Form R2 is one of the most important documents that businesses need to complete when filing their VAT return. This form allows businesses to report the value of the goods or services that they have supplied during the tax period, as well as any other associated information. In order to complete this form accurately, it is important to understand its various sections and what each one represents. This blog post will provide an overview of Form Vat R2, including a description of each section and some tips for completing it accurately. It will also explain why understanding this form is essential for businesses involved in taxable activities.

| Question | Answer |

|---|---|

| Form Name | Form Vat R2 |

| Form Length | 4 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min |

| Other names | hvat utility download, vat return utility download, haryana vat return utility, vat r2 online haryana |

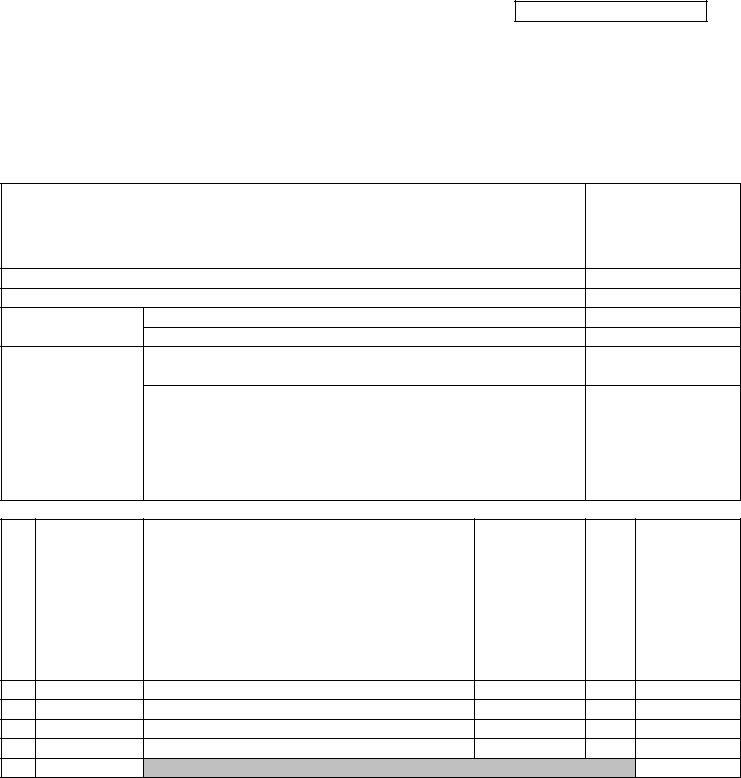

( )'*+,

[See rule 16(2) ]

DD MM YY

Name and style of business |

M/S |

|||||

|

|

|

|

|

|

|

Address |

|

|

|

Telephone No. |

|

|

|

|

|

|

|

|

|

T I N |

|

|

Economic Activity Code |

|

|

|

|

|

|

|

|

|

|

6+3

3+:;

!"!#!#$%&'#

|

!# |

|

!#) |

' Sale price received/receivable in respect of goods sold plus value of goods exported out of State or |

|

||

disposed of otherwise than by sale or sent for sale to local agents |

|

|

|

(I) |

As per column 2A(b) of the quarterly returns in Form VAT+R1 filed by the dealer for |

the year |

|

(II)As per the books of account for the year

(III)As per balance sheet for the year

(i) [(I) + (II)]

(ii) [(I) + (III)]

(I) Total of deductions as per column 2B(10)b of quarterly returns in Form VAT+R1 filed by the dealer for the year

|

(II) |

Corresponding figure as per the books of account for the year |

|

|

|

|

(III) |

[(I) + (II)] |

|

|

|

|

(I) |

Total of the value as shown in 2C(b) of quarterly returns in Form VAT+R1 |

|

filed by the dealer for the year {2A(I)(b) + 2B(I)(b)} |

|

|

|

|

(II) |

As per the books of accounts for the year {2A(II)(b) + 2B(II)(b)} |

|

|

|

|

|

(III) |

[(I) + (II)] |

!#./!+#

!# |

!# |

!# |

|

|

|

Total value of return |

Total value of return of |

Difference, if any |

of goods and (de+) / |

goods (de+) / escalation |

[(i) + (ii)] |

escalation as per LS+ |

allowable as per the books |

|

10 filed with the |

of accounts for the year, if |

|

quarterly returns of |

any. |

|

the year, if any |

|

|

|

|

|

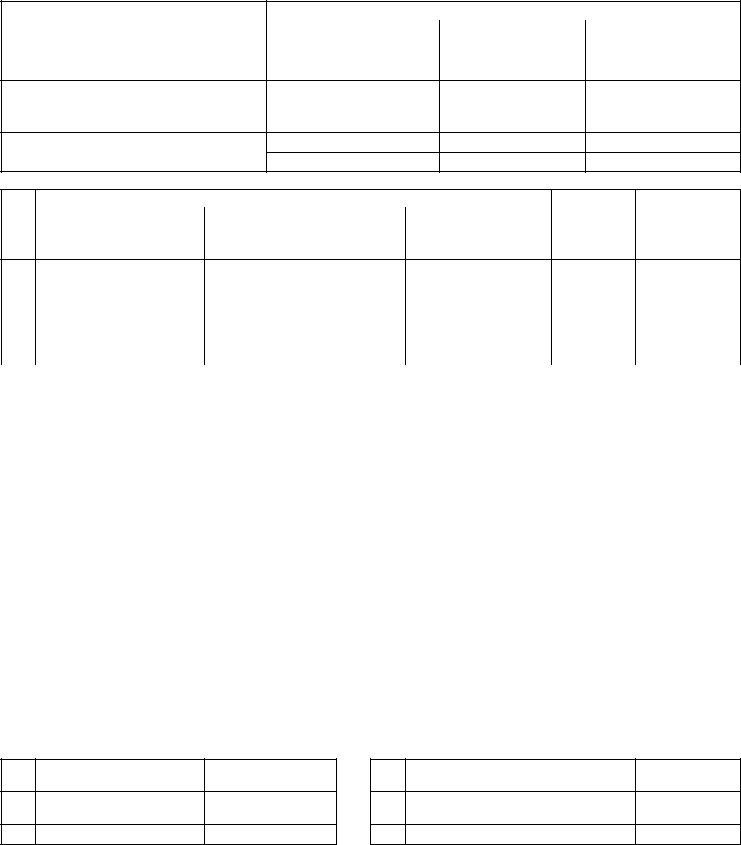

!#6 !#

7!#8 ,

!#!55#9

!#*

0!#1!#2

$< "

$' !# |

|

!#' |

|

|

|

|

|

|

|

|

(i) |

(ii) |

(iii) |

|

'B |

Total of the purchases/receipts as |

Total of the purchases/ |

||

per quarterly returns filed by the |

receipts as per the books of |

[(i) – (ii)] |

||

|

||||

|

dealer for the year |

account for the year |

||

|

|

APurchased / received for sale during the year except the purchases in the State as shown in B below.

!55# Other purchases in the State

!#./!+# |

|

!#, |

!#* |

||

|

|

|

|

0!#1!#2 |

|

|

!#. |

!#6 |

|||

|

/!+#0@<+?2 |

0!#A!#2 |

|

|

|

(1) |

|

|

|

|

|

|

|

|

|

|

(2) |

|

|

|

|

|

|

|

|

|

|

(3) |

|

|

|

|

|

|

|

|

|

|

(4) |

|

|

|

|

|

|

|

|

|

|

(5) |

|

Total tax paid |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

!#./!+# |

!#6 |

!# |

!#* |

||||||

|

|

|

|

|

, |

0!#1!#2 |

||||

|

|

!# |

!# |

!# |

||||||

|

|

|

||||||||

|

|

|

|

|

|

|

||||

|

|

Total value of return |

Total value of return of |

Difference, if any |

|

|||||

|

|

|

|

|

|

|||||

|

|

|

of goods and (de+) / |

goods (de+) / escalation |

[(i) + (ii)] |

|

|

|

||

|

|

|

|

|

|

|

||||

|

|

|

|

escalation as per LP+ |

allowable as per the books |

|

|

|

|

|

|

|

|

|

8 filed with the |

of accounts for the year, if |

|

|

|

|

|

|

|

|

|

quarterly returns of |

any. |

|

|

|

|

|

|

|

|

|

the year |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) |

|

|

|

|

|

|

|

|

|

|

(2) |

|

|

|

|

|

|

|

|

|

|

(3) |

|

|

|

|

|

|

|

|

|

|

(4) |

|

|

|

|

|

|

|

|

|

|

(5) |

|

Total tax amount |

|

|

|

|

|

|

|

|

1 |

If balance sheet is consolidated of the business in Haryana and of the branches out side state of Haryana, a |

|||||||||

|

|

|

separate reconciliation statement is required wherein sales and purchases relating to the business inside the state |

|||||||

|

|

|

should be mentioned. |

|

|

|

|

|

||

2Total as per the books of account in column 2A(ii)(b) will also include the sale of scrap, by products, waste, vehicles and capital goods

='

(1)Sale tax 2D(5)(e)

(2)Purchase tax 9(4)(d)

(3)Total tax (1) + (2)

>4 !"?'#

(1)Tax paid on purchases made in the State3B(5)(e)

(2)Less tax paid, not part of input tax 8(B)(3)(g) of this return

(3)Input tax (1) – (2)

%*C!"D'#

(1)Tax payable 4(3) – 5(3)

(2)Tax adjusted under CST Act

(3)Refund claimed

(4)Excess carried forward

&

Note:– If 6(1) is a negative value, the absolute value thereof will first be adjusted against tax payable under the Central Sales Tax Act, if any and the balance carried forward for adjustment with future tax liability but refund may be claimed in case of:+ (i) export of goods out of India, (ii) difference in rate of tax or (iii) inadvertent excess payment of tax, by making an application.

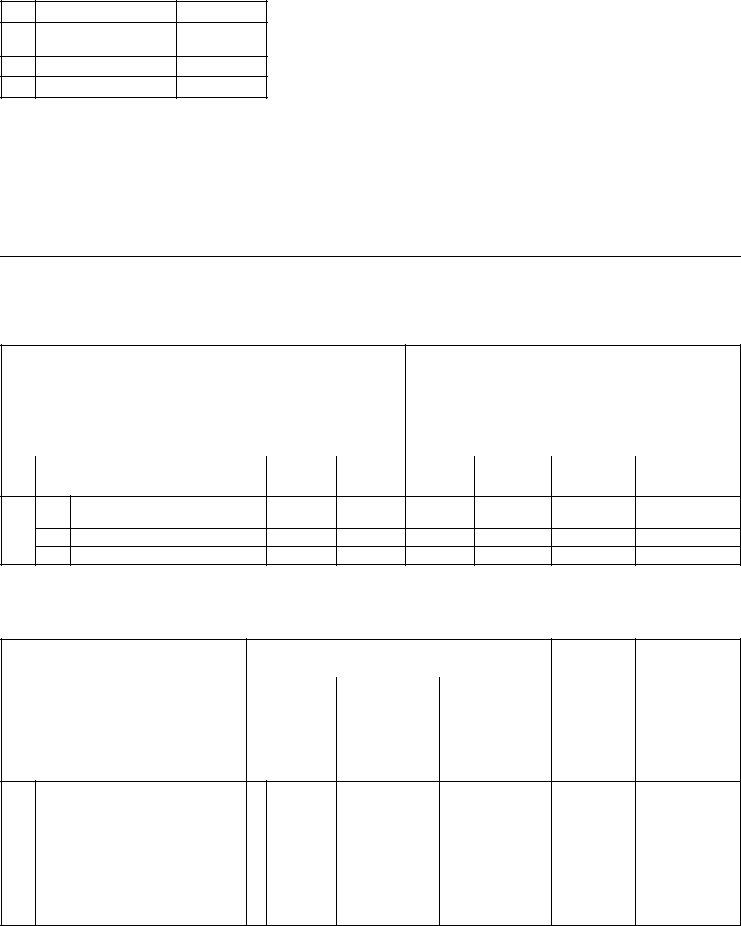

!# |

!# |

!# |

|

!# |

* |

|

!#( |

||||

|

|

|

|

|

|

|

|

|

|

|

|

Total of the |

Tax payable as |

Difference, |

Name of |

*!*,#<,' |

|

|

|

||||

tax payable as |

per the annual |

if any |

treasury |

|

|

|

|

|

|

|

|

Type of Instrument |

|

No. |

Date |

|

Amount |

DCR No. |

Date |

||||

per the |

return |

[(b) + (a)] |

where tax |

|

|

||||||

|

|

|

|

|

|

|

|

||||

quarterly |

|

|

deposited or |

|

|

|

|

|

|

|

|

returns |

|

|

Bank on |

|

|

|

|

|

|

|

|

|

|

|

which DD / |

|

|

|

|

|

|

|

|

|

|

|

Pay order |

|

|

|

|

|

|

|

|

|

|

|

drawn or |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

?4 " )'* : !"?!#".'#

'< |

)'* |

|

!#< |

|

|||

: |

E |

|

|

|

|

||

|

|

|

|

|

|

||

I As per the quarterly returns filed by the dealer for the |

|

|

|

|

|

||

year, which is sum total of figures in column 10F(b) of VAT+R1 |

|

|

|

|

|||

|

|

|

|

|

|

|

|

II Total as per the books of account for the year |

|

|

|

|

|

|

|

[(I) – (II)] |

|

|

|

|

|

|

|

- Calculation of input tax at different rate |

(b) |

(c) |

(d) |

(e) |

(f) |

(g) = Total (b) to |

|

|

|

|

|

|

|

|

(f) |

(1)Break+up of 8(A)(ii)(b) according to tax rates

(2)Rate of tax

(3)Input tax to be reversed (1) x (2)

Note+ Where any goods purchased in the State are used or disposed of partly in the circumstances where credit of input tax is not admissible and partly otherwise, the purchase value of such goods shall be computed pro rata.

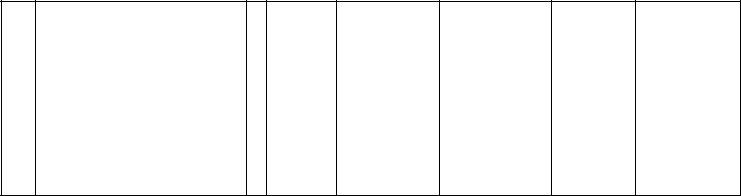

F<!"$!$#'#

|

!#< |

!#, |

!#< |

||

|

|

|

|||

|

|

|

|

|

F!#!55# |

|

(i) |

(ii) |

(iii) |

|

|

!#4 : Total purchase |

Total purchase value |

Difference, if any |

|

|

|

value as per |

as per the books of |

[(i) – (ii)] |

|

|

|

column 11 of the |

account for the year |

|

|

|

|

|

|

|

|

||

|

quarterly returns |

|

|

|

|

|

filed by the dealer |

|

|

|

|

(1)Taxable goods purchased in the State

(i) without payment of tax when such

goods or the goods manufactured |

(i) |

therefrom are either exported out of |

|

State or used or disposed of (except |

|

when sold in the course of export out |

|

|

|

of India) in a manner that no tax or |

|

CST is payable to the State |

(ii) |

|

(2)Goods purchased in the State at lower

rate of tax for specified purposes but (i) |

|

|

|

||

not made use of for the said purposes |

|

|

|

|

|

Tax computed |

|

|

|

|

|

under proviso to section 7(5) |

(ii) |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

(3) Paddy purchased in the State without |

|

|

|

|

|

payment of tax when such paddy or |

|

|

|

|

|

the rice manufactured therefrom is |

|

|

|

|

|

exported out of India |

|

|

|

|

|

|

|

|

|

|

|

(4) Total [(1)(i) + (1)(ii) + (2)(i) + (2)(ii) + |

|

|

|

|

|

(3)] |

|

|

|

|

|

|

|

|

|

|

|

Note+ |

Where any goods purchased in the State are used or disposed of partly in the circumstances mentioned in |

|

column (a) against entries at serial number (1) and (2) above and partly otherwise, the purchase tax leviable on |

|

such goods shall be computed pro rata. |

Date: |

[Signature of authorised person] |

I, |

(name in CAPITALS), hereby, solemnly affirm that I am |

authorised to furnish this return and all its contents including tables 8 and 9, lists, statements, including reconciliation statement, declarations, certificates and other documents appended to it or filed with it are true, correct and complete and nothing has been concealed therein.

Place:

Date: |

[Signature] |

Status: Tick () applicable [Karta, proprietor, partner, director, president, secretary, manager, authorised officer]

Status: Tick () applicable [Karta, proprietor, partner, director, president, secretary, manager, authorised officer]

!(#

(1)Date of date entry in VAT+register/Computer:

(2)Signature of the official making the data entry: (Affix stamp of name & designation)

(3)Signature of the assessing authority with date: (Affix stamp of name & designation)

'4G6H@..I.6*

(1) Date of receipt of return: |

(2) [Signature with stamp of name and designation of receipt clerk].”. |