Using PDF documents online is super easy with our PDF editor. Anyone can fill in tax registration form tr2 here painlessly. Our professional team is relentlessly endeavoring to expand the tool and help it become even better for people with its extensive functions. Discover an endlessly revolutionary experience now - explore and find new possibilities as you go! By taking several easy steps, you may begin your PDF journey:

Step 1: First, open the pdf editor by clicking the "Get Form Button" at the top of this page.

Step 2: With our handy PDF file editor, it is easy to do more than simply fill in blanks. Express yourself and make your forms appear high-quality with custom textual content incorporated, or adjust the file's original content to perfection - all comes along with the capability to add your own graphics and sign the document off.

It will be an easy task to fill out the pdf with this practical guide! Here is what you want to do:

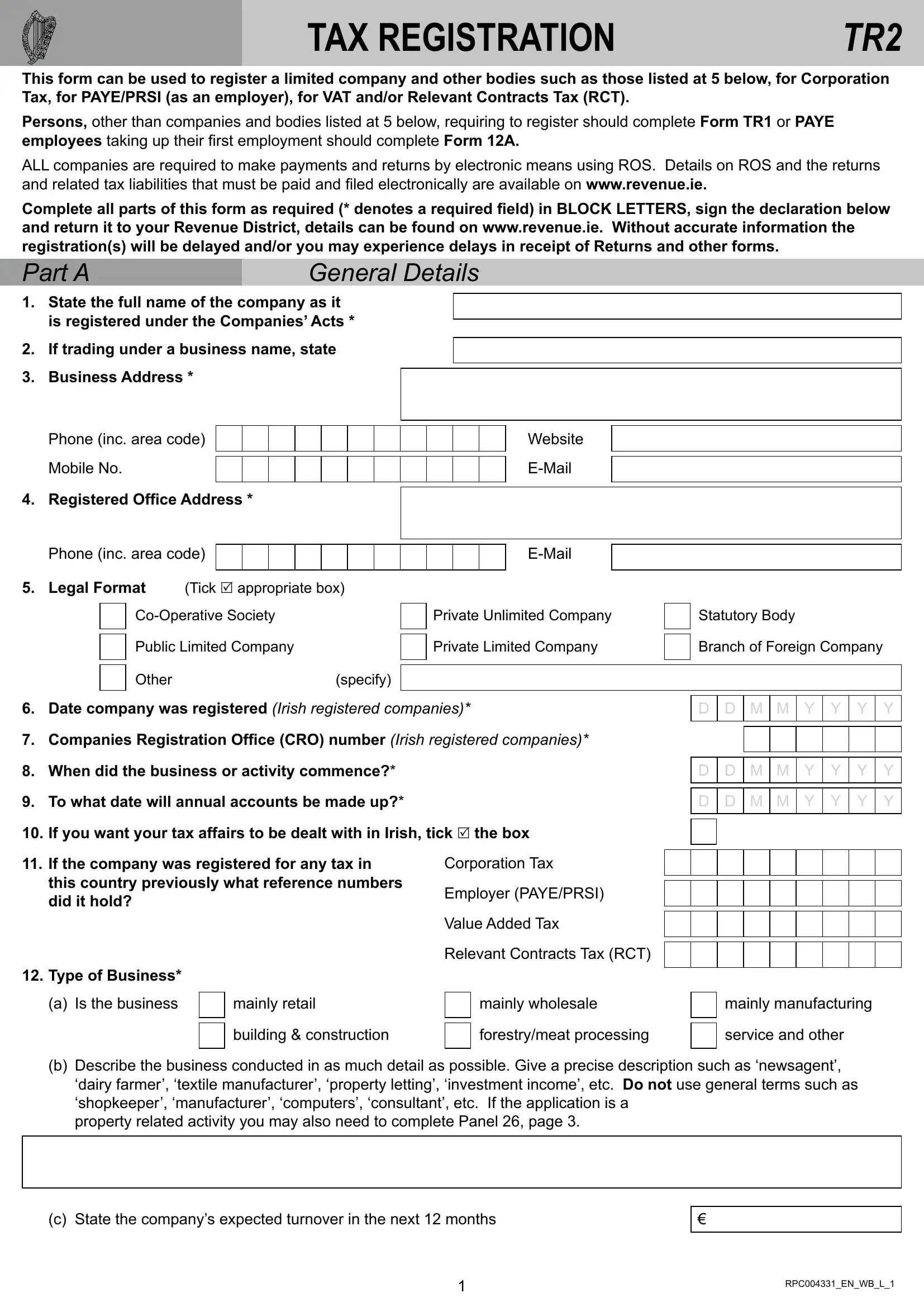

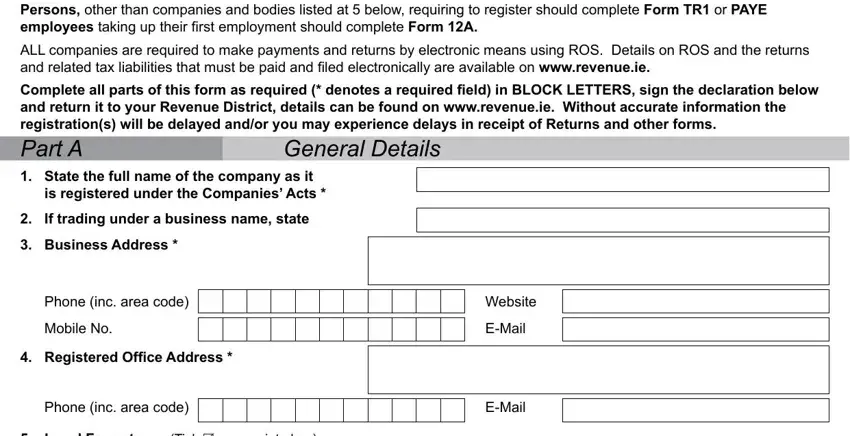

1. The tax registration form tr2 necessitates particular information to be entered. Ensure the subsequent fields are complete:

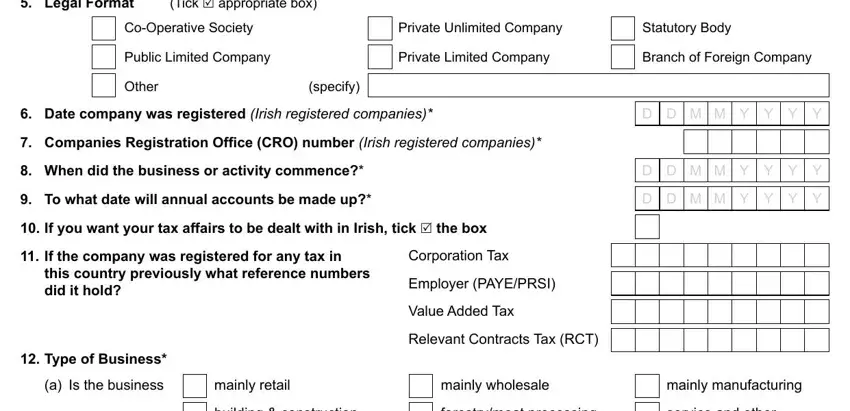

2. Once your current task is complete, take the next step – fill out all of these fields - Legal Format, Tick R appropriate box, CoOperative Society, Private Unlimited Company, Statutory Body, Public Limited Company, Private Limited Company, Branch of Foreign Company, Other, specify, Date company was registered Irish, D D M M Y Y Y Y, Companies Registration Ofice CRO, When did the business or activity, and To what date will annual accounts with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

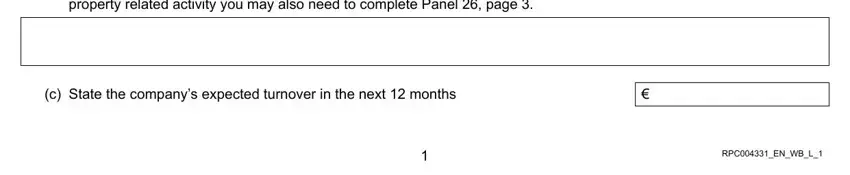

3. This subsequent section is considered fairly simple, dairy farmer textile manufacturer, c State the companys expected, and RPCENWBL - each one of these fields will need to be completed here.

It's easy to get it wrong while completing your c State the companys expected, thus make sure that you look again prior to when you submit it.

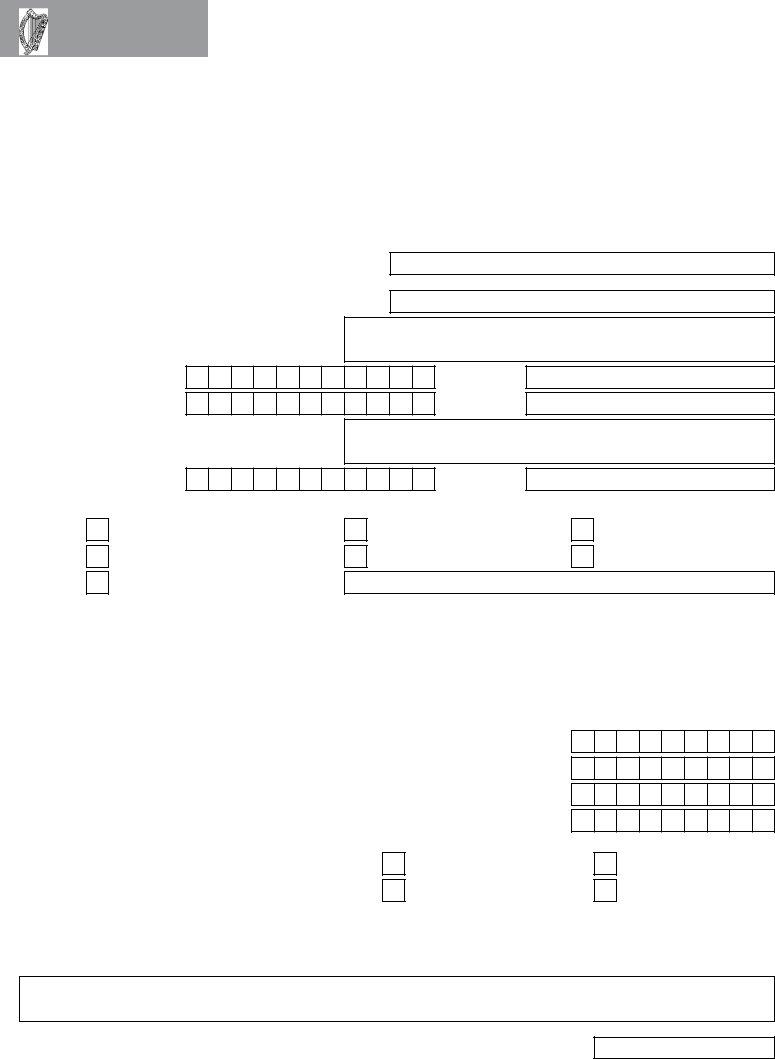

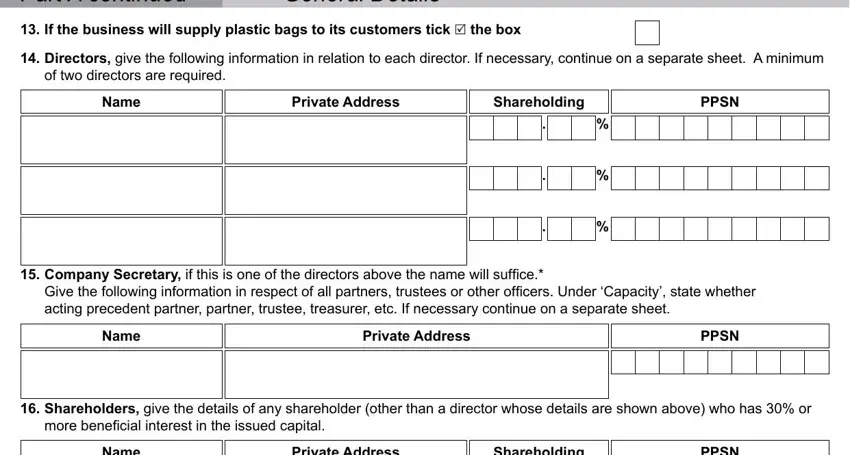

4. Filling in Part A continued, General Details, If the business will supply, Directors give the following, of two directors are required, Name, Private Address, Shareholding, PPSN, Company Secretary if this is one, acting precedent partner partner, Name, Private Address, PPSN, and Shareholders give the details of is paramount in the next part - be sure to devote some time and fill in each and every blank area!

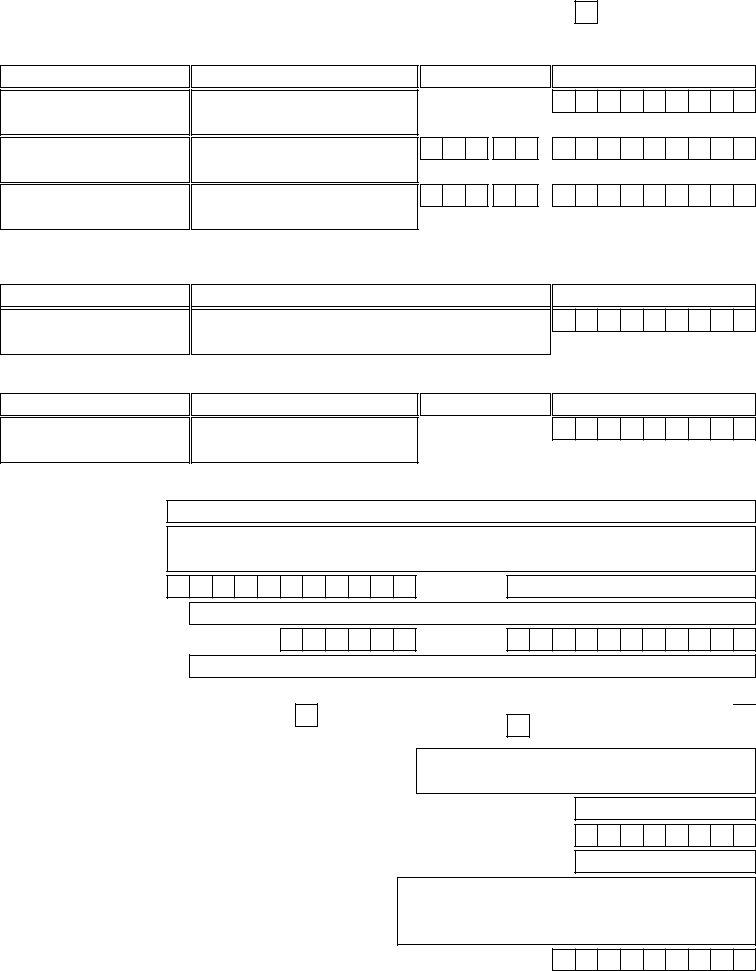

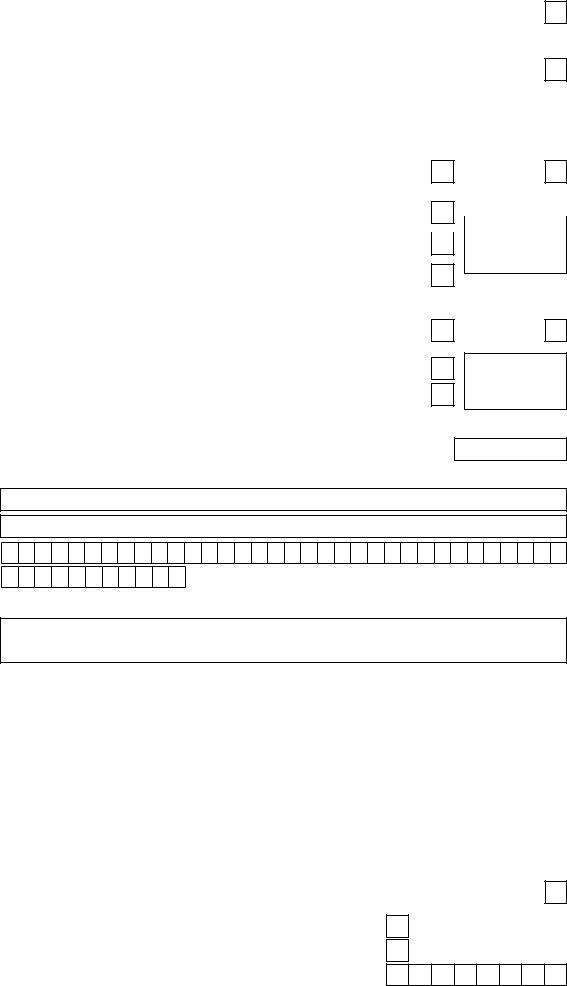

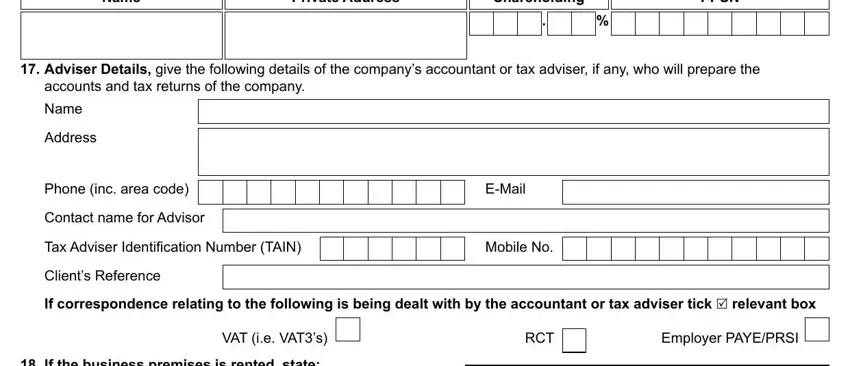

5. Lastly, this last section is precisely what you'll want to complete before closing the document. The blanks here are the following: Name, Private Address, Shareholding, PPSN, Adviser Details give the, accounts and tax returns of the, Address, Phone inc area code, Contact name for Advisor, Tax Adviser Identiication Number, Clients Reference, EMail, Mobile No, If correspondence relating to the, and VAT ie VATs.

Step 3: Ensure that your details are accurate and click on "Done" to progress further. After creating a7-day free trial account at FormsPal, you'll be able to download tax registration form tr2 or email it immediately. The PDF form will also be accessible in your personal account page with your each and every change. We don't sell or share any details you enter whenever dealing with forms at our site.