Working with PDF files online is actually very simple with our PDF tool. Anyone can fill in tsp 75 here and try out several other functions we offer. FormsPal professional team is always endeavoring to improve the tool and enable it to be even faster for clients with its many functions. Make use of the current progressive prospects, and find a heap of emerging experiences! For anyone who is looking to get started, this is what it requires:

Step 1: Click the "Get Form" button above. It is going to open our pdf tool so that you could begin filling out your form.

Step 2: As soon as you start the PDF editor, there'll be the document made ready to be filled out. Besides filling out various fields, you might also perform other sorts of things with the PDF, that is adding any words, modifying the original text, adding images, placing your signature to the PDF, and much more.

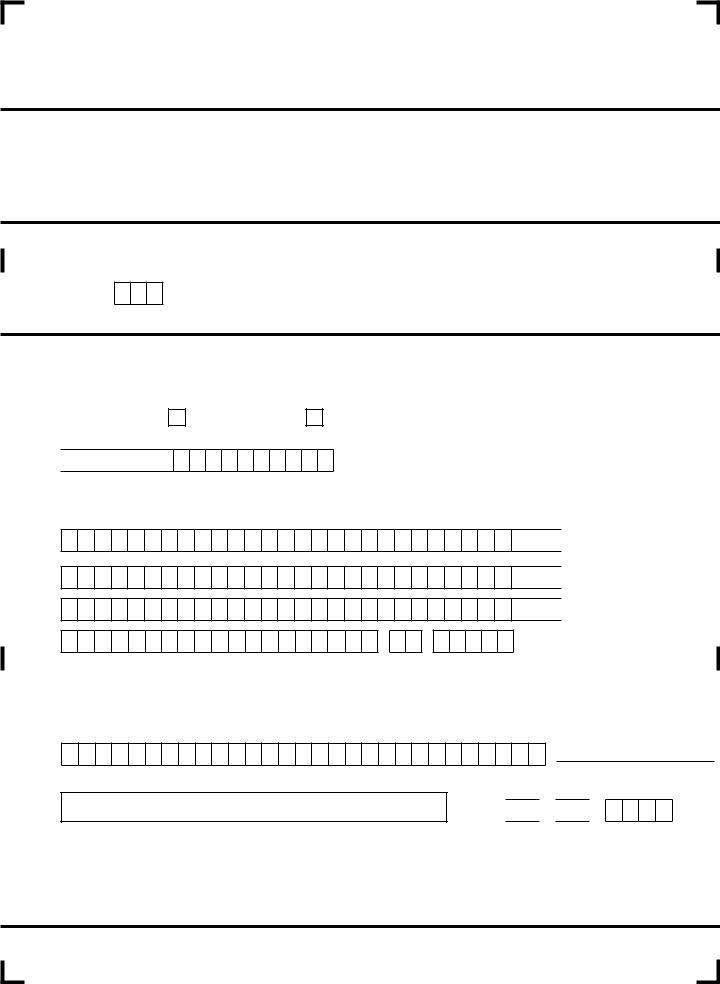

With regards to the blank fields of this precise form, this is what you need to do:

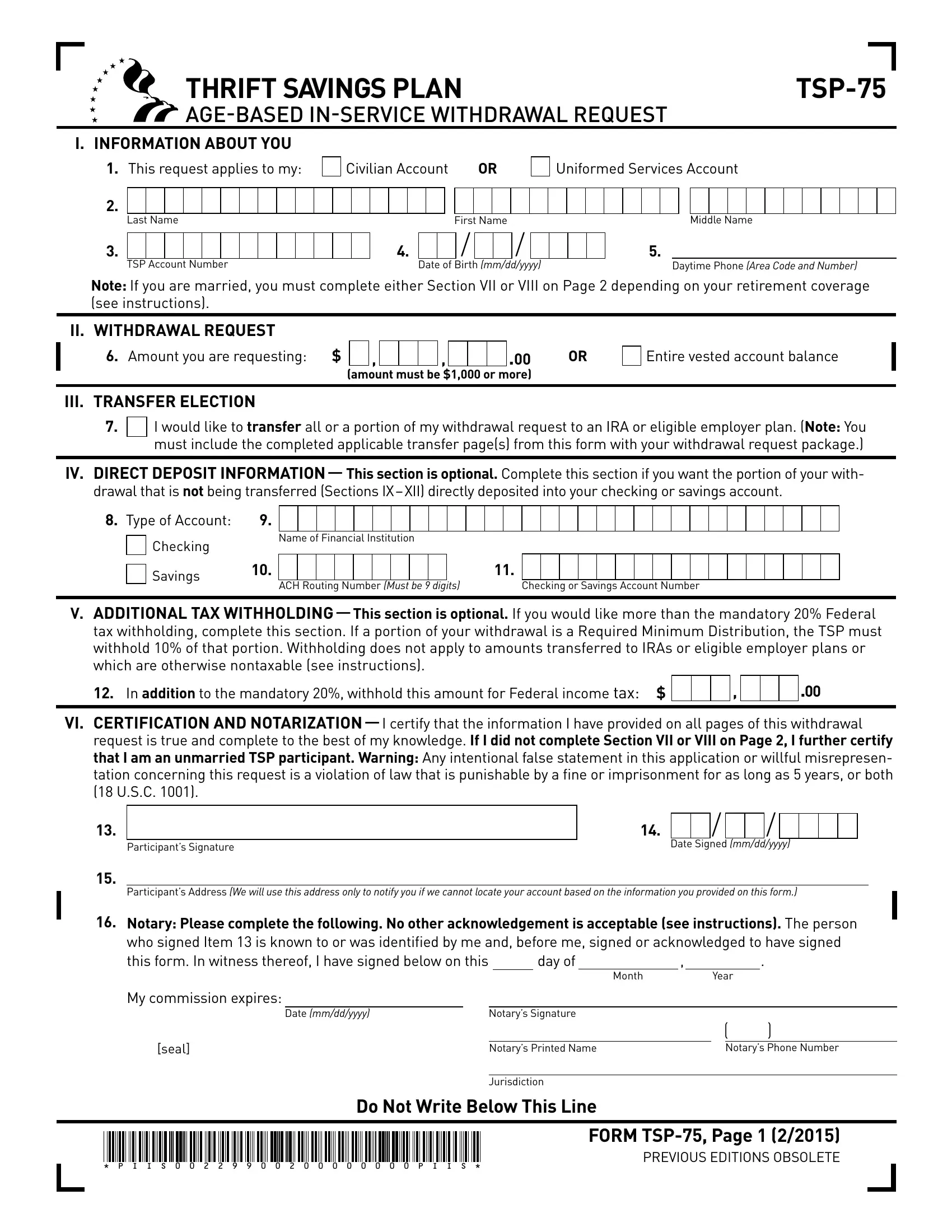

1. It is recommended to complete the tsp 75 accurately, so be mindful while filling in the segments that contain these blank fields:

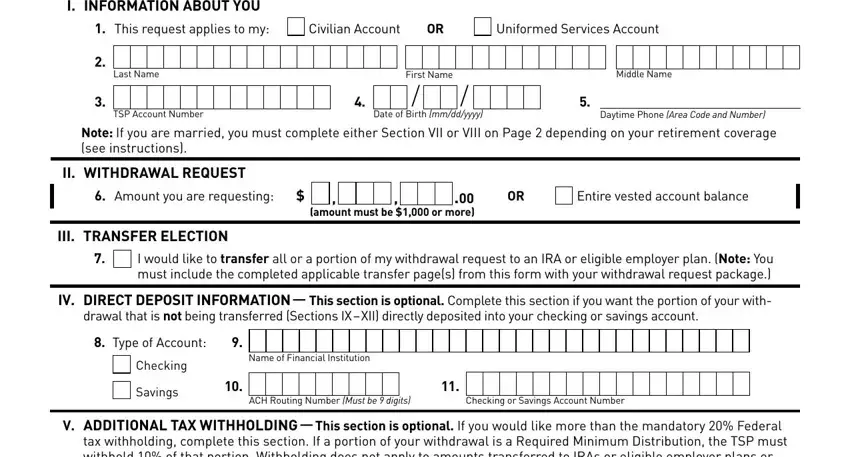

2. Once your current task is complete, take the next step – fill out all of these fields - V ADDITIONAL TAX WITHHOLDING This, In addition to the mandatory, VI CERTIFICATION AND NOTARIZATION, request is true and complete to, Participants Signature, Date Signed mmddyyyy, Participants Address We will use, Notary Please complete the, day of, Month, Year, seal, Date mmddyyyy, Notarys Signature, and Notarys Printed Name with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

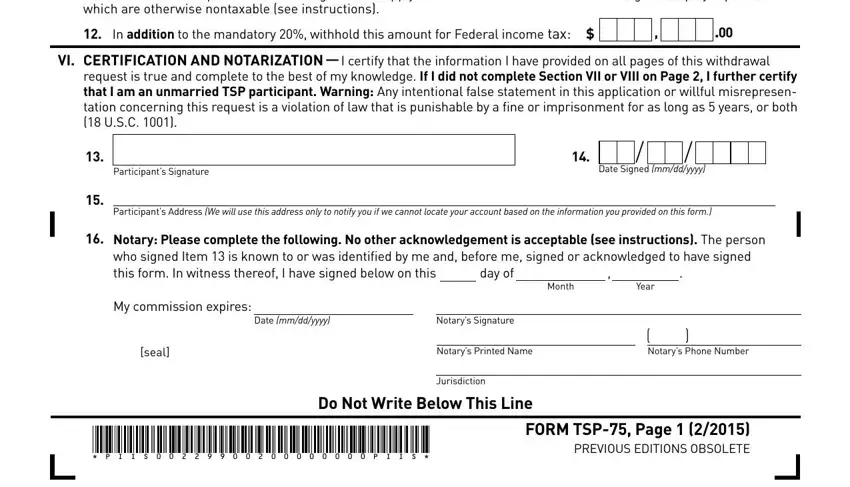

3. In this stage, review Name, Last First Middle, TSP Account Number, VII MARRIED FERS AND UNIFORMED, spouses signature must be notarized, Spouse By signing below I consent, the amount withdrawn will not be, Spouses Name Last First Middle, Spouses Signature, Date Signed mmddyyyy, Notary Please complete the, The person who signed Item is, signed this form In witness, day of, and Month. All these have to be completed with greatest focus on detail.

Be really mindful when filling out Last First Middle and spouses signature must be notarized, since this is the section in which many people make mistakes.

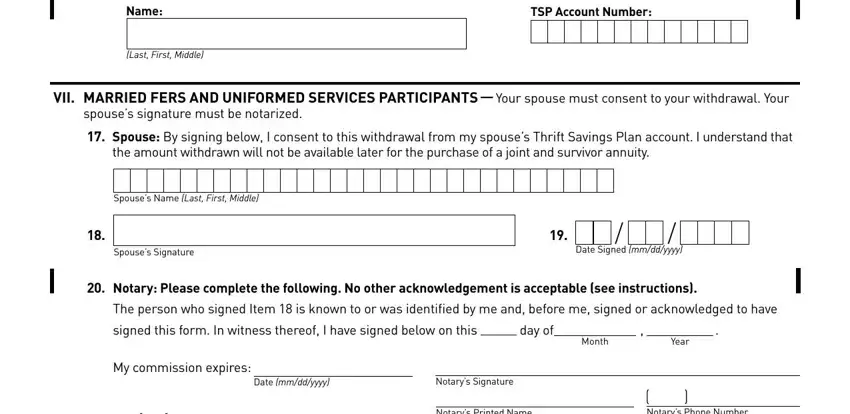

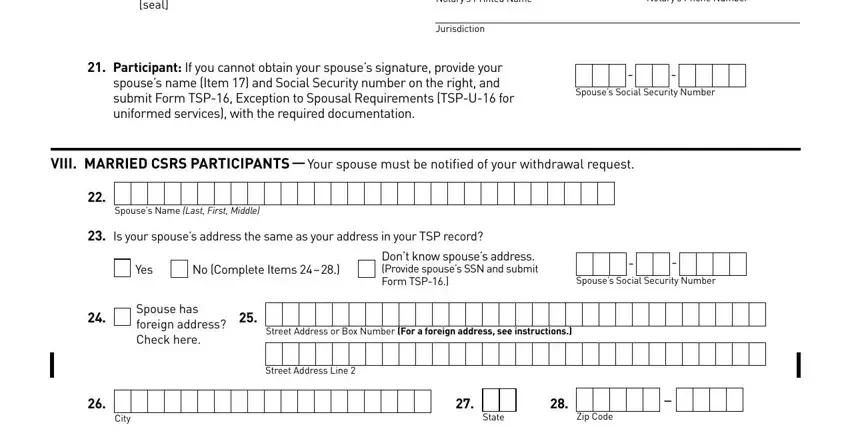

4. The next subsection needs your details in the following parts: seal, Notarys Printed Name, Jurisdiction, Notarys Phone Number, Participant If you cannot obtain, Spouses Social Security Number, VIII MARRIED CSRS PARTICIPANTS, Spouses Name Last First Middle, Is your spouses address the same, Yes, No Complete Items, Dont know spouses address Provide, Spouses Social Security Number, Spouse has foreign address Check, and Street Address or Box Number For a. Make sure that you provide all requested details to go forward.

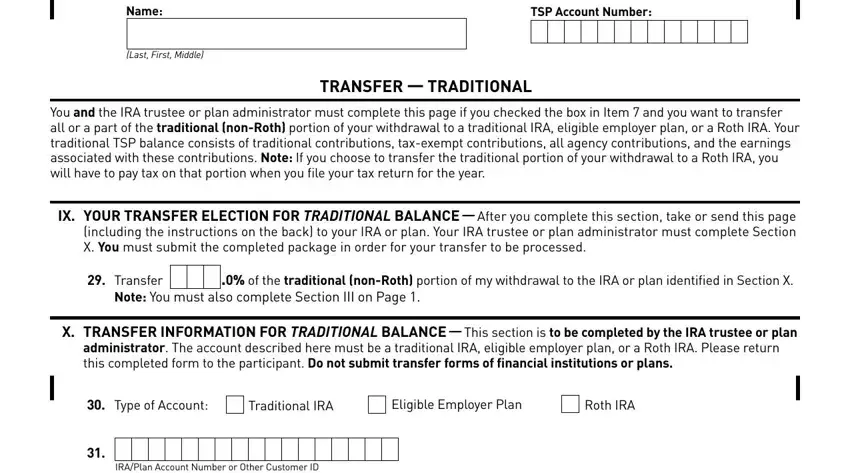

5. The last notch to submit this document is pivotal. You must fill in the displayed blank fields, such as Name, Last First Middle, TSP Account Number, TRANSFER TRADITIONAL, You and the IRA trustee or plan, IX YOUR TRANSFER ELECTION FOR, Transfer, of the traditional nonRoth, Note You must also complete, X TRANSFER INFORMATION FOR, administrator The account, Type of Account, Traditional IRA, Eligible Employer Plan, and Roth IRA, before submitting. Neglecting to do so may generate an unfinished and probably invalid form!

Step 3: Immediately after going through your form fields you've filled out, press "Done" and you're all set! Obtain your tsp 75 the instant you sign up for a free trial. Readily get access to the document in your personal account, together with any edits and changes being conveniently kept! We do not sell or share any information you type in when filling out forms at our website.