You'll be able to fill out real estate details mod r form instantly by using our PDFinity® editor. To make our editor better and easier to use, we constantly work on new features, with our users' feedback in mind. If you're seeking to get going, here's what it takes:

Step 1: Firstly, access the pdf editor by pressing the "Get Form Button" at the top of this webpage.

Step 2: When you access the editor, you will see the document made ready to be filled in. In addition to filling in different blanks, it's also possible to perform other sorts of actions with the Document, specifically putting on any textual content, editing the original textual content, inserting illustrations or photos, signing the document, and much more.

This PDF doc will involve some specific details; in order to ensure accuracy, please pay attention to the next suggestions:

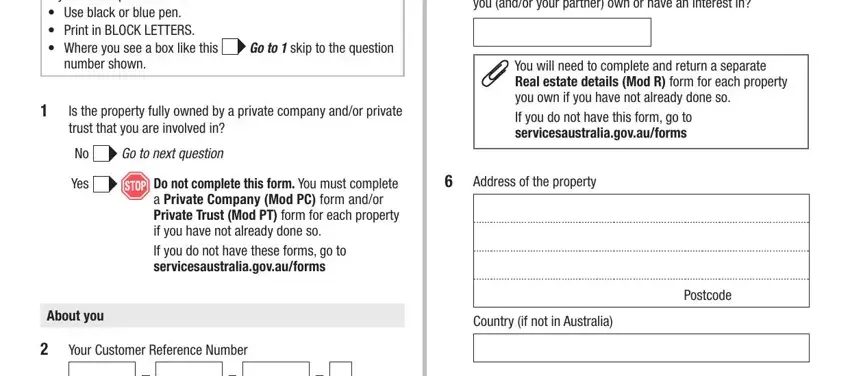

1. Begin filling out your real estate details mod r form with a group of necessary blank fields. Collect all of the information you need and ensure nothing is left out!

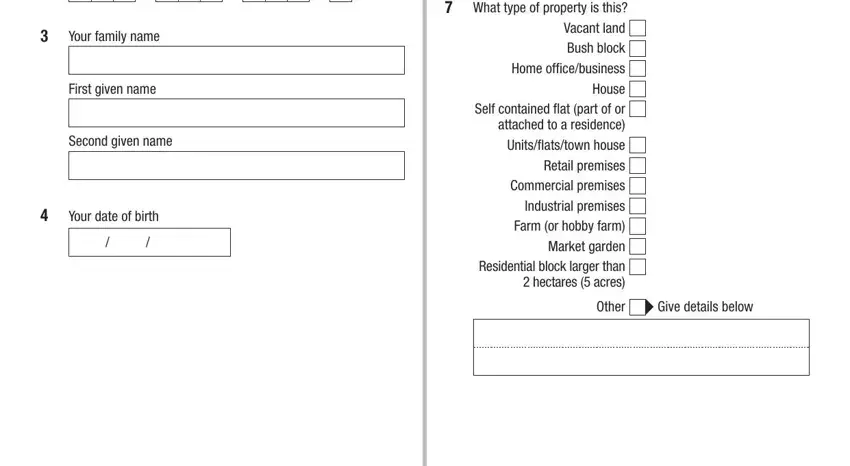

2. The third part is usually to fill in these particular blanks: Your family name, First given name, Second given name, Your date of birth, What type of property is this, Unitsflatstown house Retail, Other, and Give details below.

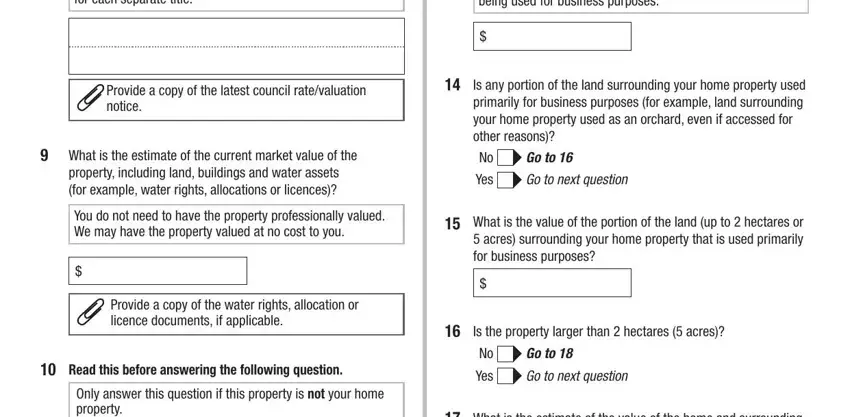

3. The following section focuses on If the property is made up of more, For example the percentage of the, Provide a copy of the latest, What is the estimate of the, property including land buildings, You do not need to have the, Provide a copy of the water rights, Read this before answering the, Only answer this question if this, Is any portion of the land, Yes, Go to, Go to next question, What is the value of the portion, and Is the property larger than - fill in each one of these blank fields.

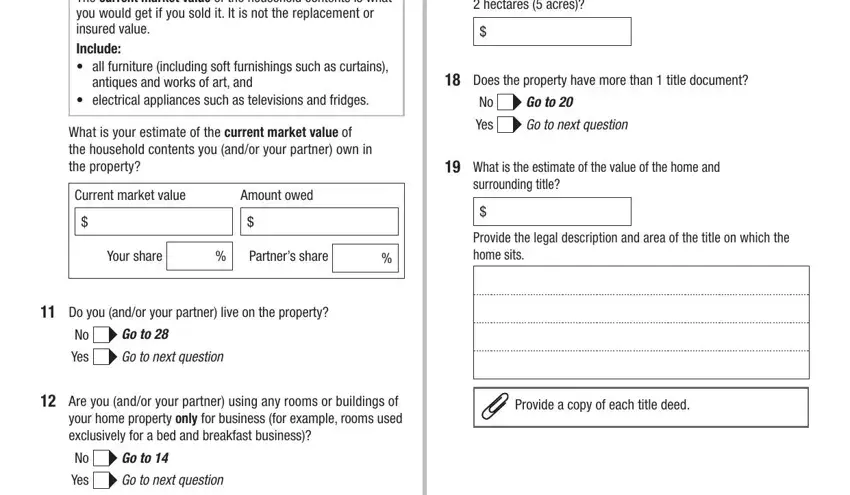

4. It is time to start working on this next part! In this case you'll have these Only answer this question if this, antiques and works of art and, electrical appliances such as, What is your estimate of the, Current market value, Amount owed, Your share, Partners share, Do you andor your partner live on, Yes, Go to, Go to next question, Are you andor your partner using, Yes, and Go to form blanks to fill out.

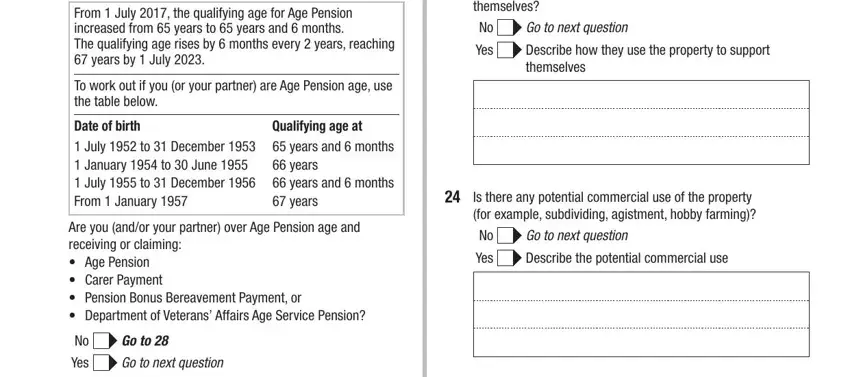

5. To wrap up your document, the last area has a few extra fields. Completing From July the qualifying age for, To work out if you or your partner, Date of birth, Qualifying age at, July to December January to, years and months years years, Are you andor your partner over, Yes, Go to, Go to next question, Does any person in your family use, Yes, Go to next question, Describe how they use the property, and Is there any potential commercial will certainly wrap up everything and you're going to be done very quickly!

Be extremely mindful while filling in years and months years years and July to December January to, as this is the section where a lot of people make mistakes.

Step 3: Proofread the details you've inserted in the blanks and then click on the "Done" button. After getting a7-day free trial account with us, you'll be able to download real estate details mod r form or email it promptly. The PDF form will also be readily available through your personal cabinet with all your adjustments. FormsPal guarantees safe form completion without data record-keeping or sharing. Be assured that your details are secure with us!