Form ftb1096 is used to report a tax-exempt organization's unrelated business taxable income (UBTI) for the year. This form is due on the 15th day of the fifth month after the end of the tax year. For most organizations, this would be May 15th. UBTI is any income from a trade or business that is regularly carried on and not related to the organization's exempt purpose. There are many factors that can contribute to an organization's UBTI, so it's important to understand how this affects your tax status. Consult with a tax professional if you have any questions about how to report UBTI on form ftb1096.

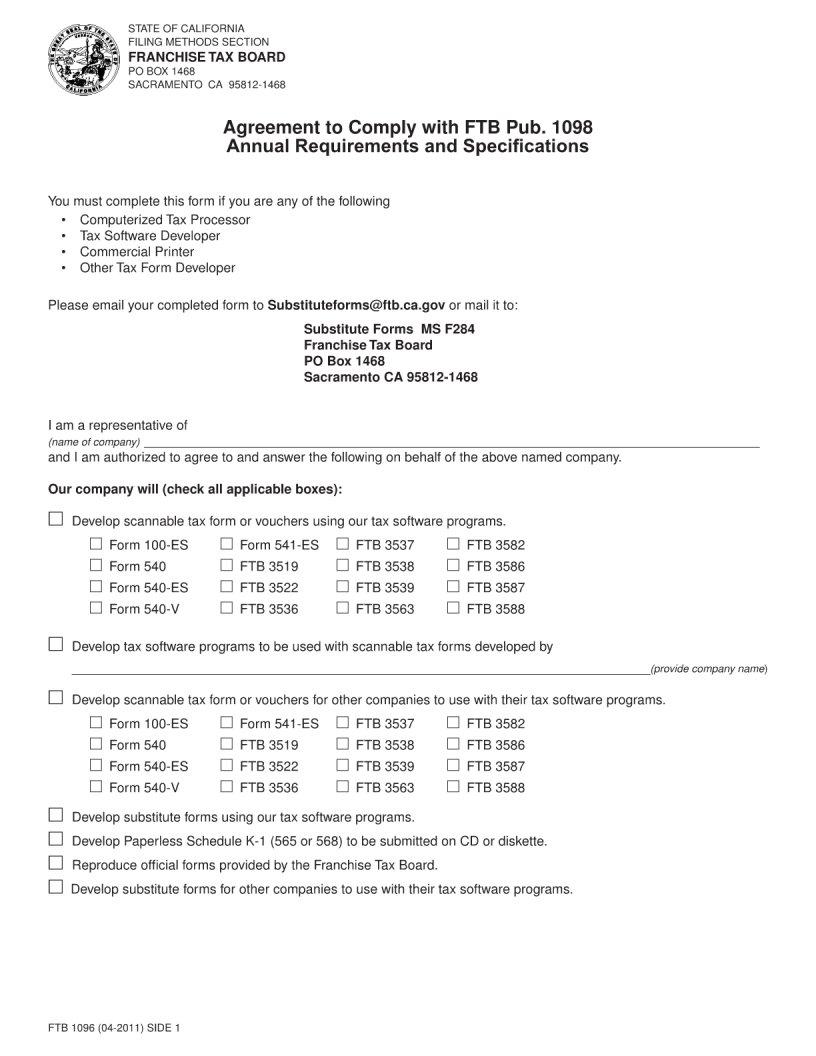

| Question | Answer |

|---|---|

| Form Name | Ftb1096 Form |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | 540-ES, pdffiller 1096 form, 100-ES, where to mail 1096 in california |