Through the online PDF editor by FormsPal, it is easy to fill out or alter filing out michigan 743 form examples here. The tool is consistently updated by our staff, acquiring powerful functions and becoming better. Starting is effortless! All that you should do is follow the following basic steps down below:

Step 1: First, open the pdf tool by clicking the "Get Form Button" above on this site.

Step 2: The editor lets you change almost all PDF files in many different ways. Change it by writing any text, adjust what's already in the document, and put in a signature - all within several clicks!

Completing this PDF generally requires attentiveness. Make sure that all required fields are done accurately.

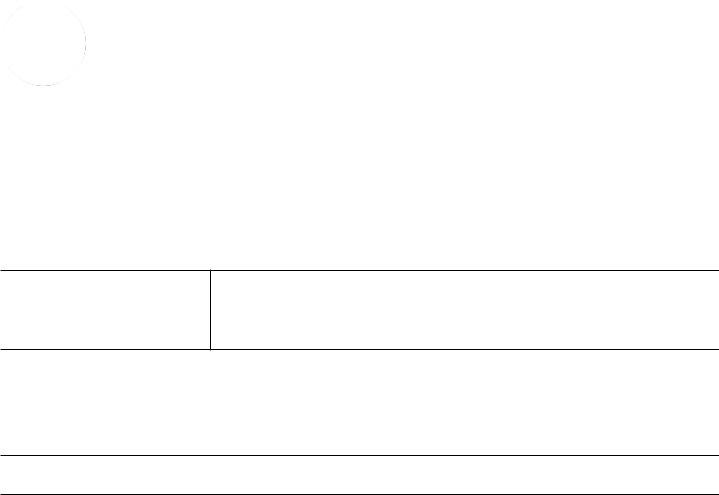

1. When filling in the filing out michigan 743 form examples, be certain to complete all needed blank fields in its relevant area. This will help to expedite the work, allowing for your details to be handled promptly and appropriately.

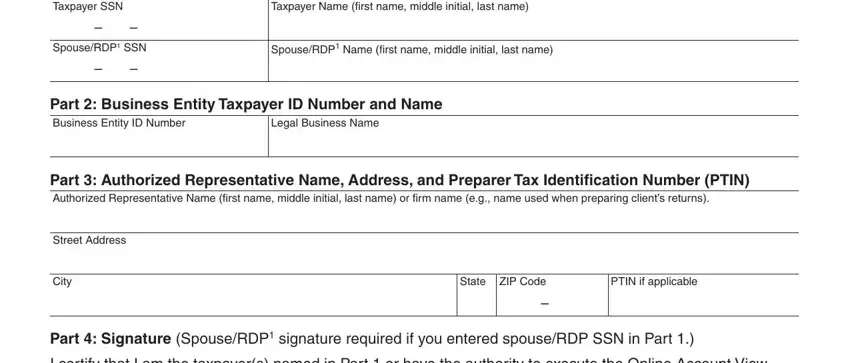

2. Just after finishing this step, go on to the subsequent step and fill out all required particulars in these fields - I certify that I am the taxpayers, Taxpayer Signature Date, SpouseRDP Signature Date, Business Entity Taxpayer Signature, Print Name and Title, Retention Information Individual, Get FTB Franchise Tax Board, RDP refers to a registered, and FTB REV.

You can certainly get it wrong while filling out the Get FTB Franchise Tax Board, consequently make sure that you take another look prior to deciding to submit it.

Step 3: Once you have reread the details in the file's blanks, click on "Done" to complete your FormsPal process. Sign up with FormsPal today and immediately gain access to filing out michigan 743 form examples, set for download. Each modification you make is conveniently saved , helping you to customize the document at a later time if required. FormsPal guarantees secure form tools without personal information record-keeping or any sort of sharing. Rest assured that your details are safe here!