When diving into the realm of home loans, especially those backed by the Federal Housing Administration (FHA), understanding the paperwork involved is crucial for both lenders and borrowers. Among the essential documents in this process is the Direct Endorsement Underwriter/HUD Reviewer Analysis of Appraisal Report, an official form from the U.S. Department of Housing and Urban Development (HUD). This form plays a pivotal role in ensuring that property appraisals for FHA loans are thorough, accurate, and fair, providing a safeguard for both the lender and borrower against overvalued or undervalued properties. By meticulously evaluating the appraisal report, underwriters and HUD reviewers assess factors such as the quality, completeness, and consistency of the report, the acceptability of comparables, and the appropriateness of adjustments. Additionally, this form addresses repair conditions that may affect the property's value and suitability for an FHA loan. With a clear OMB approval number and an estimated completion time, it ensures compliance and streamlines the review process. Understanding this form is a step towards demystifying the FHA loan process, ensuring all parties are well-informed and protected in the journey to homeownership.

| Question | Answer |

|---|---|

| Form Name | Form Underwriter Hud |

| Form Length | 1 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 15 sec |

| Other names | how to form hud 54114, hud application to print, 54114 handbook 4000 pdf, hud interim form |

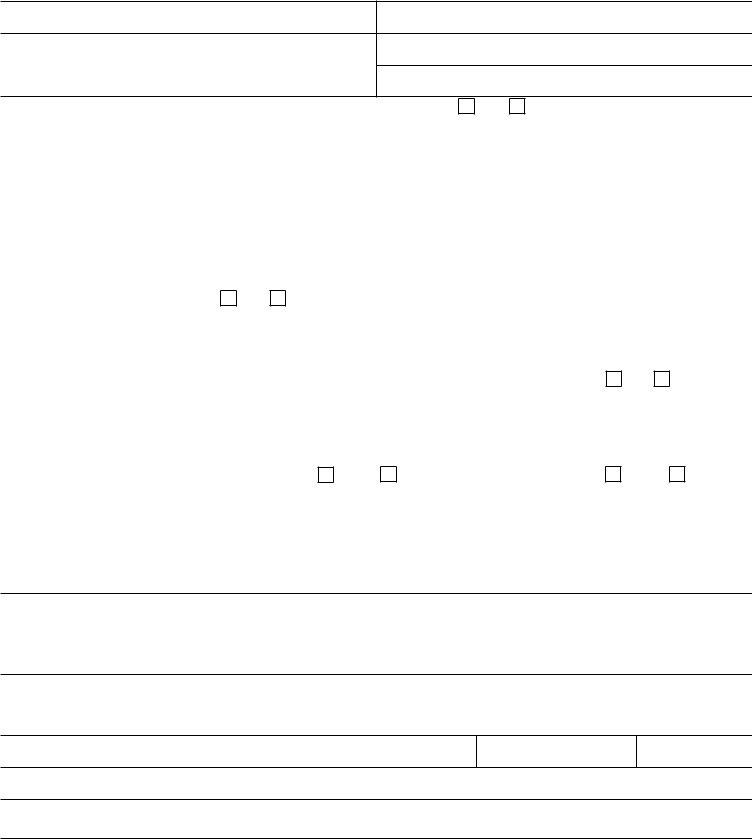

Direct Endorsement Underwriter/

HUD Reviewer

Analysis of Appraisal Report

U.S. Department of Housing OMB Approval No.

Office of Housing

Federal Housing Commissioner

Public reporting burden for this collection of information is estimated to average 3 minutes per response, including the time for reviewing instructions, searching existing data sources, gathering and maintaining the data needed, and completing and reviewing the collection of information.

This agency may not collect this information, and you are not required to complete this form, unless it displays a currently valid OMB control number.

Borrower's Name

Property Address

FHA Case Number |

Lender Loan Number |

|

|

Appraiser's Name

Appraiser's Estimate of Value: $

1. |

Does the appraisal report present a consistent and fair analysis of the property? |

Yes |

No (Explain) |

|

|

||||

|

|

|

|

|

|

||||

2. |

Comment on the report's quality, completeness, consistency, and accuracy. |

|

|

|

|

||||

|

|

|

|

|

|

||||

3. |

Are the comparables acceptable? |

Yes |

No |

(If not, the appraisal should be returned to the appraiser.) |

|

||||

|

|

|

|

||||||

4. |

Are the adjustments acceptable both as to items adjusted and the amount allocated to each item adjusted? |

Yes |

No (Explain) |

||||||

|

|

|

|

|

|

||||

5. |

Is the value acceptable for HUD/FHA loan purposes? |

Yes |

No If not, should it be corrected? |

Yes |

No |

||||

Value for HUD/FHA loan purposes $__________________________ . Provide justification for correction.

6.Repair Conditions

7.Other Comments

DE Underwriter (Name)

CHUMS Number

Date

DE Underwriter Signature

HUD Reviewer (Name and Signature)

form