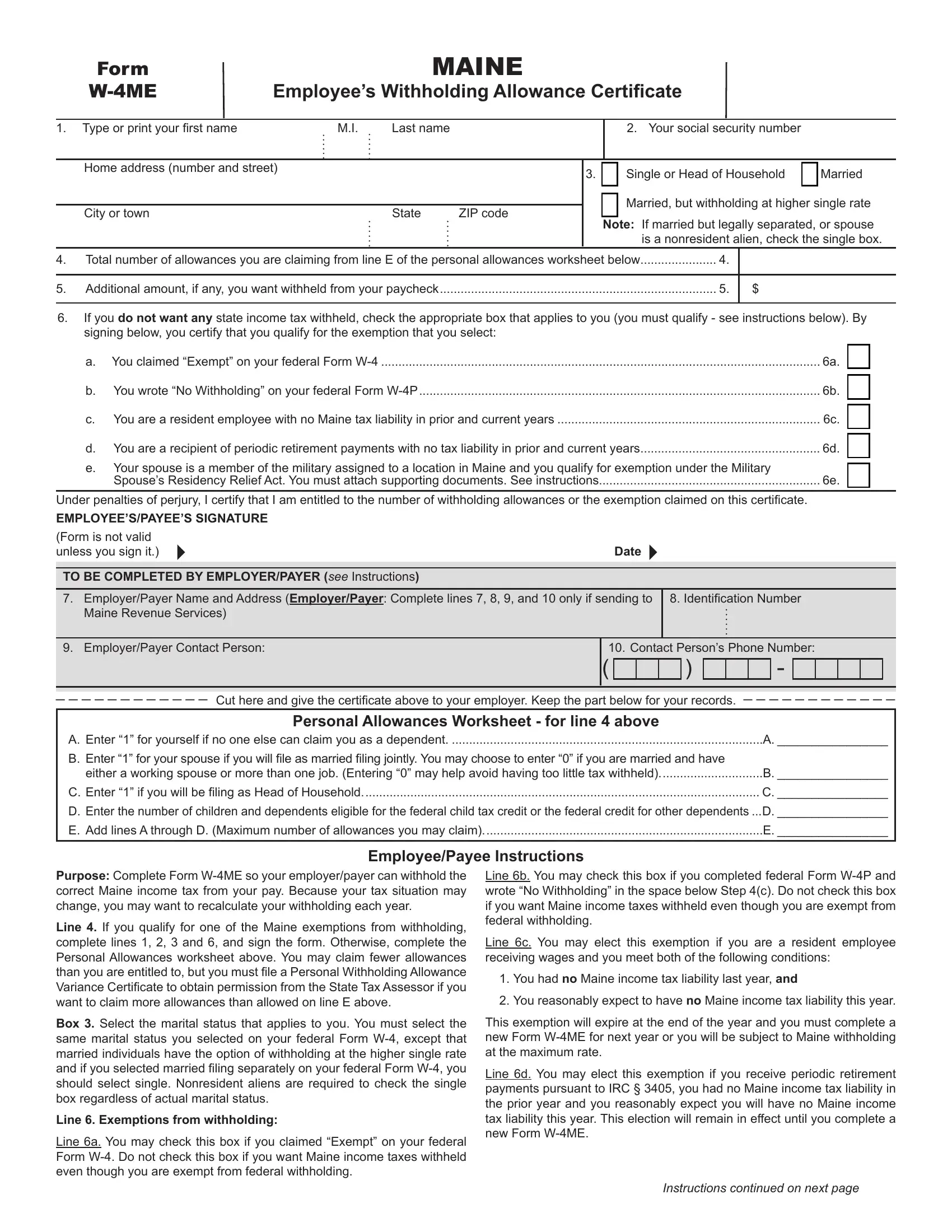

Notice to Employers and Other Payers

Maine law requires employers and other persons to withhold money from certain payments, most commonly wages, retirement payments and gambling winnings, and remit to Maine Revenue Services for application against the Maine income tax liability of employees and other payees. The amount of withholding must be calculated according to the provisions of Rule No. 803 (See www.maine.gov/revenue/rules) and must constitute a reasonable estimate of Maine income tax due on the receipt of the payment. Amounts withheld must be paid over to Maine Revenue Services on a periodic basis as provided by Title 36 M.R.S. Chapter 827 (§§ 5250 - 5255-B) and Rule No. 803 (18-125 C.M.R., ch. 803).

Employer/Payer Information for Completing Form W-4ME

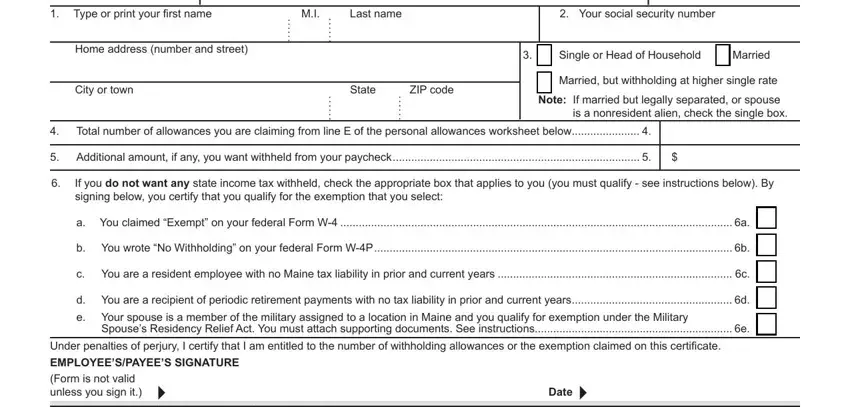

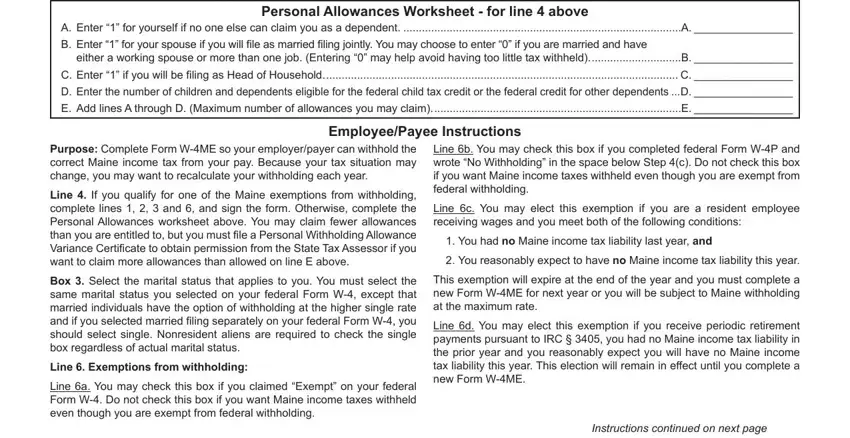

An employer/payer is required to submit a copy of Form W-4ME, along with a copy of any supporting information provided by the employee/payee, to Maine Revenue Services if:

A.The employer/payer is required to submit a copy of federal Form W-4 to the Internal Revenue Service either by written notice or by published guidance as required by federal regulation 26 CFR 31.3402(f)(2)-1(g); or

B.An employee performing personal services in Maine furnishes a Form W-4ME to the employer containing a non-Maine address and, for any reason, claims no Maine income tax is to be withheld. This submission is not required if the employer reasonably expects that the employee will earn annual Maine-source income of less than $3,000 or if the employee is a nonresident working in Maine for no more than 12 days for the calendar year and is, therefore, exempt from Maine income tax withholding.

Submit copies of Form W-4ME directly to the MRS Withholding Unit separately from any other tax filing.

Employers/Payers must complete lines 7 through 10 only if required to submit a copy of Form W-4ME to Maine Revenue Services.

Line 7 Enter employer/payer name and business address.

Line 8 Enter employer/payer federal identification number (EIN and/or SSN).

Line 9 Enter employer/payer contact person who can answer questions about withholding (i.e. human resources person, company officer, accountant, etc.).

Line 10 Enter employer/payer contact person’s phone number.

Important Information for Employers/Payers

Missing or invalid Forms W-4, W-4P or W-4ME. If any of the circumstances below occur, the employer or payer must withhold as if the employee or payee were single and claiming no allowances. Maine income tax must be withheld at this rate until such time that the employee or payee provides a valid Form W4-ME.

(1)The employee/payee has not provided a valid, signed Form W-4ME;

(2)The employee’s/payee’s Form W-4 or W-4P is determined to be invalid for purposes of federal withholding;

(3)The Assessor notifies the employer/payer that the employee’s/payee’s Form W-4ME is invalid; or

(4)The employee’s/payee’s Personal Withholding Allowance Variance Certificate has expired, a new variance certificate has not been approved and submitted to the employer/payer and the payee has not provided the payer with a valid Form W-4ME.

Exemptions from withholding Form W-4ME, line 6. Generally, employers/payers must withhold from payments subject to Maine income tax unless an exemption is claimed on line 6.

Federal exemption from withholding (lines 6a and 6b). An employee/payee who is exempt from federal income tax withholding is also exempt from Maine income tax withholding. This includes recipients of periodic retirement payments who are exempt from federal income tax withholding. The employee/payee must check the applicable box on line 6. An employee/payee exempt from federal withholding that wants Maine withholding must leave line 6 blank.

Resident employee exemption from Maine withholding (line 6c). A resident employee who is subject to federal income tax withholding is exempt from Maine income tax withholding if the employee had no Maine tax liability for the prior year and expects to have no Maine tax liability for the current year. The exemption on line 6c expires at the end of each year. If the employee fails to submit a new Form W-4ME for the next calendar year, the employer must begin withholding at the single rate with no allowances.

Withholding from payments to nonresident employees. An employee who is exempt from Maine income tax because of the nontaxable thresholds applicable to nonresidents is not required to complete and submit Form W-4ME; however, an employee becomes subject to Maine income tax withholding immediately upon exceeding a threshold at any time during the year. Because all income earned in Maine is taxable by Maine once a threshold is exceeded, employers should work with affected employees to ensure that Maine withholding is adequate to cover Maine income tax liability for the year. This may require the employee submitting a new Form W-4ME with the employer.

Withholding exemption for periodic retirement payments (line 6d). Recipients of periodic retirement payments as defined by IRC § 3405 that are subject to federal income tax withholding are exempt from Maine income tax withholding if the recipient certifies (by checking the box on line 6d) that he or she had no Maine income tax liability for the prior year and expects to have no Maine income tax liability for the current year. The exemption remains in effect until the recipient submits an updated Form W-4ME.

Exemptions under the Military Spouse’s Residency Relief Act (MSRRA). If the box on line 6e is checked, the employer must:

(1)Ensure that a copy of the military member’s Leave and Earnings Statement (LES) is attached, and verify that the assignment location entered on the LES is a location in Maine; and

(2)Review the employee’s military ID to ensure that the date on the ID is not more than four years prior to the date on the employee’s Form W-4ME, and that the ID denotes the employee as a current military spouse.

An exemption claimed on line 6e expires at the end of the calendar year. If the employee does not submit a new Maine Form W-4ME, the employer must begin withholding for the first pay period in the following year at the maximum rate (single with one allowance).

See the employee instructions for line 6e above for more information about this exemption.

Revised: December 2020