Form VAT 100B is a document used to declare and pay Value-Added Tax (VAT) on taxable supplies of goods and services in the UAE. This form must be completed by the supplier and submitted to the Federal Tax Authority (FTA) or its authorized agent. Completing this form accurately is essential for ensuring correct payments are made, and avoiding penalties and interest charges. In this article, we provide an overview of Form VAT 100B, including what information is required, and explain how to complete it correctly.

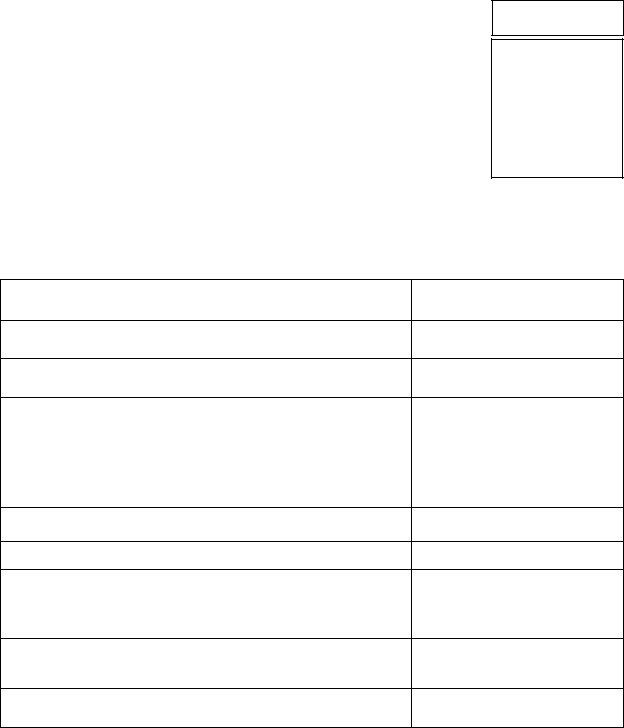

| Question | Answer |

|---|---|

| Form Name | Form Vat 100B |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | vat form 100, vat100 form download, blank vat 100 form, vat100 form |

PARTICULARS OF PARTNERS /DIRECTORS/

PERSONS RESPONSIBLE (AUTHORISED)

FOR THE BUSINESS

Name of the Business :

1)Fill in the details for each Partner/Director/Responsible Person separately in the boxes provided for. Please use BLOCK LETTERS and write clearly.

2)Strike off Partners/Directors/Responsible Persons whichever is not applicable.

FORM VAT 100B

Affix Passport size

Photo of

Partner/Director/

Person

Responsible

PARTNERS/DIRECTORS/ PERSONS RESPONSIBLE DETAILS

1.Full Name

2.Father’s/Husband’s Name

3.Date of Birth

4.Extent of interest in business (Partnership firm) / Official Designation and date of joining in the present capacity (in case of Directors in Limited Companies)/ Status & function of Person Responsible (Authorised) for the business.

5.Other business interests in the State (Please specify)

6.Other business interests outside the State (Pl. specify)

7.Present Residential Address:

Telephone No:

8.Permanent Address: Telephone No

9. Income Tax Permanent Account Number (PAN)

Date: |

Signature & Status |

Provided by www.rightmc.com

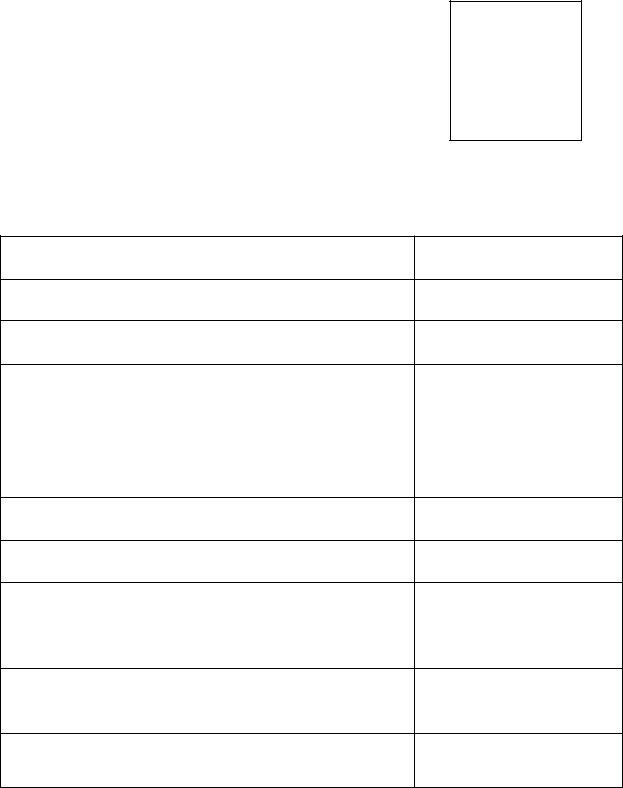

Affix Passport size

Photo of

Partner/Director/

Person

Responsible

PARTNERS/DIRECTORS/ PERSONS RESPONSIBLE DETAILS

1.Full Name

2.Father’s/Husband’s Name

3.Date of Birth

4.Extent of interest in business (Partnership firm) / Official Designation and date of joining in the present capacity (in case of Directors in Limited Companies)/ Status & function of Person Responsible (Authorised) for the business.

5.Other business interests in the State (Please specify)

6.Other business interests outside the State (Pl. specify)

7.Present Residential Address:

Telephone No:

8.Permanent Address: Telephone No

9. Income Tax Permanent Account Number (PAN)

Date: |

Signature & Status |

Provided by www.rightmc.com