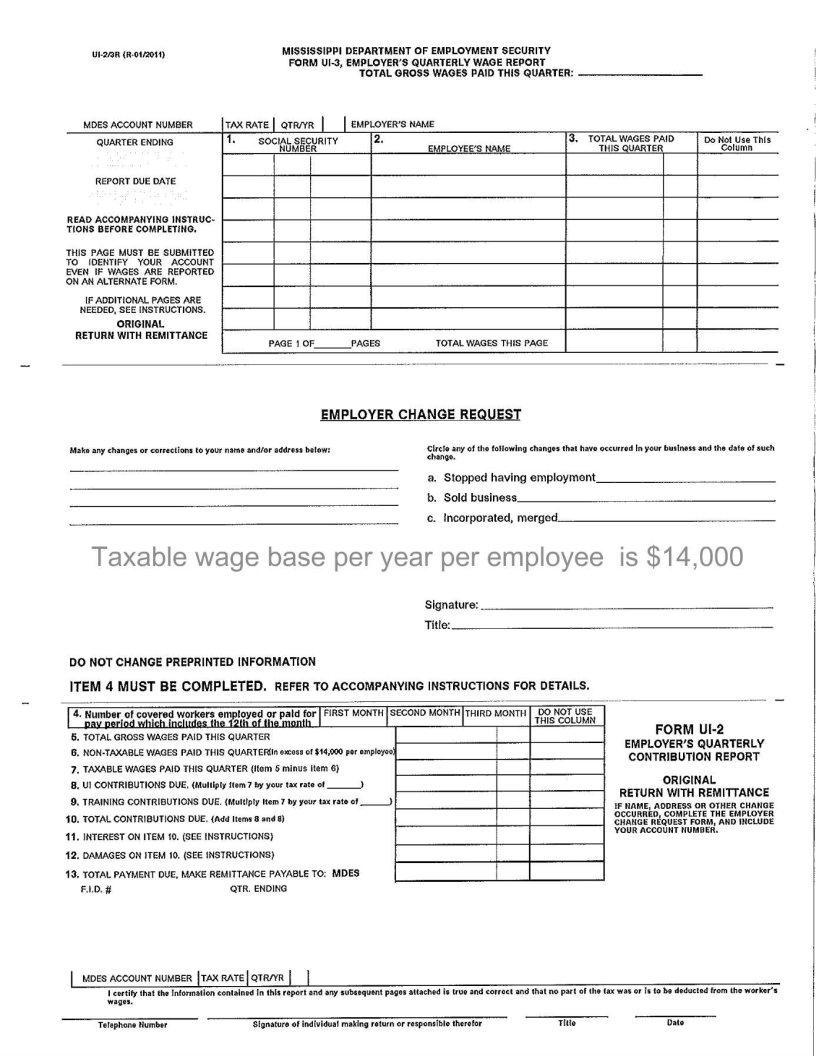

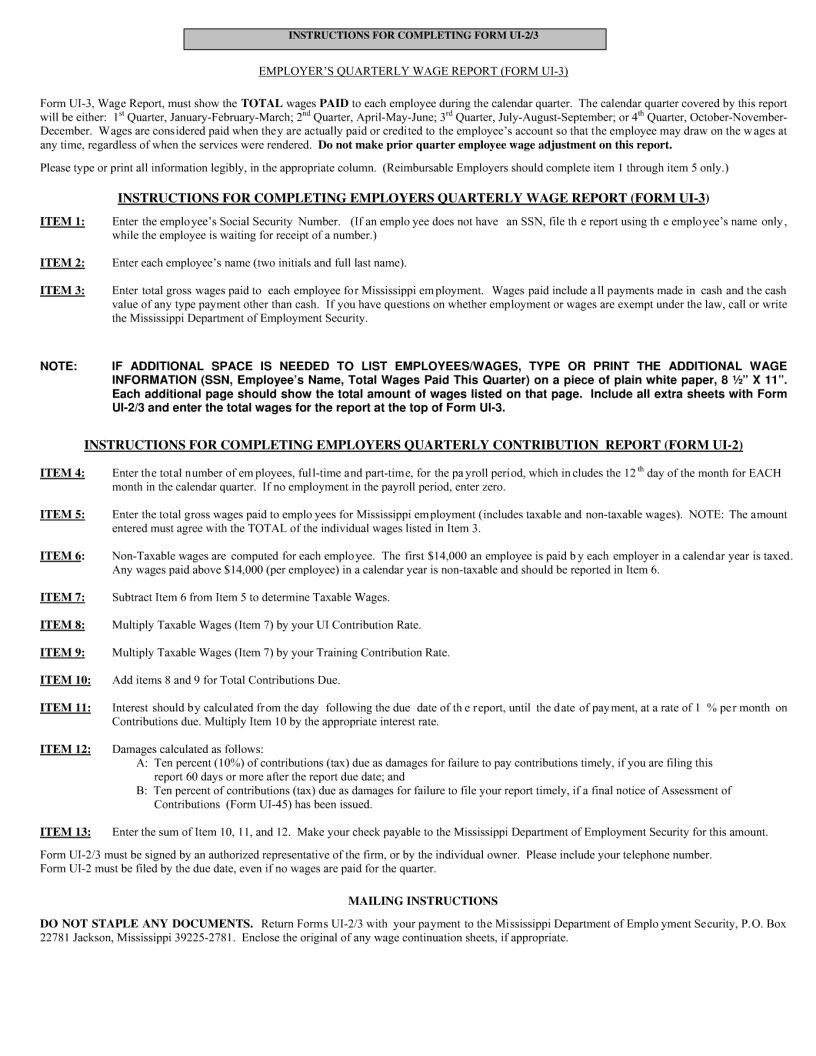

For individuals and businesses navigating the complexities of unemployment insurance, the importance of accurately completing and submitting the UI 2 3 form cannot be overstated. This document serves as a critical piece of communication between companies and the governing body responsible for overseeing unemployment insurance benefits in their area. As the cornerstone for reporting employee wages and verifying eligibility for unemployment benefits, the form ensures that employees who find themselves without work through no fault of their own have access to necessary financial support. Not only does the UI 2 3 form play a pivotal role in calculating the amount of benefits an individual can receive, but it also aids in maintaining the integrity of the unemployment insurance system. With stakes this high, the accuracy, timeliness, and completeness of the form's submission become paramount. Missteps or errors can lead to delays, incorrect benefit calculations, or, in some cases, denial of benefits to those in need. Therefore, grasping the major aspects of this form is essential for employers aiming to fulfill their obligations while supporting former employees during challenging times.

| Question | Answer |

|---|---|

| Form Name | Form Ui 2 3 |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | ms form ui, ms form ui 3, form ui 3, form ui 3 employers quarterly wage report |