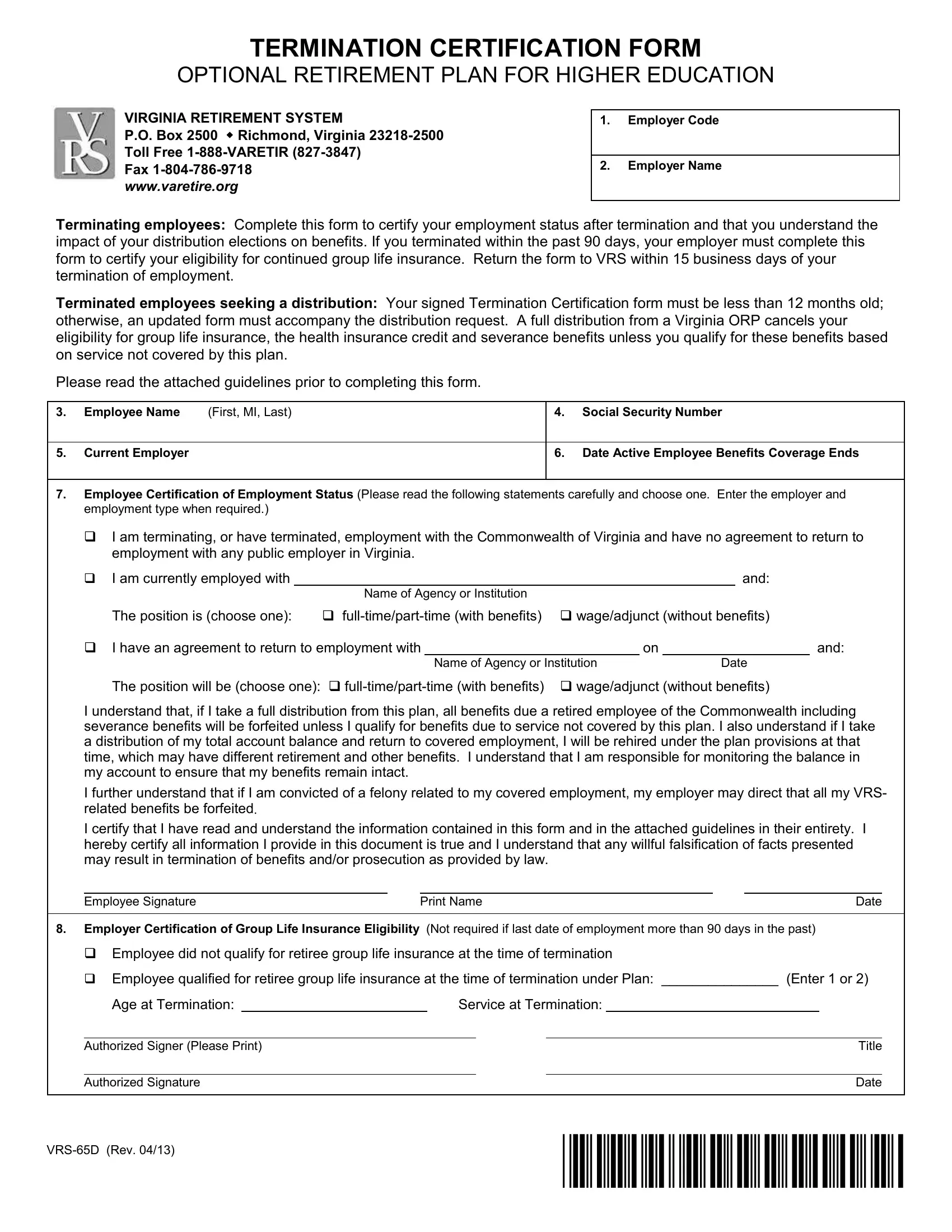

TERMINATION CERTIFICATION FORM

OPTIONAL RETIREMENT PLAN FOR HIGHER EDUCATION

VIRGINIA RETIREMENT SYSTEM

P.O. Box 2500 Richmond, Virginia 23218-2500 Toll Free 1-888-VARETIR (827-3847)

Fax 1-804-786-9718 www.varetire.org

1.Employer Code

2.Employer Name

Terminating employees: Complete this form to certify your employment status after termination and that you understand the impact of your distribution elections on benefits. If you terminated within the past 90 days, your employer must complete this form to certify your eligibility for continued group life insurance. Return the form to VRS within 15 business days of your termination of employment.

Terminated employees seeking a distribution: Your signed Termination Certification form must be less than 12 months old; otherwise, an updated form must accompany the distribution request. A full distribution from a Virginia ORP cancels your eligibility for group life insurance, the health insurance credit and severance benefits unless you qualify for these benefits based on service not covered by this plan.

Please read the attached guidelines prior to completing this form.

3. |

Employee Name |

(First, MI, Last) |

4. |

Social Security Number |

|

|

|

|

|

5. |

Current Employer |

|

6. |

Date Active Employee Benefits Coverage Ends |

|

|

|

|

|

7.Employee Certification of Employment Status (Please read the following statements carefully and choose one. Enter the employer and employment type when required.)

I am terminating, or have terminated, employment with the Commonwealth of Virginia and have no agreement to return to employment with any public employer in Virginia.

I am currently employed with |

|

and: |

Name of Agency or Institution

The position is (choose one):

full-time/part-time (with benefits) wage/adjunct (without benefits)

I have an agreement to return to employment with |

|

on |

|

and: |

|

Name of Agency or Institution |

|

Date |

The position will be (choose one): full-time/part-time (with benefits) wage/adjunct (without benefits)

I understand that, if I take a full distribution from this plan, all benefits due a retired employee of the Commonwealth including severance benefits will be forfeited unless I qualify for benefits due to service not covered by this plan. I also understand if I take a distribution of my total account balance and return to covered employment, I will be rehired under the plan provisions at that time, which may have different retirement and other benefits. I understand that I am responsible for monitoring the balance in my account to ensure that my benefits remain intact.

I further understand that if I am convicted of a felony related to my covered employment, my employer may direct that all my VRS- related benefits be forfeited.

I certify that I have read and understand the information contained in this form and in the attached guidelines in their entirety. I hereby certify all information I provide in this document is true and I understand that any willful falsification of facts presented may result in termination of benefits and/or prosecution as provided by law.

Employee Signature |

Print Name |

Date |

8.Employer Certification of Group Life Insurance Eligibility (Not required if last date of employment more than 90 days in the past)

Employee did not qualify for retiree group life insurance at the time of termination

Employee qualified for retiree group life insurance at the time of termination under Plan: _______________ (Enter 1 or 2)

|

Age at Termination: |

|

Service at Termination: |

|

|

|

|

|

|

|

|

|

|

|

Authorized Signer (Please Print) |

|

|

|

|

Title |

|

|

|

|

|

|

|

|

|

Authorized Signature |

|

|

|

|

Date |

|

|

|

|

|

|

|

VRS-65D (Rev. 04/13) |

|

|

*VRS-000066* |

|

|

|

|

|

TERMINATION GUIDELINES

OPTIONAL RETIREMENT PLAN FOR HIGHER EDUCATION

This form is not a distribution request form. To request a distribution, use the distribution forms of the provider(s) with whom you have an account balance. If you are eligible to receive a distribution from the VRS-administered ORP for Higher Education, VRS must sign the provider distribution form once this certification form is completed. For additional information, please read the important guidelines below.

The benefits provided under the ORP for Higher Education are intended to provide income in retirement. If you are leaving employment where you participated in the ORP you may in most cases begin a distribution from the plan. Unless you continue to be employed by an employer that provides retirement benefits through a plan authorized by Code of Virginia Title 51.1 Chapters 1, 2, 2.1 or 3, you must begin a required minimum distribution from the plan no later than April 1 of the year following the year you reach age 70 ½.

VRS processes requests for distribution from the Commonwealth’s ORP for Higher Education only if the Termination Certification form on file with VRS was completed within 12 months of the distribution request. Otherwise, a revised Termination Certification must accompany the distribution request. If you are employed by an institution that administers its own ORP, provide this completed form to the institution’s human resources office when you request a distribution.

Important Note: If you take a distribution of your total plan account balance and return to covered employment, you will be rehired under the plan provisions in place at that time, which may have different retirement and other benefits.

Employment Status

You may not receive a distribution from the ORP if you are reemployed in a position which provides retirement benefits in any of the following plans: The Virginia Retirement System (VRS), the Judicial Retirement System (JRS), the State Police Officers Retirement System (SPORS), the Virginia Law Officers Retirement System (VALORS), any Optional Retirement Plan or Alternative Retirement Plan authorized in the Code of Virginia.

If you return to part-time employment (non-salaried; non-classified) with any agency or institution of the Commonwealth, you must meet the following criteria to receive a payment from your ORP:

1.Have a break-in-service of no less than one full calendar month during which you receive no compensation or active member benefits from the Commonwealth (summer breaks, annual leave, sick leave, FMLA leave of less than 12 weeks or more based on employer’s policy, educational leave, and sabbaticals do not count toward the full calendar month required for a break-in- service);

2.You and your employer had no pre-determined date that you return to employment; and

3.The work you do does not have the same duties or hours that you worked prior to leaving your ORP-covered position and you work in a part-time position which is less than 80% of the normal, full-time equivalent hours for a similar position.

VRS-65D (Rev. 04/13)

Eligibility for Benefits After Termination of Employment

Important Note: A full distribution from this plan cancels your eligibility for group life insurance and the health insurance credit discussed below, unless you qualify for these benefits based on service not covered by this plan. Also, any severance benefits you are receiving from the Commonwealth will end if you take a full distribution from the plan.

If you do NOT take a full distribution from this plan, you may be eligible for benefits as follows:

1.Group Life Insurance

In some cases, you may continue group life insurance coverage after you terminate employment with the Commonwealth. If you are a Plan 1 participant, you must be age 55 with at least five years of service or age 50 with at least 10 years of service to continue to be covered by the Group Life Insurance Program whether or not you begin a distribution from the ORP. If you are a Plan 2 participant, you must be age 60 with at least five years of service or your age and service at the time of your termination must be at least 90.

A 25 percent reduction in the amount of your coverage begins on January 1 following one calendar year after you terminate employment and continues each January 1 until the amount of your coverage is 25 percent of the value of the natural death coverage at termination of employment.

If at the time you terminate employment with the Commonwealth you are covered by Optional Group Life Insurance, you may continue the optional group life coverage until you reach age 80 if you continue to pay the premiums or you may convert the coverage to an individual policy.

If you do not qualify to continue basic group life insurance benefit when you terminate employment or if you lose coverage by taking a full distribution from your ORP account, you may, within 31 days of termination or loss of coverage, convert your group life insurance benefit to an individual policy at non-group rates without providing evidence of insurability.

For more information visit the VRS Web site at www.varetire.org or call Minnesota Life toll-free at 1- 800-441-2258.

2.Retiree Health Insurance Credit

You qualify for the retiree health insurance credit if you meet the following criteria:

1)You have at least 15 years of service in VRS and/or the ORP.

2)You terminate employment with the institution and are not reemployed in a position that causes you to be covered by one of the retirement plans created by Title 51.1, Chapter 1,2,2.1 or 3 of the Code of Virginia.

3)You are receiving a periodic distribution or annuity from your ORP account.

4)You are enrolled and paying a premium for yourself in an individual or employer-sponsored health insurance plan, Medicare Part B and D, vision, dental or as a dependent under your spouse’s coverage.

5)Your employer certifies your eligibility for the health insurance credit by completing the Optional/ Alternative Retirement Plan Health Insurance Credit Employer Certification of Service (VRS-75).

6)You submit to VRS a Request for Health Insurance Credit (VRS-45) each time your health insurance plan and/or premium changes.

VRS-65D (Rev. 04/13)

Currently the credit is $4 per month per year of service. The credit you receive may not exceed the amount you pay out-of-pocket for your individual health insurance coverage. This is a tax- free benefit.

3.Health Insurance Credit for Disability

If you are receiving a long-term disability payment from your institution-sponsored plan, you are eligible for the greater of $120 or $4 per year of service. If you leave employment because of disability and are not receiving a payment from your institution’s long-term disability plan you are eligible for the health insurance credit if you have 15 years of service. The amount of the credit is based on your years of service.

You must notify VRS if your long-term disability payments cease. You are responsible to reimburse VRS for any overpayment of the health insurance credit.

4.Health Benefits

Speak with your Human Resources office for information on any health insurance benefits that are available to you once you retire or terminate employment.

For more information read the “Optional Retirement Plan For Higher Education Handbook for Participants” found on the VRS Web site at www.varetire.org under Publications.

Taking a Distribution from your Plan

If you intend to start a distribution from the ORP for Higher Education, contact your investment provider(s) for information on the choices available and for the necessary forms. If you participate in the VRS-administered ORP for Higher Education, VRS must sign your distribution form certifying that you are eligible for the distribution from this plan.

Contact information for the current providers:

Fidelity |

1-888-389-3863 |

www.fidelity.com/atwork |

TIAA-CREF |

1-800-842-2252 |

www.tiaa-cref.org |

Some participants may have balances with providers who are no longer participating in the ORP. Contact information for those providers:

Great-West |

1-800-701-8255 |

www.gwrs.com |

MetLife |

1-800-560-5001 |

www.metlife.com |

VALIC |

1-800-248-2542 |

www.aigvalic.com |

T. Rowe Price |

1-800-922-9945 |

www.troweprice.com |

VRS-65D (Rev. 04/13)