You could work with form 91 2020 without difficulty with our online PDF tool. Our editor is continually evolving to provide the best user experience achievable, and that's thanks to our dedication to constant development and listening closely to customer opinions. To get the process started, take these easy steps:

Step 1: Simply click on the "Get Form Button" in the top section of this site to see our pdf file editing tool. Here you'll find all that is required to work with your file.

Step 2: With the help of our handy PDF file editor, you may do more than simply fill out blank form fields. Edit away and make your documents appear sublime with custom text put in, or modify the original input to perfection - all that comes with the capability to add your personal images and sign the PDF off.

This PDF doc requires some specific details; to ensure consistency, be sure to heed the guidelines further down:

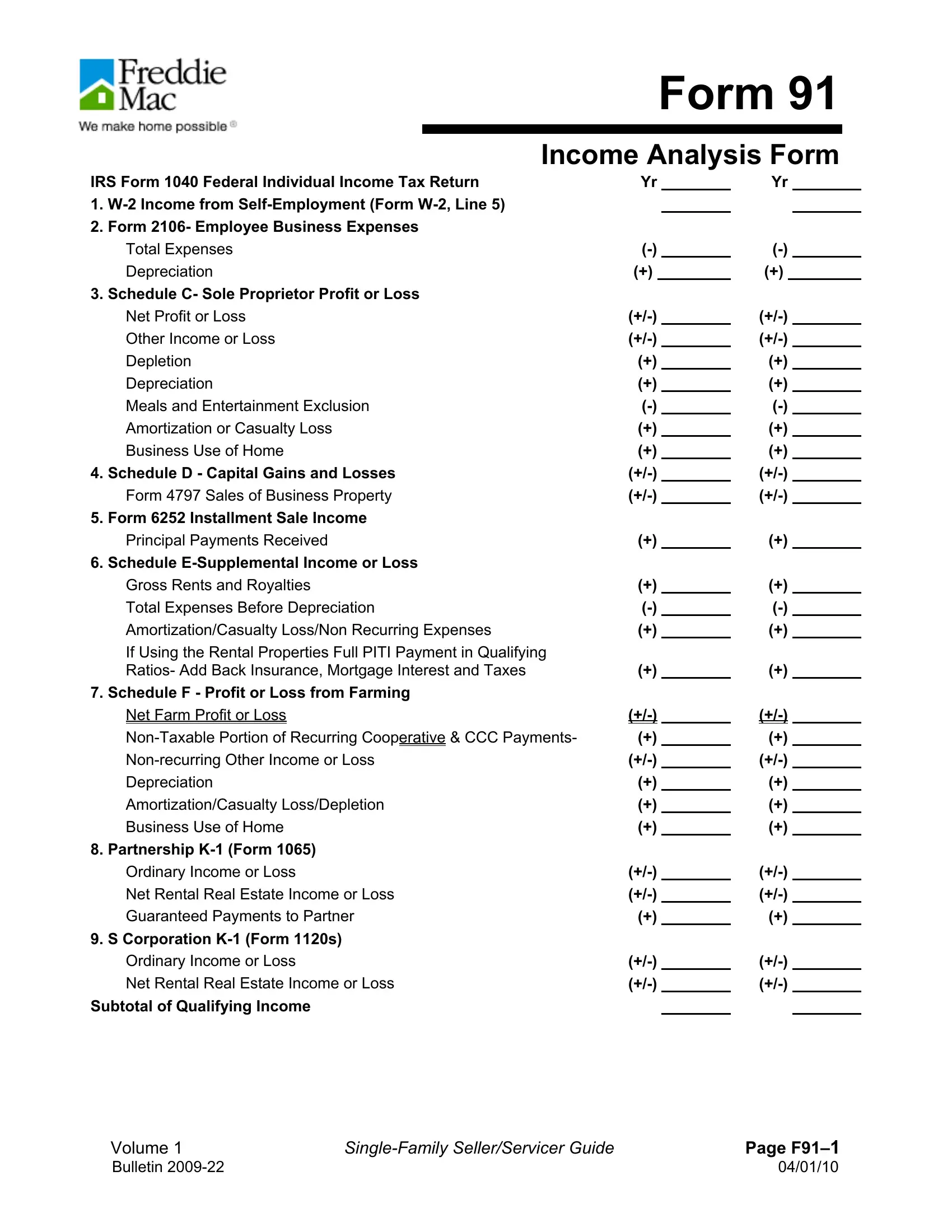

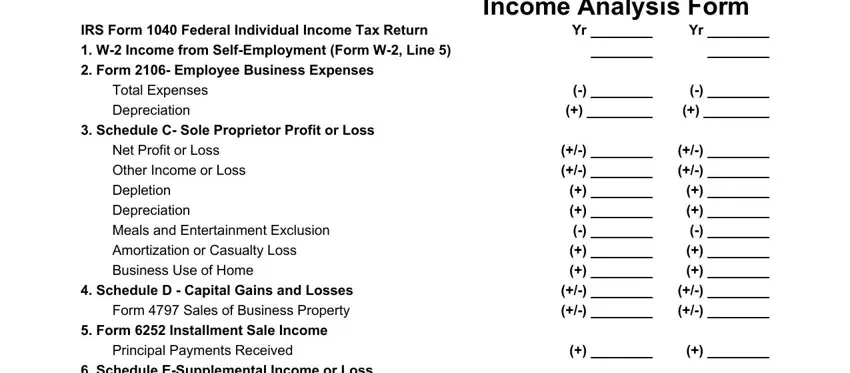

1. The form 91 2020 requires particular information to be inserted. Be sure the subsequent blank fields are filled out:

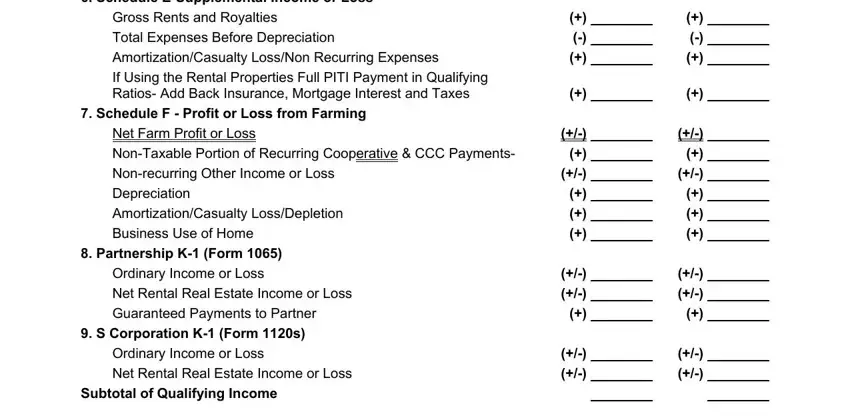

2. When the previous part is done, go on to enter the relevant information in these - Schedule ESupplemental Income or, Gross Rents and Royalties, Total Expenses Before Depreciation, AmortizationCasualty LossNon, If Using the Rental Properties, Schedule F Profit or Loss from, Net Farm Profit or Loss, Nonrecurring Other Income or Loss, Depreciation, AmortizationCasualty LossDepletion, Business Use of Home, Partnership K Form, Ordinary Income or Loss, Net Rental Real Estate Income or, and Guaranteed Payments to Partner.

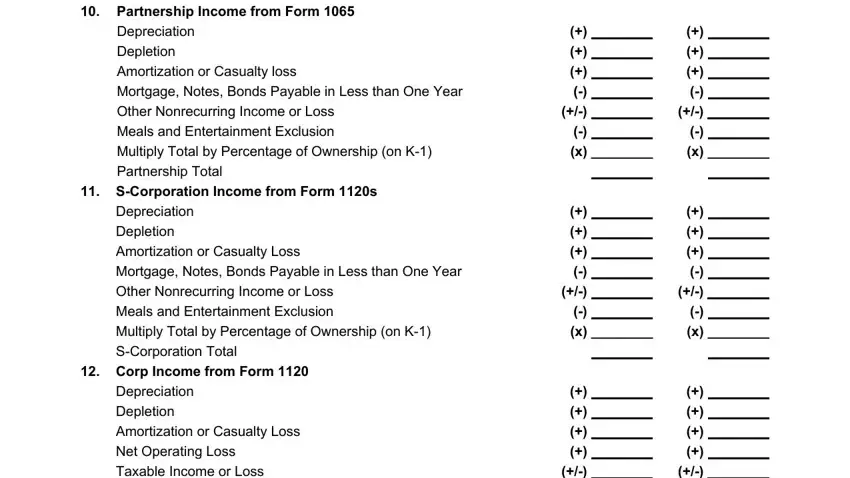

3. In this particular part, examine Partnership Income from Form, Depreciation, Depletion, Amortization or Casualty loss, Mortgage Notes Bonds Payable in, Mortgage Notes Bonds Payable in, Other Nonrecurring Income or Loss, Meals and Entertainment Exclusion, Multiply Total by Percentage of, Partnership Total, SCorporation Income from Form s, Depreciation, Depletion, Amortization or Casualty Loss, and Other Nonrecurring Income or Loss. These will need to be completed with greatest accuracy.

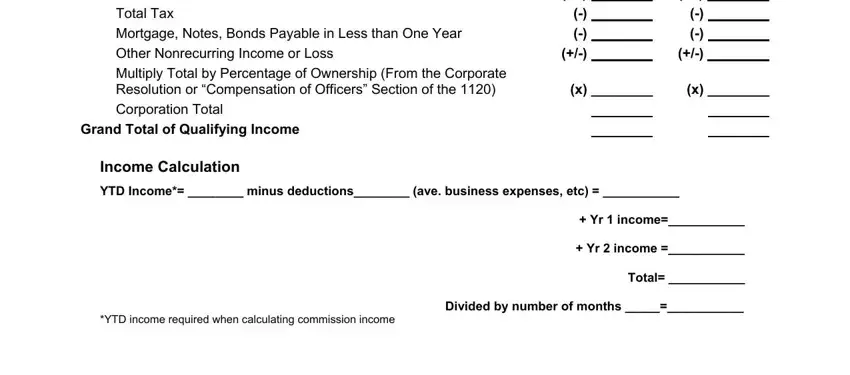

4. Now fill out this fourth section! In this case you have all these Taxable Income or Loss, Total Tax, Mortgage Notes Bonds Payable in, Other Nonrecurring Income or Loss, Multiply Total by Percentage of, Corporation Total, Grand Total of Qualifying Income, Income Calculation, YTD Income minus deductions ave, and Divided by number of months fields to complete.

Regarding Mortgage Notes Bonds Payable in and Other Nonrecurring Income or Loss, ensure that you double-check them in this section. These could be the key fields in the form.

Step 3: Make sure that the information is accurate and then click "Done" to continue further. After setting up afree trial account with us, you will be able to download form 91 2020 or email it immediately. The file will also be available from your personal account with all of your adjustments. FormsPal guarantees secure form tools devoid of data record-keeping or distributing. Be assured that your details are in good hands with us!