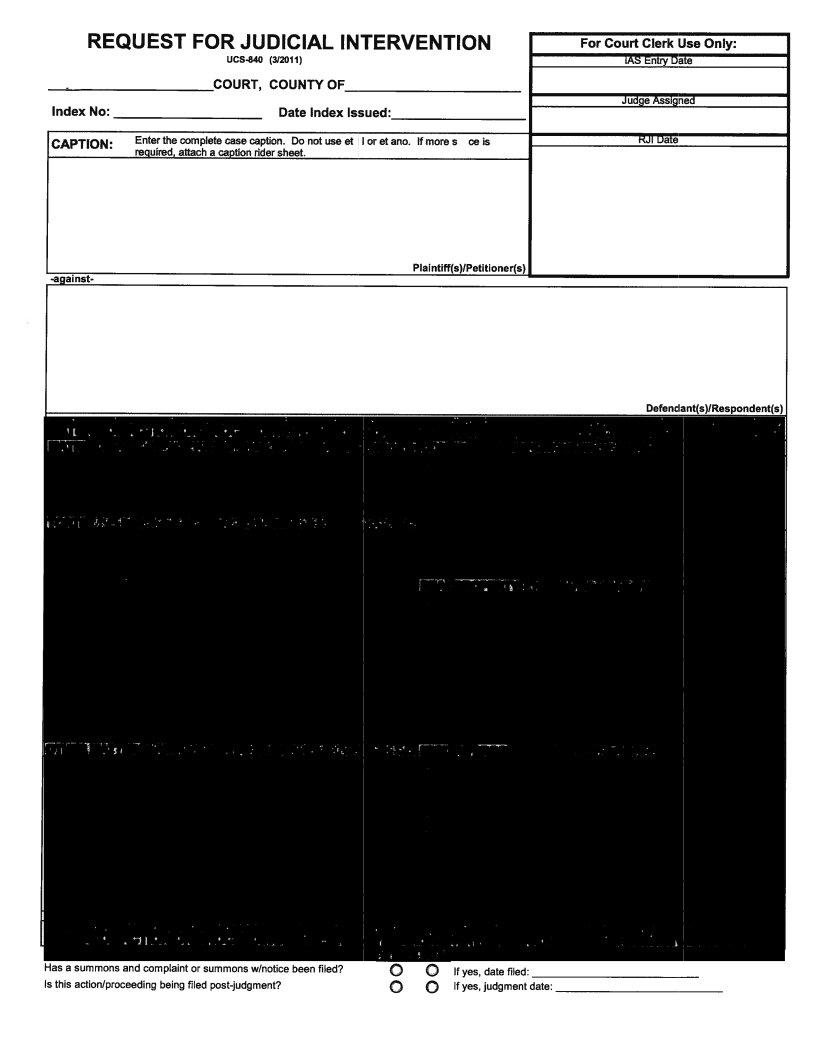

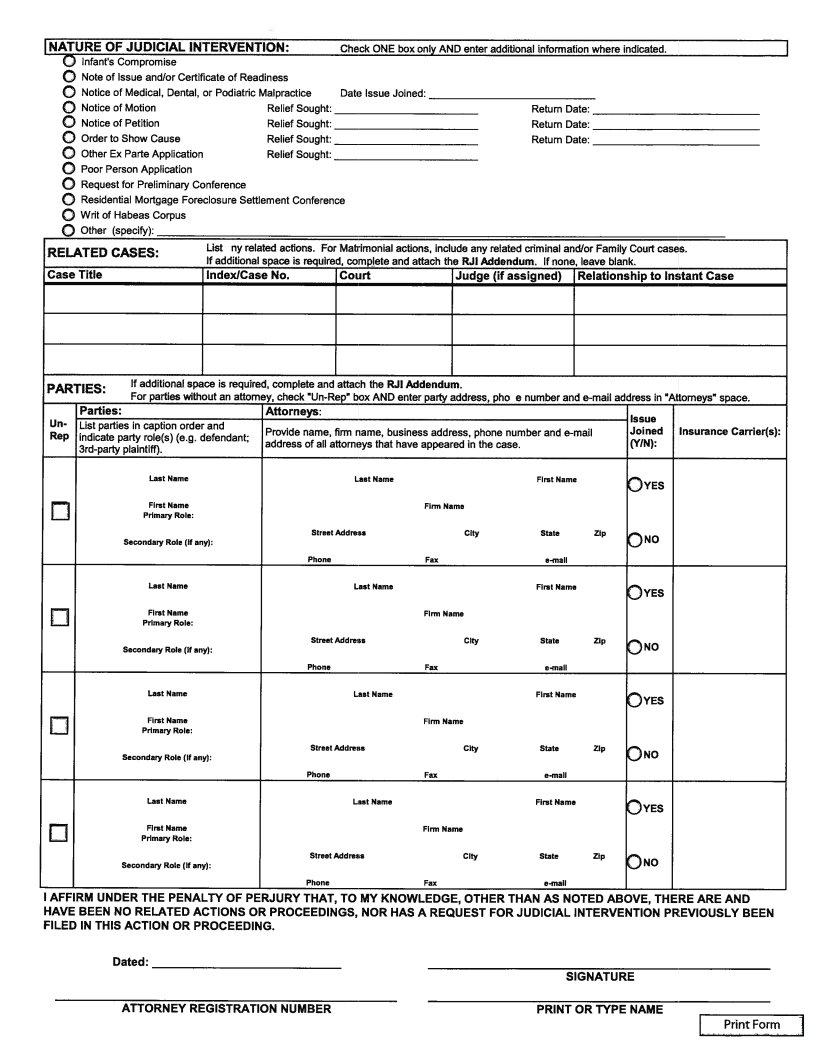

In the often complex world of unemployment insurance, the UCS 840 form stands as a critical document for employers navigating the administrative aspects of claim responses. This form, an integral part of the unemployment insurance system, serves a dual purpose: it not only allows employers to contest unemployment claims they believe to be improper but also enables them to provide essential information that can affect the outcome of a claim. Its significance cannot be overstated, as accurate completion can influence the employer’s tax rates and ensure that only valid claims are approved, thereby helping to maintain the integrity of the unemployment insurance fund. The form requires detailed information regarding the claim, including reasons for separation and any additional employment details pertinent to the case, making it a key piece of documentation in the unemployment insurance process. Through this form, employers have a voice in the claim process, a vital aspect considering the financial implications and the principles of fairness and accuracy in the administration of unemployment benefits.

| Question | Answer |

|---|---|

| Form Name | Form Ucs 840 |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | Alabama, IAS, UCS-840, NYCRR |