The Wesco Insurance Company APPLICATION FOR LAWYERS PROFESSIONAL LIABILITY INSURANCE, known as the WIC-LPL-APP-01 form, is a comprehensive document designed for law firms seeking to apply for claims-made and reported insurance policies. This application, administered by an unnamed managing agency located at 800 Superior Ave. E, 21st Floor, Cleveland, OH 44114, is crucial for firms aiming to secure coverage against professional liability claims. The form requires detailed information about the applying firm, including its full name, contact details, the date it was established, the number of lawyers and support staff, and whether it has multiple office locations. Applicants are asked to specify their current insurance coverage, desired limits and deductibles for the upcoming policy year, and any optional coverages sought. Critical sections of the form touch upon the firm's insurance history, any shared resources with other attorneys or law firms, changes in firm personnel, and any past professional liability insurance issues. Applicants must also list all predecessor firms, detail any engagements in specific legal services that may require additional supplements, and disclose any incidents or circumstances that might lead to a claim. Further, the form inquires about the firm's client base, specifically if any client accounts for a significant portion of the firm's gross receipts. Questions regarding the use of non-listed attorneys, involvement in business ventures, and the firm's practices in managing conflicts of interest, docket, and scheduling demands underline the application's thoroughness. Additionally, the form seeks information about risk management activities, the use of engagement letters, and the firm's practice areas, which necessitates a detailed practice profile. This application serves not only as a means to apply for insurance coverage but also as a tool for risk assessment by the insurer, highlighting the intrinsic link between the firm's operations and its exposure to professional liability risks.

| Question | Answer |

|---|---|

| Form Name | Form Wic Lpl App 01 |

| Form Length | 8 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 2 min |

| Other names | wic lpl app, wic lawyers company form, wic lawyers professional form, app01 company get |

Wesco Insurance Company |

APPLICATION FOR LAWYERS |

Administered by: |

800 Superior Ave. E |

<Insert Managing Agency name here> |

|

21st Floor |

PROFESSIONAL LIABILITY |

<Insert Managing Agency address here> |

Cleveland, OH 44114 |

INSURANCE |

<Insert Managing Agency address here> |

(Claims Made and Reported Policy) |

|

|

|

|

THIS IS AN APPLICATION FOR A CLAIMS MADE AND REPORTED INSURANCE POLICY. IT IS IMPORTANT THAT YOU REPORT ANY KNOWN FACTS OR CIRCUMSTANCES THAT COULD REASONABLY BE EXPECTED TO RESULT IN A CLAIM TO YOUR CURRENT INSURER OR PURCHASE AN EXTENDED REPORTING PERIOD ENDORSEMENT IN ORDER TO PRESERVE COVERAGE FOR SUCH INCIDENTS.

Full Name of

Applicant Firm:

Address 1:

Contact:

Address 2: |

|

|

City: |

State: |

Zip Code: |

|

|

|

|

|

|

County: |

|

|

Phone: |

|

Fax: |

|

|

|

|

|

|

|

|

|

Date Firm Established: |

|

|

|

|

|

|

|

|

No. Lawyers in Firm: |

|

No. Support Staff: |

|

|

|

|

|

|

|

|

|

Do you have other office locations? |

Yes |

No |

If yes, how |

Please provide a list showing each location |

|

|

|

|

many? |

and the number of attorneys at each location |

|

1.Requested Effective Date:

2. |

a. Current Limits: |

b. Limits desired this year: |

|

c. Current Deductible: |

d. Deductibles desired this year: |

|

e. Optional coverages you are requesting: |

|

First Dollar Defense: |

Aggregate Deductible: |

f.Retroactive Date Requested:

Claim Expense Outside Limits:

3. |

a. Is the firm currently insured for professional liability? |

Yes |

No |

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

Please provide a copy of your current policy declarations including retroactive date as evidence of current coverage. |

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

b. Does your current policy have any type of endorsements that exclude or modify coverage? |

Yes |

No |

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

If yes, please provide a copy of each such endorsement. |

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

4. |

List the names of all predecessor firms of the applicant firm. |

Name only those firms where the applicant is a |

|

|||||||||||||||

|

majority successor to the predecessor firm’s assets and liabilities. |

|

|

|

|

|

||||||||||||

|

Name of Predecessor Firm |

|

|

|

|

Date Established |

|

|

Number of Lawyers |

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

5. |

Do you share any of the following with other attorneys or law |

firms? |

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Office Space: |

Yes |

No |

Letterhead: |

Yes |

|

No |

|

|

Cases: |

Yes |

No |

|

|

||||

|

|

|

|

|

|

|

|

|

|

|||||||||

|

If yes, list all such lawyers on firm |

letterhead and describe their |

relationship to the firm. If the firm shares office |

|

||||||||||||||

|

space, a complete Office Sharing Supplement must be provided. |

|

|

|

|

|

|

|

|

|

||||||||

6. |

a. In the last 12 months, how many attorneys have left your firm? |

|

|

|

|

b. Joined the firm? |

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|||||||||

|

c. How many attorneys does the firm plan to add during the next 12 months? |

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|||||||||

|

d. In the last 12 months, how many non lawyer employees have left your firm? |

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|||||||||||

7. |

Has any professional liability insurance for the applicant, or any member of the applicant firm ever been |

Yes |

No |

|||||||||||||||

|

declined or cancelled, refused to be renewed or accepted only on special terms? |

|

|

|

|

|

||||||||||||

|

If yes, please provide a detailed narrative in the space provided on page 2 or on firm letterhead. |

|

|

|||||||||||||||

8. |

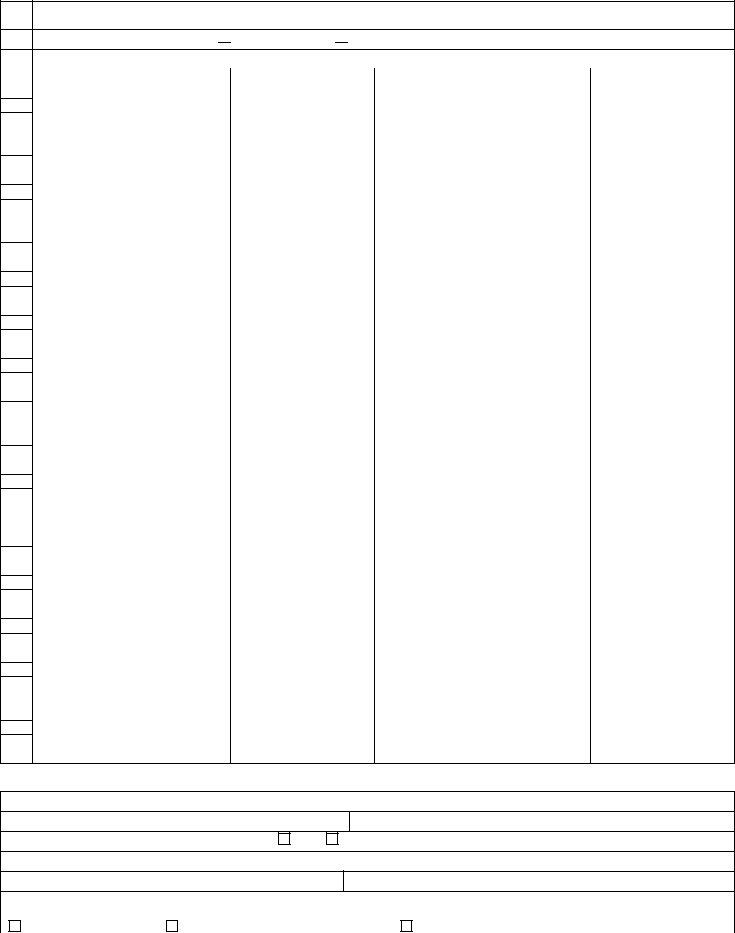

Please identify your legal professional liability insurance for the past five years. |

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

Company |

|

|

Policy Period |

|

|

|

Limits |

|

Deductible |

|

Premium |

# of Attorneys |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Page 1 of 8 |

|||

9. |

Does any client or group of related clients make up 10% or more of the firm’s gross receipts? |

Yes |

No |

|

If yes, please list all clients and the percentage of the firm’s gross receipts in the space provided below. |

|

|

10. |

Does your firm use any attorneys not listed on this application to provide legal services for the firm? |

Yes |

No |

|

If yes, list all such lawyers in the space provided below and describe their relationship to the firm. |

|

|

11. |

Is any lawyer listed on the application an officer, director, shareholder, member or exercise fiduciary |

Yes |

No |

|

control over an entity other than the applicant firm? |

|

|

|

If yes, a complete Outside Interest Supplement must be provided. |

|

|

12. |

Is any lawyer listed on the application an employee of an entity other than the applicant firm? |

Yes |

No |

|

If yes, please explain in the space provided below or on firm letterhead. |

|

|

13. |

Has any member of the firm provided legal services involving publicly traded securities or securities |

Yes |

No |

|

that are not exempt from registration? |

|

|

|

If yes, please explain in the space provided below or on firm letterhead. |

|

|

14. |

Has any member of the firm been involved in class action or mass tort litigation? |

Yes |

No |

|

If yes, please explain in the space provided below or on firm letterhead. |

|

|

15. |

Does any member of the firm provide services to, or sit on the board of directors of, a |

Yes |

No |

|

financial institution? |

|

|

|

If yes, a complete Financial Institution Supplement must be provided. |

|

|

16. |

Is any firm member aware of any incident, facts, circumstances, acts or omissions that |

Yes |

No |

|

could result in a professional liability claim against the firm or predecessor firm or against any |

|

|

|

current or former firm member while affiliated with the firm or predecessor firm? |

|

|

|

If yes, a complete Claim Supplement form must be provided for each incident. |

|

|

17. |

Has any member of the firm been the subject of any reprimand or disciplinary action or |

Yes |

No |

|

refused admission to the bar or any bar association, court or administrative agency? |

|

|

|

If yes, explain in detail in the space provided below. |

|

|

18. |

a. In the last 5 years, has any professional liability claim been made or suit brought against |

Yes |

No |

|

the firm or predecessor firm or any member of the firm or predecessor firm? |

|

|

|

If yes, how many claims: |

|

|

|

b. Has any member of the firm ever had a claim? |

Yes |

No |

|

If yes, a complete Claim Supplement form must be provided for each claim or suit within the past 5 years. |

|

|

|

|

|

|

|

SPACE PROVIDED FOR ADDITIONAL INFORMATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Page 2 of 8 |

|||

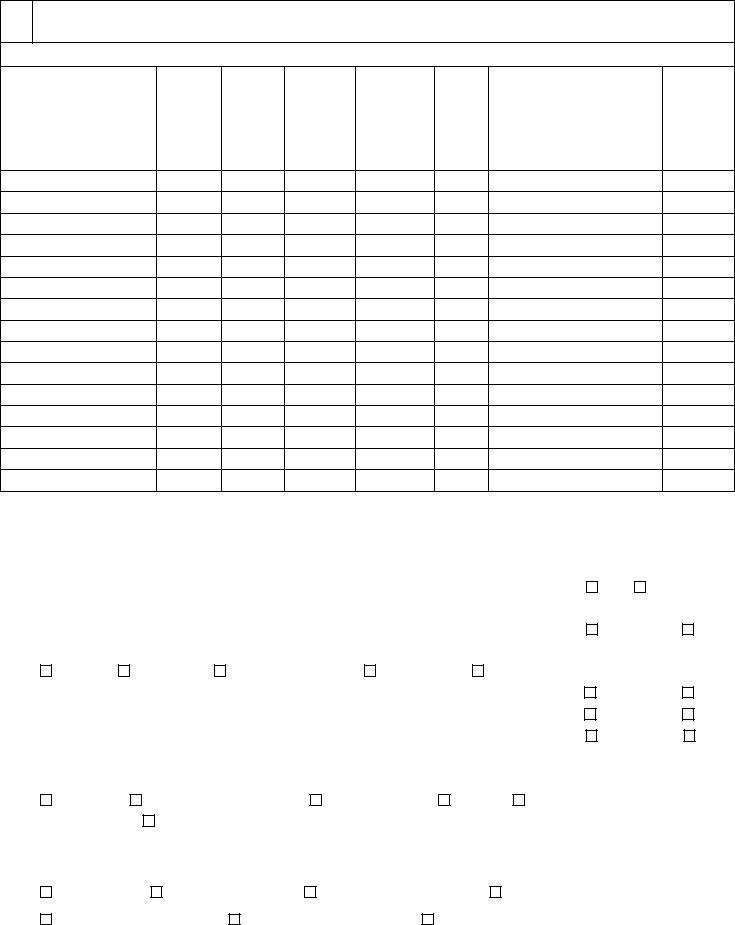

19.Complete the following table based upon either your gross revenue or billable hours for each category. The total must equal 100%

This Practice Profile is based on gross revenue or billable hours.

PRACTICE PROFILE

Area of Practice |

Percentage |

Area of Practice |

Percentage |

Admiralty (AM) |

Plaintiff %: |

Health Care (HC) |

Plaintiff %: |

|

Defense %: |

|

Defense %: |

|

Other %: |

|

Other %: |

Antitrust (AT) |

Plaintiff %: |

Insurance Defense (ID) |

Coverage%: |

|

Defense %: |

|

Defense %: |

|

Other %: |

|

Other %: |

Appellate (AP) |

Plaintiff %: |

Intellectual Property * (IP) |

Patent %: |

|

Defense %: |

|

Trademark %: |

|

Other %: |

|

Litigation%: |

Arbitration, Mediation (ADR) |

%: |

Labor & Employment (LE) |

Management %: |

Bankruptcy * (BC) |

Debtor%: |

|

Union/Labor%: |

|

Trustee%: |

|

Other %: |

Business Formation & |

Form/Alt %: |

Municipal Law (ML) |

Defense %: |

Alteration, Merger/Acquisition * |

Merge/Ac%: |

|

Financial Advice: |

(CF) |

Other %: |

|

Other %: |

Business Transactions - |

Public Corp %: |

Natural Resources, Oil & Gas (NR) |

Plaintiff %: |

Corporate & Commercial * (CF) |

Private %: |

|

Defense %: |

|

Other %: |

|

Other %: |

Civil Rights/Discrimination (CR) |

Plaintiff %: |

Personal Injury Legal Malpractice* |

Plaintiff %: |

|

Defense %: |

(PI) |

Defense %: |

|

Other %: |

|

Other %: |

Collections * (CB) |

Creditor %: |

Personal Injury Medical |

Plaintiff %: |

|

Debtor %: |

Malpractice* (PI) |

Defense %: |

Commercial Litigation (GL) |

Plaintiff %: |

|

Other %: |

|

Defense %: |

Personal Injury Mass Tort, |

Plaintiff %: |

|

Other %: |

Class Action * (PI) |

Defense %: |

Construction Law (CL) |

Plaintiff %: |

|

Other %: |

|

Defense%: |

Personal Injury Products Liability* |

Plaintiff %: |

|

Transaction %: |

(PI) |

Defense %: |

Criminal Defense (CD) |

%: |

|

Other %: |

Employee Benefits (EB) |

%: |

Personal Injury * (PI) |

Plaintiff%: |

Entertainment/Agency/ |

Management %: |

|

Defense %: |

/Sports Agency *(EN) |

Other %: |

|

Other %: |

Environmental * (ER) |

Plaintiff %: |

Real Estate * (RE) |

Commercial %: |

|

Defense %: |

|

Residential%: |

|

Other %: |

Securities * (SE) |

Public Offering%: |

Estate, Probate, Trust * (ES) (1) |

Est. Planning %: |

|

Corp. Bonds %: |

|

Trust Admin. %: |

|

Private Placemt: |

|

Other %: |

|

Other %: |

Family Law (FL) (2) |

Adoption %: |

Tax, Tax Opinions (TX) |

Personal %: |

|

Divorce %: |

|

Corporate %: |

|

Other %: |

|

Other %: |

Financial Institutions * (FI) |

%: |

Workers Compensation/Social |

Plaintiff %: |

General Civil Litigation (GL) |

Plaintiff %: |

Security (WC) |

Defense %: |

|

Defense %: |

|

Other %: |

|

Other %: |

Other (OT) (Describe): |

%: |

Immigration (IM) |

%: |

|

%: |

* Indicates that completion of the corresponding Supplement is required.

(1)Estate/Trust/Probate. In the last 24 months, please indicate the following:

Average asset value of estates handled: |

|

Highest asset value of estates handled: |

Is any firm member a trustee of any client estate? |

Yes |

No If yes, please complete an Outside Interest Supplement |

(2) Family Law. In the last 24 months, please indicate the following:

Average value of property settlement handled:

Does any firm member provide any of the following services?

Highest value of property settlement handled:

Surrogacy contracts |

Ovum or sperm donation contracts |

Embryo donation agreements |

|

Page 3 of 8 |

20.

a.Please complete the Firm Profile below for each attorney associated with your firm. Please attach an additional sheet if more space is needed.

FIRM PROFILE

Attorney Name

Position

P, A,

OC, I

Hire

Date

Date First Admitted

States

Admitted

Ave.

Hours/

Week

Primary - P

Secondary - S

Areas of Practice

Cover for work prior to date of hire by firm? Y/N

P = Partner/Owner/Member A = Associate/Employee OC = Of Counsel I = Independent Contractor

21. |

If you are a sole practitioner, who handles your cases in the event of your incapacitation or vacation? (Please |

|||||||||

|

Note: If a policy is issued in reliance upon this application, it shall not apply to the attorney noted below): |

|

||||||||

|

Name of backup attorney: |

|

|

|

|

|

|

|

|

|

22. |

Total firm billings last fiscal year: |

|

Current fiscal year billings: |

|

|

|

||||

|

|

|

|

|

|

|

||||

23. |

Does your firm accept any form of compensation other than legal fees? |

|

|

|

Yes |

No |

||||

|

If yes, please provide an explanation in the space provided on page 2 or on firm letterhead. |

|

||||||||

|

|

|

|

|

|

|||||

24. |

Does your firm have a system for detecting and avoiding conflicts of interest? |

|

Yes |

No |

||||||

|

If yes, check all that apply: |

|

|

|

|

|

|

|

|

|

|

Index |

Computer |

Conflict Committee |

Oral/Memory |

Other: |

Describe: |

|

|||

|

|

|

|

|

|

|||||

25. |

a. Does or has any member of the firm engaged in a business venture with a client? |

|

Yes |

No |

||||||

|

|

|

|

|

||||||

|

b. Does or has any firm member introduced clients to one another for investment purposes? |

Yes |

No |

|||||||

|

|

|

|

|

|

|||||

|

c. Does the firm ever represent adverse but friendly parties in the same matter? |

|

Yes |

No |

||||||

|

|

|

|

|||||||

|

If yes to 25. a, b, or c, please provide an explanation in the space provided on page 2 or on firm letterhead. |

|

||||||||

|

|

|

|

|||||||

26. |

Please indicate which of the following the firm uses to manage its docket and scheduling demands: |

|

||||||||

|

Computer |

Docket Clerk/Administrator |

Individual Diaries |

Daily or |

|

Weekly |

||||

|

master calendar |

Other: Describe: |

|

|

|

|

|

|

|

|

|

|

|

||||||||

27. |

If the firm uses a computerized system to manage its docket and scheduling demands, please indicate below which of the |

|||||||||

|

following describes that system: |

|

|

Name of software: |

|

|

|

|

||

|

Updated daily |

All branch offices integrated |

Monitored by multiple individuals |

|||||||

|

Tracks statutes of limitations |

Data backed up/stored offsite |

Other: Describe: |

|

|

|||||

|

|

|

|

|

|

|

Page 4 of 8 |

|||

28. |

Does the firm routinely use: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Engagement letters/Fee Agreements: |

Yes |

No |

Declination of Representation Letters: |

|

Yes |

No |

|

|

|

|

|

|

|

|

|

|

|

Termination of Services Letters: |

Yes |

No |

Regular File Status Updates: |

|

Yes |

No |

|

|

|

|

|

|

|

|

||

29. |

Have any suits for fees been filed against clients in the last five |

years? |

|

Yes |

No |

|

||

|

If yes, please complete the Fee Suits Supplement. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

30. |

Describe the firm’s risk management activities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

a. Does the firm have a formal procedures manual? |

|

|

|

Yes |

No |

|

|

|

|

|

|

|

|

|||

|

b. Are all employees trained regarding firm policies and procedures? |

|

Yes |

No |

|

|||

|

|

|

|

|

|

|

||

|

c. Are new attorneys supervised by a more senior attorney? |

|

|

Yes |

No |

|

||

|

|

|

|

|

|

|||

|

d. Are all cases brought in by new attorneys from prior firms reviewed by at least one senior |

|

|

|

|

|||

|

partner or officer of the firm for potential conflicts of interest? |

|

|

Yes |

No |

|

||

|

|

|

|

|

|

|||

|

d. Is support personnel work reviewed by an attorney prior to release to the client? |

|

Yes |

No |

|

|||

|

|

|

|

|

|

|||

|

e. Are all new matters reviewed prior to acceptance by firm management? |

|

Yes |

No |

|

|||

|

|

|

|

|

|

|

||

|

f. Does firm management regularly review all ongoing matters? |

|

|

Yes |

No |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Page 5 of 8 |