You are able to work with Freddie Mac Form 65 effectively using our PDFinity® online PDF tool. The tool is continually maintained by our team, acquiring new awesome functions and becoming better. If you are seeking to get started, here's what it will take:

Step 1: First, access the editor by pressing the "Get Form Button" in the top section of this page.

Step 2: As you launch the file editor, you will find the form ready to be completed. In addition to filling out various blanks, you could also perform various other things with the file, namely putting on any text, modifying the original text, inserting images, placing your signature to the document, and more.

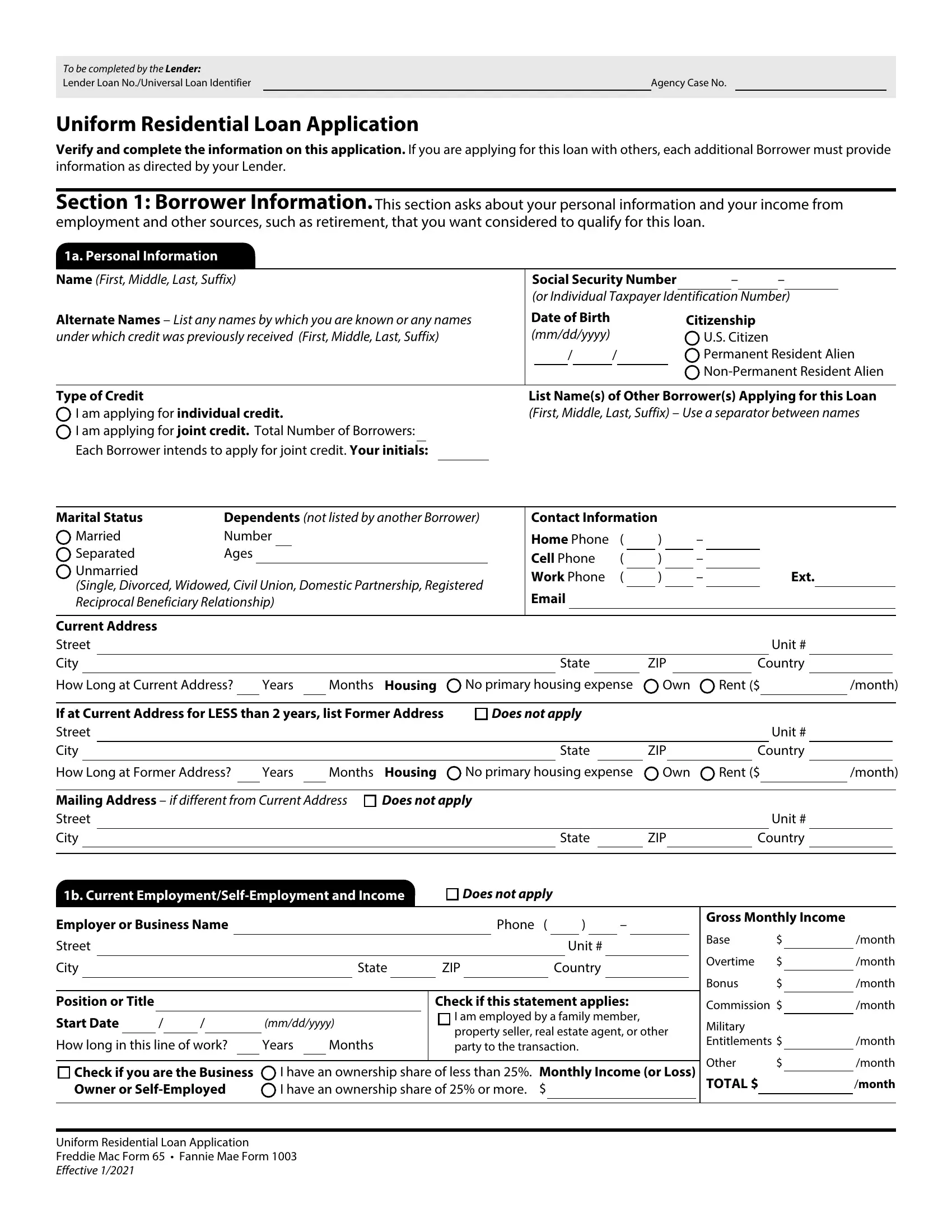

In order to finalize this document, be certain to provide the information you need in every blank:

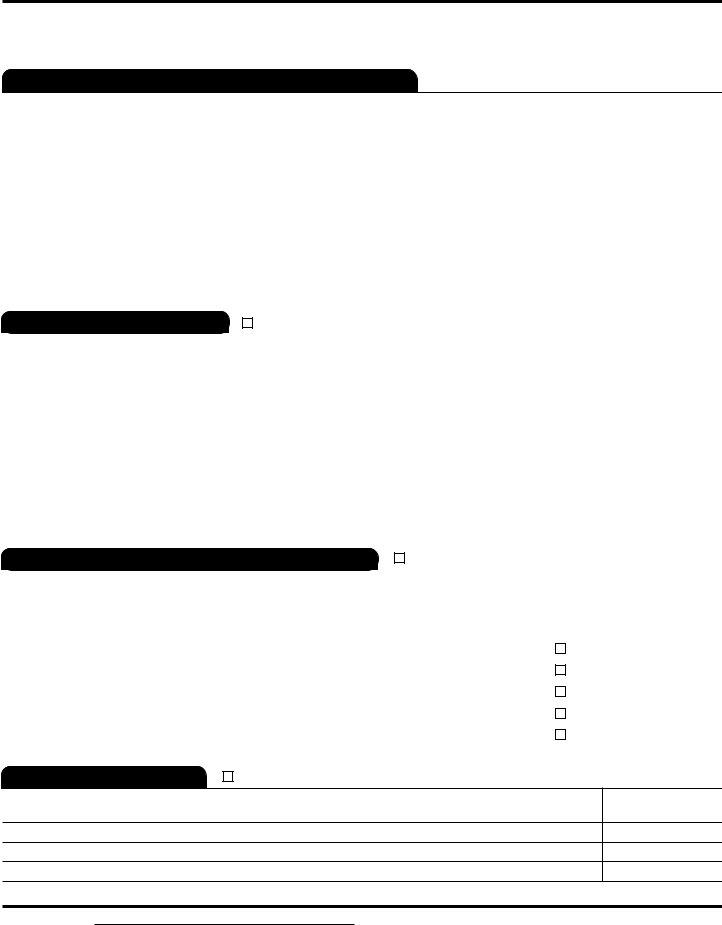

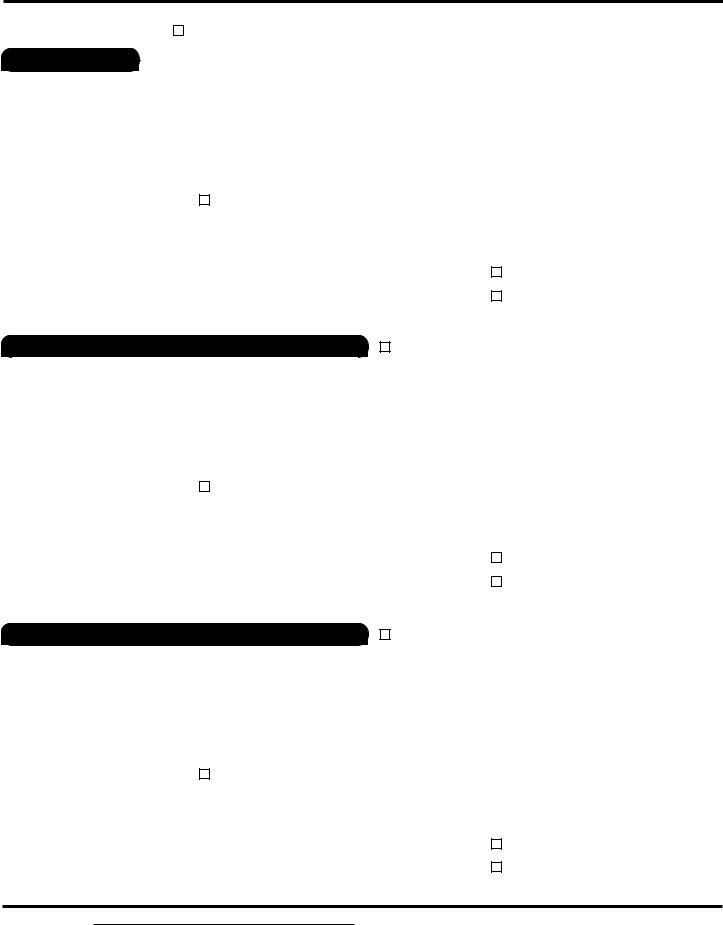

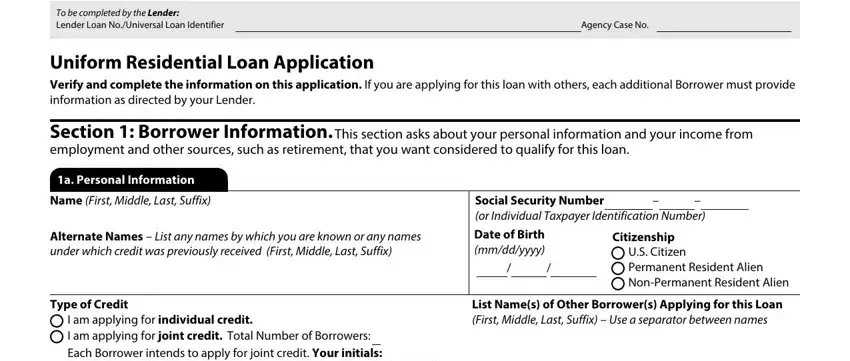

1. You need to complete the Freddie Mac Form 65 accurately, thus be careful when filling out the sections containing these fields:

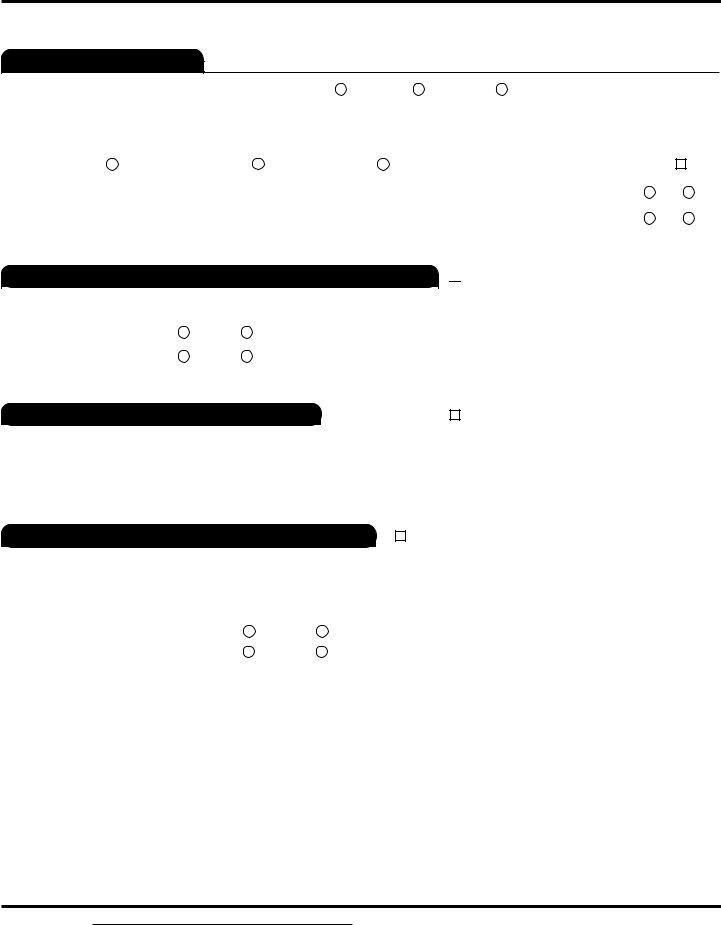

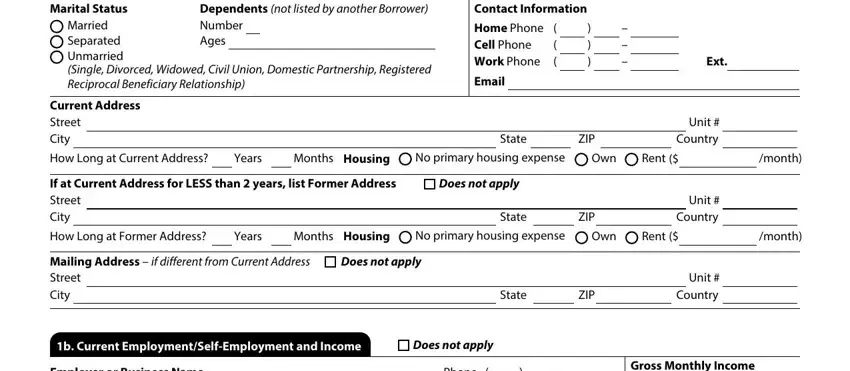

2. When the last selection of blanks is filled out, proceed to type in the suitable details in all these - Marital Status, Dependents not listed by another, Married Separated Unmarried Single, Current Address Street City, Contact Information, Home Phone Cell Phone Work Phone, Email, State, ZIP, Ext, Unit Country, How Long at Current Address, Years, Months Housing, and No primary housing expense.

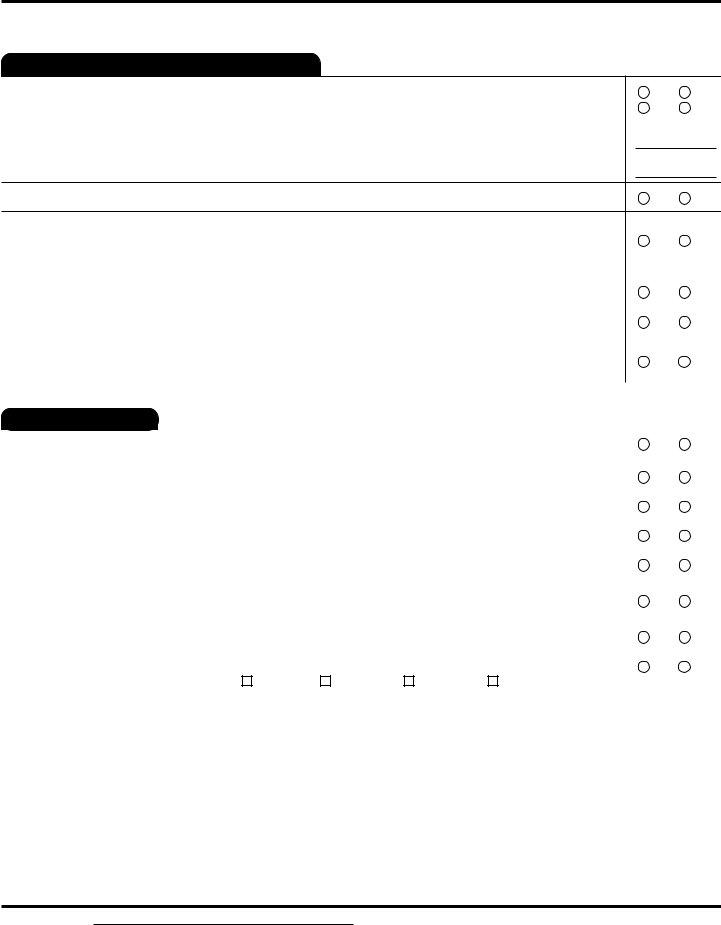

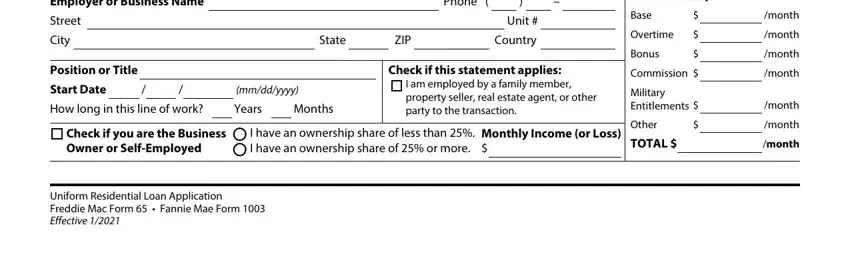

3. The following portion is focused on Phone, Gross Monthly Income, State, ZIP, Unit, Country, Base, Overtime, Bonus, Commission, Military Entitlements, Other, TOTAL, month, and month - type in each one of these blanks.

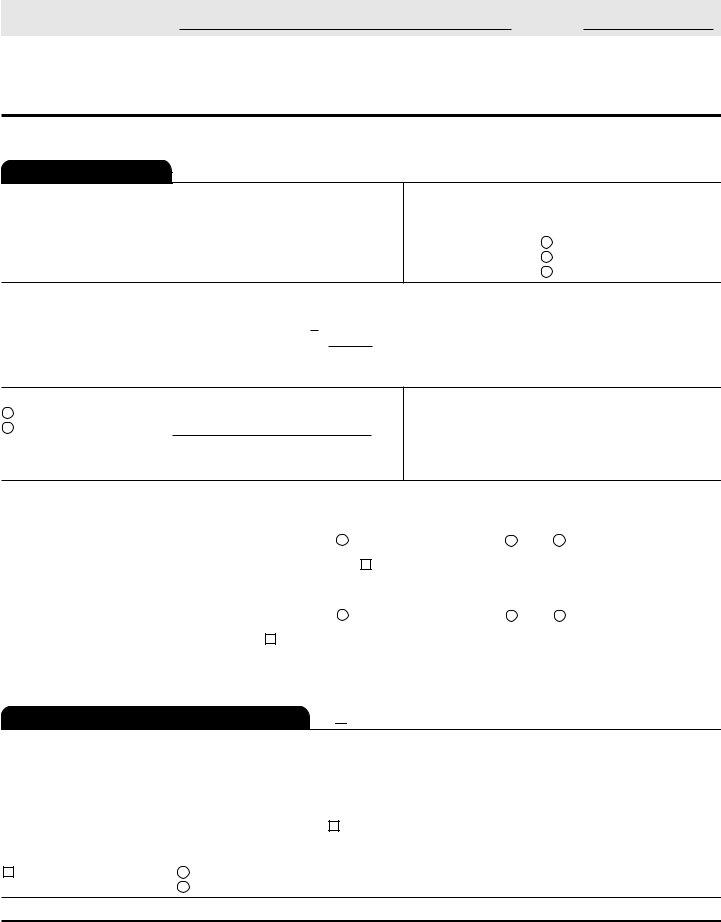

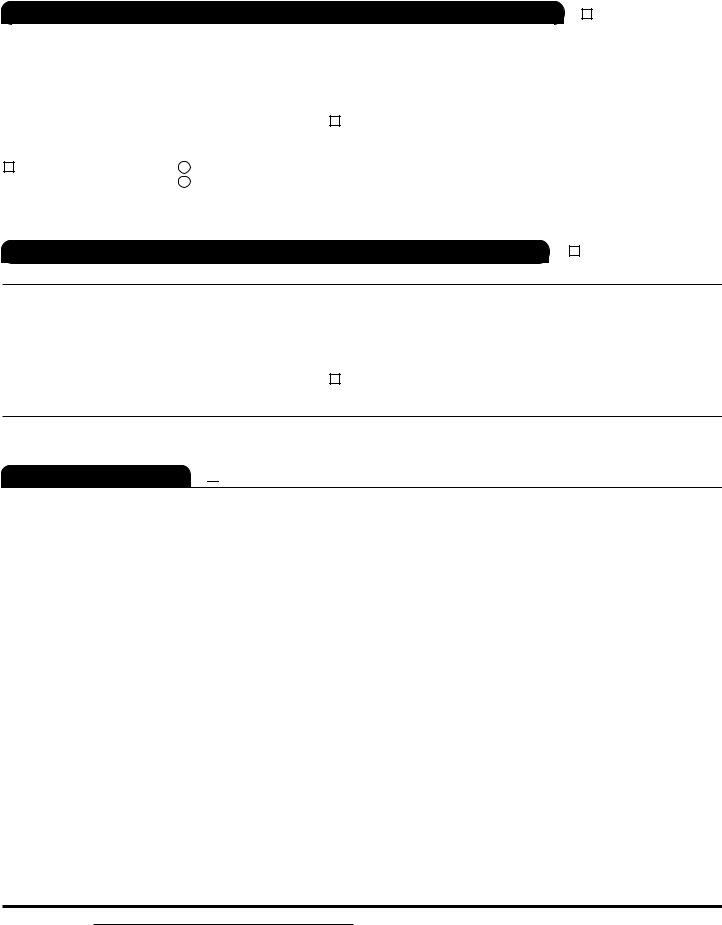

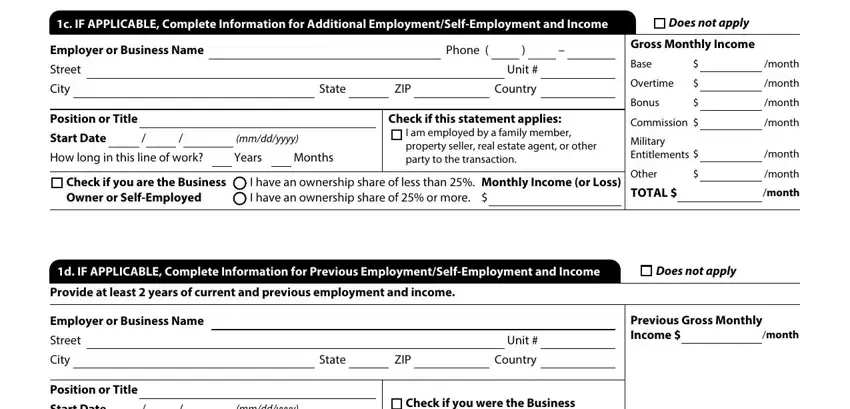

4. This fourth section comes with all of the following empty form fields to complete: c IF APPLICABLE Complete, Does not apply, Phone, Gross Monthly Income, State, ZIP, Unit, Country, Base, Overtime, Bonus, Commission, Military Entitlements, Other, and TOTAL.

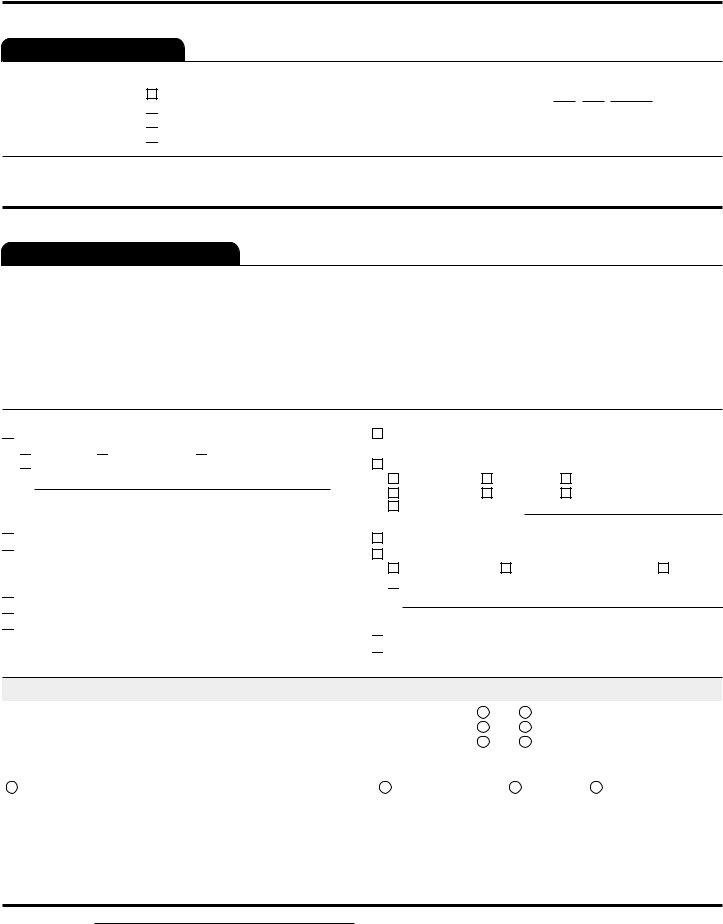

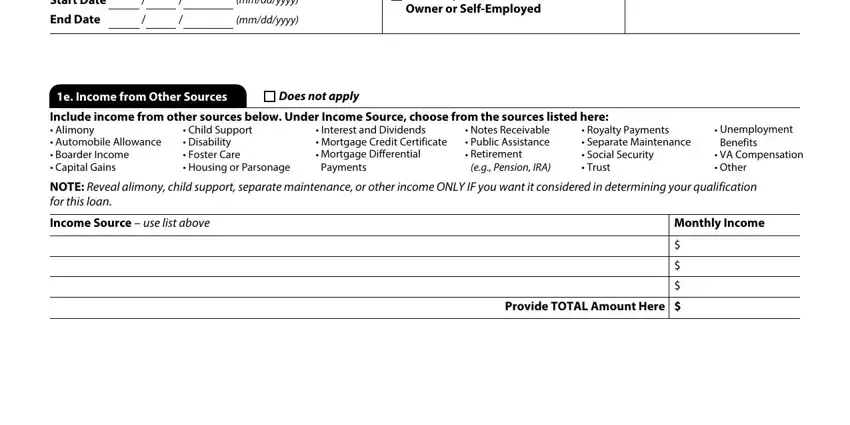

5. To conclude your form, this particular subsection has several extra blank fields. Entering Start Date, End Date, mmddyyyy, mmddyyyy, Check if you were the Business, e Income from Other Sources, Does not apply, Include income from other sources, Interest and Dividends Mortgage, Child Support Disability Foster, Notes Receivable Public, Royalty Payments Separate, Unemployment Benefits, VA Compensation Other, and NOTE Reveal alimony child support will wrap up the process and you'll be done in a flash!

Many people frequently make errors while completing Interest and Dividends Mortgage in this part. Ensure you read again everything you enter here.

Step 3: After taking one more look at the fields, click "Done" and you're all set! Sign up with FormsPal today and easily gain access to Freddie Mac Form 65, available for download. All alterations you make are saved , so that you can change the pdf at a later time if necessary. Here at FormsPal, we endeavor to be sure that your information is stored protected.