Through the online PDF tool by FormsPal, it is possible to fill in or modify valic rollover transfer out form here and now. The tool is constantly upgraded by our staff, receiving additional functions and growing to be a lot more convenient. It just takes a couple of basic steps:

Step 1: Press the "Get Form" button above. It's going to open our pdf tool so you could begin completing your form.

Step 2: This editor gives you the capability to modify almost all PDF documents in a variety of ways. Change it with any text, correct original content, and put in a signature - all within the reach of a few mouse clicks!

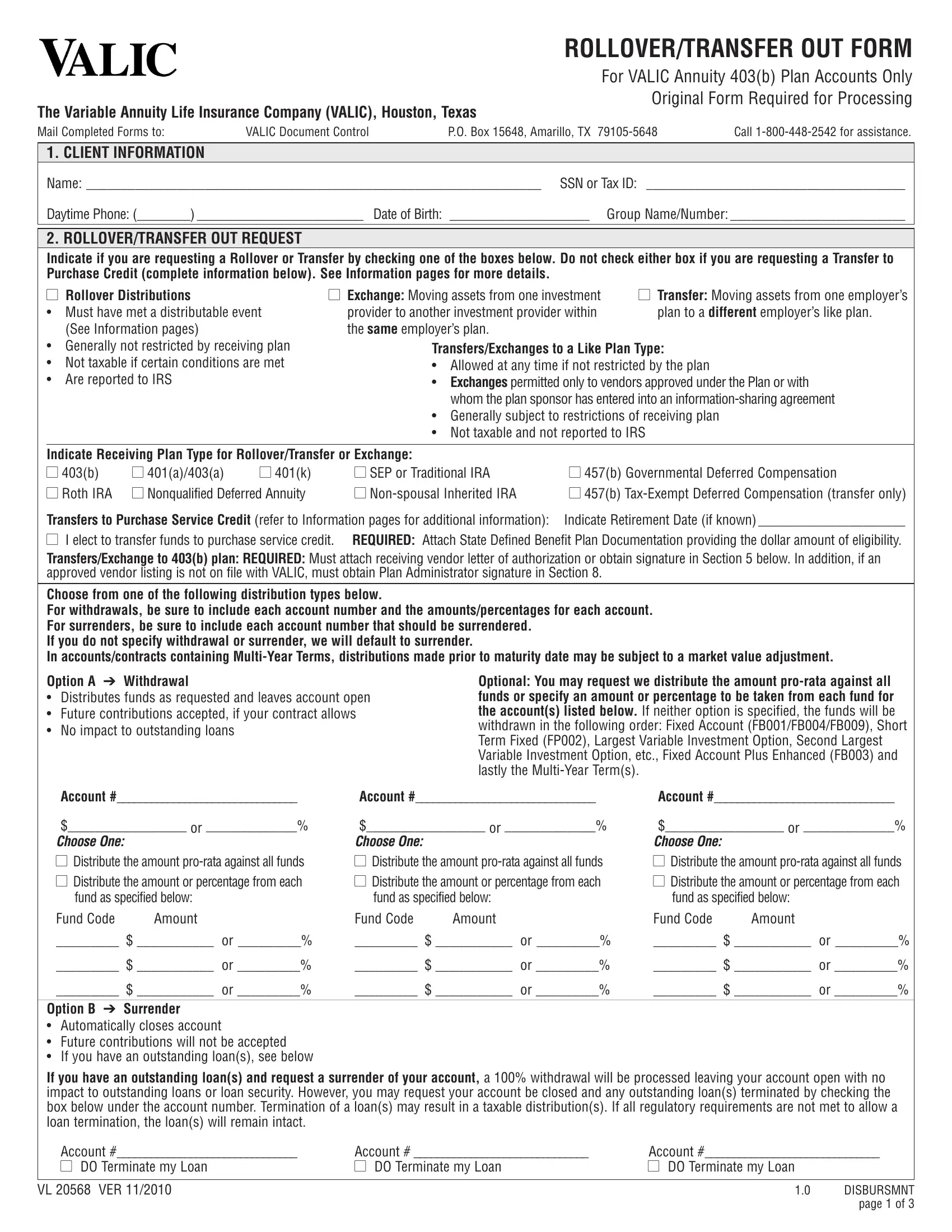

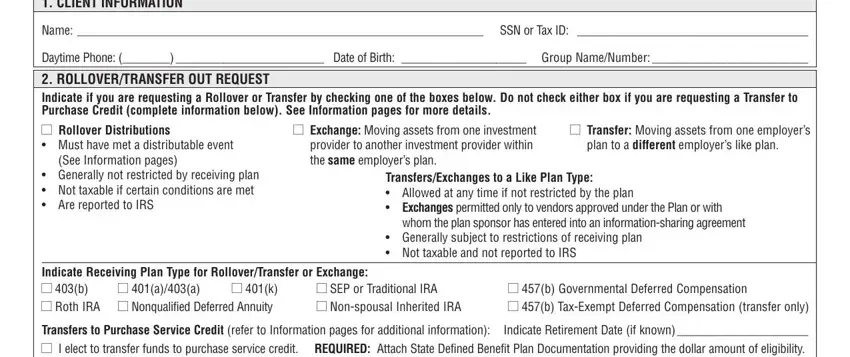

This PDF form will need specific data to be entered, thus be certain to take the time to provide what is asked:

1. To start off, while completing the valic rollover transfer out form, begin with the part that includes the next fields:

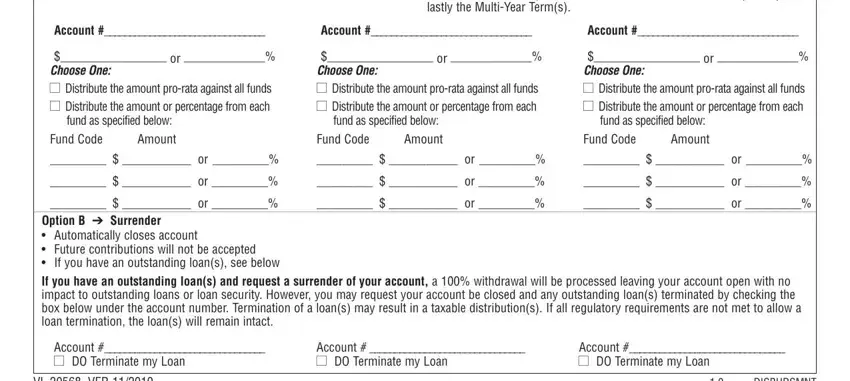

2. Now that the previous section is done, you have to add the necessary particulars in optional You may request we, account, account, account, or Choose One, or Choose One, or Choose One, Distribute the amount prorata, Distribute the amount prorata, Distribute the amount prorata, fund as specified below Amount, Fund Code, fund as specified below Amount, Fund Code, and fund as specified below Amount in order to move on further.

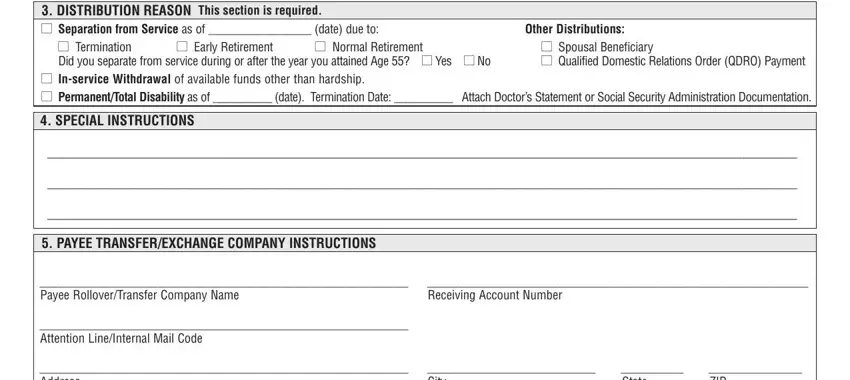

3. In this stage, have a look at DiStriBUtion reaSon this section, Separation from Service as of, other Distributions, Termination Early Retirement, Spousal Beneficiary Qualified, inservice Withdrawal of available, SPeCial inStrUCtionS, PaYee tranSfereXCHanGe ComPanY, Payee RolloverTransfer Company, Receiving Account Number, Attention LineInternal Mail Code, Address, City, State, and ZIP. Each one of these need to be completed with highest precision.

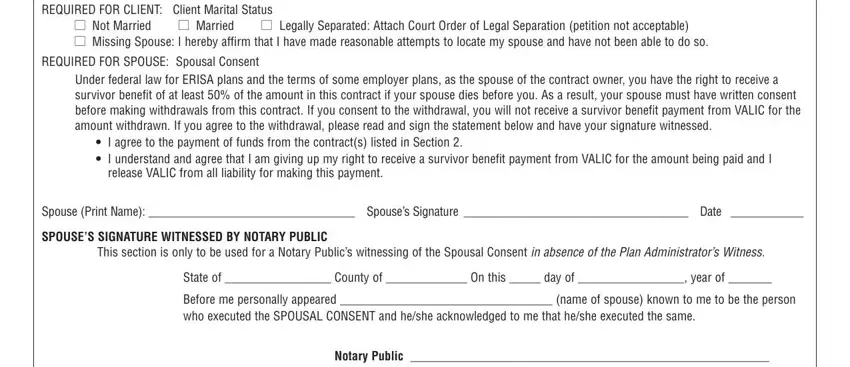

4. To move forward, this fourth section requires typing in several blanks. Examples include eriSa covered and certain other, Not Married Married Legally, REQUIRED FOR SPOUSE Spousal Consent, Under federal law for ERISA plans, I agree to the payment of funds, release VALIC from all liability, Spouse Print Name Spouses, SPoUSeS SiGnatUre WitneSSeD BY, This section is only to be used, State of County of On this day, Before me personally appeared, and notary Public, which are vital to moving forward with this particular form.

It is easy to make an error while filling out your State of County of On this day, hence be sure you reread it prior to deciding to submit it.

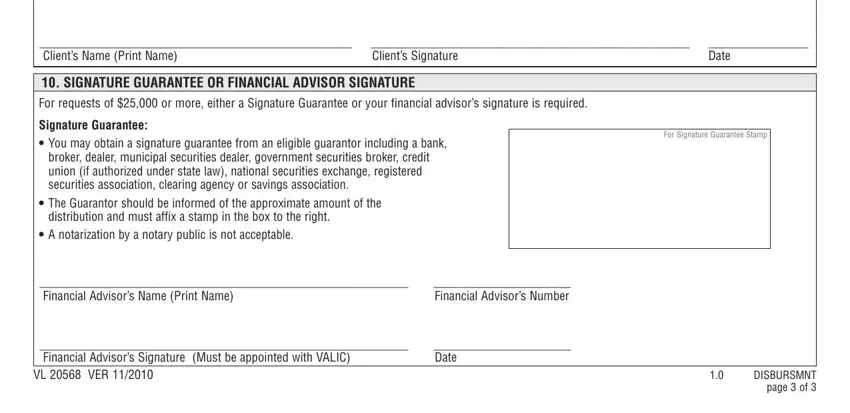

5. This last notch to complete this document is essential. Make certain you fill out the displayed blank fields, which includes Clients Name Print Name, Clients Signature, Date, SiGnatUre GUarantee or finanCial, Signature Guarantee You may, broker dealer municipal securities, The Guarantor should be informed, distribution and must affix a, A notarization by a notary public, Financial Advisors Name Print Name, Financial Advisors Number, For Signature Guarantee Stamp, Financial Advisors Signature Must, Date, and VL VER, before submitting. Neglecting to do it might give you an incomplete and possibly nonvalid paper!

Step 3: Make sure the details are correct and press "Done" to conclude the process. Right after creating afree trial account here, you will be able to download valic rollover transfer out form or send it through email right off. The PDF file will also be accessible via your personal account page with all of your adjustments. With FormsPal, you can easily fill out forms without stressing about personal data incidents or entries being shared. Our protected system makes sure that your personal data is stored safely.