When using the online PDF tool by FormsPal, you can easily complete or change spousal requirements here and now. We are dedicated to making sure you have the perfect experience with our editor by constantly releasing new functions and upgrades. Our tool has become a lot more helpful as the result of the newest updates! Currently, working with PDF documents is simpler and faster than ever. If you are looking to start, here's what you will need to do:

Step 1: Press the "Get Form" button above. It is going to open up our pdf editor so you could begin filling in your form.

Step 2: With this handy PDF file editor, you're able to do more than just complete blank form fields. Edit away and make your documents look sublime with customized textual content put in, or modify the file's original input to excellence - all that supported by an ability to incorporate your own graphics and sign the document off.

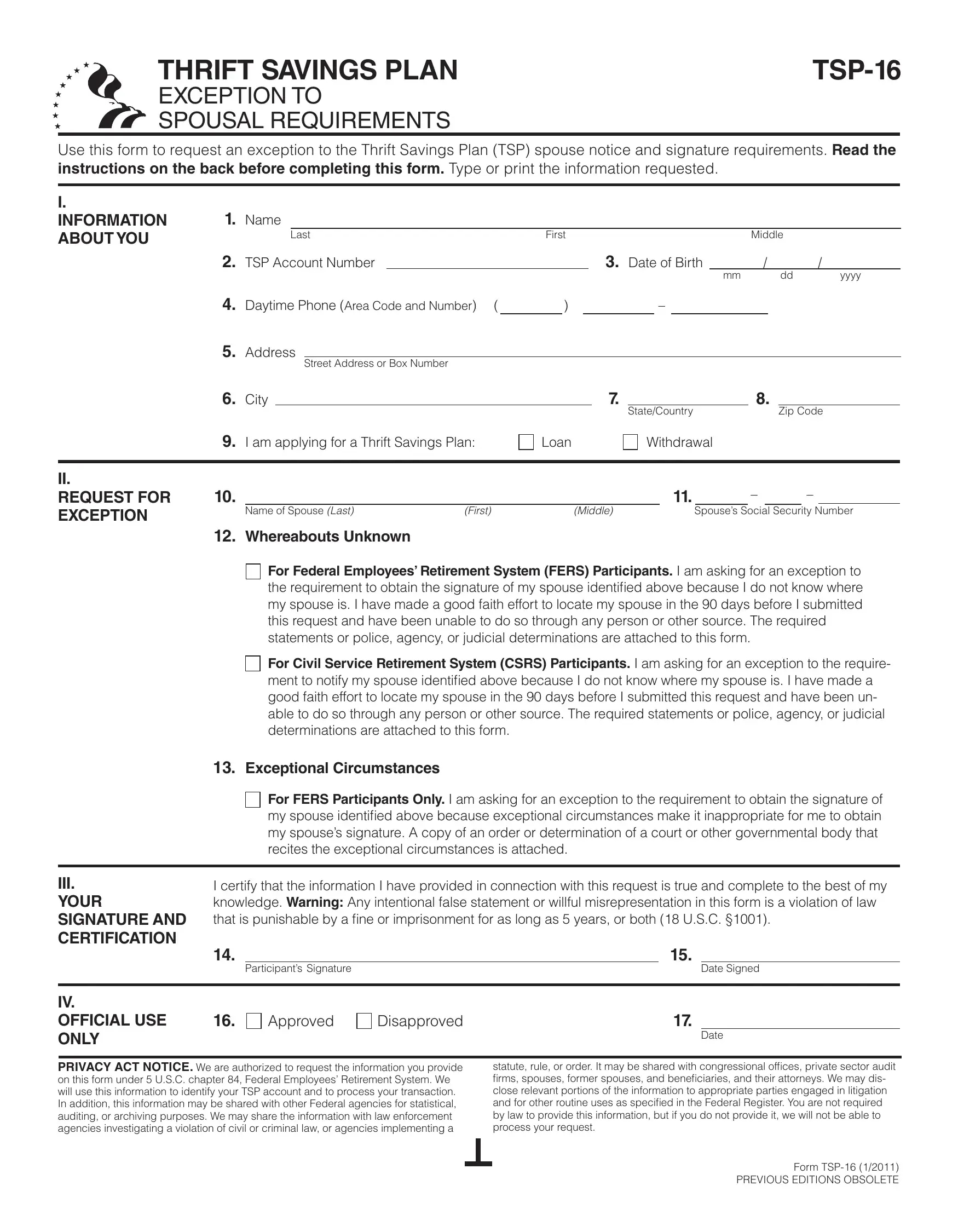

For you to fill out this PDF form, make certain you type in the right details in every single field:

1. To get started, when filling out the spousal requirements, beging with the form section that includes the next blanks:

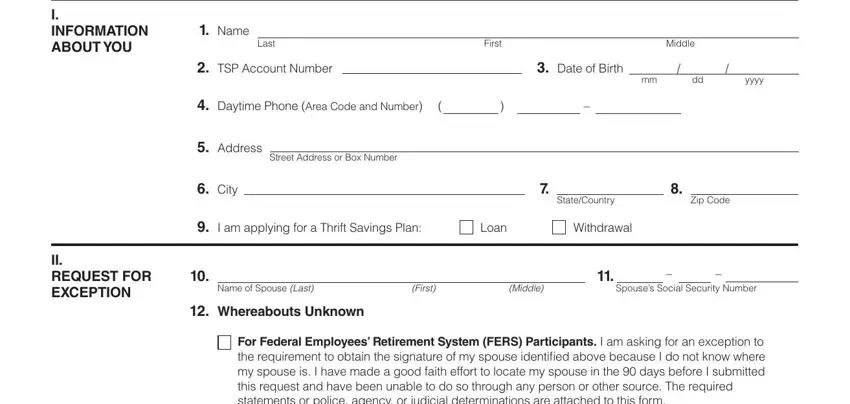

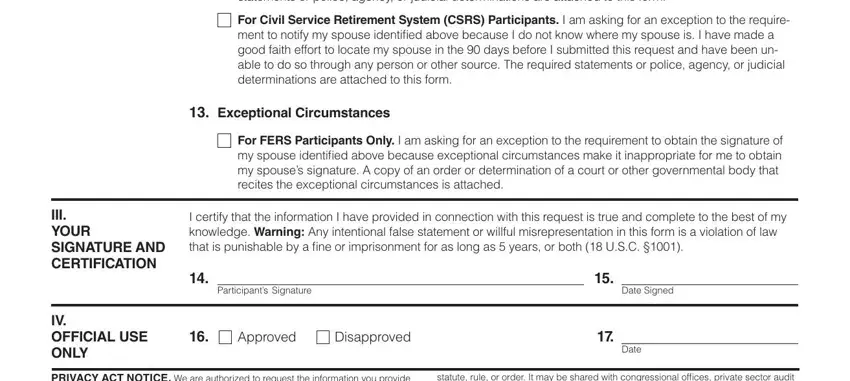

2. The next stage is to fill out the next few blank fields: Whereabouts Unknown, For Federal Employees Retirement, this request and have been unable, For Civil Service Retirement, Exceptional Circumstances, For FERS Participants Only I am, III YOUR SIGNATURE AND, IV OFFICIAL USE ONLY, I certify that the information I, Participants Signature, Date Signed, Approved, Disapproved, Date, and PRIVACY ACT NOTICE We are.

As for Approved and III YOUR SIGNATURE AND, be sure that you take a second look in this current part. Those two are definitely the key fields in the document.

Step 3: Prior to finishing the form, check that all blank fields are filled out the right way. When you believe it's all fine, click “Done." Sign up with us right now and easily get access to spousal requirements, set for download. Every modification made is handily kept , which means you can change the document later if needed. FormsPal is invested in the personal privacy of all our users; we make sure all personal information used in our editor is kept protected.