Using PDF documents online is always simple with this PDF tool. Anyone can fill out Form Twcc 3 here without trouble. Our editor is constantly developing to give the best user experience attainable, and that is thanks to our dedication to constant enhancement and listening closely to comments from customers. Getting underway is effortless! Everything you should do is adhere to the next basic steps down below:

Step 1: First of all, open the pdf tool by clicking the "Get Form Button" above on this page.

Step 2: Using our online PDF editor, it is possible to do more than simply complete blank fields. Edit away and make your documents look perfect with customized text incorporated, or fine-tune the original content to perfection - all that comes with an ability to add stunning pictures and sign the document off.

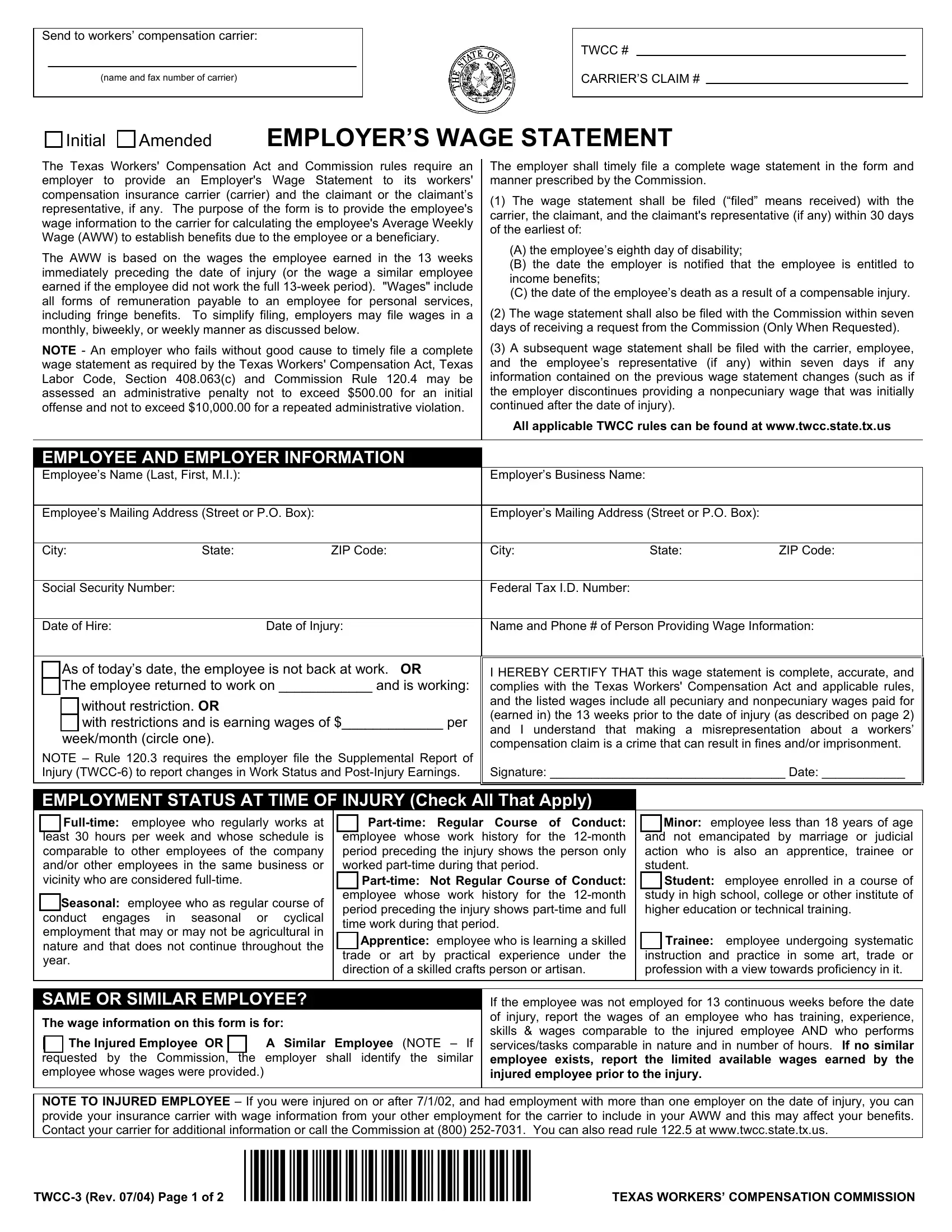

This PDF form will require specific information to be filled in, thus be sure to take whatever time to provide precisely what is asked:

1. The Form Twcc 3 will require certain information to be typed in. Be sure the following blanks are completed:

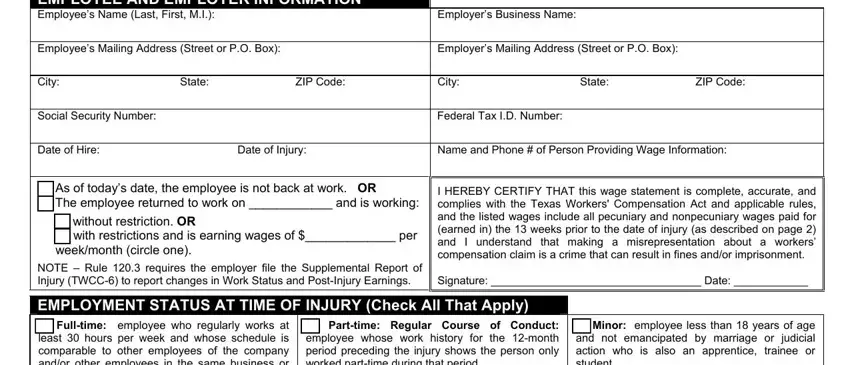

2. After the previous part is complete, you should include the essential details in EMPLOYEE AND EMPLOYER INFORMATION, Employers Business Name, Employees Mailing Address Street, Employers Mailing Address Street, City State ZIP Code, City State ZIP Code, Social Security Number, Federal Tax ID Number, Date of Hire, Date of Injury, Name and Phone of Person, As of todays date the employee is, without restriction OR with, weekmonth circle one, and NOTE Rule requires the employer allowing you to move forward further.

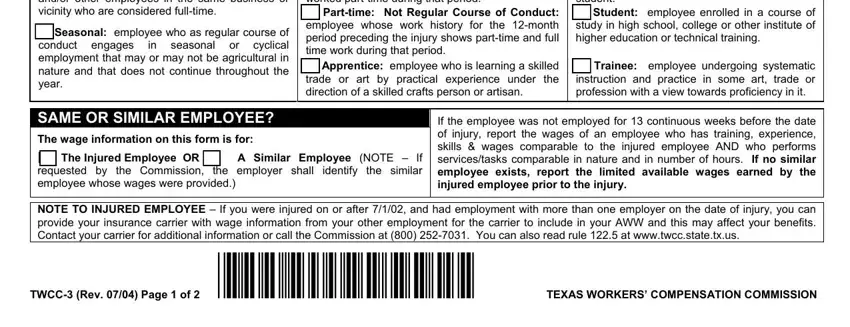

3. Completing Fulltime employee who regularly, Seasonal employee who as regular, Parttime Regular Course of Conduct, Minor employee less than years of, Parttime Not Regular Course of, Student employee enrolled in a, Apprentice employee who is, Trainee employee undergoing, SAME OR SIMILAR EMPLOYEE, The wage information on this form, The Injured Employee OR, A Similar Employee NOTE If, If the employee was not employed, NOTE TO INJURED EMPLOYEE If you, and TWCC Rev Page of FP TEXAS is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

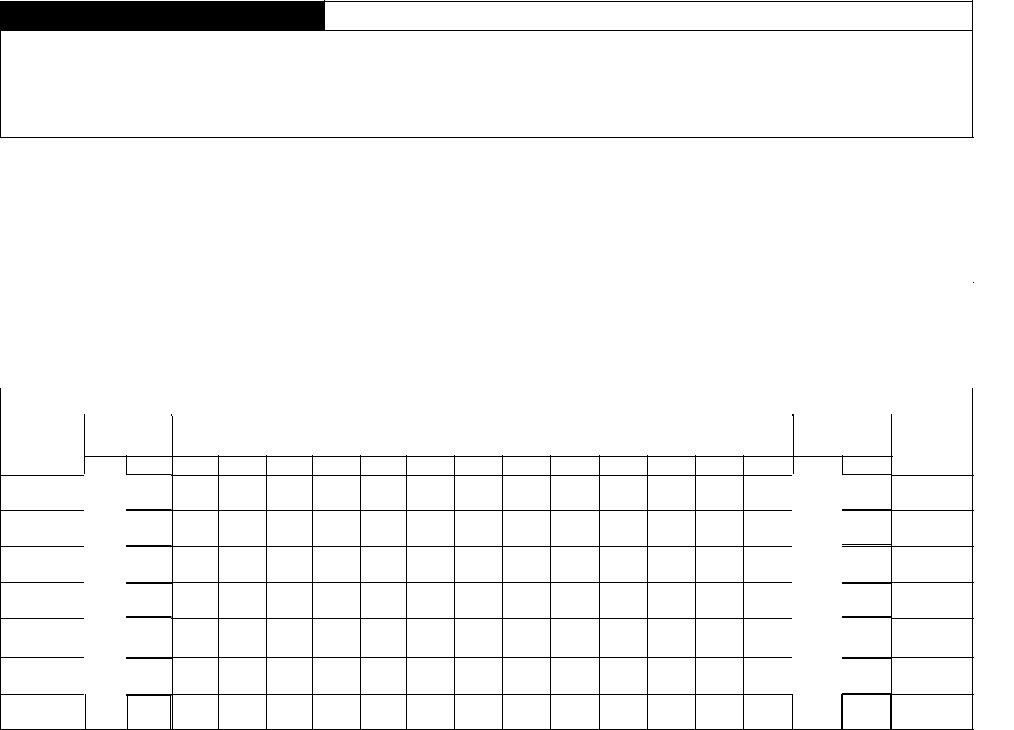

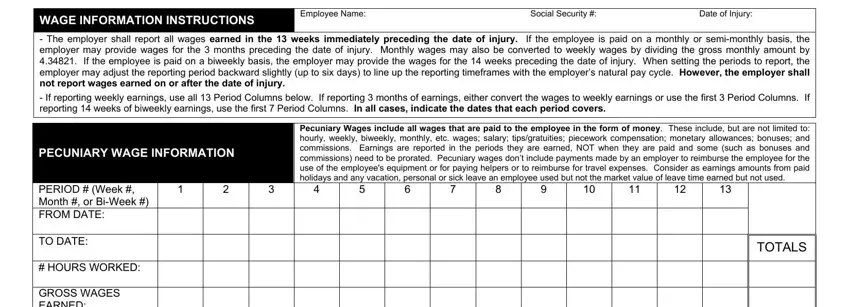

4. To move ahead, the next section will require typing in several blanks. These include WAGE INFORMATION INSTRUCTIONS, Employee Name Social Security, The employer shall report all, If reporting weekly earnings use, PECUNIARY WAGE INFORMATION, Pecuniary Wages include all wages, TOTALS, PERIOD Week Month or BiWeek, TO DATE, HOURS WORKED, and GROSS WAGES EARNED, which you'll find essential to continuing with this document.

It's very easy to make errors when filling out your If reporting weekly earnings use, hence you'll want to reread it prior to deciding to send it in.

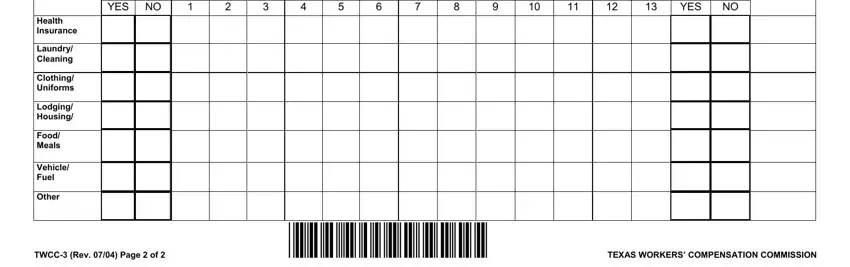

5. Lastly, the following last part is precisely what you have to complete before using the PDF. The fields in question are the next: Health Insurance, Laundry Cleaning, Clothing Uniforms, Lodging Housing, Food Meals, Vehicle Fuel, Other, To Injury YES NO, YES, and TWCC Rev Page of FP TEXAS.

Step 3: Make certain your details are accurate and click "Done" to proceed further. Sign up with FormsPal now and easily get access to Form Twcc 3, available for downloading. All adjustments you make are saved , meaning you can modify the file at a later time when necessary. At FormsPal, we do our utmost to ensure that your information is stored secure.