Dealing with PDF files online is actually simple using our PDF editor. Anyone can fill out EXEMPTIONS here without trouble. Our tool is continually evolving to grant the very best user experience attainable, and that is because of our commitment to continuous development and listening closely to user opinions. With a few basic steps, you can start your PDF editing:

Step 1: Click the "Get Form" button above on this page to open our PDF tool.

Step 2: After you access the online editor, you will see the document ready to be completed. Aside from filling in different blank fields, you might also perform some other things with the form, namely putting on custom words, modifying the initial textual content, adding images, affixing your signature to the document, and much more.

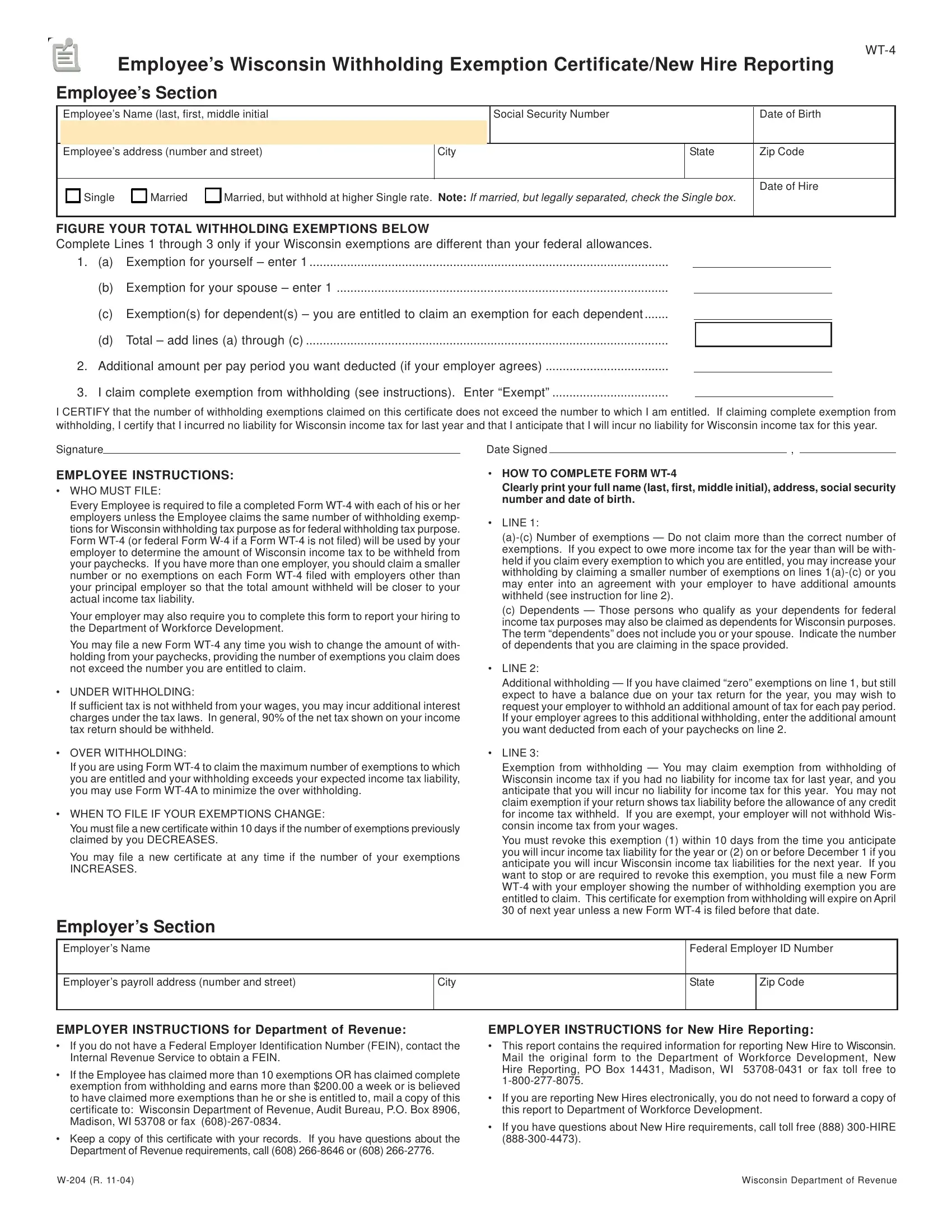

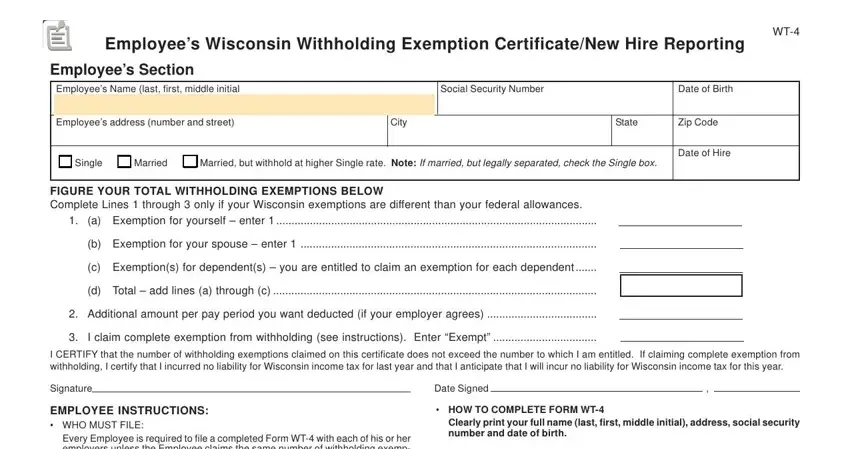

This PDF will need specific info to be typed in, hence make sure you take some time to enter exactly what is requested:

1. Start completing the EXEMPTIONS with a selection of essential blank fields. Gather all the necessary information and make sure not a single thing forgotten!

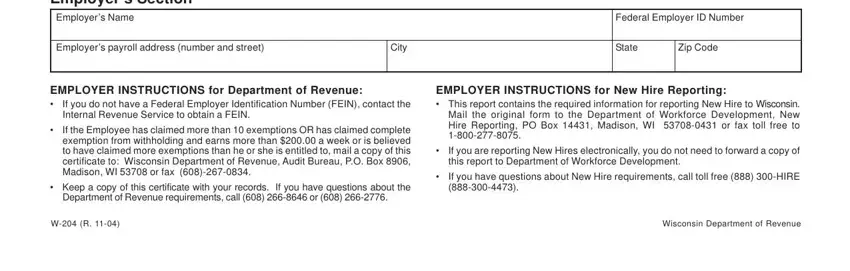

2. Soon after completing the last step, go on to the next stage and fill in the essential particulars in all these blanks - Employers Section Employers Name, Federal Employer ID Number, Employers payroll address number, City, State, Zip Code, cid, EMPLOYER INSTRUCTIONS for, If you do not have a Federal, cid Keep a copy of this, Department of Revenue requirements, EMPLOYER INSTRUCTIONS for New Hire, cid, cid, and W R.

Always be extremely mindful when completing cid and If you do not have a Federal, because this is where most people make a few mistakes.

Step 3: Reread everything you've typed into the blank fields and then press the "Done" button. Right after creating a7-day free trial account here, you'll be able to download EXEMPTIONS or email it right off. The PDF document will also be available through your personal account page with all your adjustments. FormsPal ensures your information confidentiality by using a protected system that never saves or shares any kind of personal information used in the file. Be assured knowing your files are kept confidential each time you use our tools!