You may complete california form 460 without difficulty with our PDFinity® online tool. In order to make our tool better and easier to work with, we consistently design new features, with our users' feedback in mind. In case you are looking to start, this is what it requires:

Step 1: Click on the "Get Form" button in the top part of this page to open our editor.

Step 2: The editor offers the opportunity to change your PDF file in many different ways. Change it by writing any text, adjust existing content, and put in a signature - all within the reach of several clicks!

Concentrate when filling out this form. Make certain all required blanks are completed correctly.

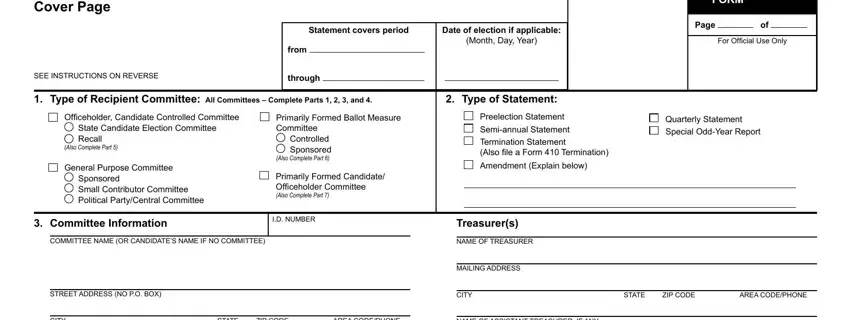

1. When filling out the california form 460, be certain to include all of the important blank fields in its associated form section. This will help to hasten the work, making it possible for your details to be handled efficiently and properly.

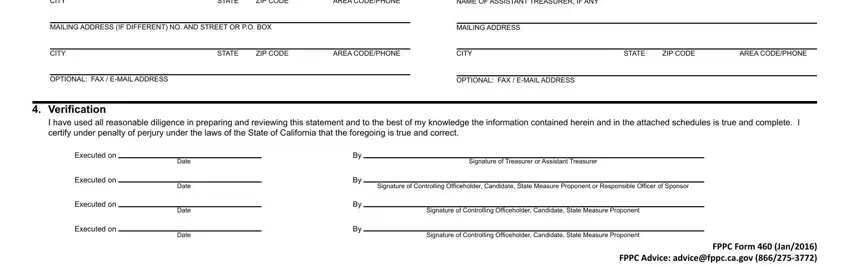

2. Once the previous part is finished, you should put in the required particulars in CITY, STATE, ZIP CODE, AREA CODEPHONE, NAME OF ASSISTANT TREASURER IF ANY, MAILING ADDRESS IF DIFFERENT NO, MAILING ADDRESS, CITY, STATE, ZIP CODE, AREA CODEPHONE, CITY, STATE, ZIP CODE, and AREA CODEPHONE so you can move forward to the 3rd stage.

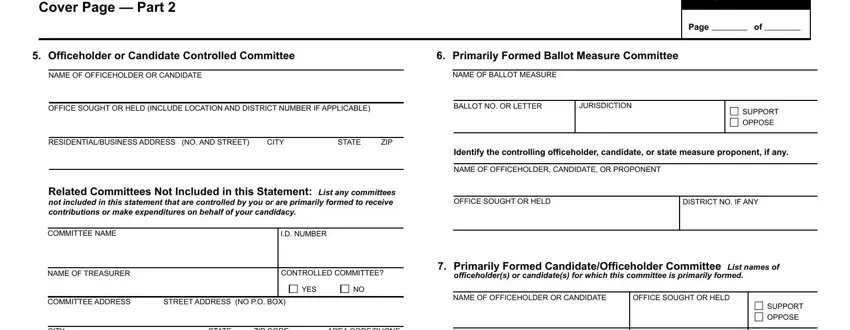

3. Your next step will be straightforward - complete all the fields in Recipient Committee Campaign, Oficeholder or Candidate, Primarily Formed Ballot Measure, NAME OF OFFICEHOLDER OR CANDIDATE, NAME OF BALLOT MEASURE, OFFICE SOUGHT OR HELD INCLUDE, BALLOT NO OR LETTER, JURISDICTION, FORM, Page, SUPPORT OPPOSE, RESIDENTIALBUSINESS ADDRESS NO AND, CITY, STATE, and ZIP to complete this segment.

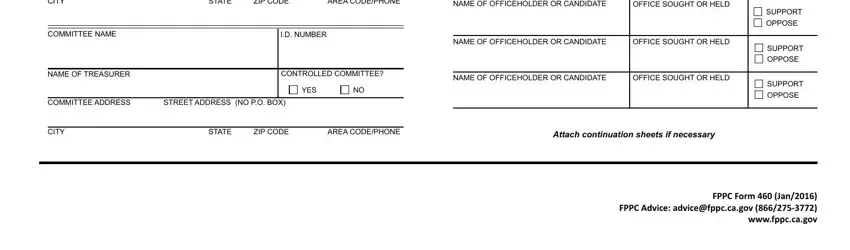

4. You're ready to complete this next portion! Here you have all of these CITY, STATE, ZIP CODE, AREA CODEPHONE, NAME OF OFFICEHOLDER OR CANDIDATE, OFFICE SOUGHT OR HELD, COMMITTEE NAME, ID NUMBER, NAME OF OFFICEHOLDER OR CANDIDATE, OFFICE SOUGHT OR HELD, NAME OF TREASURER, CONTROLLED COMMITTEE, YES, COMMITTEE ADDRESS, and STREET ADDRESS NO PO BOX blank fields to do.

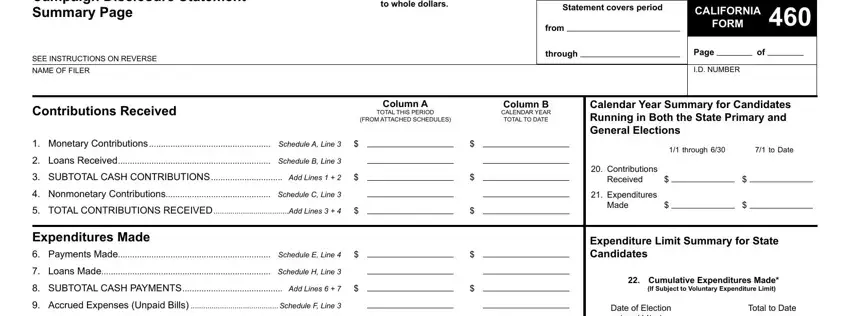

5. To conclude your document, the last section requires a few additional blanks. Typing in Campaign Disclosure Statement, to whole dollars, Statement covers period, from, through, CALIFORNIA, FORM, Page, ID NUMBER, Column B CALENDAR YEAR TOTAL TO, Calendar Year Summary for, through, to Date, SEE INSTRUCTIONS ON REVERSE NAME, and Contributions Received will certainly conclude everything and you will be done before you know it!

It is possible to make a mistake when completing your from, therefore make sure that you go through it again before you send it in.

Step 3: After proofreading the filled in blanks, click "Done" and you are all set! Download the california form 460 once you sign up for a free trial. Readily gain access to the form within your FormsPal cabinet, along with any modifications and changes all kept! At FormsPal, we endeavor to make sure that all your details are stored protected.