Using PDF forms online is certainly quite easy with this PDF editor. Anyone can fill out Form Ttb F 5150 19 here effortlessly. The editor is constantly upgraded by our staff, acquiring useful features and turning out to be greater. All it takes is a few simple steps:

Step 1: Just click the "Get Form Button" in the top section of this page to see our pdf file editing tool. Here you will find everything that is required to work with your document.

Step 2: The tool helps you modify most PDF documents in many different ways. Enhance it with any text, correct what's originally in the document, and add a signature - all manageable within a few minutes!

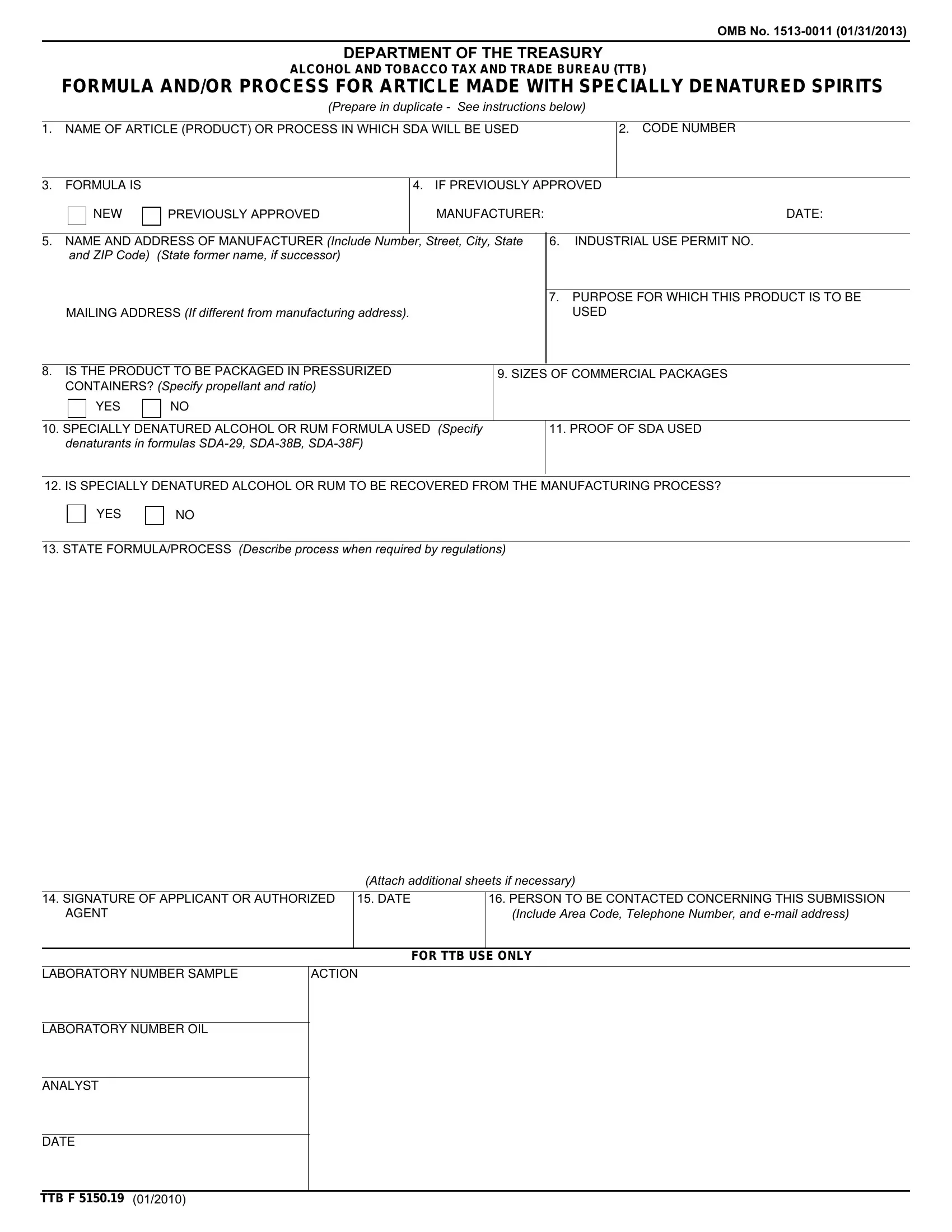

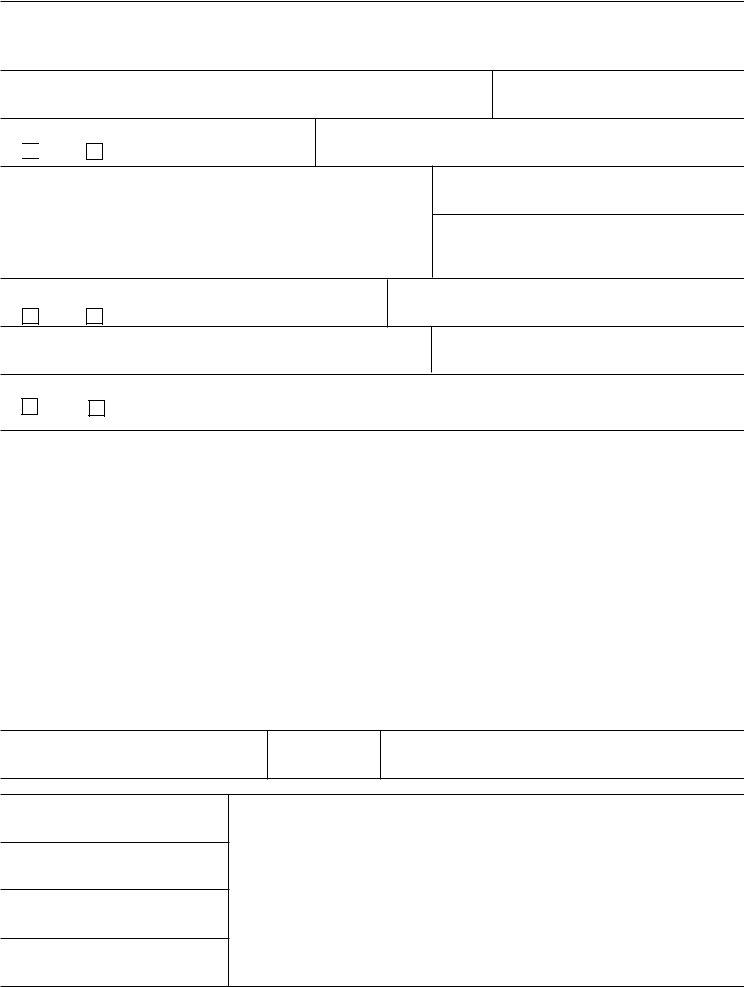

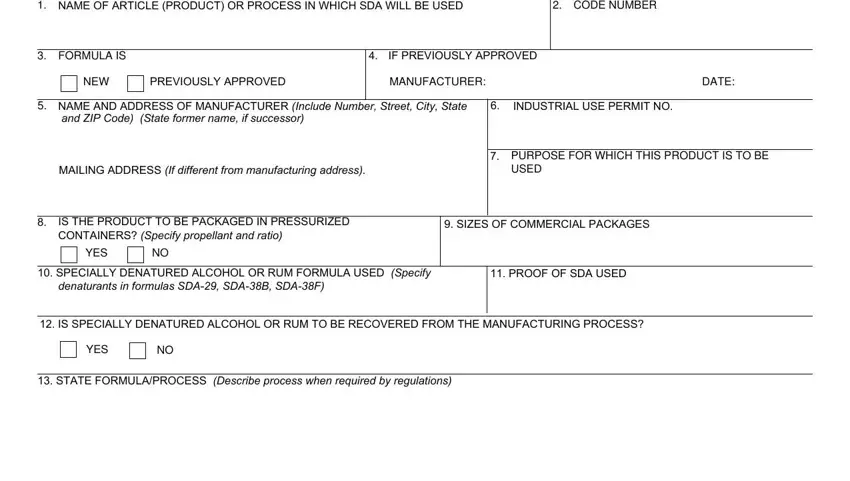

In order to complete this form, make sure that you provide the information you need in every area:

1. Start filling out your Form Ttb F 5150 19 with a selection of essential blanks. Collect all the information you need and make certain there is nothing missed!

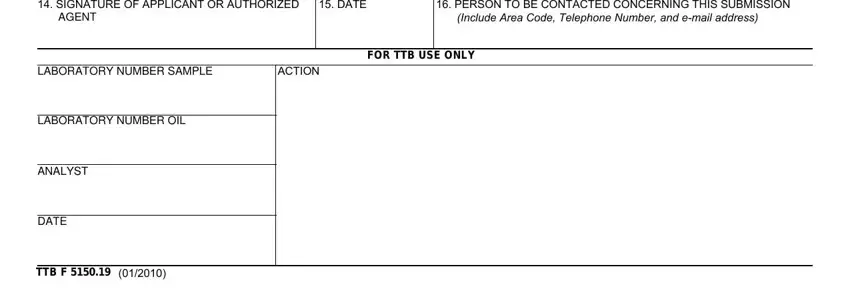

2. The third part is to fill in the following blank fields: SIGNATURE OF APPLICANT OR, DATE, PERSON TO BE CONTACTED CONCERNING, AGENT, Include Area Code Telephone Number, LABORATORY NUMBER SAMPLE, ACTION, FOR TTB USE ONLY, LABORATORY NUMBER OIL, ANALYST, DATE, and TTB F.

Always be really mindful when filling out ANALYST and AGENT, because this is the part in which many people make errors.

Step 3: Spell-check everything you've entered into the blanks and click the "Done" button. Go for a free trial option at FormsPal and obtain instant access to Form Ttb F 5150 19 - download or modify inside your FormsPal cabinet. FormsPal guarantees secure document completion devoid of personal information recording or any kind of sharing. Be assured that your data is secure with us!