

|

|

|

|

BU |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

5. |

Did you have any obligations to producers under deferred payment |

for grain procured in this state, at any time since |

|

Yes |

|

|

No |

||||

|

the beginning of your last completed fiscal year? (Response should include current fiscal year.) |

|

|

|

|

||||||

|

|

|

|

|

|

|

|||||

6. Do you make payment for grain purchased from producers upon delivery, using solely cash? (Company or |

|

|

|

|

|

||||||

checkspersonalare notchecksconsidarerednotcashconsidered.) cash.) |

|

|

|

|

|

|

Yes |

|

|

No |

|

|

If YES, you are not required to be licensed. To voluntarily license, complete question 8 and Section B, C and |

|

|

|

|||||||

|

|

|

|

|

|

||||||

|

D. If NO, please go to question 7. |

|

|

|

|

|

|

|

|

|

|

7. Do you use all grain purchased from producers yourself, solely as feed for your livestock and/or seed for planting your crops? |

|

Yes |

|

|

No |

||||||

|

If NO, complete question 8 and Section B, C and D. |

|

|

|

|

|

|

|

|

|

|

|

If YES, did you spend less than $400,000 for that grain during the past license year? |

|

|

Yes |

|

|

No |

||||

|

|

|

|

|

|||||||

|

If YES, you are not required to be licensed. To voluntarily license, complete question 8 and Section B, C and |

|

|

|

|

|

|||||

|

D. If NO, complete question 8 and Section B, C and D. |

|

|

|

|

|

|

|

|

|

|

8. How many trucks do you use to haul producer grain in this state? (Put copy of grain dealer license in each truck.) |

|

|

|

|

|

||||||

|

|

|

|

|

|

enter the number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Section B |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

9. Has the applicant attached to the application, a Grain Dealer Default Claim Waiver (Waiver) filed by a producer/producer |

|

|

|

|

|

||||||

|

agent who has greater than 50% ownership in the producer/producer agent and a greater than 50% ownership in the |

|

Yes |

|

|

No |

|||||

|

applicant? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

10. Enter the amount included in line 2 that was procured from the producer/producer agent that filed a Waiver. |

$ |

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|||

11. Enter the amount included in line 3 that was paid for using deferred payment from the producer/producer agent that filed a |

|

|

|

|

|

||||||

|

Waiver. |

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

12. Enter the amount included in line 4 that was procured from the producer/producer agent that filed a Waiver. |

|

|

|

|

BU |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

Section C |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

a) |

|

|

|

|

|

$ |

25.00 |

|

|||

b) |

Supplementary License fee - Multiply the total bushels from line 4 by $0.001 = $ |

|

|

and round down or |

|

|

|

|

|

||

|

up to nearest $100, fee may not be less $100 or more than $10,000. |

|

|

|

|

|

|

|

|

|

|

|

Examples: Total bushels 459,459.59 bu. x $0.001 = $459.46, license fee due $500. |

|

|

$ |

|

|

|

||||

|

Total bushels 220,140.00 bu. x $0.001 = $220.14, license fee due $200. |

|

enter the amount |

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|||

c) |

Multiply the # of additional business locations over the primary location ( |

|

|

) times $100. |

enter the amount |

$ |

|

|

|

||

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

Section D |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

d) |

License surcharge of $500 for operating without a license, |

|

|

|

|

enter the amount |

$ |

|

|

|

|

|

Other fees and surcharges may also be applied for activities during unlicensed periods (see s. 126.11(4)(e), Wis. Stats.), if applicable. |

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

e) |

Total License Fees: (add lines a through d) |

|

|

|

|

enter the amount |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Page 3

License holder agrees to indemnify the Wisconsin Agricultural Producer Security Fund (hereafter "Fund") for any and all money paid out of the Fund under s. 126.71, Wis. Stats., as a result of a recovery proceeding under subchapter VII of chapter 126, Wis. Stats., conducted against license holder because of license holder's default. License holder also agrees to indemnify any surety for any and all money a surety pays into the Fund as a result of license holder's default and a recovery proceeding under subchapter VII of chapter 126, Wis. Stats.

*** If any lines in the following section are left blank, this application is invalid. ***

The undersigned hereby certifies that this is a true, complete and accurate application for a Grain Dealer License under section 126.11(3), Wis. Stats.

Signature:

Type or Print - First Name and Last Name: |

Position/Title: |

|||||

|

|

|

|

|||

State of |

) |

|

|

|||

|

|

|

|

) SS. |

||

County of |

|

) |

|

|

||

Signed and sworn to (or affirmed) before me on |

|

|

|

|

||

|

|

|

|

Date |

||

by |

|

|

|

|

||

Name of applicant or officer of the applicant who signed above

Signature of Notary Public

(SEAL)

Please print name of Notary

Notary Public, State of

My commission expires (is permanent)

If you have any questions regarding this application, contact Darlene Davidson at (608)

Page 4

Page 1.

Page 2.

Page 3.

Page 4.

Instructions for completing the Grain Dealer License Application

"Grain dealer" means a person who buys producer grain or who markets producer grain as a producer agent. "Grain dealer" does not include any of the following:

(a)A person who merely brokers a contract between a grain producer and a grain dealer without becoming a party to the contract, taking control of grain, or accepting payment on behalf of the grain producer.

(b)A person who merely buys or sells grain on a board of trade or commodity exchange.

"Procure producer grain in this state" means to buy producer grain for receipt in this state or to acquire the right to market producer grain grown in this state.

On the "Legal Name" line, if a sole proprietorship, put the individual's name; if a partnership, corporation, cooperative or other, put company's full legal name. "Trade Name" - complete this only if you are using a d/b/a different from the legal name. Mailing address is where you want all correspondence to be sent. Please enter type of business operation (corporation, etc.).

Please enter name, telephone, fax number, and email address of the person we should contact at the mailing address. Enter corporation or cooperative officers, partners, trustees or managers/members of an LLC (include titles).

Please complete a line for each location engaged in the business of buying or procuring grain from producers (as defined in Chapter 126, Subchapter III).

Enter applicant's fiscal year end.

Enter the dollar amount paid and bushel amount (including purchases through barter transactions and/or credits against account receivables) for grain procured from producers in your most recently completed fiscal year. Please indicate deferred payment purchases made in your most recently completed fiscal year. If you have no previous purchases from producers or have not completed a fiscal year since you began procuring grain in Wisconsin, then estimate the total amount expected to be paid to producers and bushel amount for grain procured during a full fiscal year.

Enter number of trucks used to haul producer grain in this state. (Put copy of grain dealer license in each truck.)

Complete Section B if a producer owns greater than 50% of both the farm selling the grain and the dealer who is buying the grain and wishes to have these purchases exempt from fund assessments and financial statement requirements. A Grain Dealer Default Claim Waiver must be filed with the application.

There is a

There is a supplementary license fee obtained by multiplying the number of bushels reported under s. ATCP 99.11 (the bushel amount you indicated for producer grain procured in this state during your last completed fiscal year or the bushel amount you estimated you will procure) by 0.1 cent per bushel, and rounding (up or down) the product to the nearest $100, except that the fee may not be less than $100 or more than $10,000.

Examples: Total bushels 459,459.59 bu. x $0.001 = $459.46, license fee due is $500.00.

Total bushels 220,140.00 bu. x $0.001 = $220.14, license fee due is $200.00.

For each additional location (in excess of primary location), there is an additional fee of $100.00.

There is a license surcharge of $500.00 for operating without a license, other fees and surcharges may also be applied for activities during unlicensed periods (see s. 126.11(4)(e), Wis. Stats.), if applicable.

Total the applicable fees (add lines a through d). Enter total amount due on line e.

The application must be signed by an officer of the applicant or the applicant, who certifies the accuracy of the information. A sole proprietor would sign himself or herself. An "officer" would include a partner in a partnership, a trustee in a trust or a

ENCLOSE THE APPROPRIATE FEES/SURCHARGES (check or money order, payable to DATCP). Send application, fees/surcharges to:

Wisconsin Department of Agriculture, Trade and Consumer Protection

Producer Security

P.O. Box 8911

Madison, WI

This application applies to a Grain Dealer license.

IF YOU HAVE ANY QUESTIONS, PLEASE CALL Darlene Davidson (608)