Handling PDF forms online is definitely quite easy using our PDF editor. You can fill in FRX here and try out many other options we provide. To maintain our tool on the forefront of practicality, we strive to put into practice user-oriented capabilities and enhancements on a regular basis. We are at all times pleased to receive suggestions - join us in reshaping how we work with PDF files. With a few simple steps, it is possible to start your PDF journey:

Step 1: Hit the "Get Form" button at the top of this page to open our tool.

Step 2: With this state-of-the-art PDF tool, you'll be able to do more than merely fill out forms. Edit away and make your forms appear sublime with customized text incorporated, or adjust the file's original content to perfection - all that comes with an ability to add stunning graphics and sign the document off.

Concentrate when filling in this document. Ensure all necessary blanks are filled out properly.

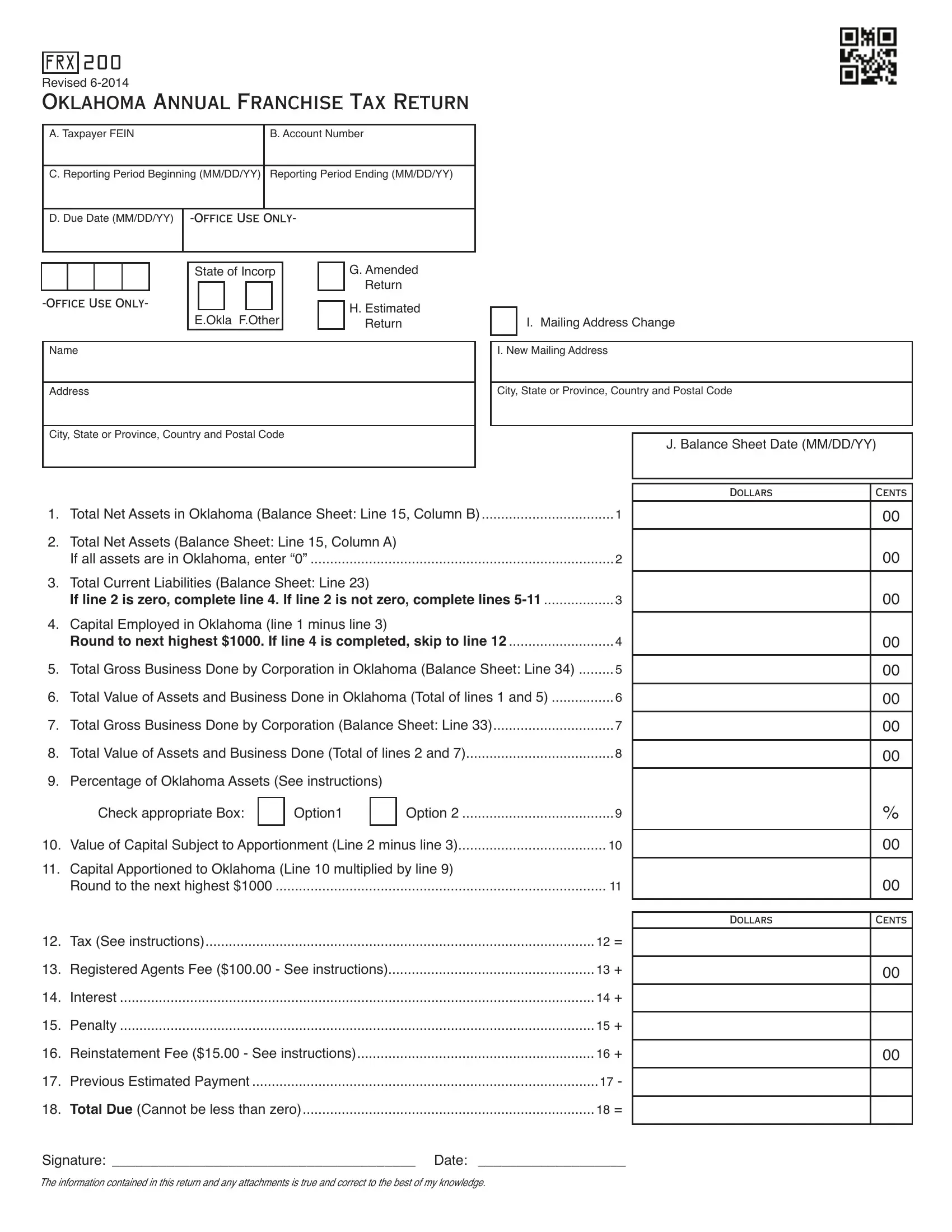

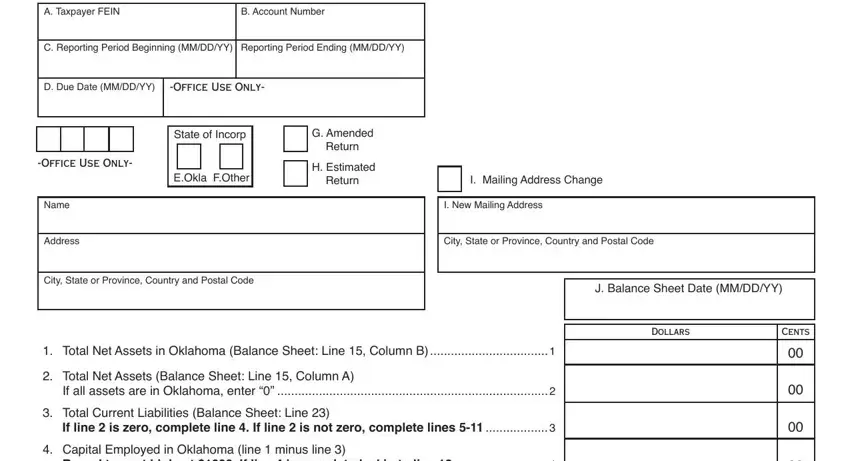

1. Complete your FRX with a selection of necessary fields. Gather all of the important information and make certain there is nothing missed!

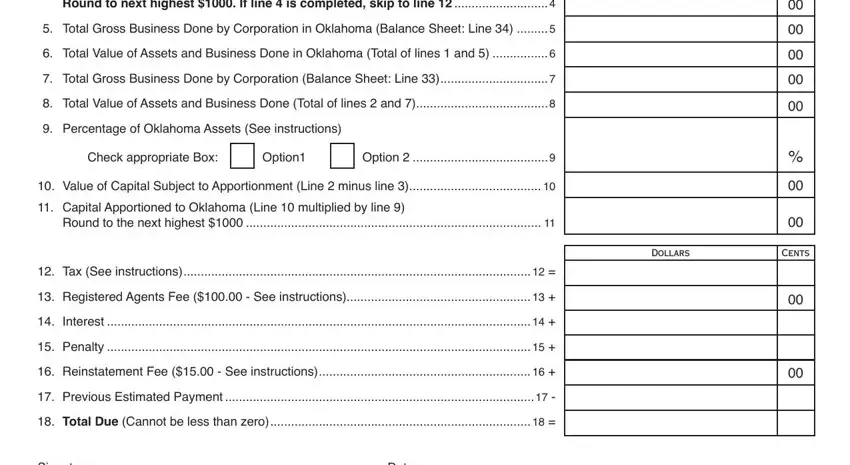

2. Once this section is complete, it is time to put in the needed details in Capital Employed in Oklahoma line, Round to next highest If line is, Total Gross Business Done by, Total Value of Assets and, Total Gross Business Done by, Total Value of Assets and, Percentage of Oklahoma Assets See, Check appropriate Box, Option, Option, Value of Capital Subject to, Capital Apportioned to Oklahoma, Round to the next highest, Tax See instructions, and Registered Agents Fee See so you're able to move forward further.

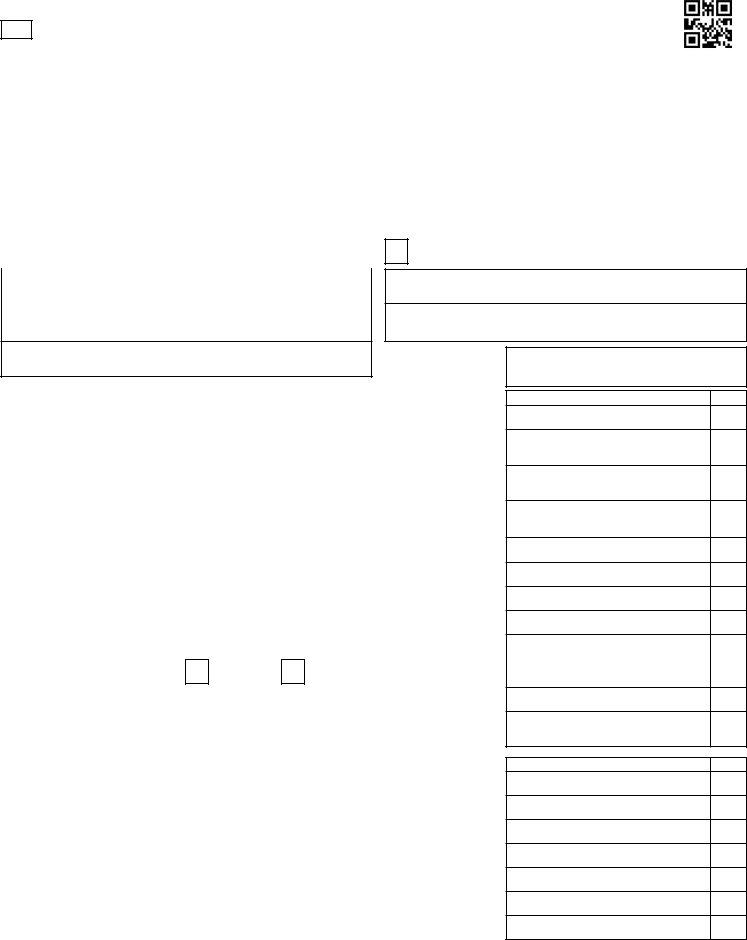

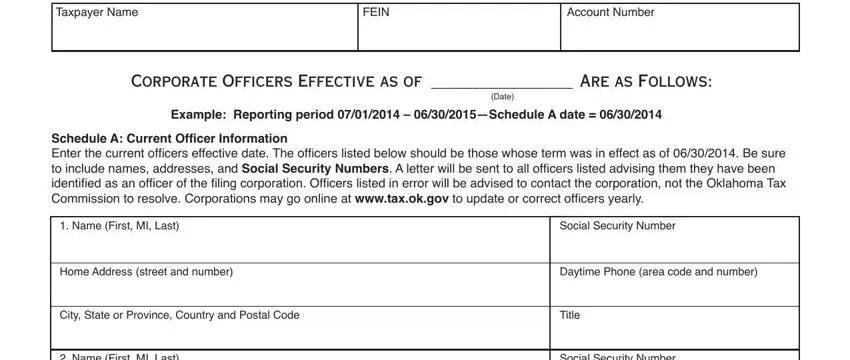

3. This next segment will be about Taxpayer Name, FEIN, Account Number, Corporate Officers Effective as of, Example Reporting period, Date, Schedule A Current Oficer, Name First MI Last, Home Address street and number, City State or Province Country and, Name First MI Last, Social Security Number, Daytime Phone area code and number, Title, and Social Security Number - type in these blank fields.

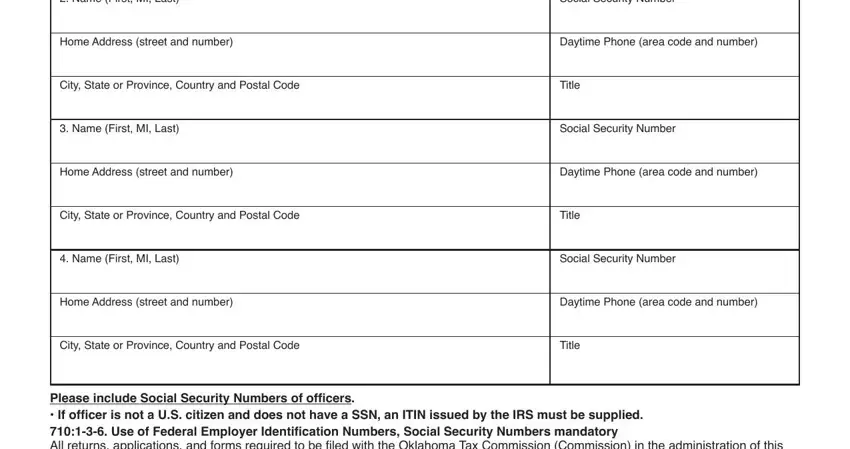

4. To move forward, your next step requires completing several form blanks. These include Name First MI Last, Home Address street and number, City State or Province Country and, Name First MI Last, Home Address street and number, City State or Province Country and, Name First MI Last, Home Address street and number, City State or Province Country and, Social Security Number, Daytime Phone area code and number, Title, Social Security Number, Daytime Phone area code and number, and Title, which are crucial to carrying on with this particular PDF.

Those who use this PDF frequently make some mistakes when filling in Title in this section. Ensure you double-check everything you type in right here.

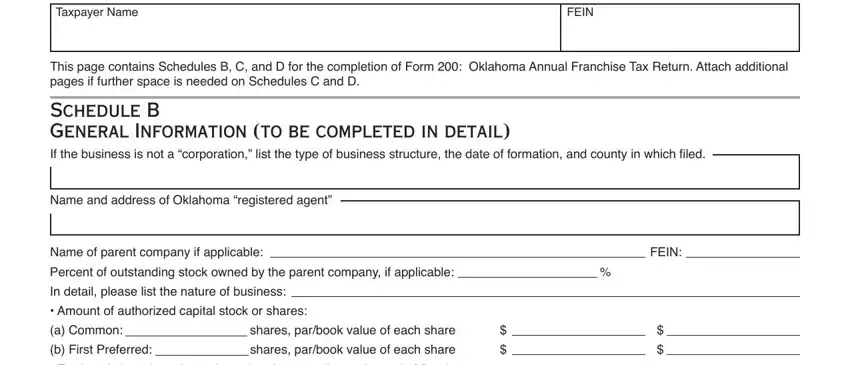

5. As a final point, the following last portion is precisely what you will need to wrap up prior to submitting the form. The blanks here are the following: Taxpayer Name, FEIN, This page contains Schedules B C, Schedule B General Information to, Name and address of Oklahoma, Name of parent company if, Percent of outstanding stock owned, In detail please list the nature, shares parbook value of each share, b First Preferred Total capital, shares parbook value of each share, and FEIN.

Step 3: After taking another look at your fields and details, click "Done" and you are all set! Get hold of your FRX once you subscribe to a free trial. Conveniently view the document inside your personal account page, with any edits and changes being automatically synced! FormsPal is dedicated to the personal privacy of our users; we always make sure that all personal data coming through our tool stays secure.