With the help of the online tool for PDF editing by FormsPal, it is possible to complete or modify Blank ... right here. FormsPal is dedicated to making sure you have the best possible experience with our editor by consistently releasing new capabilities and enhancements. Our tool has become a lot more useful thanks to the latest updates! Currently, filling out documents is easier and faster than ever. Here is what you will want to do to begin:

Step 1: Press the "Get Form" button above. It is going to open our tool so you could start completing your form.

Step 2: As you access the tool, you will find the form prepared to be filled out. Apart from filling out different blanks, you can also perform other things with the PDF, that is putting on any words, changing the original textual content, inserting illustrations or photos, placing your signature to the form, and a lot more.

Filling out this document needs attention to detail. Make certain every single blank field is filled in correctly.

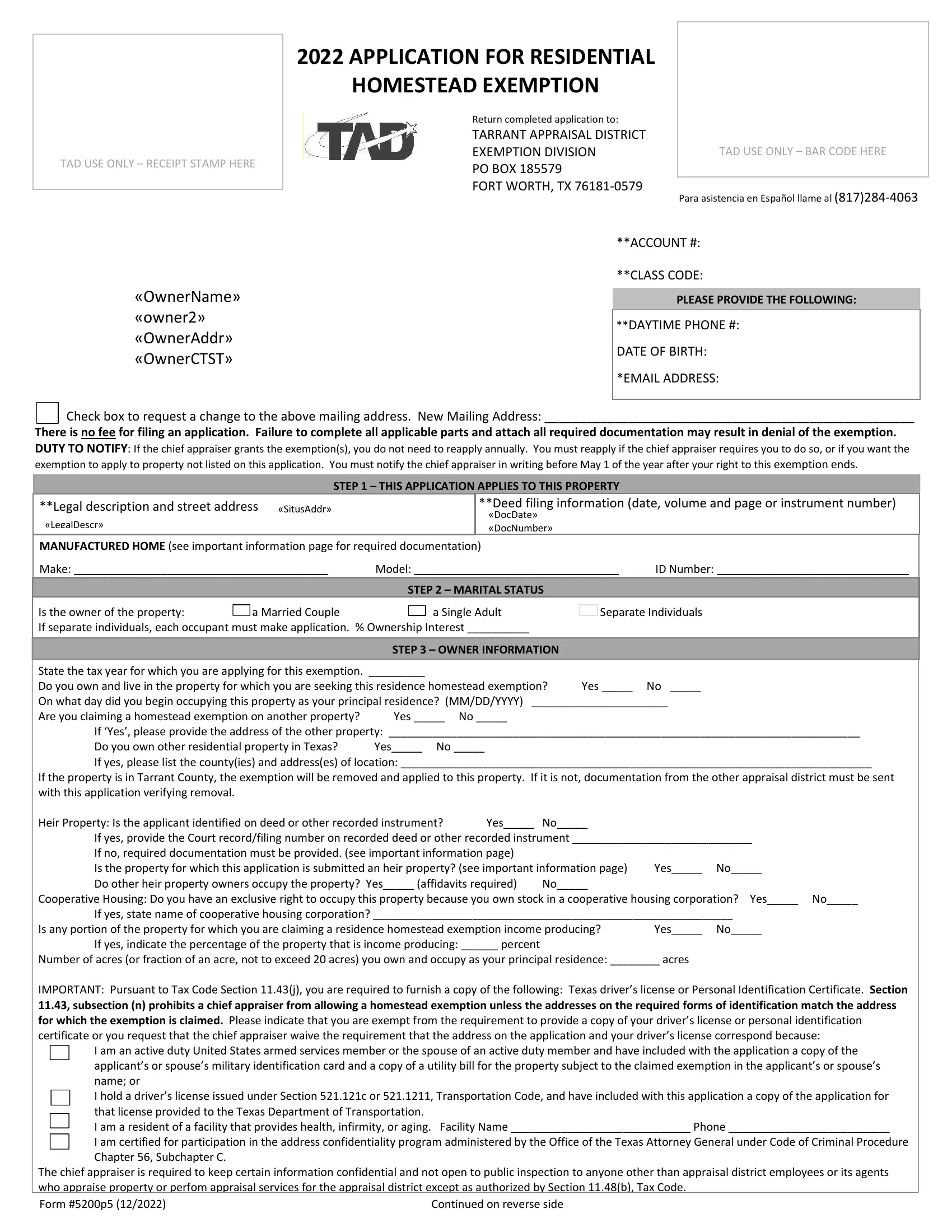

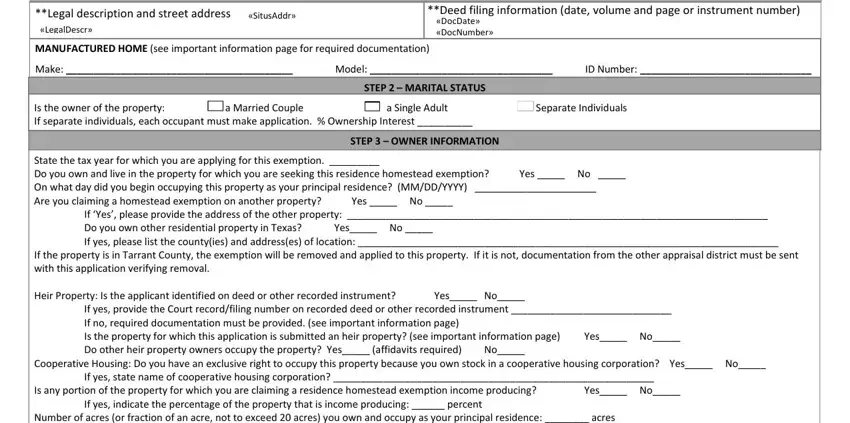

1. To begin with, when filling in the Blank ..., beging with the page that includes the next blanks:

2. Once your current task is complete, take the next step – fill out all of these fields - STEP THIS APPLICATION APPLIES TO, Deed filing information date, Legal description and street, SitusAddr, MANUFACTURED HOME see important, DocDate DocNumber, STEP MARITAL STATUS, Make, Model, ID Number, Is the owner of the property a, STEP OWNER INFORMATION, Separate Individuals, State the tax year for which you, and If Yes please provide the address with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

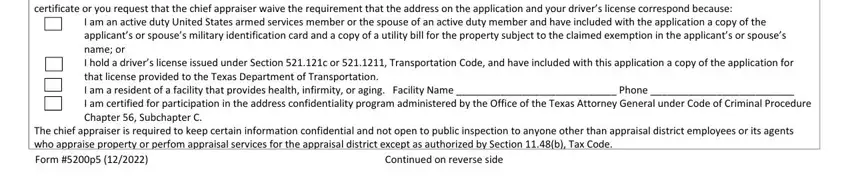

3. This third segment is usually pretty uncomplicated, IMPORTANT Pursuant to Tax Code, I am an active duty United States, The chief appraiser is required to, Form p, and Continued on reverse side - all these fields has to be filled in here.

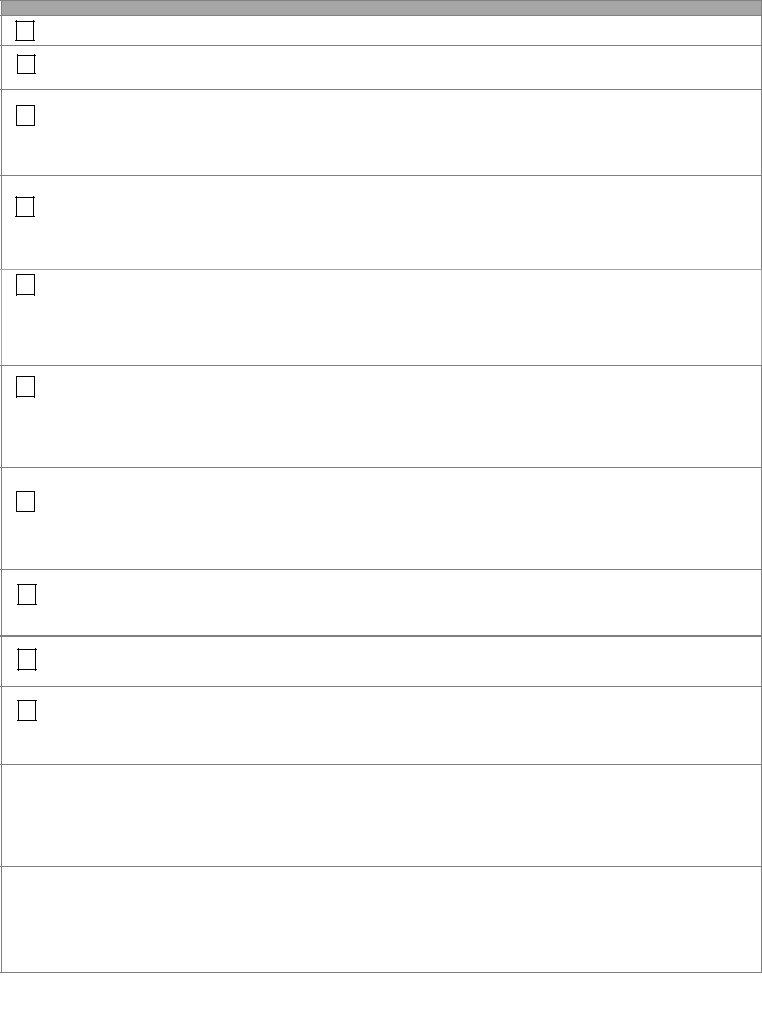

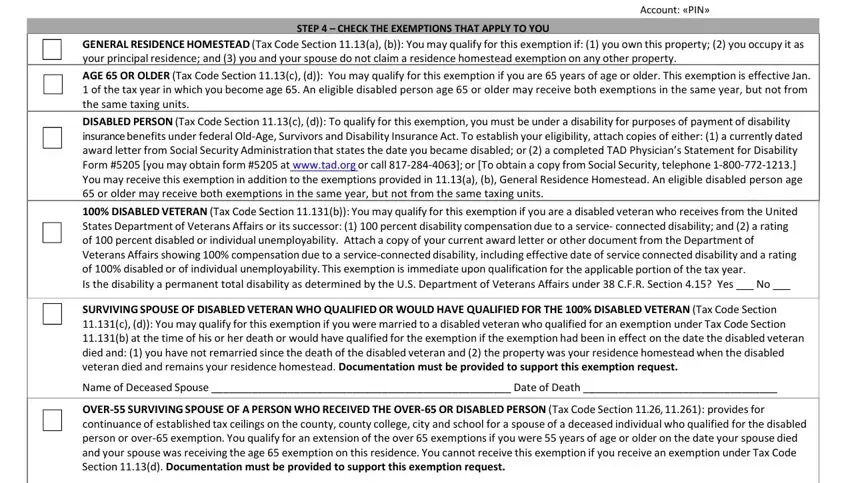

4. This next section requires some additional information. Ensure you complete all the necessary fields - Account PIN, STEP CHECK THE EXEMPTIONS THAT, GENERAL RESIDENCE HOMESTEAD Tax, SURVIVING SPOUSE OF DISABLED, Name of Deceased Spouse Date of, and OVER SURVIVING SPOUSE OF A PERSON - to proceed further in your process!

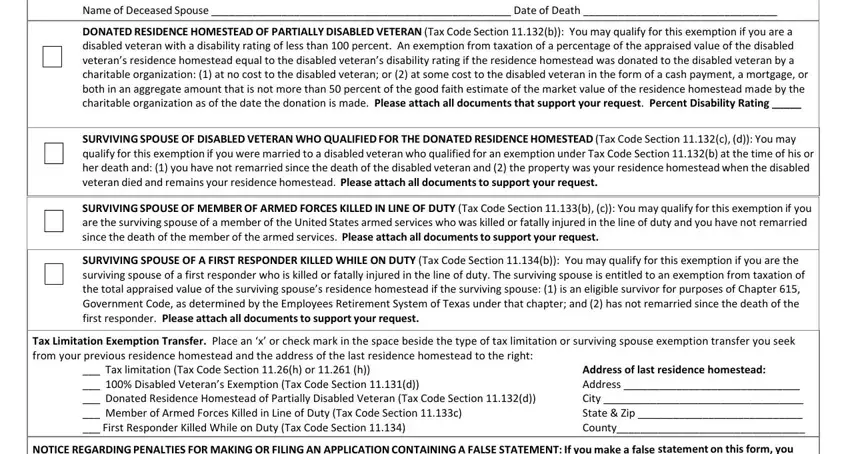

5. This very last section to submit this PDF form is critical. You must fill in the mandatory form fields, for instance Name of Deceased Spouse Date of, DONATED RESIDENCE HOMESTEAD OF, SURVIVING SPOUSE OF DISABLED, SURVIVING SPOUSE OF MEMBER OF, SURVIVING SPOUSE OF A FIRST, Tax Limitation Exemption Transfer, Tax limitation Tax Code Section h, Address of last residence, and NOTICE REGARDING PENALTIES FOR, prior to submitting. Neglecting to do so can produce an incomplete and probably invalid paper!

As to DONATED RESIDENCE HOMESTEAD OF and Tax limitation Tax Code Section h, make certain you take another look in this current part. Both of these are viewed as the key fields in the form.

Step 3: Go through the details you have typed into the form fields and then hit the "Done" button. Join us today and instantly gain access to Blank ..., set for download. Every single modification made is conveniently saved , meaning you can change the form further anytime. FormsPal provides secure form tools with no personal data record-keeping or any kind of sharing. Rest assured that your data is in good hands with us!