Managing the finances of federally or state-funded projects requires meticulous attention to detail and stringent record-keeping, and one vital tool in this process is the FS-10-F Long Form. This detailed document, issued by the University of the State of New York through its State Education Department, serves as the final expenditure report for agencies handling such projects. It encompasses a wide array of financial data, including salaries for professional and support staff, purchased services, supplies and materials, travel expenses, and employee benefits, among others. Each section must be completed with whole dollar amounts and backed by complete records, as agencies may need to provide additional details to support reported expenditures. The form requires the original signature of the Chief Administrative Officer or their designee and necessitates submission to the Grants Finance department. Additionally, it includes specific considerations for special legislative projects, reinforcing the importance of accuracy and compliance. Undoubtedly, the FS-10-F Long Form is integral for ensuring financial accountability and transparency in managing educational grants and projects. Its comprehensive layout aids agencies in maintaining a clear audit trail, assisting both internal and external stakeholders in understanding how funds are utilized within these crucial initiatives.

| Question | Answer |

|---|---|

| Form Name | Fs 10 F Long Form |

| Form Length | 8 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 2 min |

| Other names | closeout, BOCES, oms, FS-10-F |

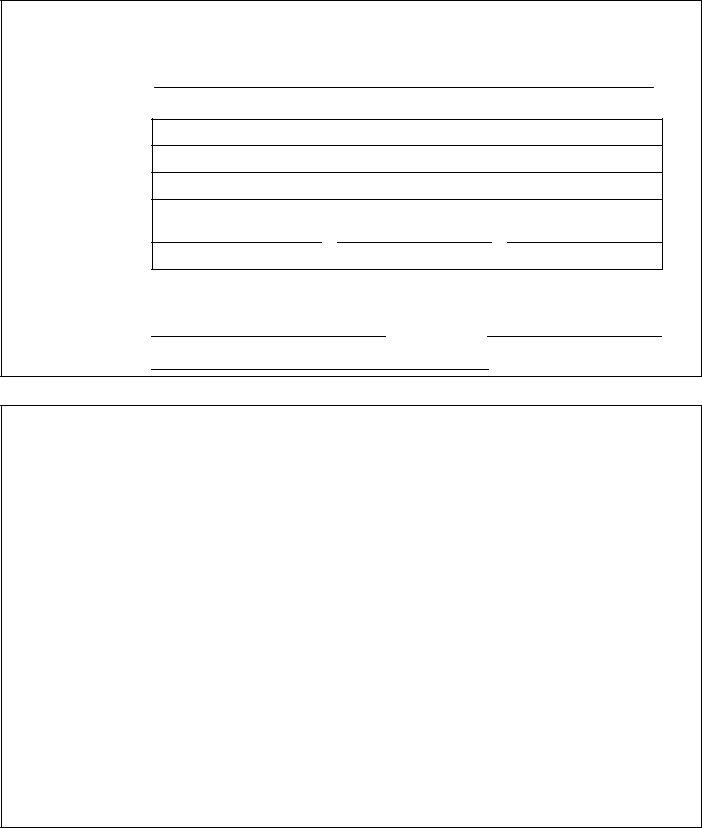

The University of the State of New York |

FINAL EXPENDITURE REPORT FOR A |

THE STATE EDUCATION DEPARTMENT |

FEDERAL OR STATE PROJECT |

Grants Finance, Room 510W EB |

|

Albany, New York 12234 |

|

Funding Source:

Report Prepared By:

Agency Name:

Mailing Address:

Telephone # of Report Preparer:

Local Agency Information

Street

City |

State |

Zip Code |

County:

INSTRUCTIONS

Agencies must maintain complete and accurate records and may be requested to provide additional detail to support reported expenditures.

Submit one report with original signature and one copy directly to Grants Finance, New York State Education Department, Room 510W EB, Albany, NY 12234.

For Special Legislative Projects, submit one report with original signature and two copies, along with a final program narrative report.

All encumbrances must have taken place within the approved funding dates of the project.

Use whole dollar amounts.

Certification on page 8 must be signed by Chief Administrative Officer or designee.

For further information about completing the final expenditure report, please refer to the Fiscal Guidelines for Federal and State Aided Grants at www.oms.nysed.gov/cafe/ or contact Grants Finance at grantsweb@mail.nysed.gov or (518)

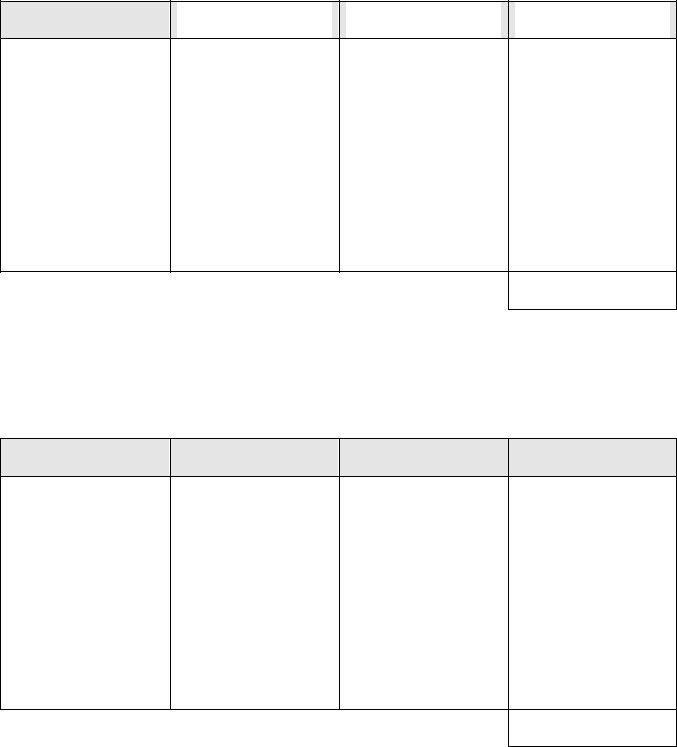

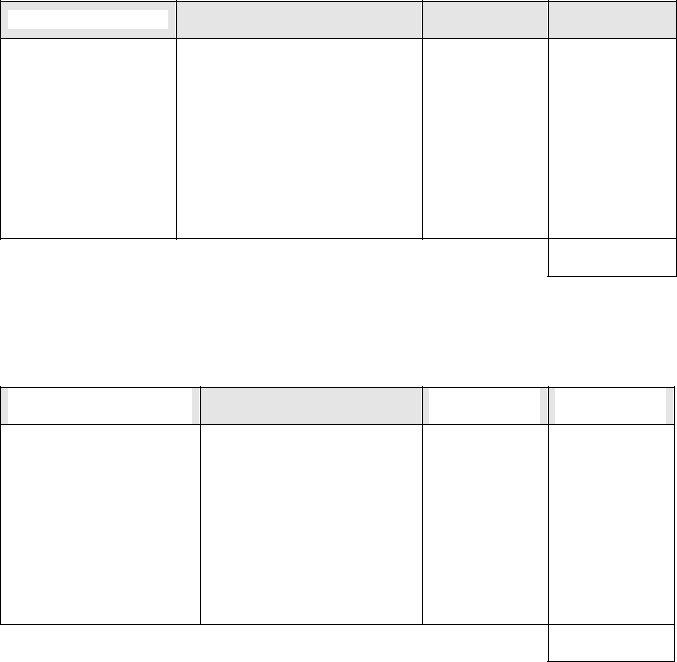

SALARIES FOR PROFESSIONAL STAFF: Code 15

Include all salaries for professional staff approved for reimbursement in budget.

Name

Position

Title

Beginning and Ending Dates of Employment

Salary

Paid

Subtotal - Code 15

SALARIES FOR SUPPORT STAFF: Code 16

Include all salaries for support staff approved for reimbursement in budget.

Name

Position

Title

Beginning and Ending Dates of Employment

Salary

Paid

Subtotal - Code 16

PURCHASED SERVICES: Code 40

Encumbrance Date

Provider of Service

Check or

Journal Entry #

Amount

Expended

Subtotal - Code 40

SUPPLIES AND MATERIALS: Code 45

Purchase

Order Date

Vendor

Check or

Journal Entry #

Amount

Expended

Subtotal - Code 45

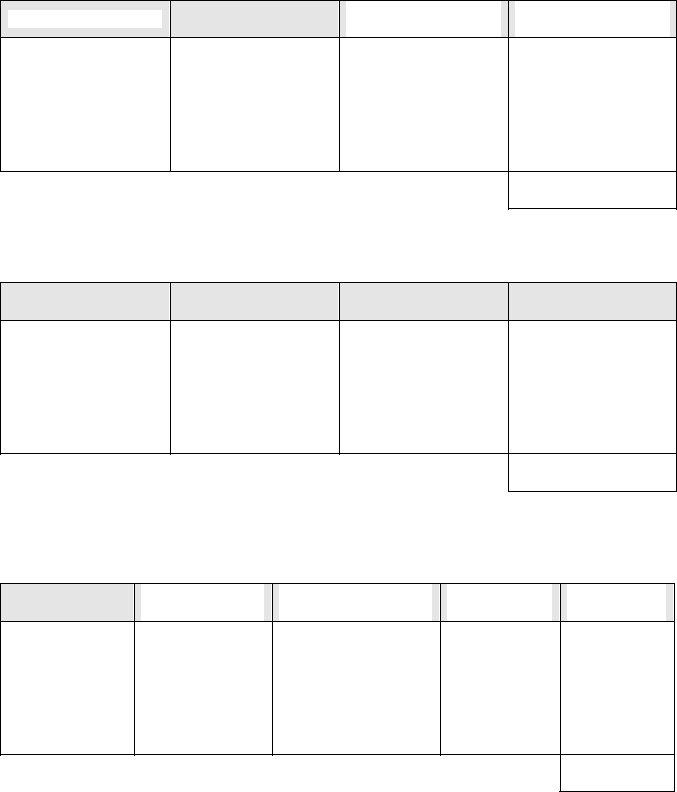

TRAVEL EXPENSES: Code 46

Dates of Travel

Name of Traveler

Destination and Purpose

Check or

Journal Entry

Amount

Expended

Subtotal - Code 46

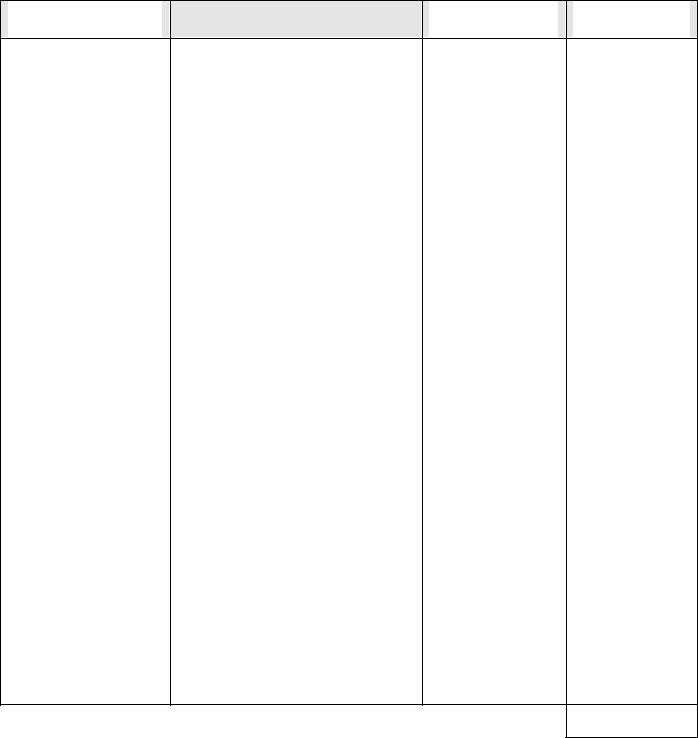

EMPLOYEE BENEFITS: Code 80

List only the total project salary amount for each benefit category. Benefits may only be claimed for salaries reported in Code 15 or Code 16. Rates used for project personnel must be the same as those used for other agency personnel.

Benefit

Project Salaries

Rate

Amount

Expended

Teacher Retirement

Employee Retirement

Other Retirement

Social Security

Worker's Compensation

Unemployment Insurance

Health Insurance

Other (Identify)

Subtotal – Code 80

INDIRECT COST: Code 90

A.Modified Direct Cost Base – Sum of all preceding subtotals (codes 15, 16, 40, 45, 46, and 80 and excludes the portion of each subcontract exceeding $25,000 and any flow through funds)

B.Approved Restricted Indirect Cost Rate

C. (A) x (B) = Total Indirect Cost |

Subtotal – Code 90 |

$ |

(A) |

|

|

% |

(B) |

|

|

$ |

(C) |

|

|

PURCHASED SERVICES WITH BOCES: Code 49

Encumbrance Date

Name of BOCES

Check or

Journal Entry #

Amount

Expended

Subtotal – Code 49

MINOR REMODELING: Code 30

Include expenditures for salaries, associated employee benefits, purchased services and supplies and materials related to alterations to existing sites.

Purchase Order Date Or Dates of Service

Provider of Service

Check or

Journal Entry #

Amount

Expended

Subtotal – Code 30

EQUIPMENT: Code 20

Items of equipment purchased must agree in type and number with the equipment approved in the project budget.

Purchase

Order Date

Vendor

Check or

Journal Entry #

Amount

Expended

Subtotal - Code 20

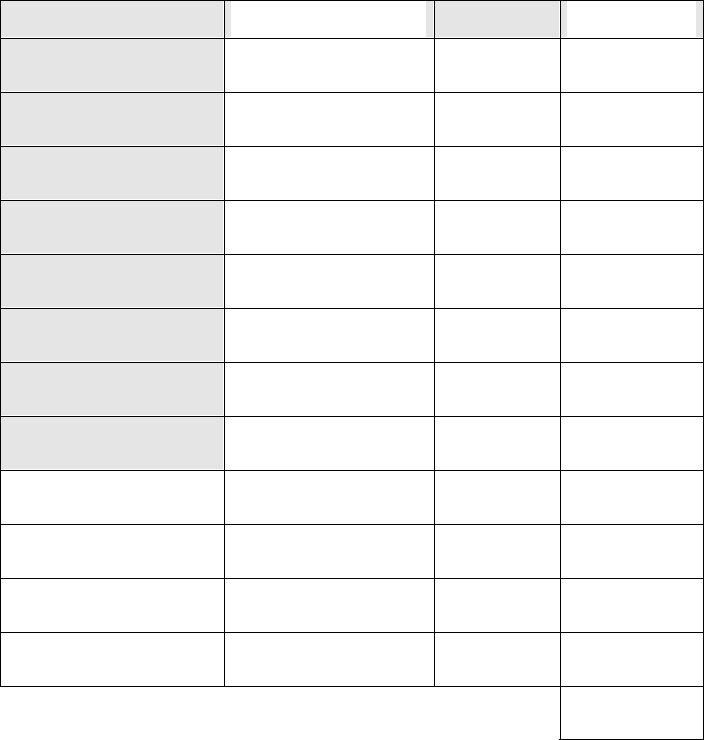

REMINDERS

Be sure to submit one report with original signature and one copy directly to Grants Finance, New York State Education Department, Room 510W EB, Albany, NY 12234.

Agencies should use the

For State projects, final expenditure reports are due within 30 days after the project end date. Reports for federal projects are due within 90 days after the project end date. For certain programs, the Department program manager may impose an earlier due date. See the Grant Award Notice to verify the due date.

After review by Grants Finance, a copy of the

All encumbrances must be made within the approved project funding dates, which are indicated on the approved

Be sure to check your math and carry all subtotals forward to the Summary on Page 8. Simple mathematical errors often require Grants Finance to contact the local agency, resulting in unnecessary delays in closeout and final payment. Use whole dollars only.

The modified direct cost used in the calculation of indirect cost cannot include equipment, minor remodeling, the portion of each subcontract exceeding $25,000 and any

Be sure to complete the agency code and project # on Page 8. For Special Legislative Projects and grant contracts, also enter the contract #.

Please make sure that Page 8 faces out.

38

|

|

Page 8 |

|

|

|

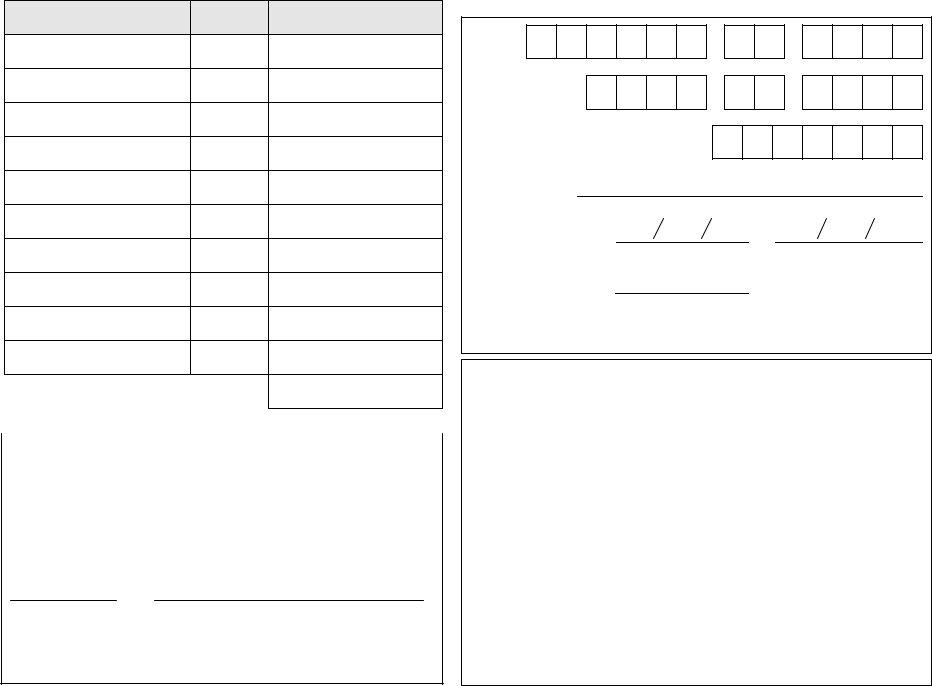

FINAL EXPENDITURE SUMMARY |

|

|

|

||

SUBTOTAL |

CODE |

PROJECT COSTS |

|

|

|

|

|

|

Agency |

|

|

Professional Salaries |

15 |

|

Code: |

|

|

Support Staff Salaries |

16 |

|

Project #: |

|

|

|

|

|

|

|

|

Purchased Services |

40 |

|

|

|

|

Supplies and Materials |

45 |

|

Contract #: |

|

|

|

|

|

|

||

Travel Expenses |

46 |

|

Agency Name: |

|

|

|

|

|

|

||

Employee Benefits |

80 |

|

Project Funding |

|

|

|

Dates: |

|

|

||

|

|

|

|

|

|

Indirect Cost |

90 |

|

|

From |

To |

|

Approved Budget |

|

|

||

|

|

|

|

|

|

BOCES Services |

49 |

|

Total: |

$ |

|

|

|

|

|

||

Minor Remodeling |

30 |

|

|

|

|

Equipment |

20 |

|

|

|

|

Grand Total |

|

|

FOR DEPARTMENT USE ONLY |

|

|

|

|

|

|

|

|

|

|

|

|

Fiscal Year |

|

Amount Expended |

Final Payment |

|

||||||||

|

|

|

__________ |

|

$ |

|

|

|

|

|

$ |

|

|

|

||

|

CHIEF ADMINISTRATOR'S CERTIFICATION |

__________ |

|

$ |

|

|

|

|

|

$ |

|

|

|

|||

|

I hereby certify that all expenditures reported herein are directly |

__________ |

|

$ |

|

|

|

|

|

$ |

|

|

|

|||

|

__________ |

|

$ |

|

|

|

|

|

$ |

|

|

|

||||

|

attributable to this project and have been made in accordance with |

|

|

|

|

|

|

|

|

|||||||

|

the approved budget and all applicable Federal and State laws and |

__________ |

|

$ |

|

|

|

|

|

$ |

|

|

|

|||

|

regulations. |

|

|

|

|

|

|

|

|

|

||||||

|

|

_______________ |

|

$ |

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

||||||||

|

Date |

Signature |

|

|

|

Voucher # |

Final Payment |

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

Finance: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name and Title of Chief Administrative Officer |

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Log Approved MIR