louisville metro revenue commission form w 1d can be filled in without difficulty. Simply use FormsPal PDF editor to do the job promptly. FormsPal is devoted to making sure you have the ideal experience with our editor by consistently presenting new capabilities and upgrades. Our editor has become a lot more helpful with the most recent updates! Currently, filling out PDF forms is easier and faster than ever. This is what you will have to do to begin:

Step 1: First, open the editor by clicking the "Get Form Button" at the top of this page.

Step 2: This tool will allow you to work with the majority of PDF forms in a variety of ways. Modify it by writing your own text, correct what is originally in the document, and place in a signature - all at your fingertips!

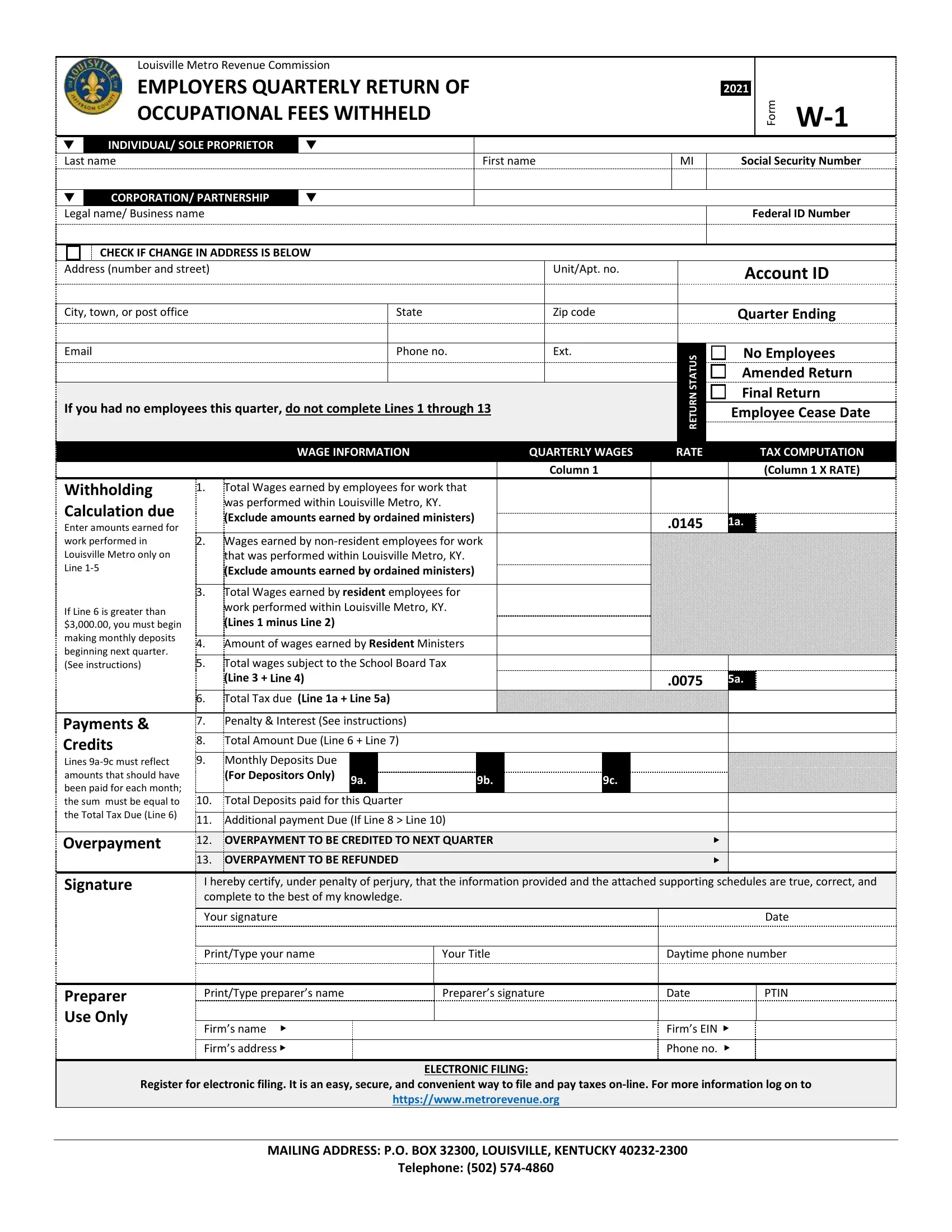

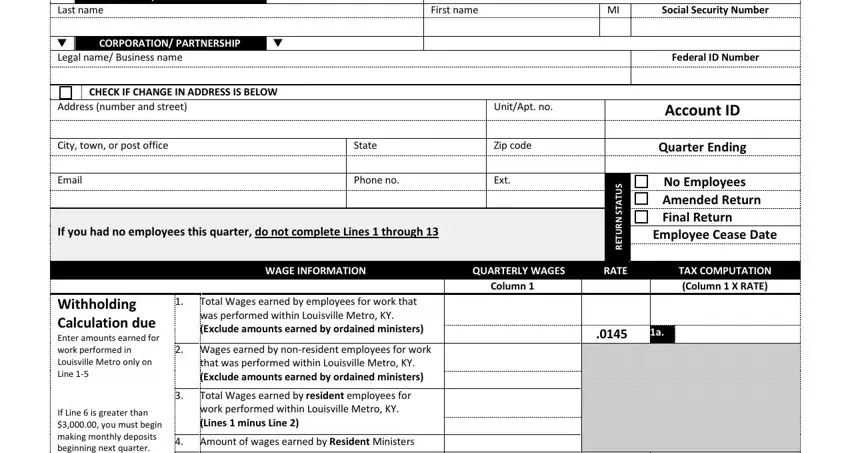

With regards to the blanks of this particular PDF, here's what you need to know:

1. Whenever submitting the louisville metro revenue commission form w 1d, make sure to incorporate all needed fields in their relevant form section. It will help to speed up the work, making it possible for your information to be processed efficiently and correctly.

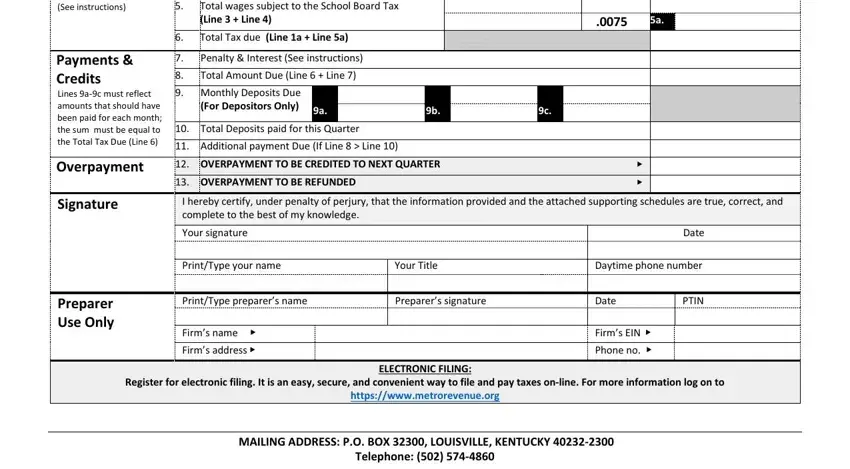

2. The subsequent step is usually to fill in these particular blank fields: If Line is greater than you must, Payments Credits Lines ac must, Total wages subject to the School, Total Tax due Line a Line a, Penalty Interest See instructions, Total Amount Due Line Line, Monthly Deposits Due For, Total Deposits paid for this, Additional payment Due If Line, Overpayment, OVERPAYMENT TO BE CREDITED TO, OVERPAYMENT TO BE REFUNDED, Signature, I hereby certify under penalty of, and Your signature.

Always be extremely attentive while filling in Payments Credits Lines ac must and Penalty Interest See instructions, since this is the section where most users make a few mistakes.

Step 3: After you have looked over the information you given, simply click "Done" to conclude your form at FormsPal. Create a 7-day free trial account with us and acquire immediate access to louisville metro revenue commission form w 1d - download, email, or change inside your personal account. FormsPal is committed to the personal privacy of our users; we make sure that all information entered into our system is secure.