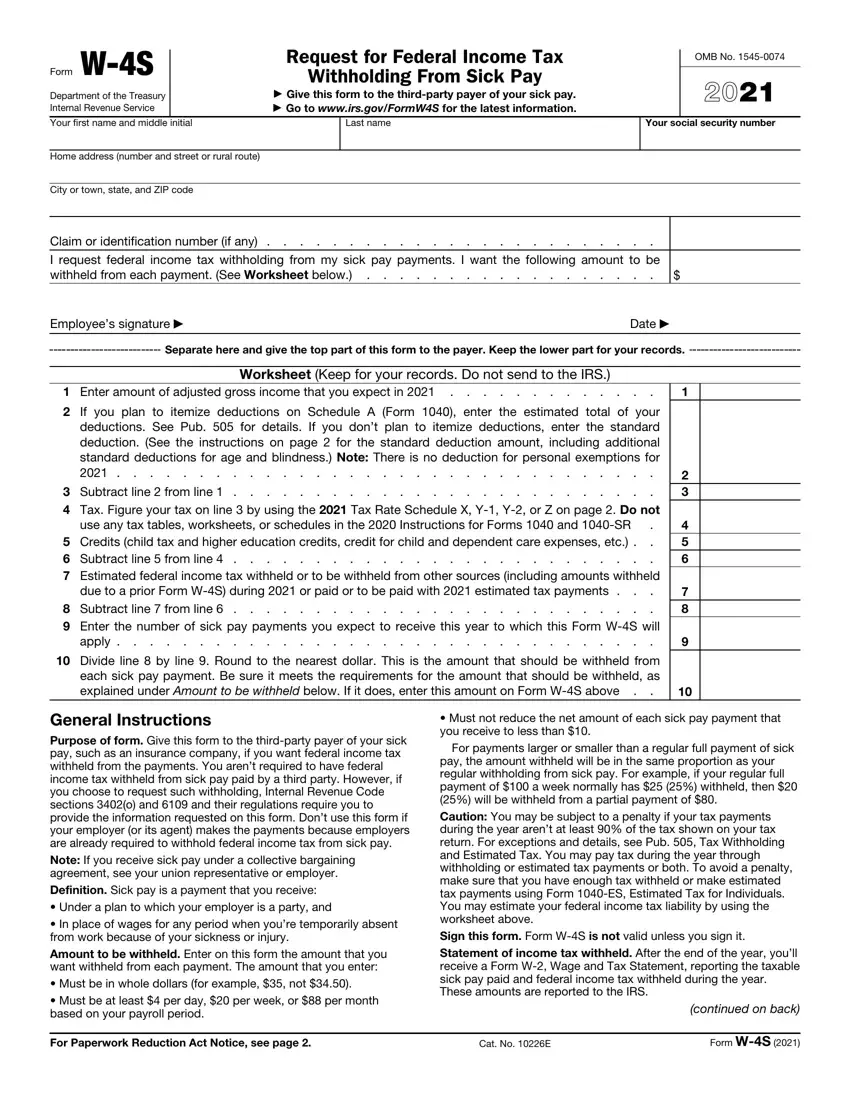

We were developing the PDF editor with the prospect of making it as easy to apply as possible. This is the reason the entire process of typing in the 10226E will undoubtedly be effortless perform the following actions:

Step 1: Hit the "Get Form Now" button to get going.

Step 2: At this point, you're on the file editing page. You can add text, edit current information, highlight certain words or phrases, insert crosses or checks, add images, sign the document, erase unneeded fields, etc.

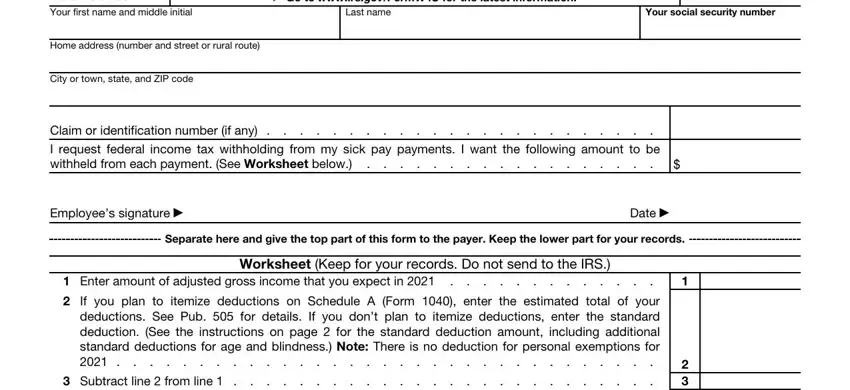

If you want to fill in the 10226E PDF, enter the details for each of the segments:

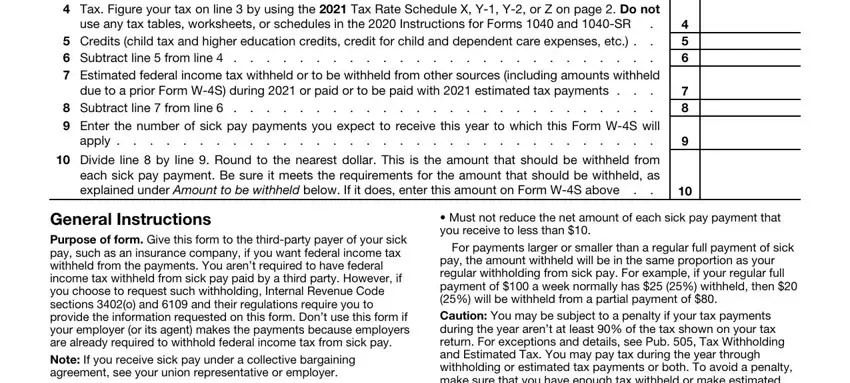

The application will need you to prepare the Subtract line from line Tax, due to a prior Form WS during or, Subtract line from line, apply, Divide line by line Round to the, General Instructions Purpose of, Must not reduce the net amount of, For payments larger or smaller, and pay the amount withheld will be in section.

Step 3: Select the "Done" button. Now it's easy to transfer your PDF document to your device. Besides, you can deliver it by email.

Step 4: Be sure to stay away from upcoming troubles by making a minimum of 2 copies of the document.