Every year, as tax season approaches, individuals and businesses alike turn their attention to the crucial documents required for filing taxes accurately and on time. Among these, the W2 form issued by payroll services like Frankcrum holds a place of paramount importance. This essential document summarizes an employee's annual earnings and the taxes withheld from those earnings. For both employers and employees, the W2 form serves as a cornerstone of financial record-keeping and tax preparation. Frankcrum's payroll solutions, which facilitate this process, ensure that the data contained within each W2 form is precise, thus streamlining the tax reporting process. As we delve into the specifics of the Frankcrum Payroll W2 form, it's important to recognize its role not only in fulfilling legal obligations but also in providing clear financial insights. The form contains detailed information such as wages earned, federal and state taxes withheld, Social Security and Medicare contributions, and any additional withholdings. This comprehensive data is indispensable for individuals planning their fiscal year and for businesses maintaining accurate payroll records.

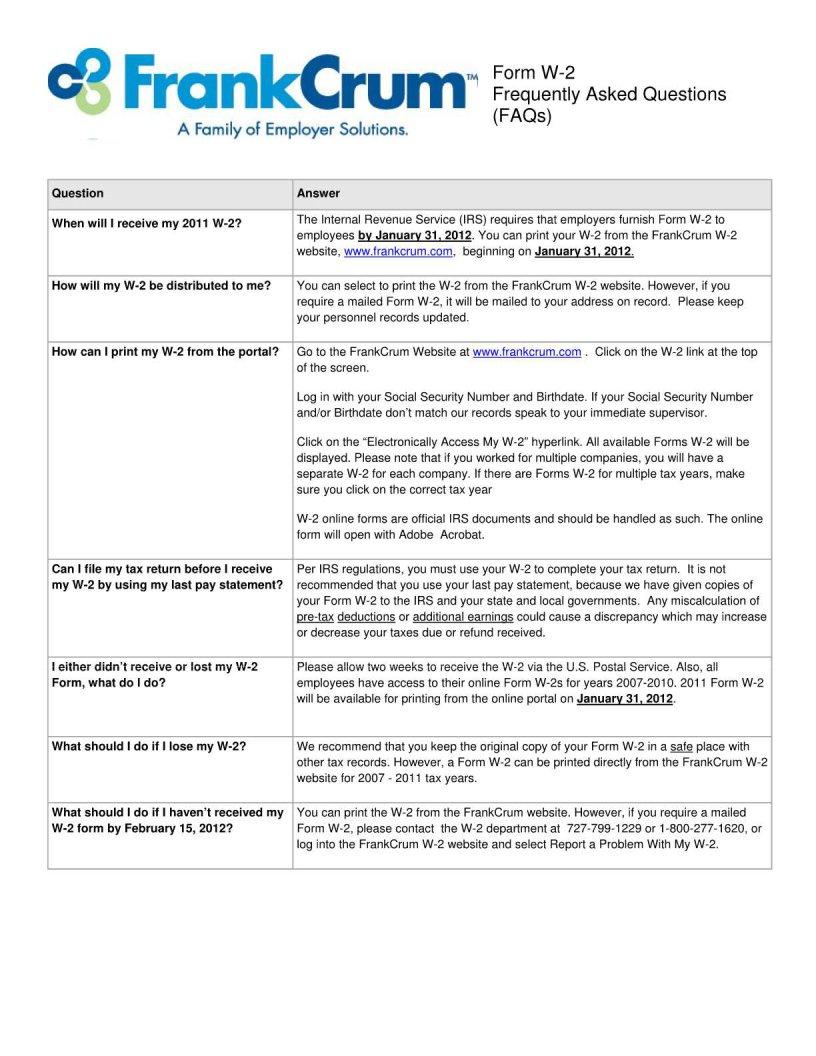

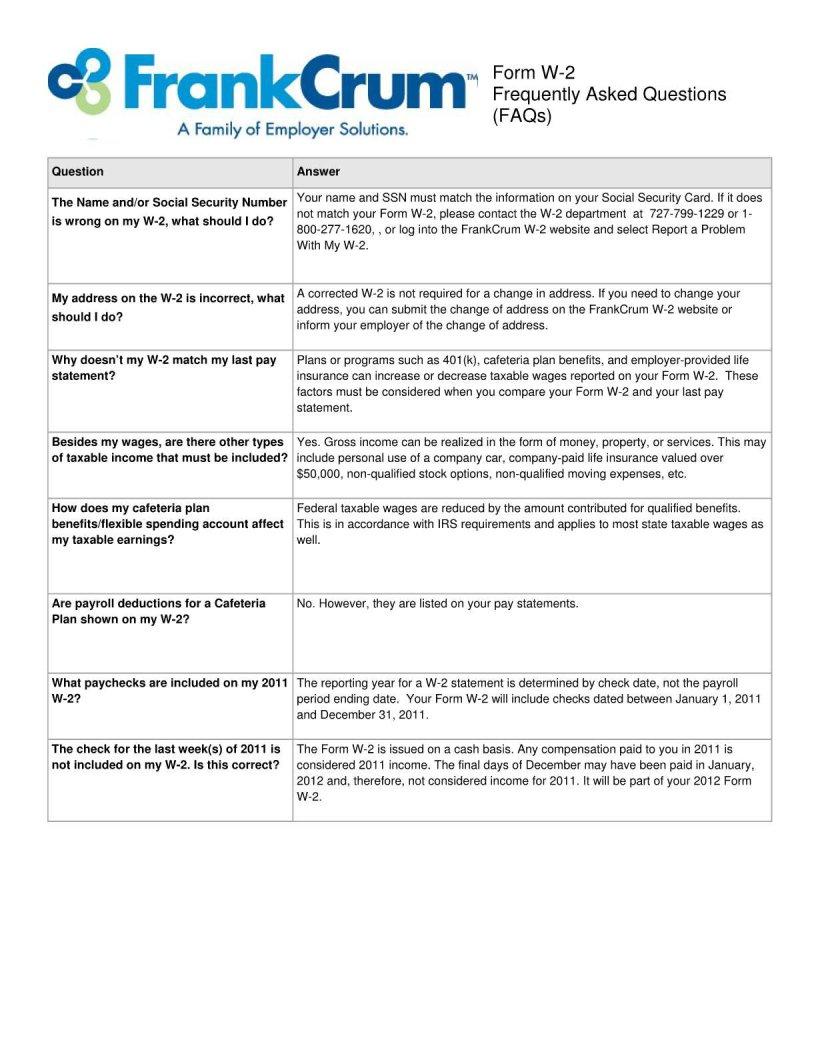

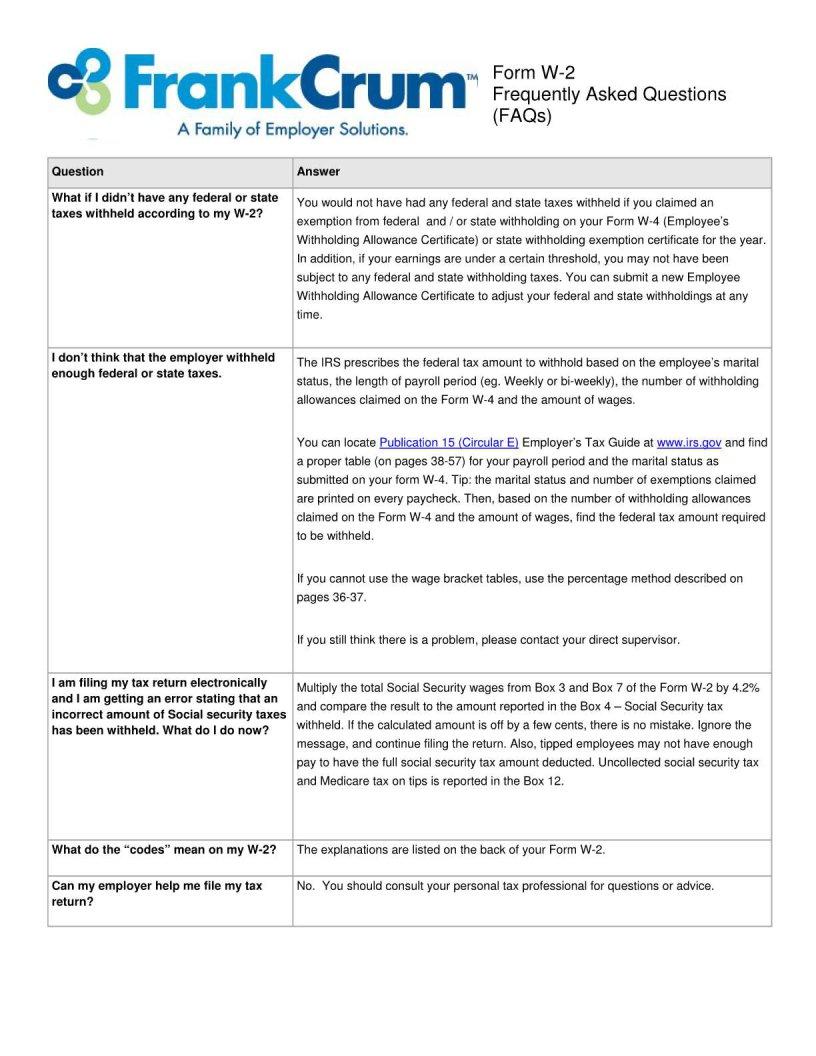

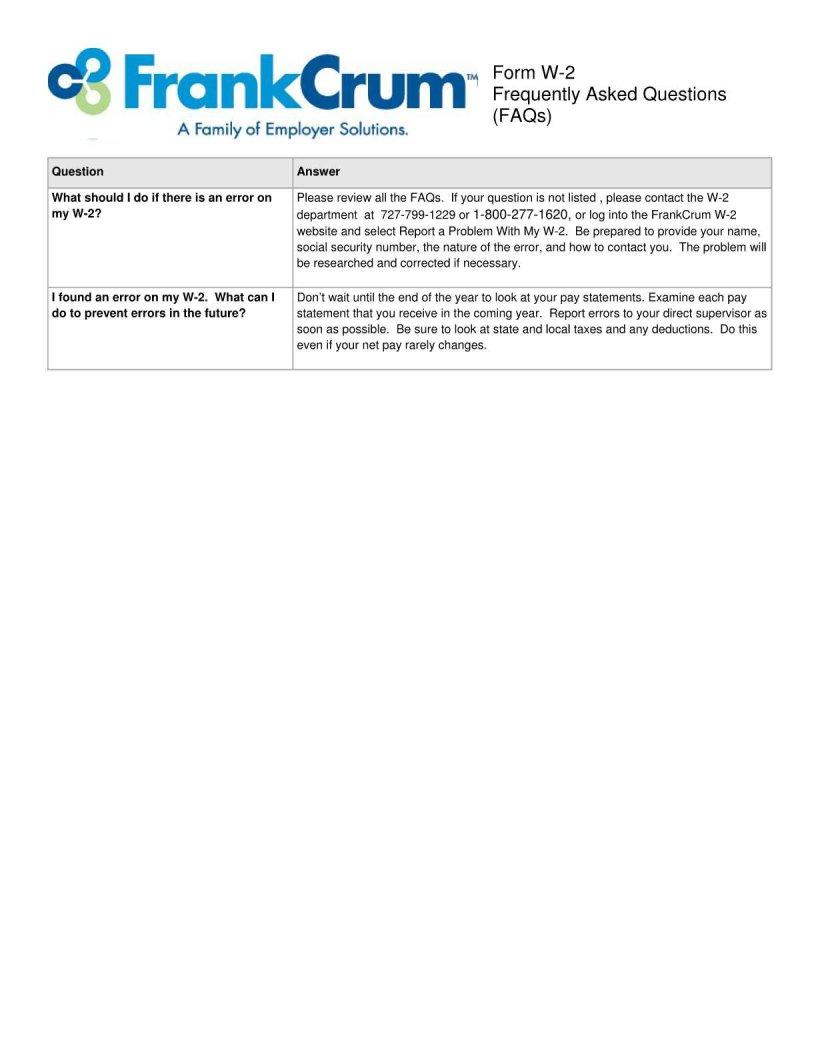

| Question | Answer |

|---|---|

| Form Name | Frankcrum Payroll W2 Form |

| Form Length | 4 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min |

| Other names | my frankcrum, myfrankcrum com, my frankcrum employee login, frankcrum com login |