Dealing with PDF files online is certainly surprisingly easy with this PDF tool. You can fill in franchise tax board form 4107 here in a matter of minutes. Our team is aimed at providing you with the perfect experience with our editor by constantly presenting new capabilities and enhancements. With all of these improvements, working with our editor gets easier than ever before! Here's what you'd want to do to start:

Step 1: Access the PDF file inside our editor by clicking the "Get Form Button" at the top of this webpage.

Step 2: Using our state-of-the-art PDF editor, you can do more than just fill out blank fields. Try each of the features and make your documents seem perfect with custom text incorporated, or tweak the original input to perfection - all comes along with an ability to incorporate just about any pictures and sign the document off.

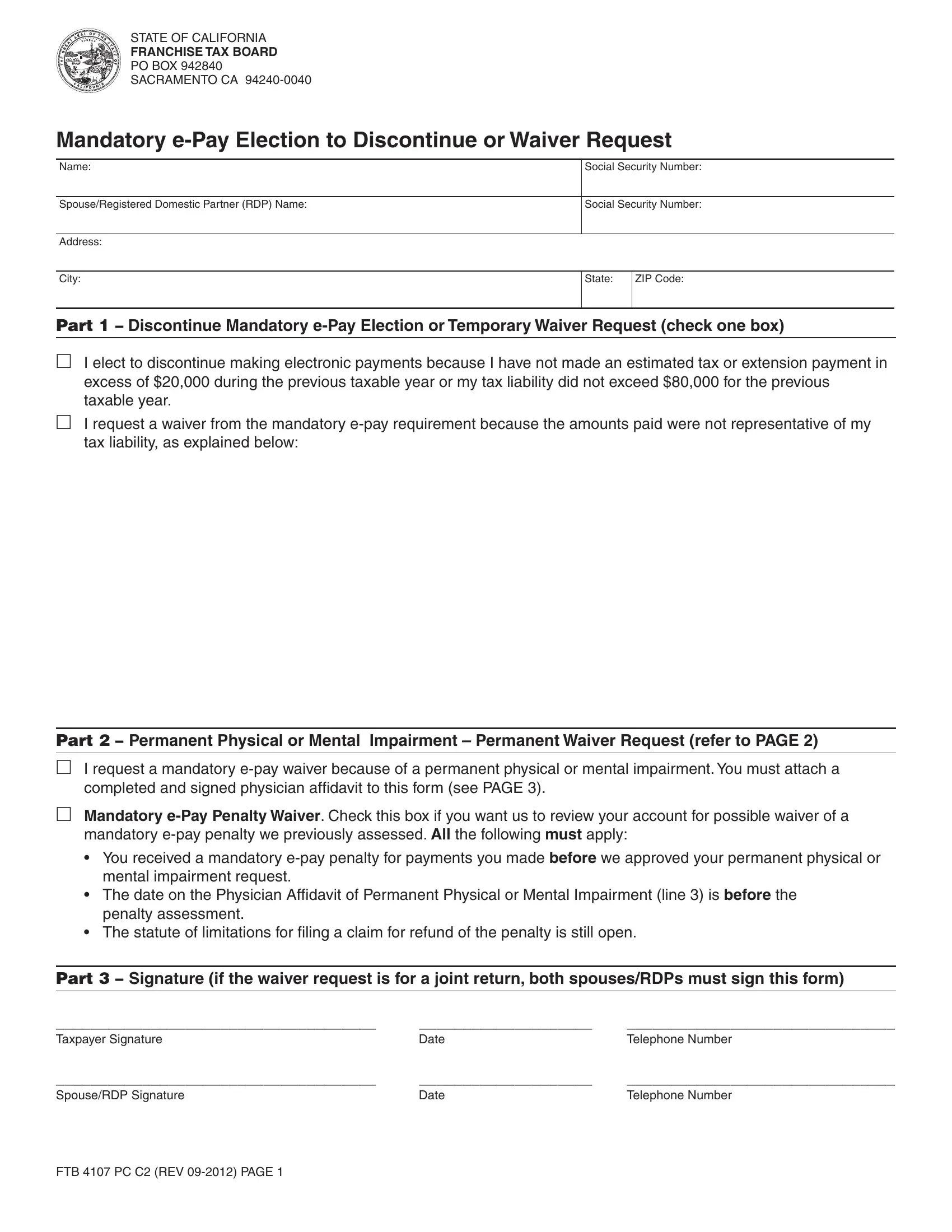

With regards to the blank fields of this specific document, here's what you should do:

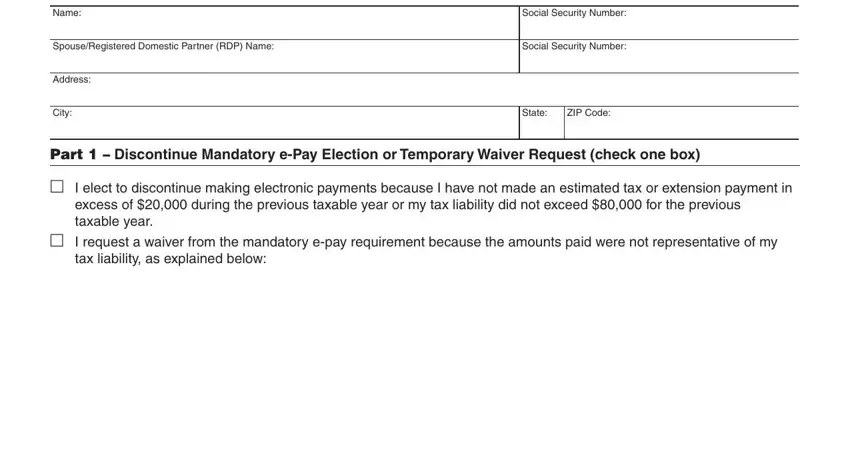

1. You'll want to complete the franchise tax board form 4107 correctly, thus be careful while filling in the areas containing these blank fields:

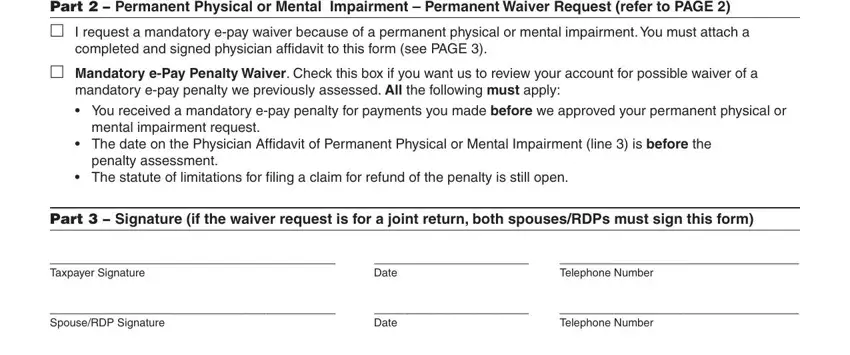

2. Just after finishing the last section, head on to the next stage and fill in the necessary details in all these blank fields - Part Permanent Physical or, m I request a mandatory epay, completed and signed physician, m Mandatory ePay Penalty Waiver, mandatory epay penalty we, mental impairment request, penalty assessment, Part Signature if the waiver, Taxpayer Signature, Date, Telephone Number, SpouseRDP Signature, Date, and Telephone Number.

It is possible to make an error when completing the mental impairment request, for that reason ensure that you look again before you'll finalize the form.

Step 3: Prior to finishing the document, double-check that blank fields have been filled out the correct way. When you are satisfied with it, click on “Done." Make a free trial subscription at FormsPal and gain instant access to franchise tax board form 4107 - with all changes saved and available inside your FormsPal cabinet. FormsPal guarantees your information privacy with a protected system that never saves or shares any type of personal data typed in. Feel safe knowing your paperwork are kept safe every time you use our editor!