You'll be able to complete Fppc Form 461 without difficulty with our PDFinity® editor. FormsPal team is focused on giving you the absolute best experience with our tool by consistently releasing new features and enhancements. Our editor is now even more useful as the result of the latest updates! So now, editing PDF files is simpler and faster than ever before. Here is what you would need to do to begin:

Step 1: Open the PDF form inside our tool by clicking on the "Get Form Button" at the top of this webpage.

Step 2: With the help of our advanced PDF editor, you could do more than merely complete blanks. Edit away and make your documents appear sublime with custom text incorporated, or fine-tune the original content to excellence - all that accompanied by the capability to add stunning pictures and sign the file off.

This PDF form will involve some specific details; in order to guarantee correctness, don't hesitate to take into account the guidelines down below:

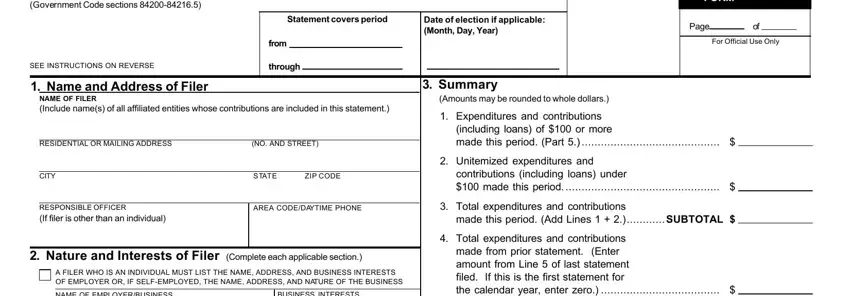

1. The Fppc Form 461 involves particular details to be typed in. Make sure the subsequent blanks are completed:

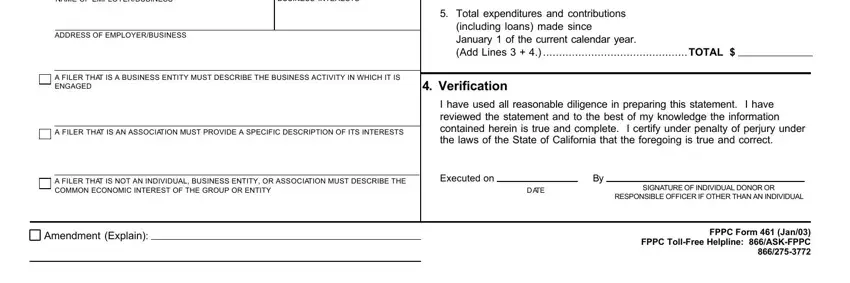

2. Once the previous section is finished, you need to put in the essential particulars in NAME OF EMPLOYERBUSINESS, BUSINESS INTERESTS, ADDRESS OF EMPLOYERBUSINESS, Total expenditures and, including loans made since January, A FILER THAT IS A BUSINESS ENTITY, Verification, A FILER THAT IS AN ASSOCIATION, I have used all reasonable, A FILER THAT IS NOT AN INDIVIDUAL, Executed on, DATE, SIGNATURE OF INDIVIDUAL DONOR OR, RESPONSIBLE OFFICER IF OTHER THAN, and Amendment Explain so that you can progress to the 3rd part.

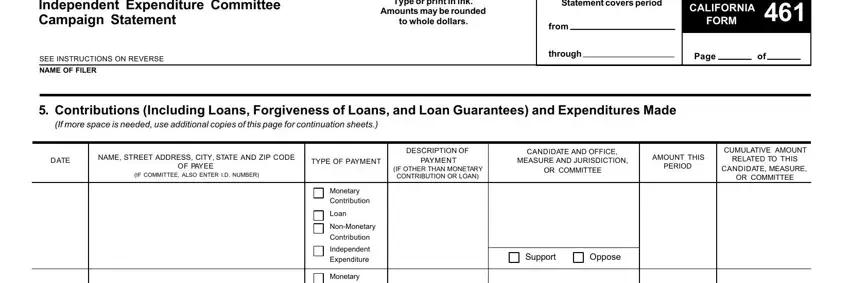

3. The following step is about Major Donor and Independent, Type or print in ink, Amounts may be rounded, to whole dollars, SEE INSTRUCTIONS ON REVERSE, NAME OF FILER, Statement covers period, from, through, CALIFORNIA, FORM, Page, Contributions Including Loans, If more space is needed use, and DATE - type in all these blank fields.

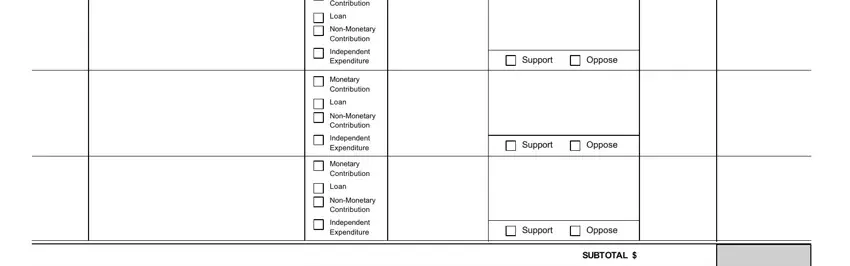

4. This next section requires some additional information. Ensure you complete all the necessary fields - Monetary Contribution, Loan, NonMonetary Contribution, Independent Expenditure, Monetary Contribution, Loan, NonMonetary Contribution, Independent Expenditure, Monetary Contribution, Loan, NonMonetary Contribution, Independent Expenditure, Support, Oppose, and Support - to proceed further in your process!

As for Oppose and Independent Expenditure, make sure that you don't make any mistakes in this current part. The two of these are definitely the most significant fields in the file.

Step 3: As soon as you've glanced through the information in the blanks, press "Done" to conclude your FormsPal process. Sign up with FormsPal now and immediately obtain Fppc Form 461, set for download. All changes made by you are kept , which means you can change the pdf further if necessary. When you work with FormsPal, you can easily complete forms without having to be concerned about personal data incidents or data entries being distributed. Our protected software ensures that your private data is maintained safely.