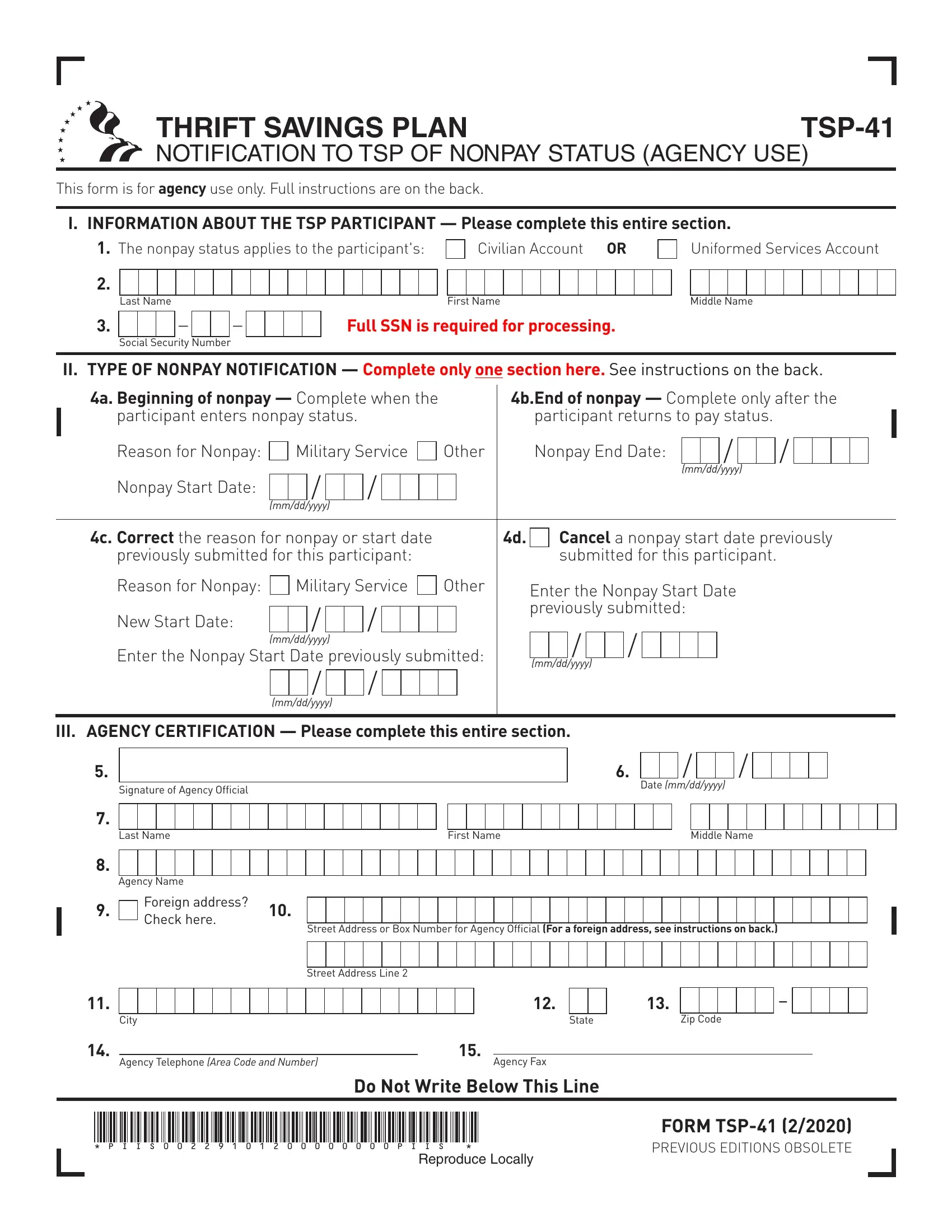

TSP-41, INFORMATION AND INSTRUCTIONS — FOR AGENCY USE ONLY

Every period of nonpay for a participant must be documented by two form submissions: (1) when the period of nonpay begins and (2) at the end of a period of nonpay, when the participant returns to pay status. Failure to do this could allow a participant who is ineligible for a TSP loan to receive one, or could result in serious, costly tax consequences for a participant who already has a TSP loan.

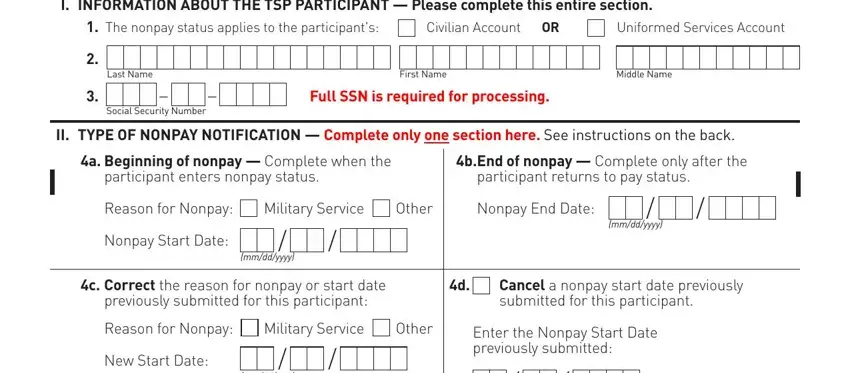

SECTION I. Please complete this entire section. Be sure to indicate whether the nonpay status applies to a civilian or a uniformed services account. Provide the participant’s full name and Social Security number. A full Social Security number is required for processing.

SECTION II. There are four choices in this section. Complete only one of items 4a – 4d per form submission.

Item 4a—Beginning of nonpay: Complete this item to notify the TSP when a participant has entered a period of approved nonpay status (e.g., furlough, suspension, leave without pay—including leave without pay to perform military service—or pending resolution of a grievance or appeal). Do not submit this form more than 30 days before the start date of the nonpay period.

You must also indicate whether the nonpay period is for military service or other (nonmilitary), because the regulations are different for each— especially if the participant has a TSP loan:

Nonpay due to military service—The IRS allows a TSP loan to be placed on hold for the entire period of nonpay, and the maximum period for repaying the loan is extended.

Nonpay, nonmilitary —The IRS allows up to one year of missed loan payments. When the one-year period is over, the loan will be reamortized and loan payments must resume.

Item 4b—End of nonpay: Complete this item only after the participant returns to pay status. If you submit a date to end nonpay before the participant's return date and the participant does not return to pay status on the anticipated date, the participant may have to resume loan payments if he or she has a TSP loan. Note: You cannot cancel or correct an end date once you have submitted it. If you send a premature end date and that date changes, you cannot use this form to change it. Call the ThriftLine (1-877-968-3778) for further instructions.

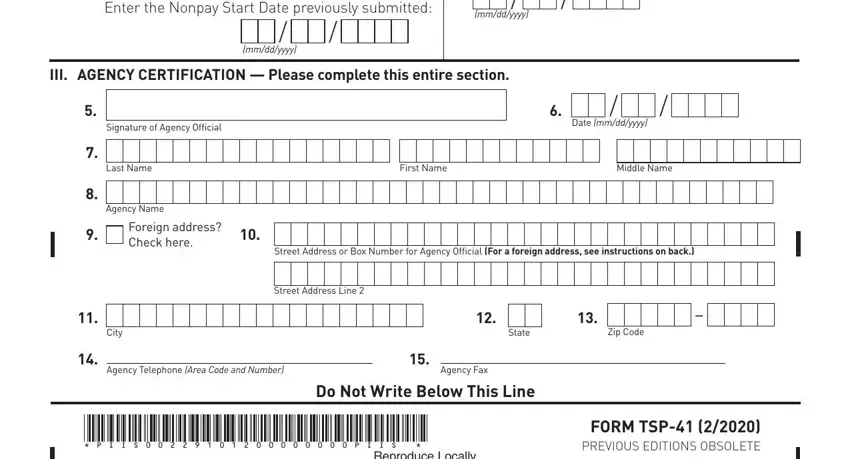

Item 4c —Correct reason for nonpay or start date: If you previously submitted a Form TSP-41 indicating the wrong reason for the nonpay or an incorrect start date, you can correct the information here. Check the corresponding box for the reason of nonpay, enter the new start date, and enter the nonpay start date previously submitted.

Item 4d—Cancel a nonpay start date: Check this box only if you previously submitted a Form TSP-41 indicating a nonpay start date, and the participant did not go into nonpay status. Enter the nonpay start date previously submitted.

SECTION III. This section is for the signature and contact information of the agency official responsible for reporting a participant's nonpay status to the TSP. Do not provide participant information in this section. Complete this entire section. Full address information will allow the TSP to notify the agency when the form has been completed incorrectly or cannot be processed.

In Item 8, provide your agency name, using a standard abbreviation, if necessary.

If you have a foreign address, check the box in Item 9 and enter the foreign address as follows in Items 10-13:

First address line: Enter the street address or post office box number.

Second address line: Enter the city or town name, other principal subdivision (e.g., province, state, county), and postal code, if known. (The postal code may precede the city or town.)

City/State/Zip Code fields: Enter the entire country name in the City field; leave the State and Zip Code fields blank.

If you use an Air/Army Post Office (APO) or Fleet Post Office (FPO) address, enter that address in the two available address lines (include the unit designation). Enter APO or FPO, as appropriate, in the City field. In the State field, enter AE as the state abbreviation for Zip Codes beginning with 090-098, AA for Zip Codes beginning with 340, and AP for Zip Codes beginning with 962-966. Then enter the appropriate Zip Code.

Either mail the completed form to: |

Thrift Savings Plan |

|

P.O. Box 385021 |

|

Birmingham, AL 35238 |

Or fax the form to: |

1-866-817-5023 |