With the online PDF tool by FormsPal, you can easily fill in or edit 2008 here. Our editor is consistently evolving to present the very best user experience achievable, and that is because of our resolve for constant improvement and listening closely to customer opinions. It merely requires a few basic steps:

Step 1: First, access the tool by pressing the "Get Form Button" in the top section of this site.

Step 2: This editor grants the capability to work with your PDF in a variety of ways. Transform it by adding your own text, adjust existing content, and put in a signature - all at your fingertips!

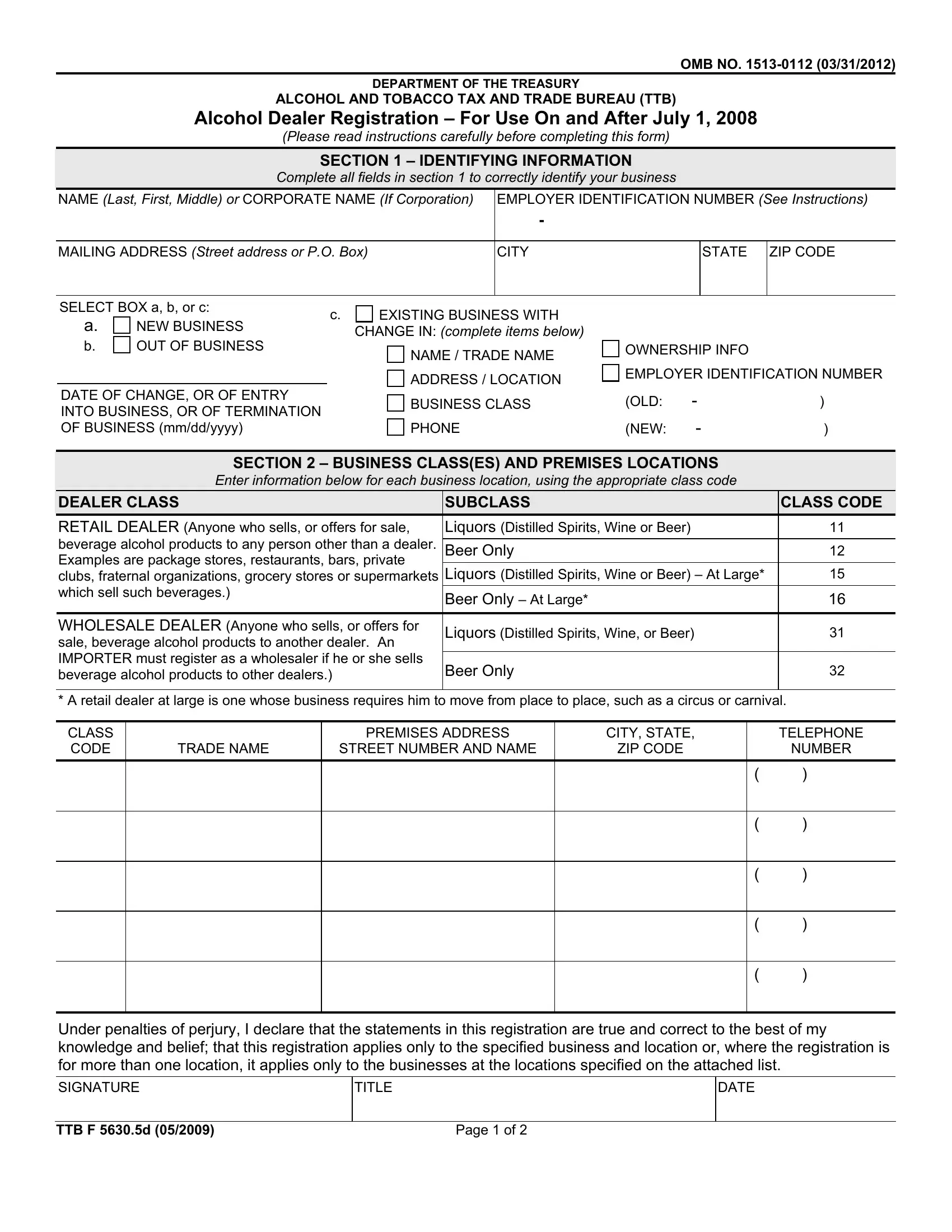

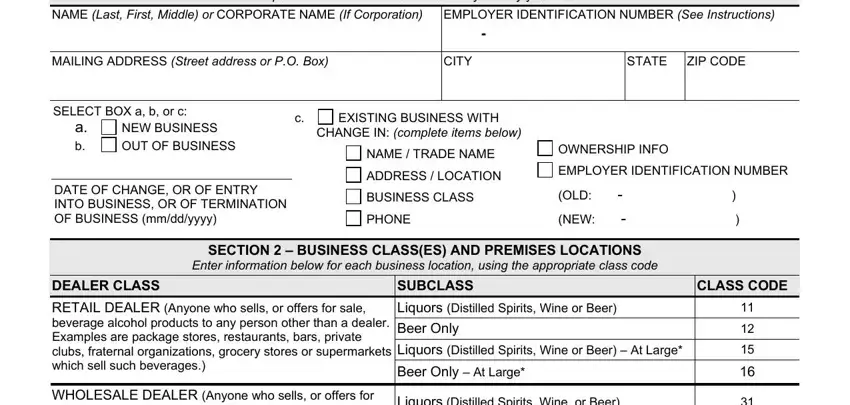

This PDF requires particular information to be typed in, so you should take some time to provide precisely what is asked:

1. When submitting the 2008, make certain to include all important fields in its corresponding area. It will help expedite the work, making it possible for your details to be processed quickly and properly.

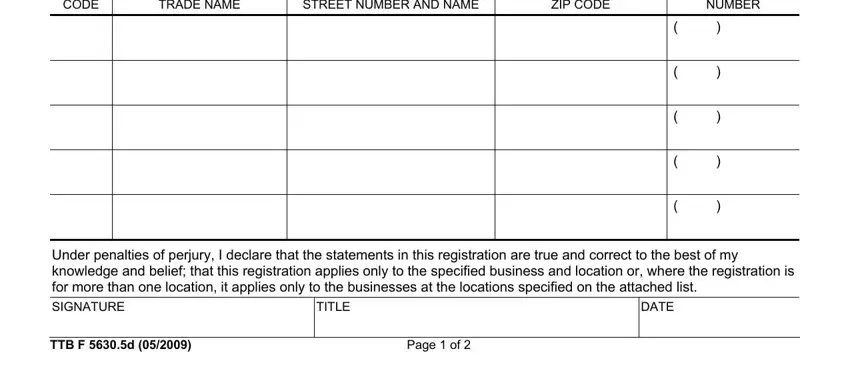

2. The third step would be to complete all of the following fields: CLASS CODE, TRADE NAME, STREET NUMBER AND NAME, ZIP CODE, NUMBER, Under penalties of perjury I, SIGNATURE TTB F d, TITLE, Page of, and DATE.

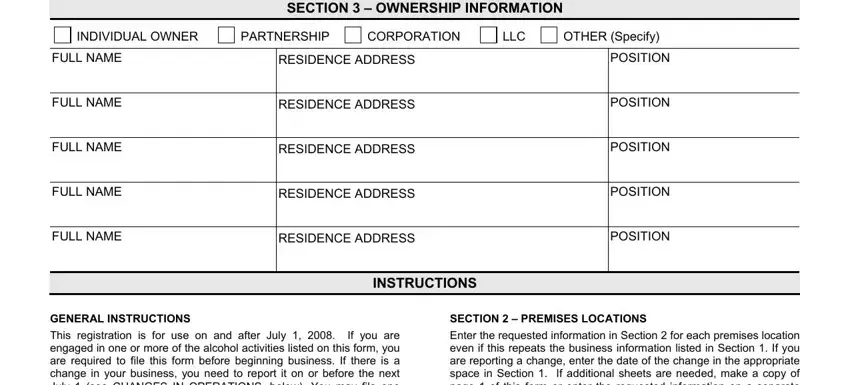

3. This next segment is focused on SECTION OWNERSHIP INFORMATION, INDIVIDUAL OWNER, FULL NAME, FULL NAME, FULL NAME, FULL NAME, FULL NAME, PARTNERSHIP, CORPORATION RESIDENCE ADDRESS, RESIDENCE ADDRESS, RESIDENCE ADDRESS, RESIDENCE ADDRESS, RESIDENCE ADDRESS, INSTRUCTIONS, and LLC - fill out each one of these empty form fields.

Always be very mindful while filling in FULL NAME and RESIDENCE ADDRESS, since this is the section where a lot of people make errors.

Step 3: Once you've looked once more at the details in the document, just click "Done" to complete your document generation. Right after starting a7-day free trial account with us, you'll be able to download 2008 or send it through email without delay. The PDF file will also be accessible from your personal account page with all of your adjustments. When using FormsPal, you're able to fill out documents without needing to get worried about personal information incidents or entries being shared. Our protected platform ensures that your personal data is kept safely.