It is possible to fill out tdd effectively using our online PDF editor. To maintain our tool on the forefront of convenience, we work to adopt user-oriented capabilities and improvements on a regular basis. We're routinely looking for feedback - play a pivotal role in revampimg the way you work with PDF docs. Starting is easy! All you need to do is adhere to the next easy steps below:

Step 1: Click the "Get Form" button in the top section of this webpage to access our PDF tool.

Step 2: With this advanced PDF file editor, you can actually do more than merely complete blank fields. Edit away and make your forms seem perfect with customized text put in, or fine-tune the file's original content to excellence - all that comes with the capability to add stunning images and sign the document off.

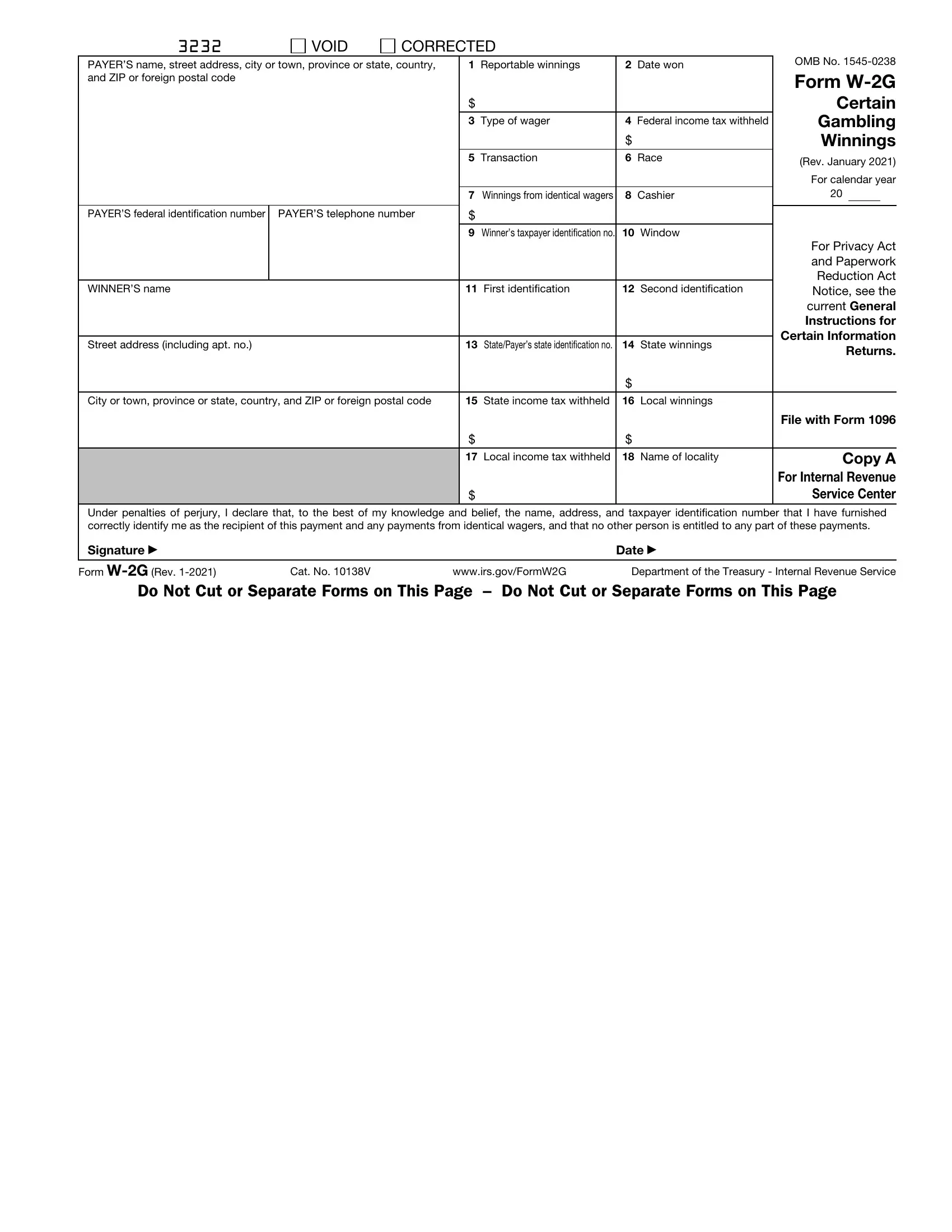

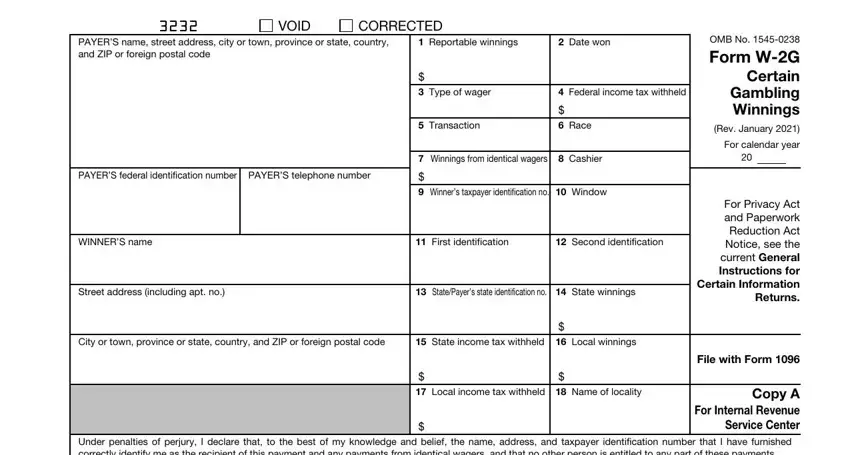

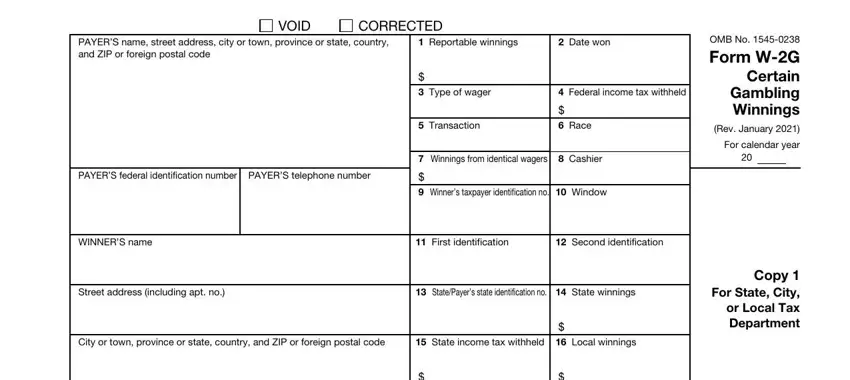

When it comes to blank fields of this specific PDF, here is what you need to know:

1. Complete the tdd with a group of major blanks. Note all of the necessary information and make certain there is nothing forgotten!

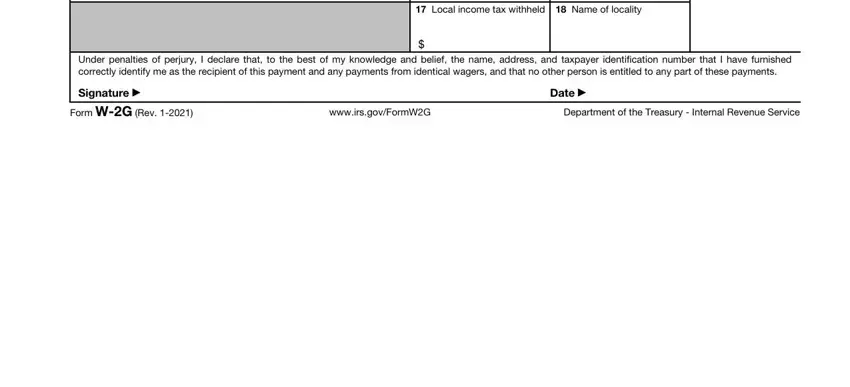

2. Once the last array of fields is completed, it is time to add the essential particulars in Under penalties of perjury I, Signature, Form WG Rev, Cat No V, wwwirsgovFormWG, Department of the Treasury, Date, and Do Not Cut or Separate Forms on allowing you to go to the next stage.

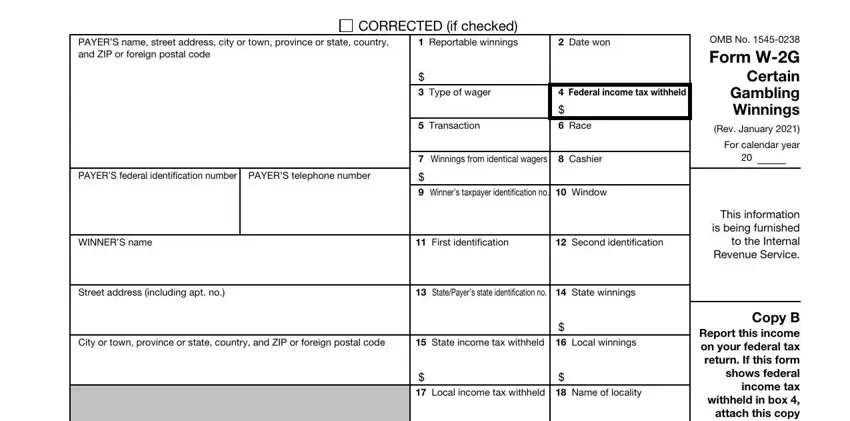

3. The following step is related to VOID, CORRECTED, PAYERS name street address city or, Reportable winnings, Date won, PAYERS federal identification, Type of wager, Transaction, Federal income tax withheld, Race, Winnings from identical wagers, Cashier, Winners taxpayer identification, WINNERS name, and First identification - type in all of these blanks.

4. The fourth part comes next with the following fields to fill out: Local income tax withheld, Name of locality, Under penalties of perjury I, Signature, Form WG Rev, wwwirsgovFormWG, Department of the Treasury, and Date.

It's simple to make an error while completing your Local income tax withheld, so make sure you go through it again prior to deciding to send it in.

5. When you draw near to the completion of your document, there are actually several more requirements that must be fulfilled. Notably, PAYERS name street address city or, CORRECTED if checked Reportable, Type of wager, Transaction, Date won, Federal income tax withheld, Race, PAYERS federal identification, Winnings from identical wagers, Cashier, Winners taxpayer identification, WINNERS name, First identification, Second identification, and Street address including apt no should be filled in.

Step 3: Soon after looking through the entries, hit "Done" and you're all set! Go for a 7-day free trial account with us and get immediate access to tdd - downloadable, emailable, and editable from your FormsPal account. FormsPal offers safe form completion with no data recording or distributing. Rest assured that your details are secure with us!