Should you would like to fill out taxes form 020 online, there's no need to download and install any software - simply make use of our online tool. To make our editor better and less complicated to work with, we constantly implement new features, taking into account suggestions from our users. With just a couple of simple steps, you'll be able to start your PDF editing:

Step 1: Click on the "Get Form" button in the top part of this page to access our PDF tool.

Step 2: Using our state-of-the-art PDF editing tool, you'll be able to accomplish more than merely fill out forms. Edit away and make your forms seem perfect with customized textual content put in, or optimize the original content to excellence - all that backed up by the capability to add any type of images and sign the file off.

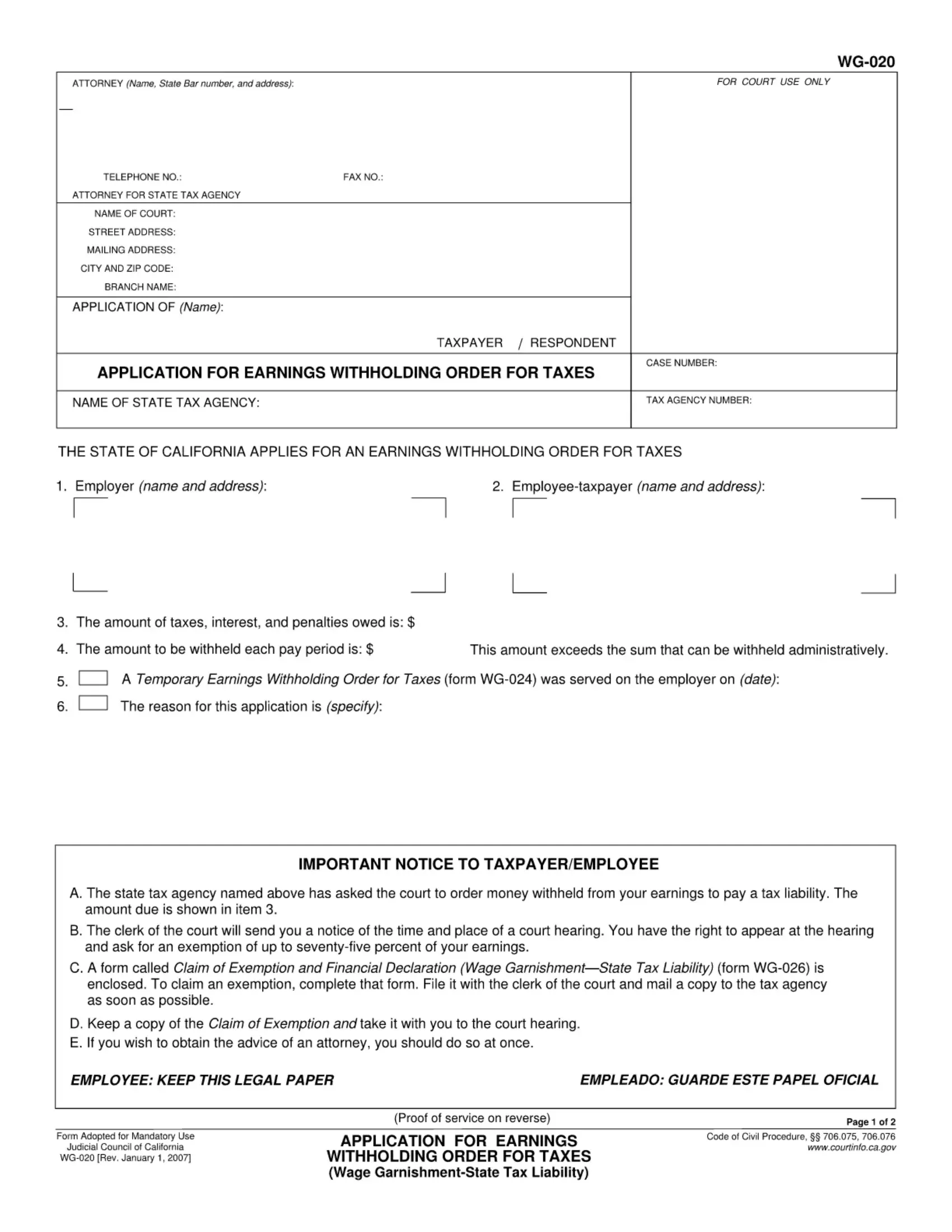

As for the blanks of this particular form, here is what you should consider:

1. When filling out the taxes form 020 online, make certain to complete all of the needed blank fields in its corresponding section. This will help to hasten the process, allowing for your details to be processed fast and appropriately.

2. Soon after completing the previous section, head on to the subsequent step and complete the necessary details in these fields - .

When it comes to this field and next field, make sure that you double-check them in this current part. Both these are considered the most significant ones in the form.

3. In this particular step, review . All these have to be completed with greatest accuracy.

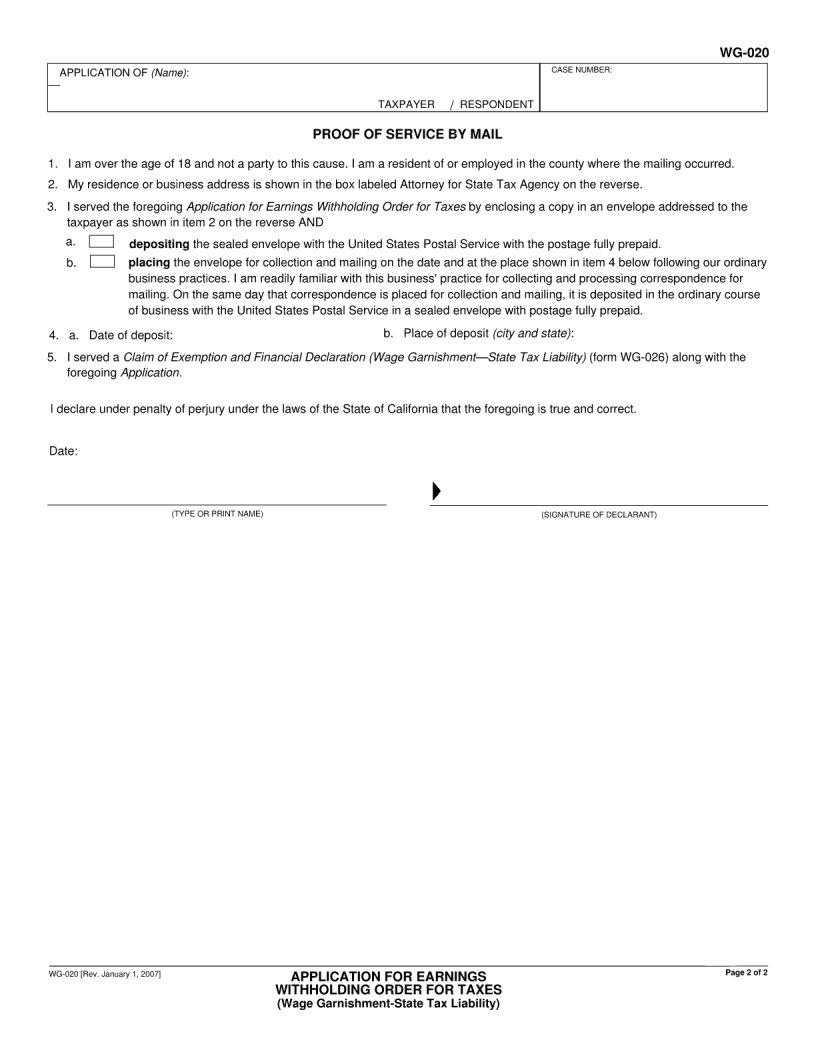

4. The subsequent subsection requires your involvement in the subsequent places: . Remember to enter all of the required details to go forward.

Step 3: When you have looked over the details you given, simply click "Done" to conclude your form at FormsPal. Right after starting a7-day free trial account here, you will be able to download taxes form 020 online or send it via email immediately. The PDF form will also be available via your personal account menu with your each modification. At FormsPal, we aim to make sure that all your information is kept private.