wh 1612 can be filled out online with ease. Just use FormsPal PDF editor to complete the task promptly. Our editor is continually evolving to present the best user experience attainable, and that is because of our dedication to constant enhancement and listening closely to feedback from customers. Starting is simple! What you need to do is stick to the following basic steps below:

Step 1: Just hit the "Get Form Button" above on this page to launch our pdf form editor. This way, you will find all that is needed to fill out your file.

Step 2: As soon as you launch the PDF editor, you will notice the form made ready to be completed. Besides filling in various blanks, you could also do various other things with the Document, namely adding custom textual content, modifying the original text, adding graphics, putting your signature on the PDF, and much more.

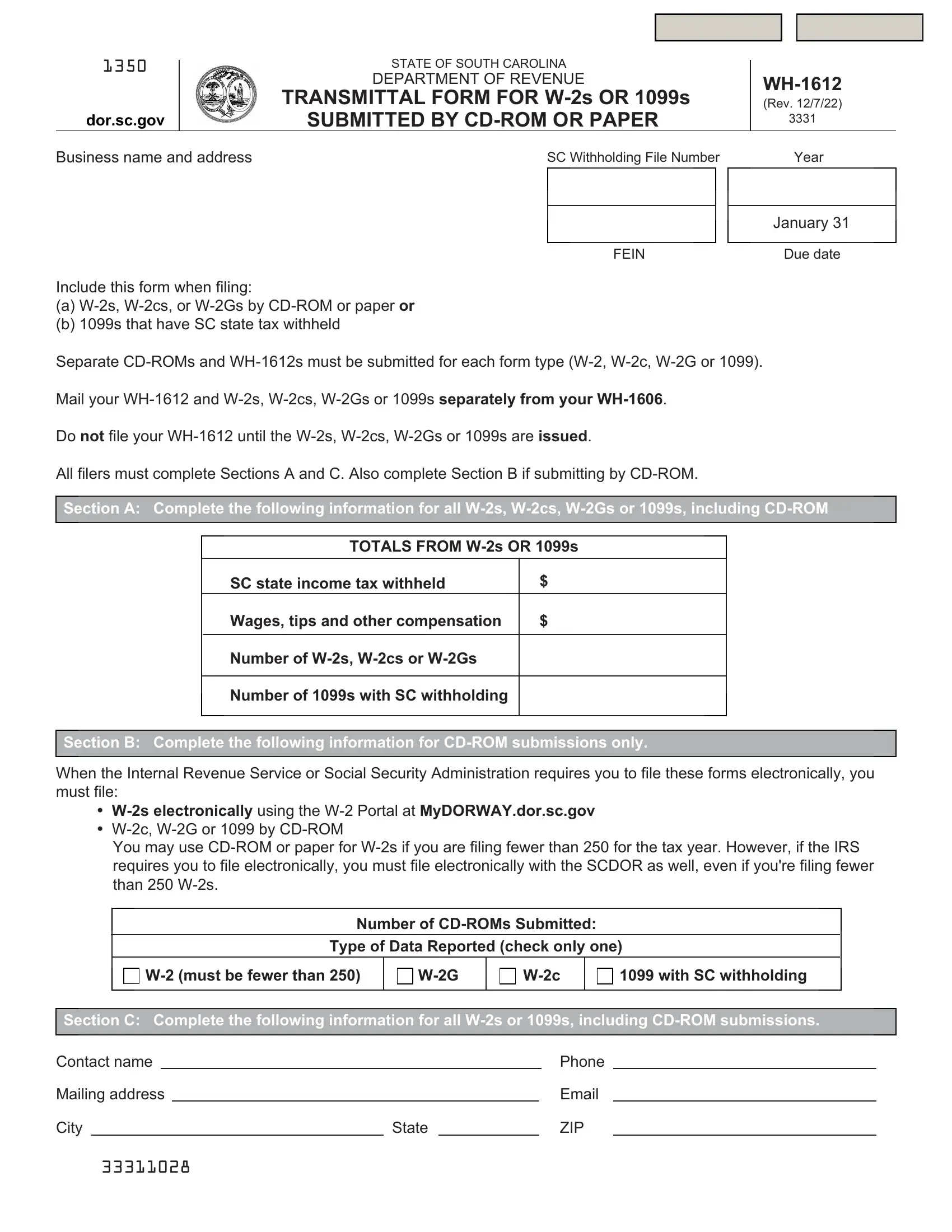

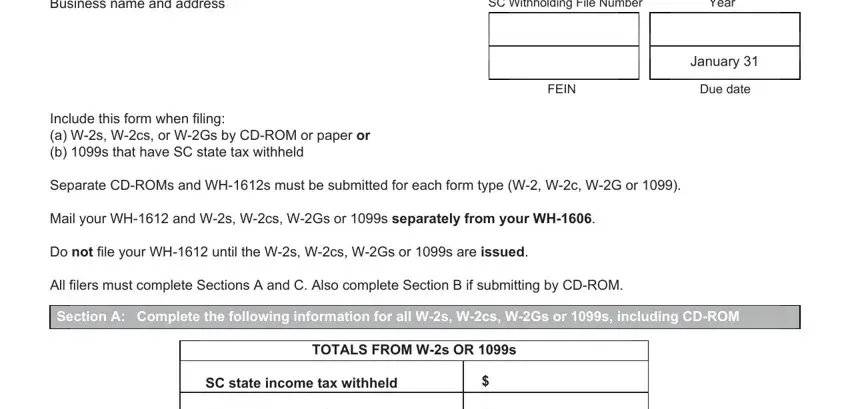

In order to fill out this form, make sure that you type in the necessary details in each and every area:

1. Whenever filling in the wh 1612, be sure to incorporate all of the necessary fields in its associated part. This will help to speed up the work, which allows your information to be processed quickly and correctly.

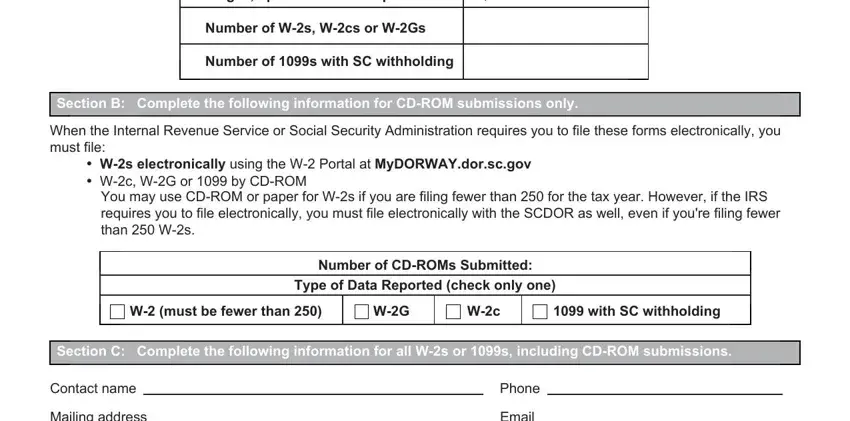

2. Once the previous array of fields is complete, you need to put in the needed particulars in Wages tips and other compensation, Number of Ws Wcs or WGs, Number of s with SC withholding, Section B Complete the following, When the Internal Revenue Service, Ws electronically using the W, You may use CDROM or paper for Ws, Number of CDROMs Submitted, Type of Data Reported check only, W must be fewer than, with SC withholding, Section C Complete the following, Contact name, Mailing address, and Phone allowing you to move on further.

Concerning with SC withholding and You may use CDROM or paper for Ws, be certain you review things in this current part. These are thought to be the most important fields in this form.

3. The third part will be hassle-free - fill in all the empty fields in Mailing address, City, Email, ZIP, and State in order to complete the current step.

Step 3: When you've reviewed the details in the blanks, press "Done" to complete your form at FormsPal. Obtain the wh 1612 as soon as you join for a free trial. Easily view the pdf file within your FormsPal account page, with any edits and changes automatically synced! Here at FormsPal, we aim to ensure that all your information is kept protected.