If you want to fill out usda fsa 2002, you won't have to download and install any applications - simply try our PDF tool. Our tool is consistently developing to deliver the very best user experience possible, and that's because of our dedication to continual improvement and listening closely to feedback from customers. This is what you'd want to do to begin:

Step 1: Access the PDF doc in our editor by pressing the "Get Form Button" above on this webpage.

Step 2: This editor enables you to customize almost all PDF files in various ways. Modify it by including personalized text, correct existing content, and place in a signature - all at your convenience!

Filling out this form generally requires attention to detail. Ensure that every blank field is filled out accurately.

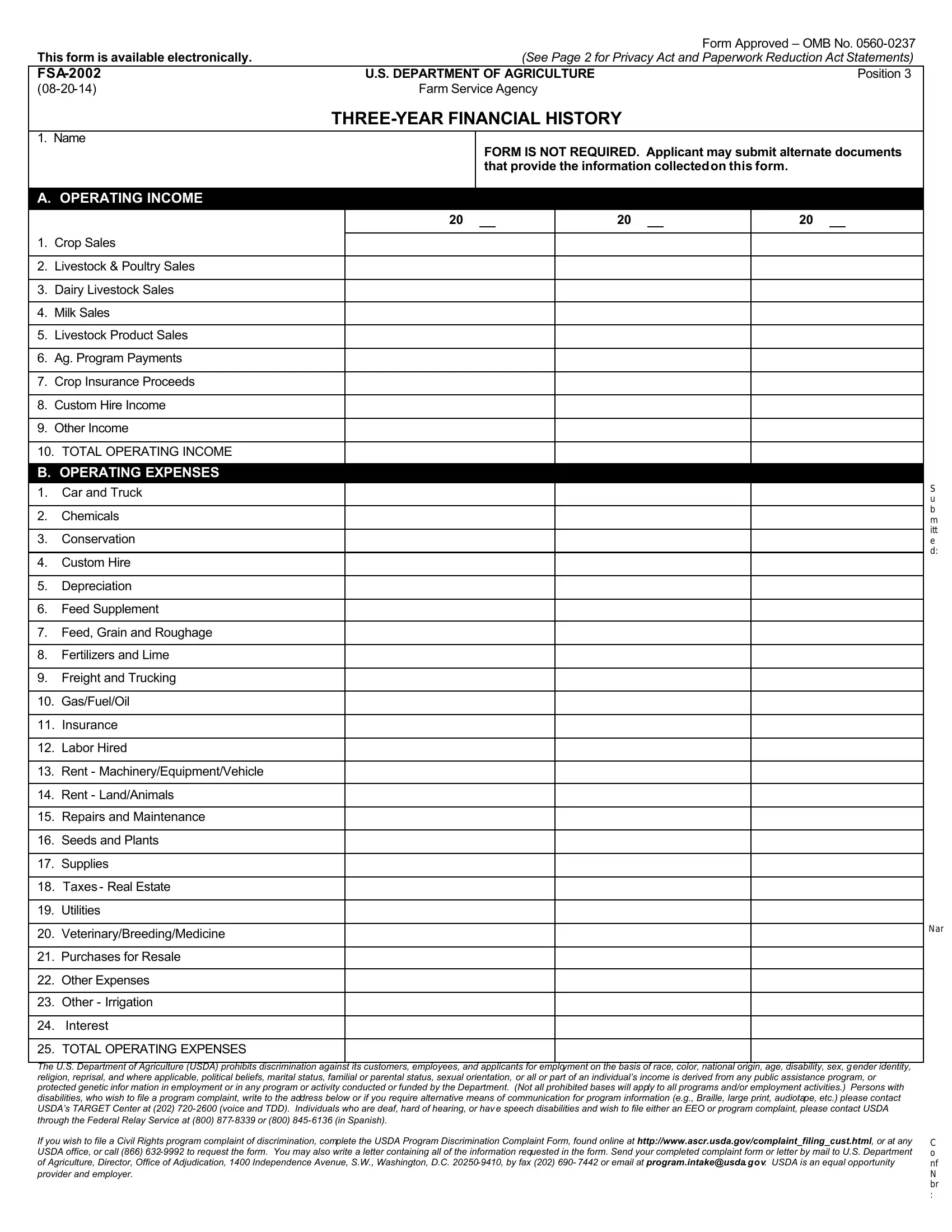

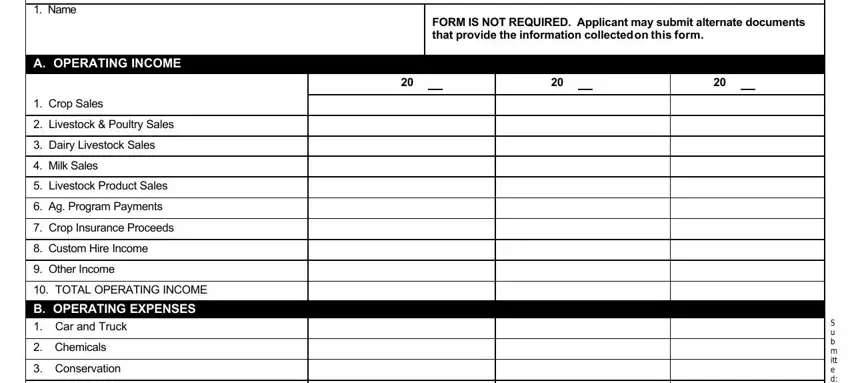

1. The usda fsa 2002 usually requires particular details to be inserted. Be sure that the next blanks are filled out:

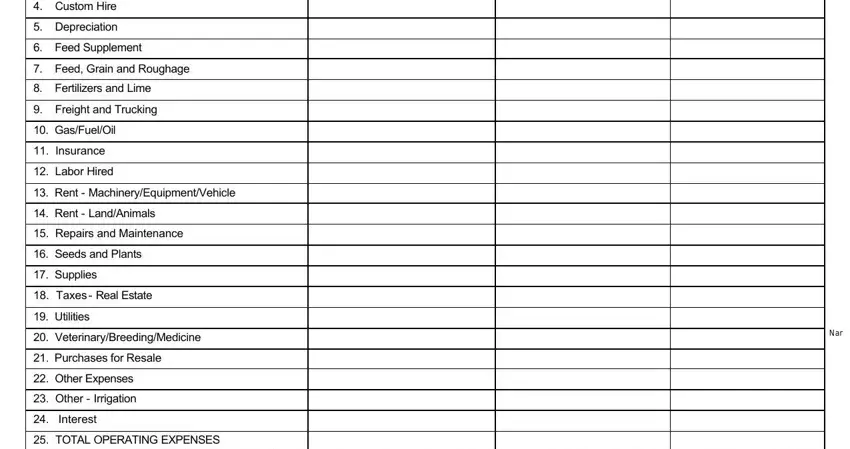

2. The next stage would be to complete the following fields: GasFuelOil, Insurance, Labor Hired, Depreciation, Custom Hire, Feed Supplement, Fertilizers and Lime, Rent LandAnimals, Freight and Trucking, Repairs and Maintenance, Feed Grain and Roughage, Rent MachineryEquipmentVehicle, The US Department of Agriculture, TOTAL OPERATING EXPENSES, and VeterinaryBreedingMedicine.

3. This step is usually straightforward - complete all of the empty fields in The US Department of Agriculture to finish this process.

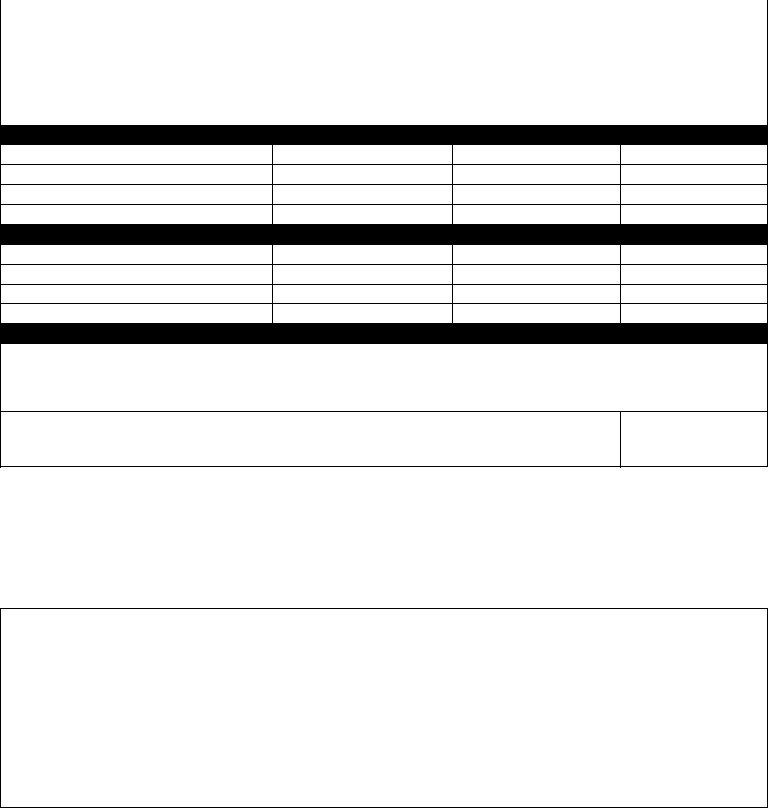

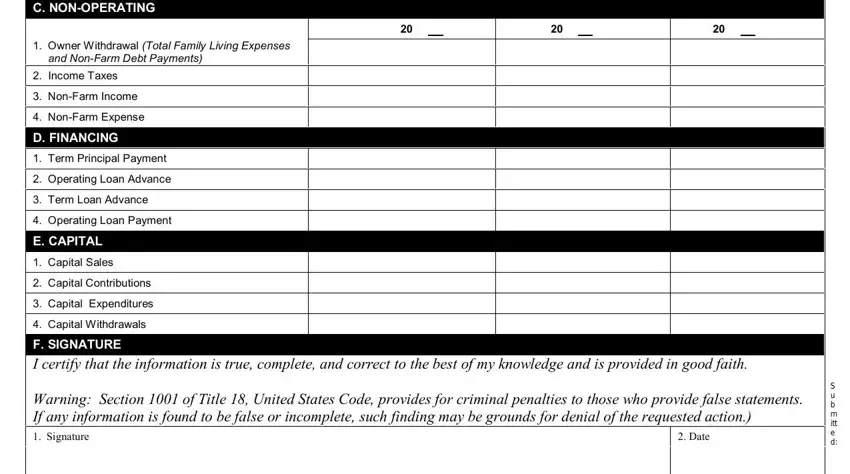

4. To go onward, this next stage involves filling in a couple of form blanks. Examples include C NONOPERATING, Owner Withdrawal Total Family, and NonFarm Debt Payments, Income Taxes, NonFarm Income, NonFarm Expense, D FINANCING, Term Principal Payment, Operating Loan Advance, Term Loan Advance, Operating Loan Payment, E CAPITAL, Capital Sales, Capital Contributions, and Capital Expenditures, which you'll find crucial to continuing with this document.

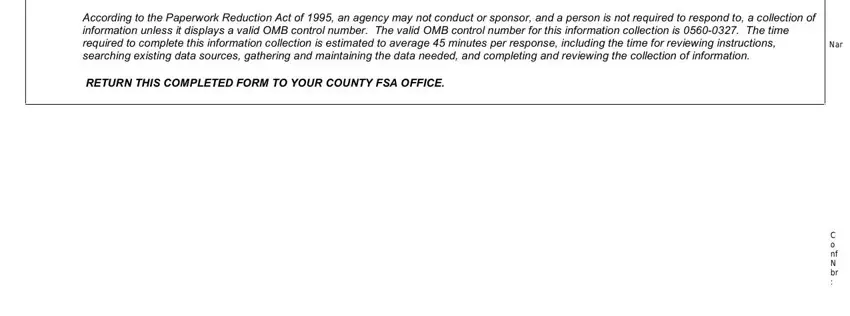

5. This very last section to submit this form is integral. You must fill out the displayed blank fields, for example According to the Paperwork, and RETURN THIS COMPLETED FORM TO YOUR, before using the document. Failing to do so can generate an unfinished and potentially invalid document!

People frequently make some errors while filling out According to the Paperwork in this part. Ensure you double-check everything you type in right here.

Step 3: When you've reread the information you given, click "Done" to finalize your form. Sign up with FormsPal today and easily use usda fsa 2002, available for download. All modifications you make are preserved , making it possible to change the pdf later on if required. When using FormsPal, you're able to fill out forms without needing to get worried about data incidents or data entries being shared. Our protected software ensures that your personal details are maintained safely.