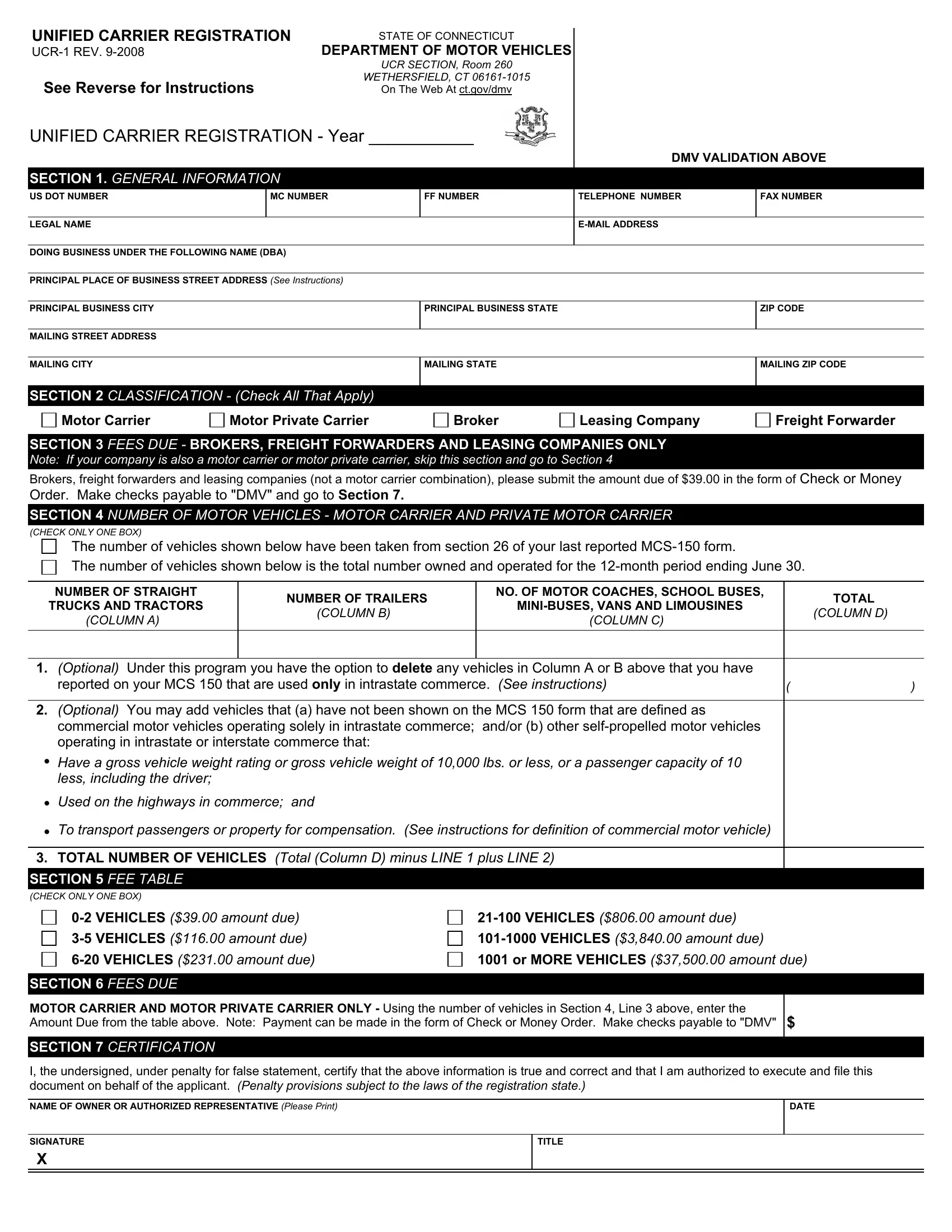

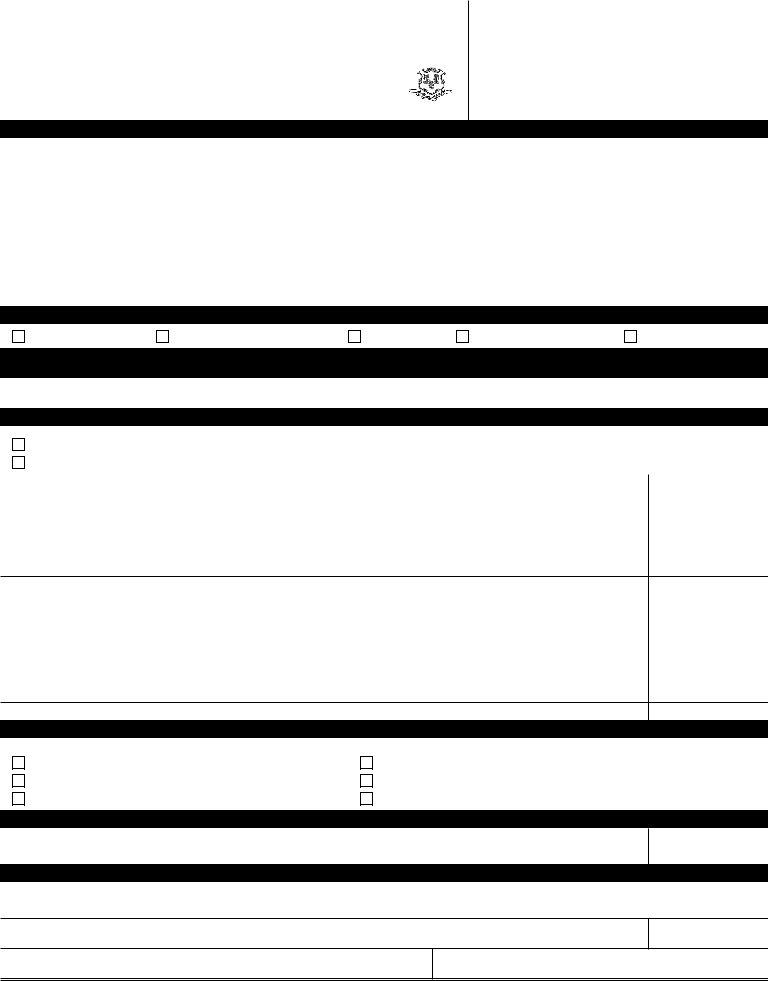

UNIFIED CARRIER REGISTRATION |

STATE OF CONNECTICUT |

UCR-1 REV. 9-2008 |

DEPARTMENT OF MOTOR VEHICLES |

|

UCR SECTION, Room 260 |

See Reverse for Instructions |

WETHERSFIELD, CT 06161-1015 |

On The Web At ct.gov/dmv |

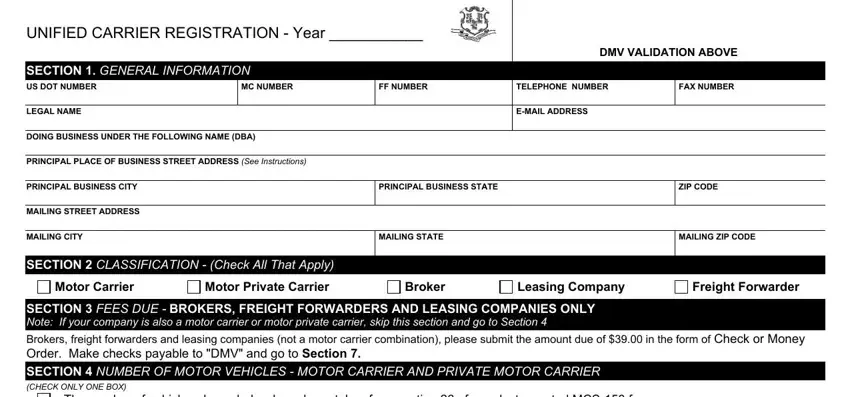

UNIFIED CARRIER REGISTRATION - Year ___________

DMV VALIDATION ABOVE

SECTION 1. GENERAL INFORMATION

US DOT NUMBER |

MC NUMBER |

FF NUMBER |

TELEPHONE NUMBER |

FAX NUMBER |

|

|

|

|

|

LEGAL NAME |

|

|

E-MAIL ADDRESS |

|

|

|

|

|

|

DOING BUSINESS UNDER THE FOLLOWING NAME (DBA) |

|

|

|

|

|

|

|

|

PRINCIPAL PLACE OF BUSINESS STREET ADDRESS (See Instructions) |

|

|

|

|

|

|

|

|

PRINCIPAL BUSINESS CITY |

|

PRINCIPAL BUSINESS STATE |

|

ZIP CODE |

|

|

|

|

|

MAILING STREET ADDRESS |

|

|

|

|

|

|

|

|

|

MAILING CITY |

|

MAILING STATE |

|

MAILING ZIP CODE |

|

|

|

|

|

SECTION 2 CLASSIFICATION - (Check All That Apply)

SECTION 3 FEES DUE - BROKERS, FREIGHT FORWARDERS AND LEASING COMPANIES ONLY

Note: If your company is also a motor carrier or motor private carrier, skip this section and go to Section 4

Brokers, freight forwarders and leasing companies (not a motor carrier combination), please submit the amount due of $39.00 in the form of Check or Money Order. Make checks payable to "DMV" and go to Section 7.

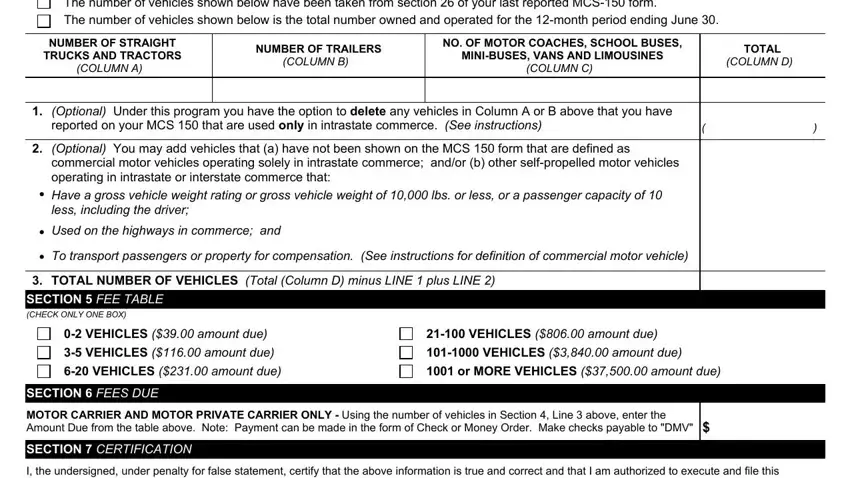

SECTION 4 NUMBER OF MOTOR VEHICLES - MOTOR CARRIER AND PRIVATE MOTOR CARRIER

(CHECK ONLY ONE BOX)

The number of vehicles shown below have been taken from section 26 of your last reported MCS-150 form.

The number of vehicles shown below is the total number owned and operated for the 12-month period ending June 30.

|

NUMBER OF STRAIGHT |

NUMBER OF TRAILERS |

NO. OF MOTOR COACHES, SCHOOL BUSES, |

TOTAL |

|

TRUCKS AND TRACTORS |

MINI-BUSES, VANS AND LIMOUSINES |

|

(COLUMN B) |

(COLUMN D) |

|

(COLUMN A) |

(COLUMN C) |

|

|

|

|

|

|

|

|

|

|

|

|

|

1.(Optional) Under this program you have the option to delete any vehicles in Column A or B above that you have

reported on your MCS 150 that are used only in intrastate commerce. (See instructions) |

( |

) |

2.(Optional) You may add vehicles that (a) have not been shown on the MCS 150 form that are defined as commercial motor vehicles operating solely in intrastate commerce; and/or (b) other self-propelled motor vehicles operating in intrastate or interstate commerce that:

•Have a gross vehicle weight rating or gross vehicle weight of 10,000 lbs. or less, or a passenger capacity of 10 less, including the driver;

•Used on the highways in commerce; and

•To transport passengers or property for compensation. (See instructions for definition of commercial motor vehicle)

3.TOTAL NUMBER OF VEHICLES (Total (Column D) minus LINE 1 plus LINE 2)

SECTION 5 FEE TABLE

(CHECK ONLY ONE BOX)

0-2 VEHICLES ($39.00 amount due) |

21-100 VEHICLES ($806.00 amount due) |

3-5 VEHICLES ($116.00 amount due) |

101-1000 VEHICLES ($3,840.00 amount due) |

6-20 VEHICLES ($231.00 amount due) |

1001 or MORE VEHICLES ($37,500.00 amount due) |

SECTION 6 FEES DUE

MOTOR CARRIER AND MOTOR PRIVATE CARRIER ONLY - Using the number of vehicles in Section 4, Line 3 above, enter the Amount Due from the table above. Note: Payment can be made in the form of Check or Money Order. Make checks payable to "DMV" $

SECTION 7 CERTIFICATION

I, the undersigned, under penalty for false statement, certify that the above information is true and correct and that I am authorized to execute and file this document on behalf of the applicant. (Penalty provisions subject to the laws of the registration state.)

NAME OF OWNER OR AUTHORIZED REPRESENTATIVE (Please Print)

Instruction Sheet for UCR Carrier Registration

What is my base state for UCR?

(A)If your principal place of business as completed in Section 1 of the form is AK, AL, AR, CA, CO, CT, DE, GA, IA, ID, IL, IN, KS, KY, LA, MA, ME, MI, MN, MO, MS, MT, NC, ND, NE, NH, NM, NY, OH, OK, PA, RI, SC, SD, TN, TX, UT, VA, WA, WI, or WV, you must use that state as your base state. If your principal place of business is not in one of these states, go to (B).

(B)If your principal place of business is not one of the states listed in (A) above but you have an office or operating facility located in one of the states listed in (A) above, you must use that state as your base state.

(C)If you cannot select a base state using (A) or (B) above, you must select your base state from (A) above that is nearest to the location of your principal place of business; or

(D)Select your base state as follows:

a.If your principal place of business is in DC, MD, NJ, or VT or the Canadian Province of ON, NB, NL, NS, PE, or QC, you may select one of the following states: CT, DE, MA, ME, NH, NY, PA, RI, VA, or WV.

b.If your principal place of business is in FL or a state of Mexico, you may select one of the following states: AL, AR, GA, KY, LA, MS, NC, OK, SC, TN, or TX.

c.If your principal place of business is in the Canadian Province of ON or MB, you may select one of the following states: IA, IL, IN, KS, MI, MN, MO, NE, OH, or WI.

d.If your principal place of business is in AZ, NV, OR, or WY or the Canadian Province of AB, MB, SK, or BC or a state of Mexico, you may select one of the following states: AK, CA, CO, ID, MT, ND, NM, SD, UT, or WA.

Change of Base State

•If you selected your base state using (C) or (D) above and your principal place of business has moved to a qualified state in (A) or (B) above, you may at the next registration year change your base state to a state listed in (A) or (B).

Section 1. - General Information

•Enter all identifying information for your company. The owner and DBA name should be identical to what is on file for your USDOT number (See http://safer.fmcsa.dot.gov/CompanySnapshot.aspx). Enter the principal place of business address that serves as your headquarters and where your operational records are maintained or can be made available.

Section 2. - Classification (DEFINITIONS)

•"Motor carrier" means a person providing commercial motor vehicle (as defined in section 31132 of 49 USC) transportation for compensation.

•"Motor private carrier" means a person, other than a motor carrier, transporting property by commercial motor vehicle (as defined in section 31132 of 49 USC) when - (A) the transportation is as provided in section 13501 of 49 USC; (B) the person is the owner, lessee, or bailee of the property being transported; and (C) the property is being transported for sale, lease, rent, or bailment or to further a commercial enterprise.

•"Broker" means a person, other than a motor carrier, who sells or arranges for transportation by a motor carrier for compensation.

•"Freight forwarder" means a person that arranges for truck transportation of cargo belonging to others, utilizing for-hire carriers to provide the actual truck transportation, and also performs or provides for assembling, consolidating, break-bulk and distribution of shipments and assumes responsibility for transportation from place of receipt to destination.

•"Leasing company" means a person or company engaged in the business of leasing or renting for compensation motor vehicles they own without drivers to a motor carrier, motor private carrier, or freight forwarder.

Section 3. - Fees Due-Brokers, Freight Forwarders and Leasing Companies

•Brokers, freight forwarders and leasing companies pay the lowest fee tier. If your company is also a motor carrier (whether private or for-hire) you will skip this section of the application.

Section 4. - No. Of Motor Vehicles - Motor Carrier & Motor Private Carrier

•Check the appropriate box indicating where you obtained the vehicle count for the numbers you entered into the table in this section.

•In the table, enter the number of commercial motor vehicles you reported on your last MCS-150 form or the total number of commercial motor vehicles owned and operated for the 12-month period ending June 30 of the year immediately prior to the year for which the UCR registration is made. This table includes owned and leased vehicles (term of lease for more than 30 days). Any vehicle designed to transport 10 passengers or less, including the driver, is not defined as a commercial motor vehicle for the purpose of payment of fees under this program and should not be counted in Column D of the table.

•Option 1. You may subtract the number of property carrying vehicles used solely in intrastate commerce (never used to carry interstate freight) that you included in Section 4, Columns A or B. You may not enter on this line the number of passenger carrying vehicles included in Column C that were used solely in intrastate commerce.

•Option 2. You may add the number of owned commercial motor vehicles (straight trucks, tractors, trailers, motor coaches, school buses, mini-buses, vans or limousines) that were used only in intrastate commerce if they were not included in Columns A, B or C above. You may also include on this line the number of other self propelled vehicles (not trailers) used in interstate or intrastate commerce to transport passengers or property for compensation that are not defined as a commercial motor vehicle that have a GVWR or GVW of 10,000 pounds or less or a passenger capacity of 10 or less, including the driver.

•Line 3, Total Number of Vehicles. Add the number of vehicles shown in Column D, subtract any vehicles you reported in Option 1 and add any vehicles you reported under Option 2 and show the total on Line 3. Use this total number of vehicles and go to the fee table in Section 5. Pay the amount due for your total number of vehicles.

•Definition - "Commercial motor vehicle" (as defined under 49 USC Section 31101) means a self-propelled or towed vehicle used on the highways in commerce principally to transport passengers or cargo, if the vehicle: (1) Has a gross vehicle weight rating (GVWR) or gross vehicle weight (GVW) of at least 10,001 pounds, whichever is greater; (2) Is designed to transport more than 10 passengers, including the driver; or (3) Is used in transporting material found by the Secretary of Transportation to be hazardous under section 5103 of this title and transported in a quantity requiring placarding under regulations prescribed by the Secretary under section 5103."

Section 5. - Fee Table for Motor Carrier & Motor Private Carrier

•This table is the approved UCR fees you will pay dependent upon the number of vehicles reported in Section 4. This fee may change from year to year. Contact your base state if you do not have the fee table for the correct registration period.

Section 6. - Fee Due for Motor Carrier & Motor Private Carrier

•Enter the amount due for the total number of vehicles calculated in Section 4.

Section 7. - Certification

•The owner or an individual who has a power of attorney to sign on behalf of the owner or owners must sign this form. This certification indicates that the information is correct under penalty of perjury.